CenterPoint Energy: Expensive Into Earnings, A Muddled Chart

Summary

- The Fed's "high for longer" apparent rate policy stands to hurt companies with floating rate financing.

- One Utilities sector stock has nearly $3 billion of such debt as of mid-2022.

- I see shares of CNP near fair value while the technicals are mixed at best.

Brandon Bell/Getty Images News

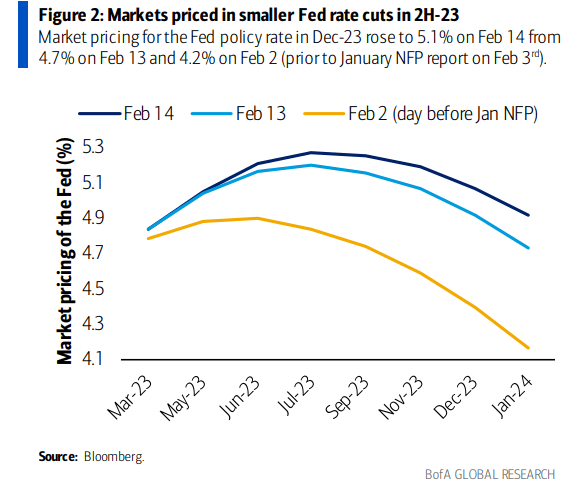

“High (not higher) for longer.” That’s the new outlook given a Fed Terminal Rate now above 5.25% and higher than 5% by year-end 2023. Companies that have variable-rate debt could be in trouble as they refinance.

One utility firm fits that category, but its shares have not fallen too hard lately. Is that a good sign heading into earnings? Or will sellers finally rule the day with CenterPoint Energy? Let’s check it out.

Fed Rate > 5% Throughout 2023

BofA Global Research

According to Bank of America Global Research, CenterPoint Energy (NYSE:CNP) is a diversified public utility holding company headquartered in Houston, Texas. Its utility segment provides electric distribution and transmission as well as natural gas distribution services to over 2.4 million electric and 3.4 million natural gas customers.

The Houston-based $18.6 billion market cap Multi-Utilities industry company within the utilities sector trades at a low 12.0 trailing 12-month GAAP price-to-earnings ratio and pays an above-market average dividend yield of 2.6%, according to The Wall Street Journal.

CNP has held up well despite higher interest rates. The firm has a sizable floating rate debt portion ($2.8 billion) of its balance sheet, which you would think would be hurt by much higher borrowing costs across the yield curve. Still, the stock has managed to hold near its all-time highs lately – even amid weakness in the sector. Still, goings on across the Texas power grid are a key risk – as evidenced two years ago during the notorious Texas Freeze.

CenterPoint is transitioning its business, though, toward higher EPS projects with modest risk – gaining regulatory approval for such endeavors is key while natural disasters and rate risk are still apparent.

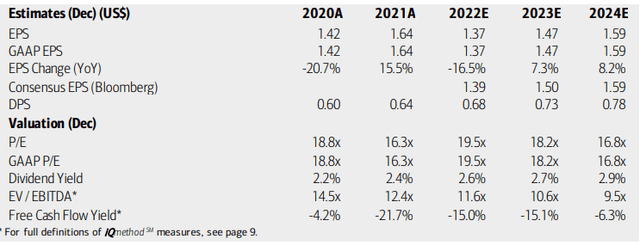

On valuation, analysts at BofA see earnings having fallen rather sharply in 2022 after 2021’s robust gains. Per-share profits are seen as recovering this year and in 2024, though. The Bloomberg consensus forecast is about on par with what BofA sees.

Dividends, meanwhile are expected to rise at a solid clip. If we assume $1.50 of earnings this year and a market multiple of 18 (which is generous), then the shares should trade near $27. That's above the current stock price, so it may not be a great buy on valuation here. Seeking Alpha’s D valuation rating generally agrees with that, but I like the earnings growth story with CNP, so it is by no means a sell or short.

CenterPoint: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

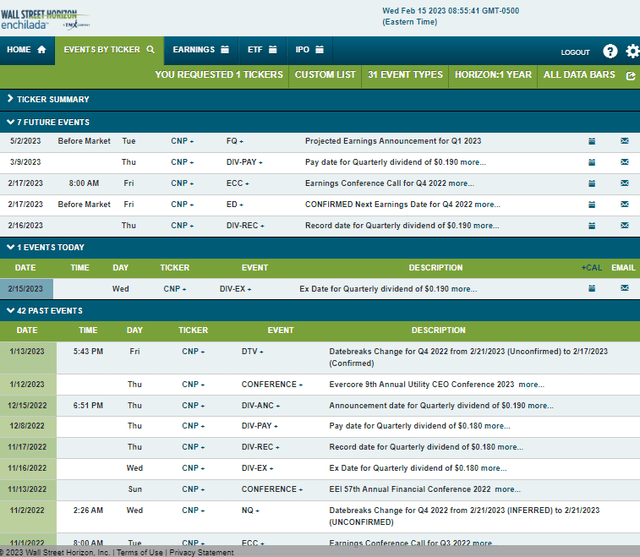

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Friday, Feb. 17, before market open with a conference call immediately after the results cross the wires. You can listen live here. Shares trade ex-div on the 15th.

Corporate Event Risk Calendar

Wall Street Horizon

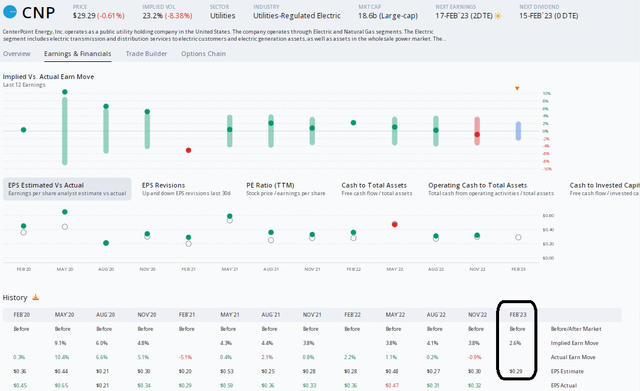

The Options Angle

Digging into the upcoming earnings report, data from Options Research & Technology Services (ORATS) show a consensus EPS forecast of $0.29 which would be a 19% fall from the same period last year. What’s bullish though is that CNP has topped estimates in 11 of the 12 previous reports, so an earnings beat is likely. Moreover, the stock has traded higher post-earnings in 10 of the 12 reports – a very impressive history.

The options are inexpensive on this low-volatile name as you might expect. The current at-the-money straddle expiring soonest after the earnings date shows a 2.6% implied move up or down, but the stock has not moved more than 2.2% on an earnings date since February 2021. With cheap premium, though, playing a long options trade could be worth a shot for a flier.

CNP: Bullish Earnings History, YoY EPS Drop Seen

ORATS

The Technical Take

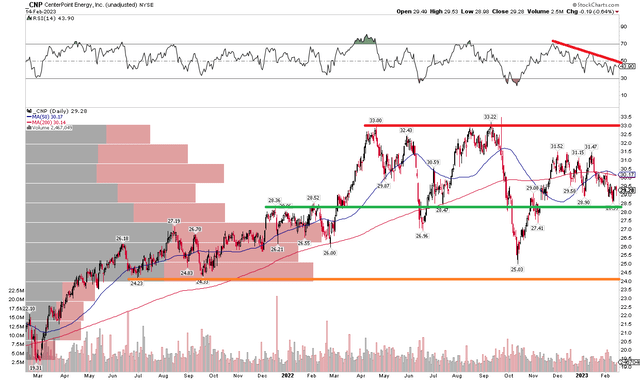

With shares trading at a slight premium to my fair value, the chart is not a whole lot more optimistic. Notice in the chart below that shares topped out around $33 last year, and featured a plunge to lows not seen since Q3 2021 during the September-October rate-induced selloff. The bulls managed to bring CNP back above its 200-day moving average, but also failed to capture new highs.

So here we are in the upper $20s with CNP straddling its flat 200-day amid declining RSI momentum. The support line drawn is admittedly weak but could be used as a bogey for a long trade into earnings. A stop below it would make sense. Ultimately, I’d like to see a new high in price for a momentum play, or a move down to, say, $24, where further support comes into play – and that would go along with a buy on valuation.

CNP: Falling Momentum, Eyeing $24 For A Buy-Limit. Patience.

Stockcharts.com

The Bottom Line

CNP is a hold into earnings. I see the valuation as unattractive, but not super pricey. The chart is also lackluster. Buying on valuation and technically near $24 is probably the best play this year.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.