Blue Ridge Bankshares: Recovering From A Bad Year

Summary

- $3.1 billion asset bank holding company, Blue Ridge Bankshares, Inc., traces its roots back to Page Valley Bank of Virginia, chartered and organized in 1893.

- From 2018 - 2021, the bank grew rapidly through acquisitions with EPS peaking at $2.94 in 2021.

- 2022 EPS declined to $1.47 from a catch-up loan loss provision, an unfavorable year-over-year comparison with large one-time gains and remediation expenses related to an OCC Agreement.

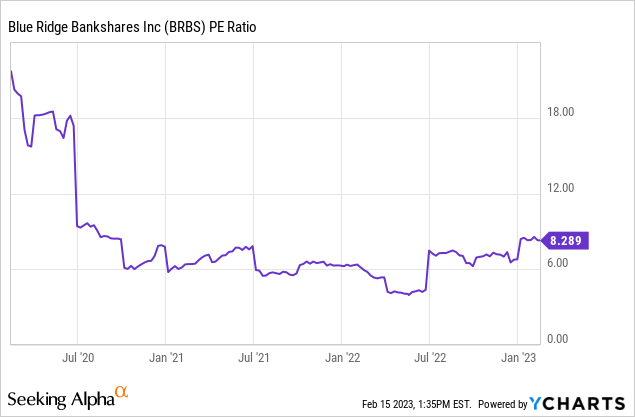

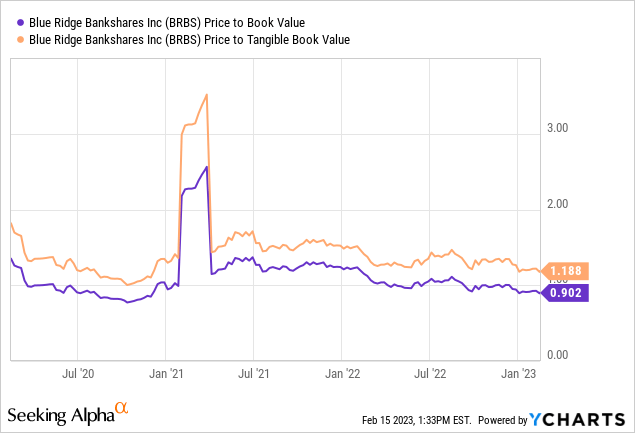

- BRBS stock is relatively cheap at a PE of 8.3 and 1.1x tangible book value, but there are better banks at good prices.

Charlottesville, Virginia; home of Blue Ridge Bankshares, Inc.

halbergman/iStock via Getty Images

$3.1 billion-asset bank holding company Blue Ridge Bankshares, Inc. (NYSE: NYSE:BRBS) traces its roots back to Page Valley Bank of Virginia, chartered and organized in 1893. BRBS was a relatively small community bank that grew organically until two acquisitions: $11.8 million-asset River Bancorp in 2016 and $250.6 million-asset Virginia Community Bancshares in 2019, and a much larger merger with $1.0 billion-asset Bay Banks in 2021.

The bank holding company provides typical commercial and consumer banking and financial services through its wholly-owned bank subsidiary, Blue Ridge Bank, and its wealth and trust management subsidiary, BRB Financial Group, Inc. BRBS operates 26 branches and 6 commercial loan productions offices. 25 branches and 2 loan production offices are in Virginia; one branch and two loan production offices are in North Carolina.

Financial Performance

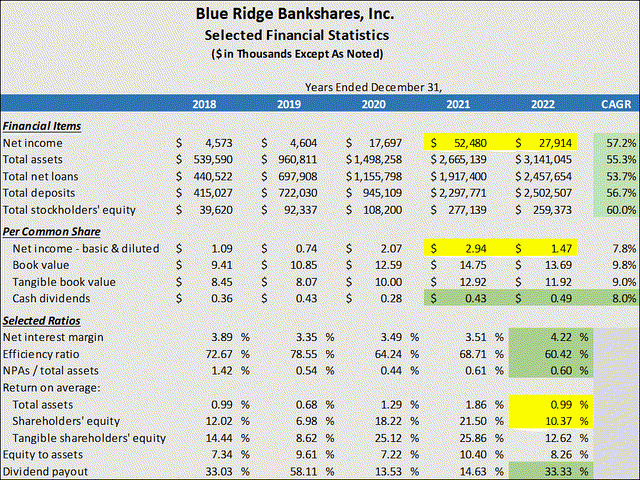

Until 2022, the bank’s recent history was largely the story of well-managed acquisitions, very rapid growth and improving financial performance. In the table below, the items marked in green as positive and yellow as negative will help you follow my observations.

Blue Ridge Bankshares 2022 4Q 2022 Press Release and 2021 Form 10K

An obvious first item to mark in yellow is the $24.6 million or 46.8% decline in net income from $52.4 million in 2021 to $27.9 million in 2022 that interrupted a streak of rapid progress. EPS was cut in half to $1.47 from $2.94 – marked in yellow a few rows below. What happened in 2022?

Net interest income increased by $17.9 million due to a remarkable 35% increase in loans held for investment and the net interest margin’s widening to 4.22%, but a $17.7 million increase in the loan loss provision, a disturbingly common occurrence under FASB’s CECL methodology, wiped out that gain.

There was a $38.9 million decline in noninterest income to $48.1 million in 2022 from $87.0 million in 2021. The primary reductions were one-time gains not repeated in 2022; $24.3 million from PPP loans sold and $6.2 million on the termination of interest rate swaps, plus a $16.0 million decline in residential mortgage banking income.

Noninterest expense declined $6.2 million to $104.8 million in 2022 from $111.0 million in 2021, due primarily to a $11.9 million drop in merger-related costs and a $5.5 million decline in salaries and benefits. Partially offsetting these declines was a $7.4 million increase in one-time regulatory remediation expenses. These expenses related to an agreement with the OCC on August 29, 2022, regarding board accountability, third-party risk management, Bank Secrecy Act / Anti-Money Laundering risk management, suspicious activity reporting and information technology control and risk governance stemming from its BaaS partnerships with non-bank fintech companies. According to CEO Brian Plum in the February 2, 2023 Press Release:

…we appreciate the need to improve our fintech division operations, practices, and procedures to conform to the formal written agreement entered into with the Office of the Comptroller of the Currency. We are committed to doing the things necessary to rise to this challenge and lay the groundwork for future success.

Plum also touted the hiring of former bank regulator and fintech executive Kirsten Muetzel as President of the bank’s new Fintech Division with responsibilities including fintech oversight, managing BaaS partners, ensuring regulatory compliance and advancing fintech strategy and goals.

The huge 50%-plus five-year CAGRs in net income, assets, loans, etc. in the table - all marked in green - are not solely due to organic growth. Virginia’s population, for example, one of the prime factors in bank growth, only increased at a 0.7% annual rate from 2010 to 2019 – although certain counties grew much faster. If we accept assets as a proxy for the table’s financial items, we can isolate two drivers of the $2.6 billion increase in BRBS’s assets from 2018 to 2022; $1.2 billion in acquisitions and $330.9 million in Paycheck Protection Program loans. These two items accounted for roughly 60.0% of the bank’s asset growth, suggesting the remaining $544.9 million was due to organic growth. Recalculating without these two items, the five-year CAGR in total assets fell from a stratospheric 55.3% to a merely sky-high 26.2%. Although extraordinary items have helped fuel BRBS’s growth, a large part has apparently been organically generated.

The bank has increased dividends at an 8.0% CAGR - marked in green - since 2018. The apparent dividend cut in 2020 was the result of a 50% stock dividend. At $0.43 per share in 2022, dividends per share exceed the 2018 pre-stock dividend amount of $0.36 per share on twice as many shares. The payout ratio of 33.33% - marked in green a few rows down - in a down year for earnings is conservative.

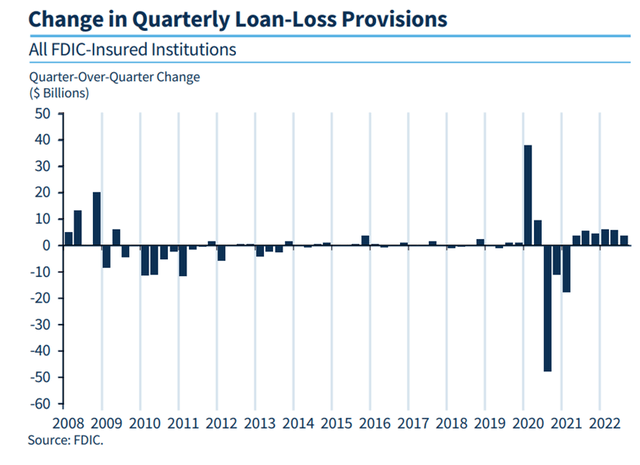

The 4.22% net interest margin - marked in green – exceeds the 3.83% for the banks with assets in the “$1 Billion to $10 Billion” category of the most recent FDIC Quarterly Banking Profile. Also marked in green due to its improvement, the 60.42% efficiency ratio is down significantly from 68.71% in 2021, however, per the FDIC Quarterly Banking Profile, peer banks average a lower 56.89%. NPAs to total assets - also in green - of 0.60% are low by any measure, but the bank’s big $17.1 million catch-up loan loss provision only raised the allowance for loan losses to 0.96% of gross loans held for investment (excluding PPP loans) at year-end 2022. Other banks are apparently preparing for the often-predicted 2023 recession. Notice the successive quarterly increases in the provision on the far right in the graph below.

FDIC

BRBS’s earnings may suffer from higher provisions in 2023 as the bank adjusts to changing economic conditions. Per the FDIC Quarterly Banking Profile, for example, the allowance for credit losses to total loans for all FDIC-insured institutions was 1.55% as of 3Q 2022, higher than the pre-pandemic average of 1.29 percent.

One final area of comment on the table above concerns the 0.99% ROA, 10.37% ROE and 12.6% ROTE for 2022 marked in yellow. BRBS’s earnings should rebound in 2023, perhaps not to the 2021 levels that were boosted by one-time gains, but 2020’s ROA and ROE would be about par for this bank – although a return to the 25.1% ROTE reported in that year due to the timing of share issuances and acquisitions is probably a remote possibility.

We’re going to take a quick look at the bank’s loan portfolio to see how BRBS achieved that stellar loan growth in 2022.

Loan Portfolio

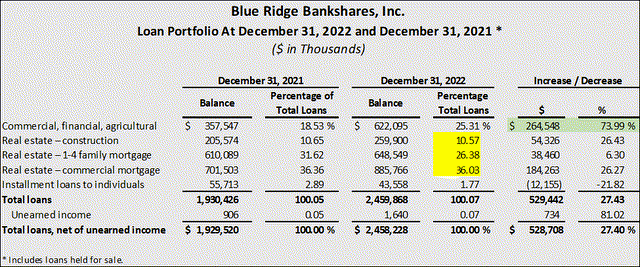

Here’s what BRBS’s loan portfolio (including loans held for sale) looked like as of December 31, 2021 and December 31, 2022.

Blue Ridge Bankshares 2022 and 2021 FDIC Call Reports

BRBS is typical of most community banks I review of this size; it’s a thinly disguised savings and loan circa 1985. It’s a real estate lender; real estate loans comprised 73% of the 4Q 2022 loan portfolio - the categories marked in yellow. As of 4Q 2022, non-real estate loans comprised 27.08% of the loan portfolio but accounted for only 13.8% of the bank’s $35.8 million past due and nonaccrual loans.

Commercial, financial and agricultural loans increased $264.5 million or 74.0% compared to 2021 - marked in green - and accounted for 50% of the $528.7 million year-over-year increase in the loan portfolio. Management attributed the higher volume of non-real estate originations to an increased investment in SBA, middle market, and specialized lending teams. Commercial real estate mortgage loans increased $184.3 million or 26.3% and comprised 34.9% of the increase in the loan portfolio.

While the loan portfolio has grown very rapidly, loan sales, predominantly Paycheck Protection Program and 1-4 family mortgages, have kept the loan to deposit ratio at a reasonable 95%. Securities held for sale totaled $354.3 or 11.3% of assets, suggesting room for loan growth.

Deposits

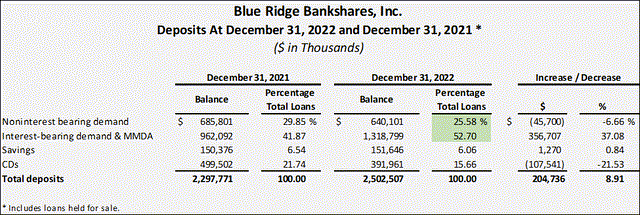

Deposits totaled $2.5 billion at 4Q 2022, an increase of $93.0 million, or 3.9%, from 3Q 2022, and $204.7 million, or 8.9%, from 4Q 2021. The bank’s branches averaged a very efficient $96.3 million per branch at year-end 2022. The table below presents summary data regarding the bank’s deposits.

Blue Ridge Bankshares 2022 and 2021 FDIC Call Reports

Noninterest-bearing deposits comprised 25.6% of total deposits as of 4Q 2022, down significantly from 32.7% as of 3Q 2022 and 29.8% as of 4Q 2022. Core deposits - marked in green; essentially various types of checking, money market and savings accounts, accounted for 71.7% of deposits, a level that should provide relatively low-cost funding in a rising rate environment. Bank executives from almost any point in the past 40 years would have been envious of BRBS’s 0.85% 4Q 2022 cost of deposits, even if significantly higher than the extremely low 0.29% reported for 4Q 2021.

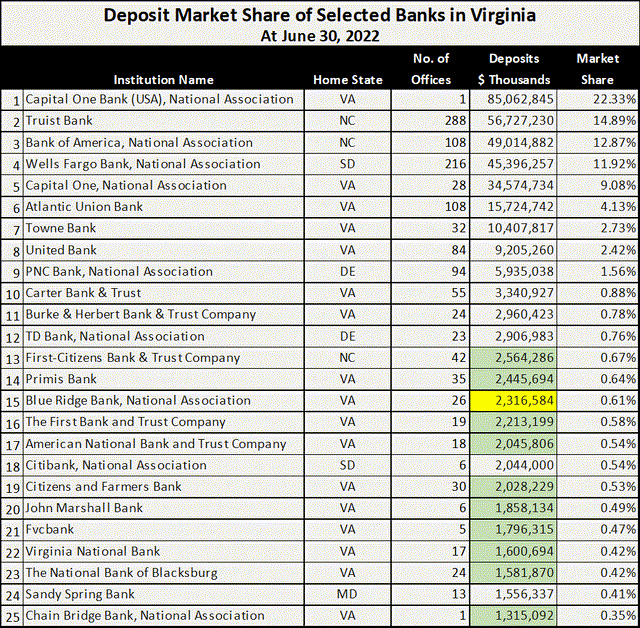

Per June 30, 2022 FDIC data, BRBS ranked 15th in deposit market share - marked in yellow – out of 115 total banks operating in Virginia. Management seems determined to continue to grow through acquisition. In July, 2021, BRBS announced the all-stock merger of equals with FVCBankcorp, Inc. (NASDAQ: FVCB), a Fairfax, VA-based bank with 11 branches, $1.9 billion in assets and the 21st largest deposit market share in Virginia. The merger would have given the combined bank a statewide presence with a meaningful concentration in the wealthy and growing Washington, D.C. suburbs, but was called off in January 2022 after the OCC identified concerns with BRBS’s fintech programs.

FDIC June 30, 2022 Deposit Market Share Report

As the table above indicates there is no shortage of like-sized merger and/or acquisition targets – marked in green - when BRBS completes its required remediation per the OCC.

Capital

Blue Ridge Bank's regulatory capital ratios as of 4Q 2022 were 11.15%, 10.25%, 10.25%, and 9.25% for total risk-based capital, tier 1 risk-based capital, common equity tier 1 risk-based capital, and tier 1 leverage, respectively, drifting down from 13.11%, 12.49%, 12.49%, and 10.05% for the same ratios as of 4Q 2021, but still meeting the definition of a well-capitalized bank.

Conclusion

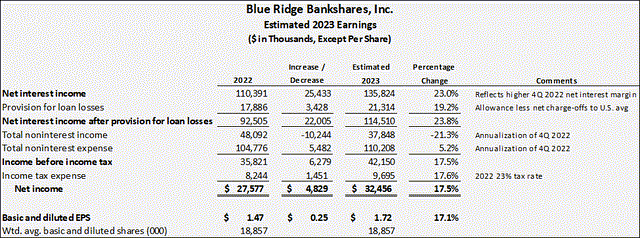

BRBS is not a Wall Street favorite. I could not find evidence of any analyst coverage on Seeking Alpha, E*Trade or Schwab so I decided to try a rough-and-ready estimate of 2023 EPS.

Blue Ridge Bankshares 4Q 2022 Press Release, 2021 Form 10K, 4Q 2022 FDIC Call Report, 4Q 2022 FDIC Quarterly Banking Profile, Herding Value Analysis

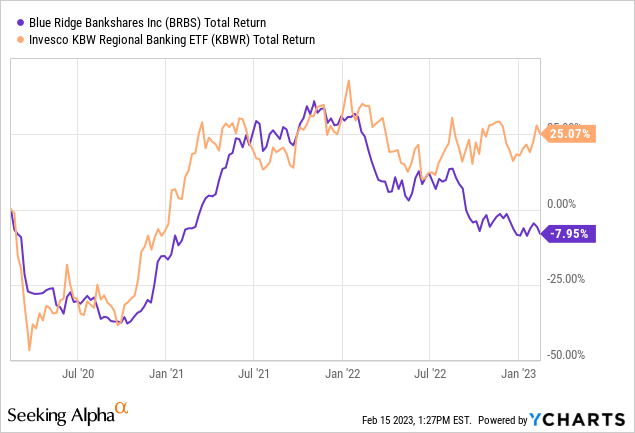

Total returns from BRBS generally tracked the Invesco KBW Bank ETF (KBWB) for the last three years until early 2022 when the OCC required remediation to BRBS's fintech program and essentially declined to approve the merger with FVC Bank.

Today, BRBS looks like a reasonable value proposition on at least three basic metrics.

As the two charts above indicate, BRBS is trading a few points above a 3-year low in PE ratio (it's been below 6!) and near 3-year lows on price to book and price to tangible book. That doesn’t necessarily mean BRBS is a good buy. The stock price has been depressed by the large 2022 catch-up loan loss provision, an unfavorable year-over-year comparison with large one-time gains from PPP loans sold and termination of an interest rate swap, declining mortgage banking income due to rising rates and ongoing OCC remediation expenses.

However, there are some positives:

- Management has shown the ability to grow profitably through acquisitions.

- Virginia consistently ranks well for lifestyle and as a business location.

- Potential for a profitable exit as a bite-size acquisition.

- Significant loan growth not compromising credit quality.

- A consistent record of increased dividends, currently yielding about 4%.

BRBS is not the stock for you if you’re looking for one Sunbelt bank stock. Buy Truist (NYSE: TFC) and its 4% dividend yield instead. Ideally, I see this stock as part of a portfolio of small bank stocks to even out the volatility and risk associated with these smaller institutions.

Even then, this is not a stock I expect to pop over the next 6 months, although today's 8.3 multiple on my $1.72 per share EPS estimate would mean a $14.29 stock price, a nice 15.6% return. I suspect 2021 will be the high-water mark for earnings for at least the next 2–3 years. I'll watch the stock and start getting interested around the 52-week low of $11.71 per share, a small discount to 2022 tangible book value of $12.00. For a conservative 3 to 5-year Sunbelt bank investment, right now there are much better banks at good prices – see the paragraph above!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.