Zoetis: Back On Track In Q4, Regaining Premium Valuation

Summary

- Zoetis shares rose 5.4% on Tuesday after Q4 2022 results showed the company's growth back on track; the P/E is now back to 35x.

- Operational revenue growth was 9% in Q4, with strong growth in key new products and the "majority" of supply issues resolved.

- Management expects operational growth of 6-8% in revenues and 7-9% in Adjusted Net Income in 2023, and no major new competition.

- P/E is now 35x and we expect a small de-rating to 32.5x, but long-term returns should trend towards 12% a year, driven by EPS growth.

- With shares at $171.90, we expect a total return of 29% (9.3% annualized) by 2025 year-end. Buy.

Ирина Мещерякова/iStock via Getty Images

Introduction

Zoetis Inc. (NYSE:ZTS) released their Q4 2022 results on Tuesday (14 February). Zoetis shares finished the day up 5.4%, taking their year-to-date rebound to more than 17%:

| Zoetis Share Price (Last 1 Year)  Source: Google Finance (15-Feb-23). |

We upgraded our rating on Zoetis to Buy in February 2022. Since our initiation, Zoetis shares have lost 11% in a year, primarily due to a 15% headwind from the P/E de-rating from 41x to 35x, offset by a 4% growth in the Adjusted EPS in 2022 (lower than the 9.4% we originally forecasted, partly due to currency) and dividends worth around 1%.

Q4 2022 results showed that Zoetis’s growth is back on track, with revenue growing 9% year-on-year operationally. Key new products continue to grow strongly, and the “majority” of previous supply issues have been resolved. For 2022, revenue and Adjusted Net Income both grew by 8% operationally, though currency reduced dollar growth to just below 4%. Management does not expect new competition to emerge against its key products in 2023. The outlook for 2023 is for operational growth of 6-8% in revenues and 7-9% in Adjusted Net Income. Zoetis shares have risen to 35x 2022 EPS, and cash conversion will be worse in the short-term due to elevated CapEx. Our forecasts now show a total return of 29% (9.4% annualized) by 2025 year-end. We reiterate our Buy rating for now.

Zoetis Buy Case Recap

Zoetis is the global leader in animal health, with a high-quality business that we believe to be capable of growing EPS at a 10%+ CAGR sustainably:

- The global animal health market is growing structurally, historically at 5-6% per year. Petcare is the main driver, benefiting from growing pet numbers and new products serving previously unmet needs

- Zoetis can grow its revenues faster than the market, at a high-single-digit revenue CAGR, thanks to its leading portfolio, brands, product innovations, scale, sales and marketing infrastructure

- Zoetis’ margin will continue to expand, from a combination of mix shift, pricing power, manufacturing efficiencies and natural operational leverage

2021 was a great year for Zoetis, as COVID-19 boosted the number of pets and their demand for medical products, though this was partly offset by a reduction in protein demand and lower livestock prices. 2022 was more challenging, with headwinds including supply issues, cost inflation and veterinary clinic labour shortages.

Q4 2022 results showed that Zoetis’s growth is back on track.

Zoetis Q4 2022 Results Headlines

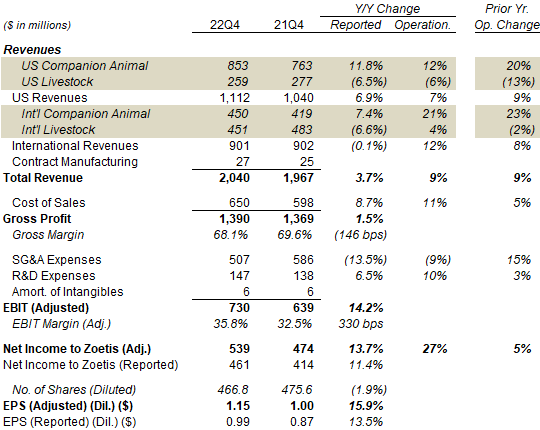

In Q4 2022, Zoetis total revenue grew by 9% operationally, and 3.7% as reported in U.S. dollars:

| Zoetis P&L (Non-GAAP) (Q4 2022 vs. Prior Year)  Source: Zoetis results release (Q4 2022). |

Q4’s 9% operational revenue growth represented a rebound from the 5% in Q3, and was more in line with the 8% and 9% shown in the first two quarters of the year. Revenue growth was driven again by a strong Companion Animal segment (which grew revenues 12% in the U.S. and 21% in International), with Livestock revenues flat operationally overall (falling 6% in the U.S. but growing 4% operationally in International).

Strong Companion Animal revenues were driven by the same structural trends and new Zoetis products as before (more below), with the “majority” of the supply issues highlighted in the U.S. (in particular in parasiticides like Simparica Trio) having been resolved. U.S. veterinary clinic visits were still impacted by labour shortages (and were down 4% year-on-year), but were more than offset by a higher average revenue per visit (up 10%). U.S. diagnostic revenues were still affected by the reorganization of the field salesforce that began in Q2 2022.

Weak U.S. Livestock revenues were attributed to generic competition to DRAXXIN (an antibiotic against respiratory diseases in cattle, swine and sheep) and Zoamix (an feed additive against coccidiosis in poultry), as well as supply issues on certain products and a weak U.S. cattle market. International Livestock revenues were also negatively impacted by a weak China swine market, related to COVID restrictions there.

Q4 revenues had benefited from higher-than-usual inventory, as distributors took advantage of promotions in Simparica Trio (designed to regain market share lost during Q3 supply chain disruptions), but management estimated the benefit to be “in the $25-30m range” and “not a significant number”.

Gross Margin was down 146 bps in U.S. dollars, primarily due to currency, and down 60 bps operationally, due to higher inventory charges, manufacturing costs and freight costs, partially offset by price increases and a positive mix shift.

Adjusted EBIT Margin actually grew year-on-year, after a 9% operational reduction in SG&A expenses, “driven by lower compensation-related expenses and lower advertising and promotion, partially offset by higher freight and logistics related expenses”. Some of the expenses involved were discretionary and could have been reduced to enable Q4 guidance to be met, though the 10% operational growth in R&D Expenses showed Zoetis has continued to invest.

Adjusted Net Income grew slightly less than Adjusted EBIT due to a higher tax rate.

Currency was a major headwind. In U.S. dollars, total revenues only grew 3.7% (5 ppt lower than operationally) and Adjusted Net Income only grew 13.7% (13 ppt lower) in Q4. Adjusted EPS grew 15.9% in U.S. dollars.

Zoetis 2022 Results Headlines

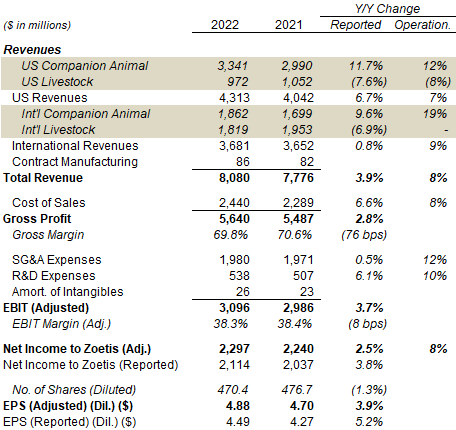

In full-year 2022, Zoetis’s revenue and Adjusted Net Income grew by 8% year-on-year operationally. However, after currency headwinds, revenue grew 3.9% and Adjusted Net Income grew 2.5%; Adjusted EPS grew 3.9%:

| Zoetis P&L (Non-GAAP) (2022 vs. Prior Year)  Source: Zoetis results release (Q4 2022). |

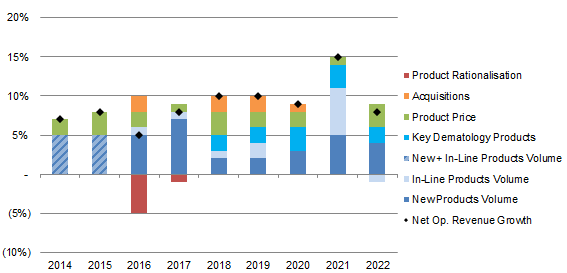

2022 represented a return to Zoetis’ annual high-single-digit operational revenue growth, after COVID-19 benefits to Companion Animal revenue boosted growth to 15% in 2021:

| Zoetis Components of Op. Revenue Growth (2014-22)  Source: Zoetis company filings. |

In 2022, price contributed 3 ppt to operational revenue growth (4 ppt if excluding DRAXXIN), new products contributed 4 ppt and key dermatology products contributed 2 ppt, offset by a 1 ppt impact from volume declines in other products.

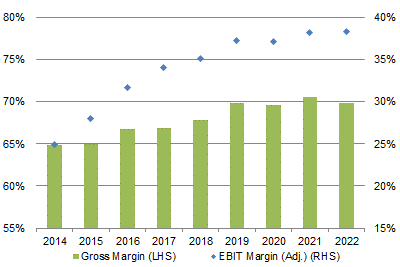

2022 Adjusted EBIT Margin was slightly (8 bps) down year-on-year, with a 76 bps decline in Gross Margin and a 10% operational growth in R&D Expenses, offset by flattish (up 0.5%) S&GA Expenses:

| Zoetis Gross Margin & EBIT Margin (2014-22)  Source: Zoetis company filings. |

This represents a temporary pause in Zoetis’s long-term margin expansion:

Zoetis Key Products Update

Zoetis’s key new products continue to show strong growth, management does not expect new competition to emerge against its main drugs in 2023, and the impact of generic competition to DRAXXIN is moderating.

Simparica Trio (a parasiticide for dogs) grew revenues 39% operationally in Q4, reaching a global total of $171m (including $158m in the U.S.), and was the biggest contributor in the quarter. Management does not expect competition to appear before 2024.

Key Dermatology products APOQUEL and Cytopoint grew revenues 14% operationally in Q4, reaching $347m. Management “do not expect competitive entrants in 2023” for these products.

Librela (monoclonal antibodies for osteoarthritic pain in dogs) generated $26m of revenues in Q4, dipping slightly from Q3 ($31m) due to higher inventory levels at the end of last quarter. Total 2022 Librela sales exceeded $100m, Management expects FDA approval for Librela in H1 2023 and a U.S. market launch “late in the year”.

Solensia (monoclonal antibodies for osteoarthritic pain in cats) generated $7m of revenues in Q4 (up from $6m in Q3), taking the 2022 total to $30m. Sales have come “primarily” from International markets, with only limited sales in the U.S. after launching there in late September last year.

Companion Animal Diagnostics revenues fell 2% operationally in 2022, with declines in the U.S. partially offset by above-market growth in International. Management has set up a dedicated field salesforce for the business in the U.S. in Q2, and expects to “return to at least market growth in the U.S., if not faster” by the middle or end of the year.

DRAXXIN sales continue to decline in the face of generic competition, but its impact is moderating because of its smaller size. DRAXXIN revenues were at round $350m in 2020 (equivalent to 5% of the group), but had shrunk by 16% in 2021 and around 25% in 2022, so should be down to around $210m (2.5% of the group) by now.

Zoetis 2023 Outlook

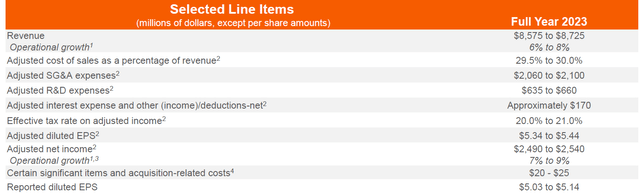

Zoetis’s 2023 outlook included operational growth of 6-8% in revenues and 7-9% in Adjusted Net Income:

| Zoetis 2023Outlook  Source: Zoetis results presentation (Q4 2022). |

2023 revenue growth is again expected to be driven by the Companion Animal segment, with Livestock revenues expected to be “slightly down year-on-year” but “maybe marginally better” than 2022 (down 2% operationally).

At the mid-point of the outlook, S&GA Expenses will be 5% higher (2022: $1,980m), while R&D Expenses will be 20% higher (2022: $538m).

2023 CapEx is expected to be much higher at $0.95-1bn as investments continue, including in manufacturing capacity. (2022 cashflows have not yet been reported, but CapEx was $415m for Q1-3, up 34% year-on-year).

Q1 is expected to be the weakest quarter, with operational revenue growth below the low-end of the full-year range, due to a stronger prior-year comparable, recent COVID disruption in China and higher inventory levels at Q4 2022. Adjusted Net Income is expected to fall year-on-year.

Currency is expected to be a headwind in H1 but a tailwind in H2.

Zoetis Stock Back to Premium Valuation

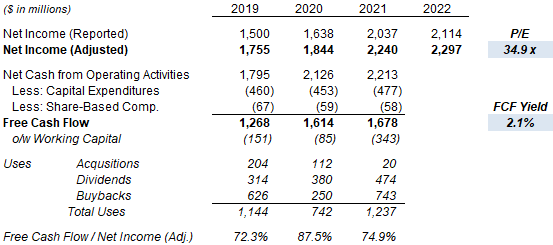

At $171.90, relative to 2022 financials, Zoetis shares are at a 34.9x P/E:

| Zoetis Earnings, Cashflows & Valuation (2019-22)  Source: Zoetis company filings. |

Relative to the mid-point of the 2023 Adjusted EPS outlook, Zoetis shares are at a P/E of 31.9x.

2022 cashflows have not yet been reported, but are likely significantly lower year-on-year as a result of higher CapEx and working capital (the latter to mitigate supply chain issues). On 2021 figures, Free Cash Flow Yield was 2.1%.

Cash conversion (from Adjusted Net Income to Free Cash Flow) averaged 78% in 2019-21, will likely be worse in 2022 and may remain relatively low in 2023.

Zoetis pays a dividend of $1.50 ($0.375 per quarter), representing a Dividend Yield of 0.9%. The dividend was raised by 15% in December 2022, and Zoetis is committed to grow the dividend “at or faster than” Adjusted Net Income growth.

Zoetis has repurchased “almost” $1.6bn of its stock in 2022 (including $400m in Q4), equivalent to 2% of its current market capitalization.

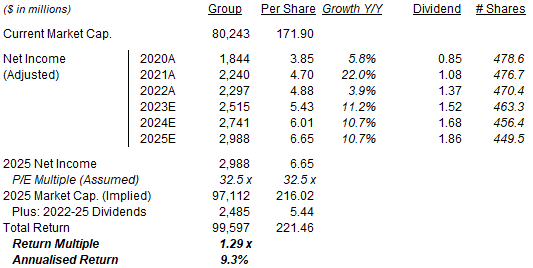

Zoetis Stock Forecast

We update our 2023 forecast to meet management outlook, and reduce our growth assumptions slightly.

Our key assumptions now include:

- 2022 share count of 470.4m (was 469.0m)

- 2023 EPS of $5.43 (was $5.48)

- Net Income growth of 9% annually (was 11%)

- Share count reduction of 1.5% a year (unchanged)

- Dividend Payout Ratio of 28.0% (was 25%)

- P/E of 32.5x at 2025 year-end (unchanged)

Our new 2025 EPS forecast of $6.65 is 4% lower than before ($6.95):

| Illustrative Zoetis Return Forecasts  Source: Librarian Capital estimates. |

With shares at $171.90, we expect a total return of 29% (9.3% annualized) by 2025 year-end.

Our forecasted annualised return is lower than 10% largely because of an assumed de-rating (from 35x to 32.5x P/E) in a relatively short period (less than 3 years). As we expect Zoetis’s Adjusted Net Income growth to be 9% and buybacks to continue over the long term, annualized return should trend towards 12% (EPS growth + dividend) over time.

Is Zoetis Stock A Buy? Conclusion

We reiterate our Buy rating on Zoetis Inc. stock.

While its forecasted annualized return by 2025 year-end is below 10%, this is a resilient business with strong long-term growth potential, and we are willing to accept a slightly lower return than we typically target. In addition, annualized return should trend towards 12% over time for long-term investors.

However, there may be better opportunities elsewhere. In particular, Mastercard (MA) and Visa (V) and have P/E multiples (35x and 30x, respectively) that are the same or lower than Zoetis’s, but expected Adjusted EPS growth rates that are a few points higher and better cash conversion.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.