Barclays: Buy For 2023 And Beyond

Summary

- Barclays PLC closed 2022 with a strong performance, accumulating £7 billion of pre-tax profits.

- However, BCS stock dropped as much as 8% in the trading session following the bank's Q4 2022 report (London trading reference).

- This was due to a higher cost of risk and a drop in fee income at Barclays' investment bank, partially offset a robust performance at its consumer lending business.

- However, reflecting on a higher yield environment for all asset classes, I see strong profitability for Barclays in 2023, and I upgrade my EPS expectations for Barclays through 2025.

- With a $26.4/share price target, Barclays remains a high conviction "Strong Buy."

Oli Scarff

Thesis

Barclays PLC (NYSE:BCS) stock dropped as much as 8% in the trading session following the bank's Q4 2022 report (London trading reference). Barclays reported a 4% decline in profit for the fourth quarter, with an increase of cost of risk and a significant drop in fee income at its investment bank, partially offsetting a robust performance at its consumer lending business.

But although Barclays' results slightly disappointed against market consensus estimates, investors should consider that the results were undoubtedly strong on an absolute basis--especially compared to the bank's current market cap. And on the backdrop of increasing interest rates, I believe that as compared to 2021 Barclays' profits this could incrementally expand to somewhere between £7-8 billion within the next 3 years. With a $26.4/share price target, Barclays remains a high conviction "Strong Buy."

For reference, although BCS stock has shown some strength recently, the bank remains a relative outperformer: for the trailing twelve months, BCS stock is down approximately 14%, as compared to a loss of close to 6% for the S&P 500 Index (SP500).

Barclays' Q4 and FY 2022

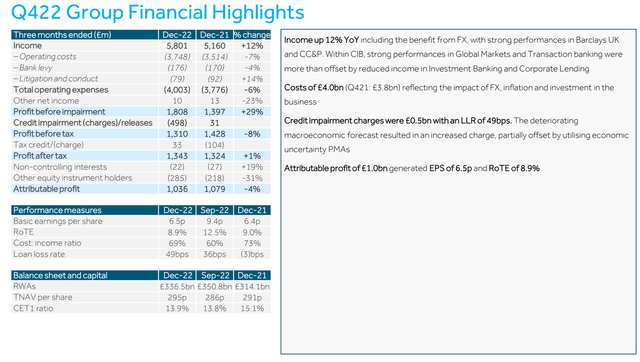

During the period from September to the end of December, Barclays PLC generated about £5.8 billion of revenues, which compares to £5.2 billion for the same period one year earlier, reflecting a 12% year-over-year top line growth. Quarterly profit before taxes, and before impairments, jumped to £1.8 billion, 29% higher as compared to £1.4 billion for the same period in 2021.

However, as a result of credit impairments due to "deteriorating macroeconomic forecast[s]" equal to £498 million, Barclays Q4 2022 net operating profit did contract slightly, to £1.3 billion versus £1.4 billion in Q4 2021.

Barclays Q4 & FY 2022 Reporting

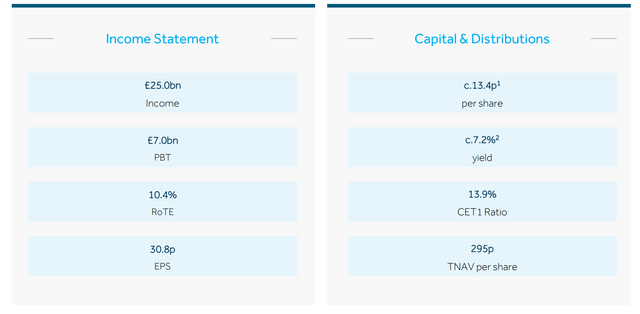

For the full year 2022, Barclays' reported exceptionally strong results. Total group revenues grew to £25 billion, and operating profit before tax jumped to £7 billion. This compares to £21.9 billion and £8.2 billion in 2021, respectively.

Barclays Q4 & FY 2022 Reporting

Notably, all of Barclays' operating business units grew significantly in 2022. The company's UK business expanded 11% year-over-year, while CC&P (Commercial, Cards, and Payments) and CIB (Corporate and Investment Bank) grew 35% and 8%, respectively.

Although the bank's investment banking division recorded a 46% negative growth in fees, the bank announced that it will continue to invest in dealmaking talent--positioning the franchise for a strong IB rebound.

Barclays Q4 & FY 2022 Reporting

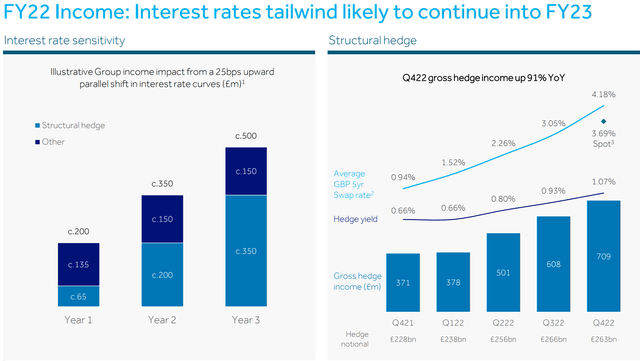

Confident Going Into 2023

Although Barclays has already enjoyed a strong performance in 2022 due to a supportive NIM expansion versus 2021, I argue that the full effects of the favorable interest rate environment are likely to materialize before late 2023/ early 2024. Investors should consider that the bank of England has already raised rates to 4% (most of which in mid/-late 2022), while the ECB is still in the process of raising the cost of capital--with the marginal lending facility likely to edge towards 4 percentage points in 2023. Barclays' CEO C.S. Venkatakrishnan argued that:

[the] interest rates tailwind [is] likely to continue into FY23 ... I want to remind you of our interest rate sensitivity, which underpins the income momentum from our consumer and corporate businesses. As I’ve highlighted before, a lot of this comes from the roll of the structural hedge, as you can see on the left-hand chart. Although the long end of the curve has moderated from the Q4 average, reinvestment rates on the hedge roll are still well above the average yield and the yield on maturing hedges

With that frame of reference, as compared to 2021 numbers, my model--which anchors on management commentary from Deutsche Bank, Barclays, UniCredit and Societe Generale--calculates that for every 1 percentage point of interest rate increase, European banks are likely to enjoy a 20 basis point increase in NIM expansion. For Barclays, such a model would assume about to £7-8 billion in 2025, approximately in line with Barclay's cost/income and ROTE target on a £30-33 billion of revenue assumption.

Barclays Q4 & FY 2022 Reporting

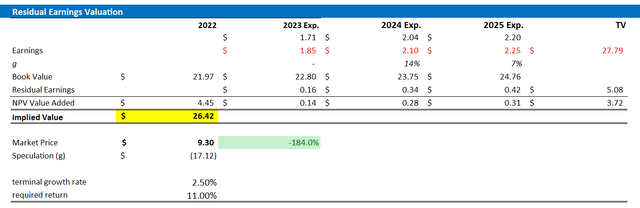

Valuation Update - Raise TP to $26.42

Reflecting on a higher yield environment for all asset classes, I upgrade my EPS expectations for BCS through 2025. I now estimate that Barclays' EPS in 2023 will likely expand to somewhere between $1.8 and $1.9. Moreover, I also raise my EPS expectations for 2024 and 2025, to $2.10 and $2.25, respectively.

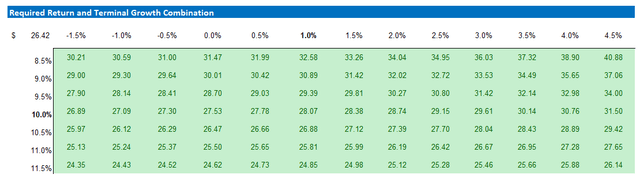

I continue to anchor on a 2.5% terminal growth rate (approximately in line with nominal global GDP growth to reflect conservatism), as well as on a 11% cost of equity, which I deem a highly conservative estimate.

Given the EPS update as highlighted below, I now calculate a fair implied share price of $26.42.

Author's EPS Estimates and Calculation

Below is also the updated sensitivity table.

Author's EPS Estimates and Calculation

Risks

With regard to risks related to investments in banks, I would like to highlight what I have written before:

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate BCS share-price significantly. For reference, the company has still not recovered the share-price levels seen before the great financial crisis.

In any case, Barclays' close to 14% CET1 ratio should puffer the company for most market stress scenarios, even severe ones.

As an important consideration, however, Barclays did warn that the ratio of bad loans could double in 2023 vs 2022, increasing towards 60 basis points. Although this number is manageable, given the income tailwind, investors should take not and monitor this unfavorable trend of higher cost of risk.

Conclusion

Barclays PLC closed 2022 with a strong performance, accumulating £7 billion of pre-tax profits. However, BCS stock dropped as much as 8% in the trading session following the bank's Q4 2022 report (London trading reference), as a higher cost of risk and a drop in fee income at its investment bank partially offset a robust performance at its consumer lending business.

However, reflecting on a higher yield environment for all asset classes, I see strong profitability for Barclays PLC in 2023, and I upgrade my EPS expectations for Barclays through 2025. With a $26.4/share price target, Barclays remains a high conviction "Strong Buy."

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BCS, DB, SCGLF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advice