Air Products And Chemicals: Short-Term Pain But Long-Term Gain

Summary

- APD reported fiscal Q1 adjusted EPS of $2.64 with a 7% decline in stock price after earnings release.

- The company has a sound balance sheet, growing dividends, and an ambitious capital allocation plan with a strong track record of capital deployment.

- I lowered my fair value per share from $334 to $305, with lower revenue growth and margin improvements in the short term offset by potential acceleration in the medium term.

schulzhattingen/iStock Editorial via Getty Images

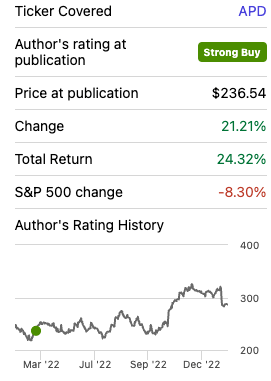

Since my last article almost a year ago, the shares of Air Products and Chemicals Inc. (NYSE:APD) increased by 35.6% (right before Q1 earning release) whereas the S&P 500 decreased by 8.3%. However, on February 2nd, 2023 the shares dropped from $320 to $297, as the company's results fell short of analyst expectations. While prices for APD’s products increased by 7% for the quarter and volumes were up 2%, unfavourable foreign currency fluctuations and higher costs narrowed the company's top and bottom lines. In this article, I will update my valuation of APD based on the latest earnings results and expectations.

Seeking Alpha

Q1 Earning Results

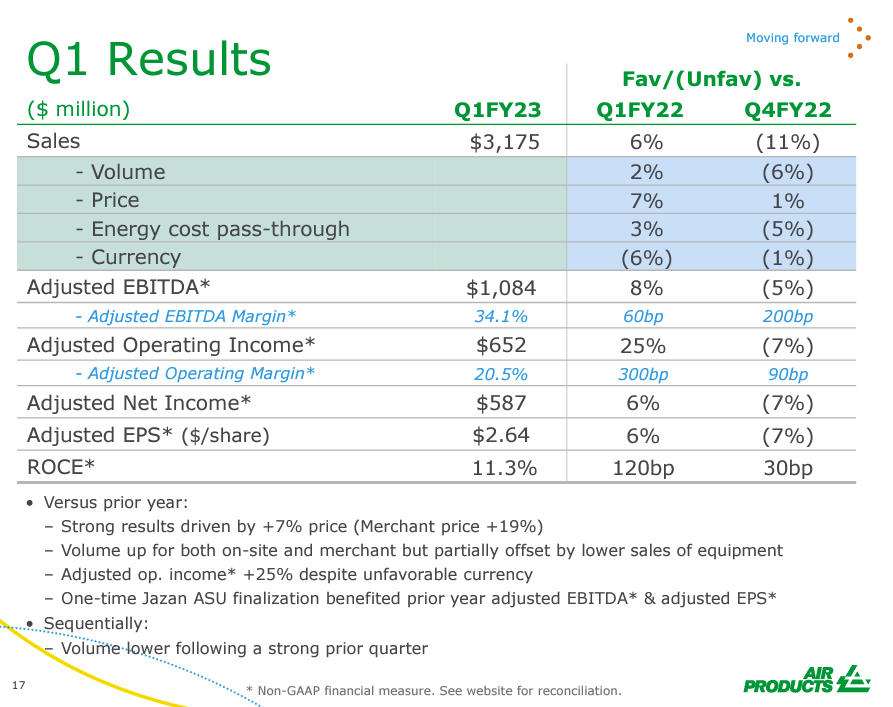

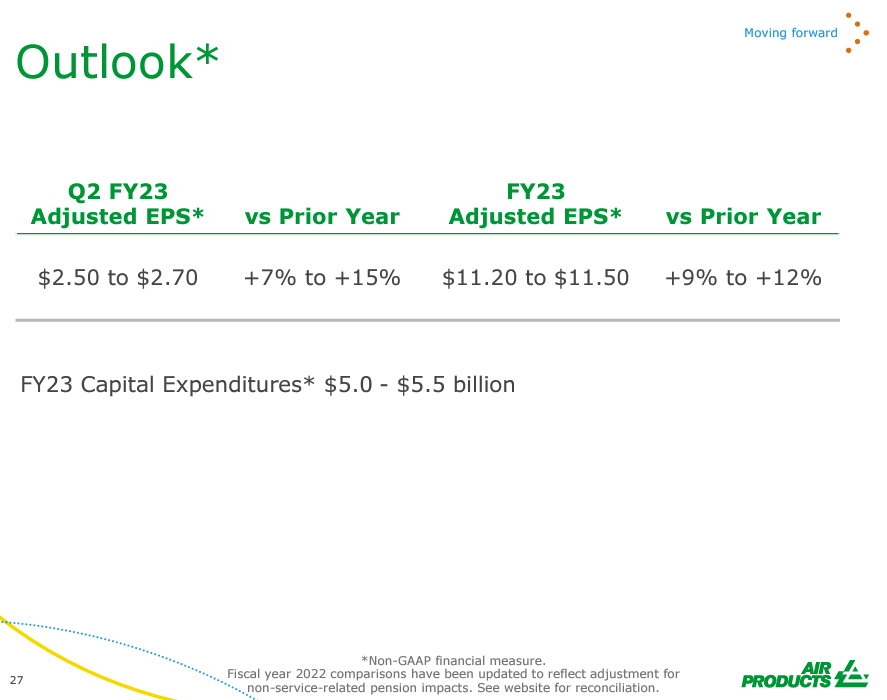

APD reported fiscal Q1 adjusted EPS of $2.64. The stock declined by approximately 7% after the earnings release. However, management reaffirmed its fiscal 2023 guidance, expecting an adjusted EPS in the range of $11.20 to $11.50. APD' Q1 sales increased by 9% YoY, driven by a 2% rise in volumes and a 7% increase in price attainment. Volumes increased 7% in Asia and 6% in the Americas but decreased by 6% in Europe. Merchant prices were up 19% from the prior year, including 24% in Europe, due to price increases to offset higher inflation and energy prices.

Company presentation

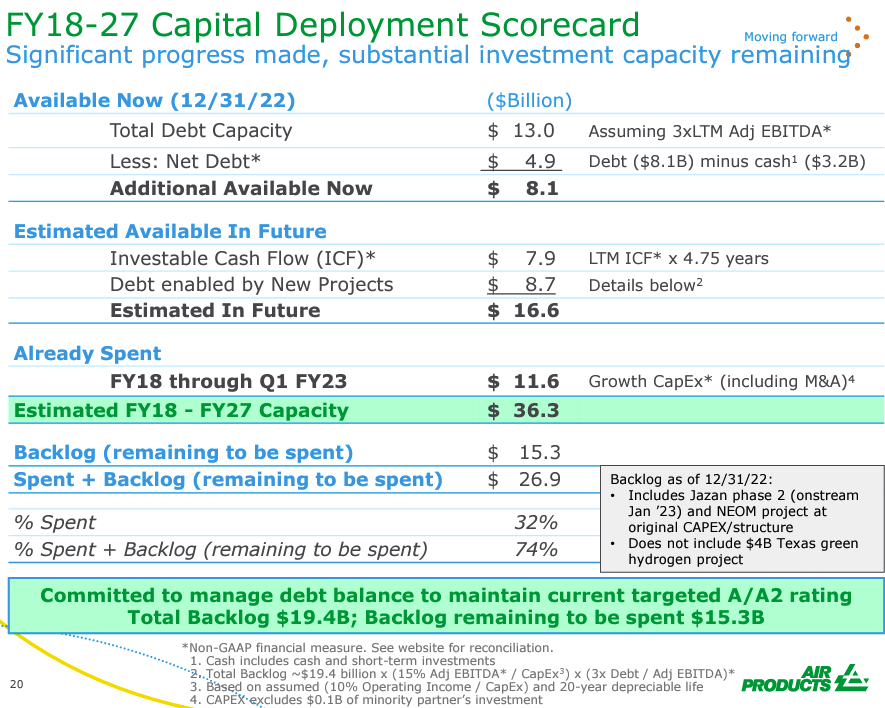

The NEOM green hydrogen project's total capital required is now anticipated to be around $8.5 billion, funded with 75% of non-recourse project financing, reducing APD' cash contribution from $1.7 billion to under $0.8 billion. However, $1.2 billion of additional scope is expected to make the project more self-sufficient.

APD Positioned for Long-Term Growth in Lucrative Industrial Gas Industry

APD operates in a favorable industry structure that consistently delivers lucrative returns despite selling commodities like industrial gases. Customers are willing to pay a premium and sign long-term contracts, generating a predictable cash flow stream due to high switching costs and long-term contracts. APD can fuel additional revenue growth through acquisitions, asset buybacks, and new projects, particularly in emerging markets. I am optimistic about the long-term outlook for APD, given its potential to benefit from the Inflation Reduction Act in the U.S., which offers tax incentives for green hydrogen and carbon capture and sequestration.

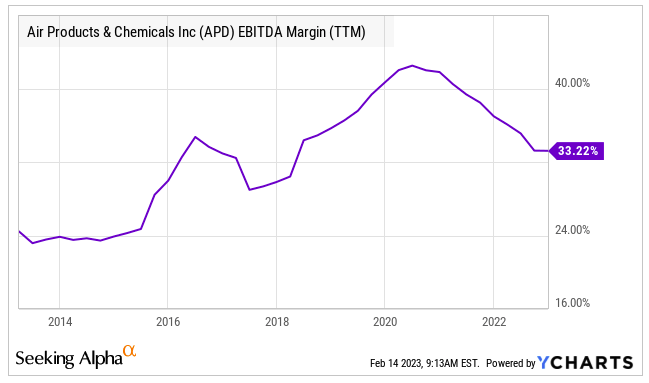

Since Seifi Ghasemi's appointment as CEO in 2014, APD's profitability has improved significantly by launching several initiatives that raised EBITDA margins materially as illustrated below.

Ycharts

The company aims to deploy $36 billion during the decade from fiscal 2018 through fiscal 2027, and it has already spent or committed over $27 billion. APD’s ambitious capital allocation plan will fuel tremendous growth for many years to come, driven by investments in traditional industrial gas projects, as well as new opportunities such as gasification, green hydrogen, and carbon capture.

Company presentation

Understanding APD's Strong Position in the Industrial Gas Industry

The industrial gas industry, despite selling commodities, benefits from moats because customers are willing to pay a premium and sign long-term contracts to ensure uninterrupted supply. Industrial gases are distributed through three supply modes: on-site, merchant, and packaged, with varying levels of switching costs. APD has a strong portfolio of on-site and merchant businesses, which account for 92% of their revenue, and both benefit from long-term contracts and high switching costs.

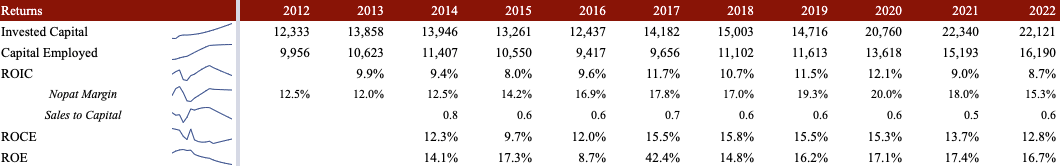

APD’s competitive advantage could be observed in its high returns on capital in the past decade.

Author calculations & Company filings

Sound Balance Sheet and Growing Dividends

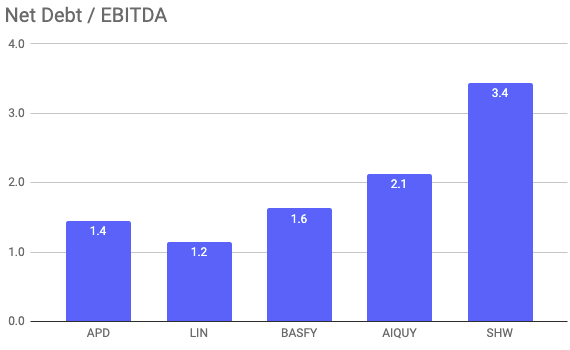

APD boasts a strong balance sheet with $3.2 billion in cash and $8.8 billion in debt. Its leverage multiples stand among the lowest in the industry at 1.4x Net Debt / EBITDA, allowing it to pursue growth opportunities by investing in new projects.

Author calculations & Company filings

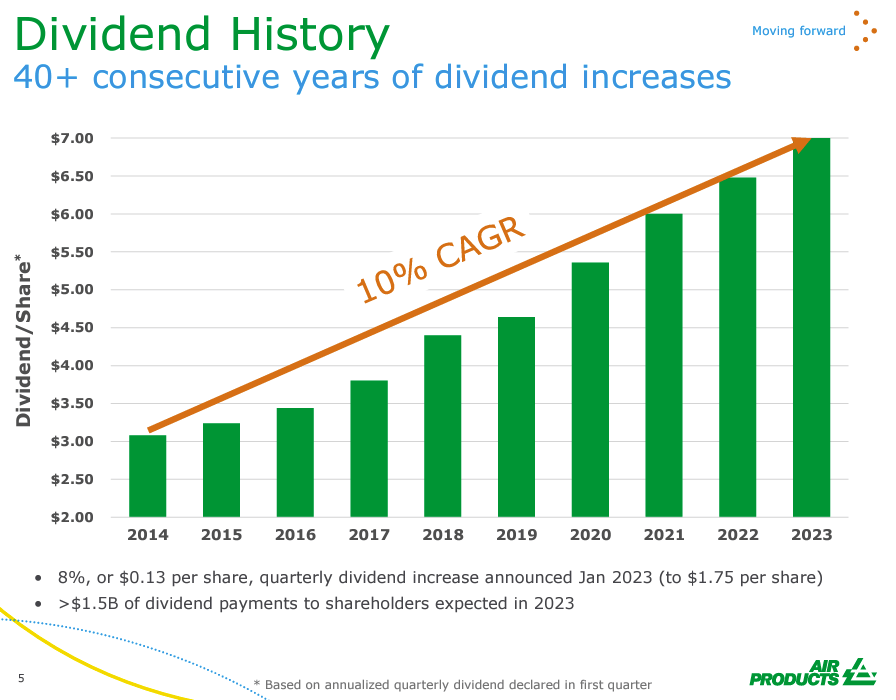

Management has a solid track record of capital deployment, which has greatly improved profitability and accelerated growth in recent years. Since 2014, APD has constantly grown the dividend at a CAGR of 10%, with its quarterly dividend increased by 8% in January 2023.

Company presentation

The company's proactive approach to pursuing growth opportunities and effectively managing its portfolio has allowed it to reduce debt and fund investments using proceeds from divestments. In 2018, APD acquired gasification businesses such as GE’s (GE) gasification business to become the global leader in this space, positioning it to take advantage of future gasification opportunities in emerging markets like China and India. These markets already make up a significant portion of the company's backlog.

Valuation

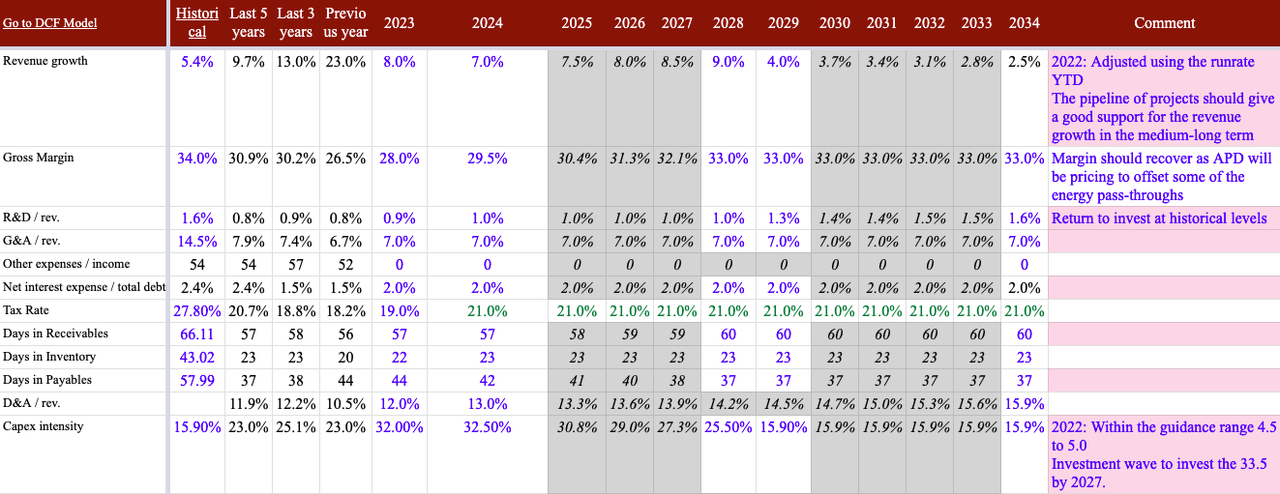

Following APD's Q1 earnings release, I have adjusted my fair value to $305 per share from $334. This modification is due to a lower revenue growth and lower margin improvements in the short-term. In the medium term I expect revenue growth to accelerate driven by gasification, green hydrogen, and carbon capture. Management has maintained its guidance for the full fiscal year 2023, with adjusted earnings per share expected to fall between $11.20 and $11.50.

Company presentation

Below are my main financial assumptions:

Author estimates & company filings

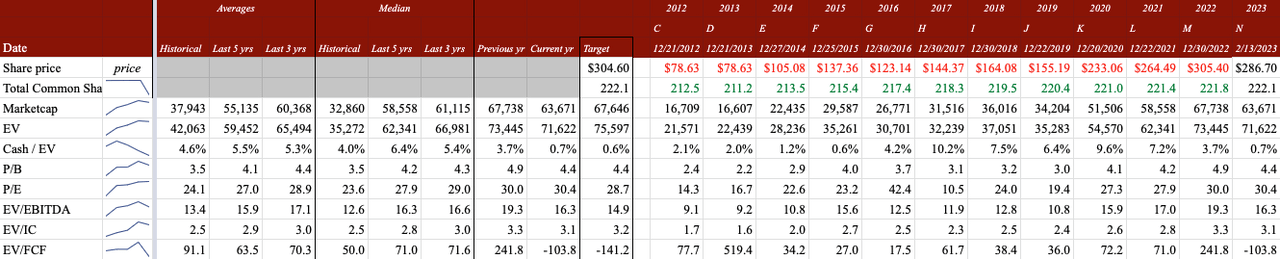

At a fair price of $305 per share, the multiples are reasonably comparable to historical figures.

Author estimates, company filings & Seeking Alpha

Risk and Uncertainties

The demand for industrial gases is linked to global industrial production, so the company's growth is dependent on the world economy. However, if China and India's growth slows down, anticipated high growth rates in these regions may not materialize. In emerging markets, competition for new contracts and the option for on-site customers to choose in-house production may limit pricing upside. Additionally, the NEOM green hydrogen project cost has risen from $5 billion to $8.5 billion due to a combination of inflation, project expansion, and higher financing costs, reducing returns and increasing the risk of further cost overruns. ADP lags behind its competitors after industry consolidation (Air Liquide’s 2016 acquisition (OTCPK:AIQUF)(OTCPK:AIQUY) of Airgas and the Praxair-Linde merger (LIN) in 2018) , and may struggle to regain market share, particularly in emerging countries like China and India, where competition for new contracts could result in lower returns. Finally, reduced demand for gasification projects in emerging economies could impact APD's capital deployment plan.

Conclusion

APD is expected to experience rapid growth in the medium term thanks to its $36 billion capital allocation plan and the acquisition of Shell's and GE's gasification businesses in 2018, making it a global leader in this segment. As China and India's coal gasification industries grow, APD is well-positioned to benefit. The company's on-site investments will lead to a more stable cash flow and a derisked portfolio. Although the shares are currently trading at only 7% below my target value of $305, I believe APD is an excellent company to have in one's portfolio.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in APD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.