Global X SuperDividend ETF Is Too Risky And Probably A Dividend Trap

Summary

- The ETF has a high exposure to riskier investments such as Chinese real estate and mortgage REITs.

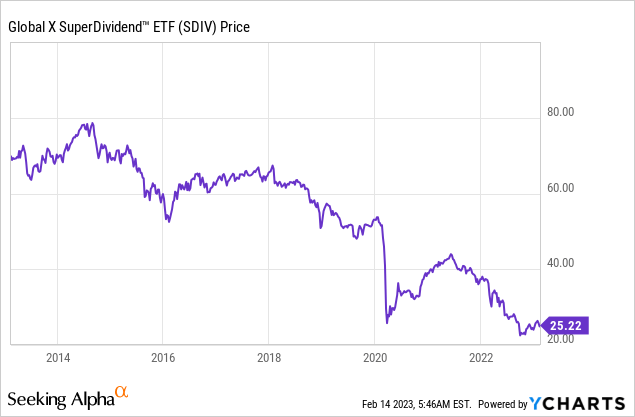

- The probability seems to be very high that the actual future dividend yield will be significantly lower than it looks on paper at the moment.

- The annual payout has been declining for ten years. Plus the historical total return is extremely poor.

Vergani_Fotografia/iStock via Getty Images

Investment Thesis

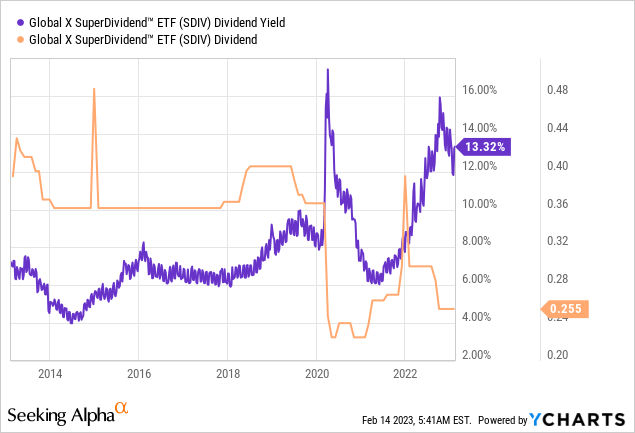

The Global X SuperDividend ETF (NYSEARCA:SDIV) is designed to provide exposure to companies with high dividends from around the world. The current yield is 13%. However, this is based on the past, and there is a considerable risk that the dividend will be lowered in the future as it takes a few months for the interest rate hikes to affect companies. This would also follow the historical trend that the ETF's dividend tends to decrease over time, which is not a sign that the ETF invests in great companies.

ETF Overview

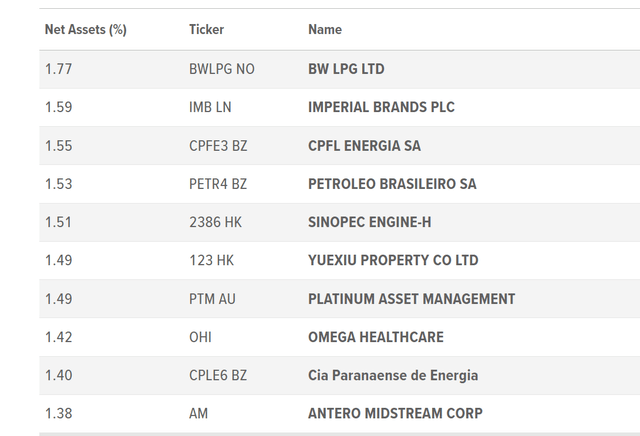

The Global X SuperDividend ETF invests in high-yielding stocks from all over the world and from different sectors and tracks the performance of the Solactive Global SuperDividend Index. The yearly expense ratio is 0.58%. Currently, the ETF contains 105 stocks (you can see the complete list here), with the top ten representing only 15%; these are:

- The top sector in the ETF is Financials with 35%, followed by Real Estate at 13%, Materials at 11%, and Energy at 10%.

- The top countries are the USA with 30% Brazil with 14% Hong Kong with 11%, China with 10%, and the UK with 6%. Therefore, global diversification is given, and the USA is far less overweight than other ETSs, such as the MSCI World.

Valuation & Dividend

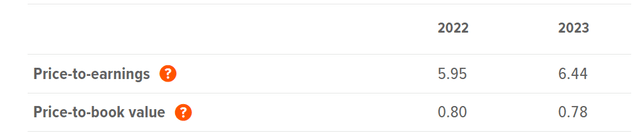

Valuation plays less of a role due to the broad diversification. However, the average P/E ratio is often given for ETFs. Therefore, the ETF is cheaply valued, as shown in the following key figures.

The high dividend yield is only possible due to this low valuation. At the moment, it is around 13%. But the annual payout has been declining for ten years, and if this trend continues, the yield on cost will get worse and worse over time. In the following chart, we can see how the monthly payout is currently $0.26, which is much lower than years ago.

Nevertheless, it has to be said that the valuation is now so cheap that the dividend yield is almost historically high. From this perspective, the ETF would be a much better buy now than from 2013 - 2020, when the dividend in cash terms was higher, but the yield on cost was lower. This is because the price of the ETF has fallen so much that the valuation on a P/E basis is now much cheaper. This means that either this is an attractive entry point or it is a value/yield trap.

The yield is likely a trap

I think the latter is the case. The ETF has a high exposure to interest rate-sensitive sectors such as financials and real estate. However, it will take several quarters before interest rate increases are reflected in the results. Mortgage REITs, in particular, are likely to have a harder time in this environment. What has happened here is that the market has already priced in the deteriorating results in advance in the share prices, but the results have yet to come. As a result, lower earnings of the respective holdings of the ETF mean, conversely, dividend cuts. This means that the dividend looks like a very high yield for the ETF based on the last 12 months, but the probability of cuts is very high.

Furthermore, the ETF consists of 10% energy stocks. Especially in the first half of 2022, we saw very high average energy prices, but these have fallen significantly in the meantime. One of the stocks I have analyzed separately is a top holding of the ETF, the Brazilian oil producer Petrobras. The company is very cheaply valued and will likely continue to pay a high dividend yield in the next few years, but probably less than in 2022. In the case of Brazil, this has additional political reasons, as the newly elected President Lula wants to force the company to invest more in renewable energies.

There are also other risks associated with Hong Kong and China-based investment groups. Again, this is a tricky area to navigate. Some say China is the biggest real-estate bubble ever or even a Ponzi scheme. I am not an expert on Chinese real estate, but with a declining population and the well-known ghost cities, this is not an area I would like to invest in. Furthermore, Chinese equities have greater risks for Western investors anyway in the face of the growing conflict over who will be the world power of the 21st century.

Performance

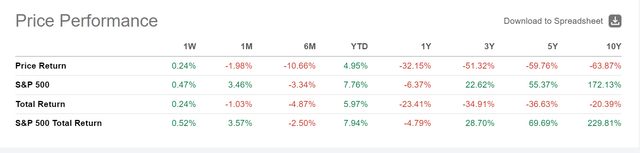

The historical performance of the last ten years is extremely poor. There is no time when the ETF has outperformed a broad market such as the S&P 500. This shows that even in times of low-interest rates worldwide, the ETF performed poorly.

Other things I do not like

It is always more pleasant if you know where you are investing your money. Most of the stocks in this ETF are smaller, little-known stocks from all kinds of countries. They do not have to meet any special requirements except that they have paid a high dividend in the last 12 months; at least GlobalX mentions nothing on their website. However, the fact that the dividend has tended to fall over time does not speak for the quality of the companies. Healthy companies tend to increase their dividends. However, if the high dividend is the main selling point of the ETF, and it tends to decrease over time, then why invest? Other ETFs look at the quality of the dividend and where, for example, one criterion is that the dividend increases. So you only have companies in the ETF that are healthy and tend to earn more money. After a few years, the personal yield on cost will probably be higher than with this ETF, even though you start with a 13% yield.

Conclusion

The probability seems to be very high that the actual future dividend yield will be significantly lower than it looks on paper at the moment. Therefore, investors should not chase the potential high dividend yield but also consider the risks, i.e., the ETF's high exposure to financials and emerging markets. This is not fundamentally bad, but it is riskier for investors due to factors such as political instability, softer currencies in the countries, etc.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.