TransDigm: The M&A-Driven Aerospace Stock To Watch

Summary

- After discussing the fantastic risk/reward of TransDigm in October, the stock surged 50%, thanks to rebounding aerospace demand and an attractive valuation.

- In this article, we discuss what makes TransDigm so special and what we can expect going forward.

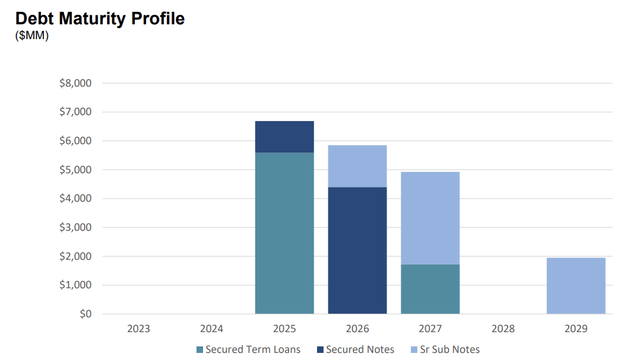

- Moreover, despite a high-rate environment, the company sees new M&A opportunities thanks to high balance sheet liquidity, fixed-rate debt, and no maturities until 2025.

kafl/iStock via Getty Images

Introduction

It's time to talk about the TransDigm Group (NYSE:TDG). Since my most recent article was written in October, the stock has accelerated by roughly 50%. The company is, once again, firing on all cylinders, as it benefits from accelerating defense demand, rebounding commercial demand, and its ability to boost margins and free cash flow, thanks to its M&A and pricing-driven business model. In this article, we'll assess all of this and discuss why I believe that this company will continue doing what it did so well before the pandemic: Outperforming its peers.

So, without further ado, let's dive into one of the most spectacular stocks in the industrial sector!

TransDigm Is Back

With a market cap of $41 billion, TransDigm is a leading designer, producer, and supplier of highly engineered aerospace components. The company's products are used on a broad range of commercial and military aircraft, as well as helicopters and other defense platforms.

TransDigm's components are critical to the safety, reliability, and performance of these aircraft, and the company has built a reputation for quality, innovation, and customer service. In total, 90% of its products are proprietary products.

In FY2022, defense sales, including defense OEM and aftermarket, accounted for 43% of total sales, which is quite significant.

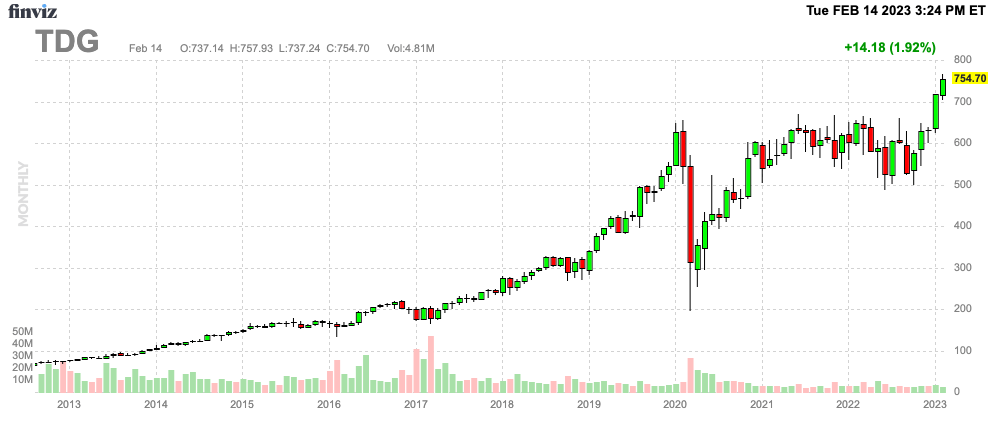

As the chart below shows, the pandemic hit the company very hard, as its share price dropped from $650 to $200 before the vaccine news broke. Now, the stock has broken out, as it's up close to 20% since the start of this year.

FINVIZ

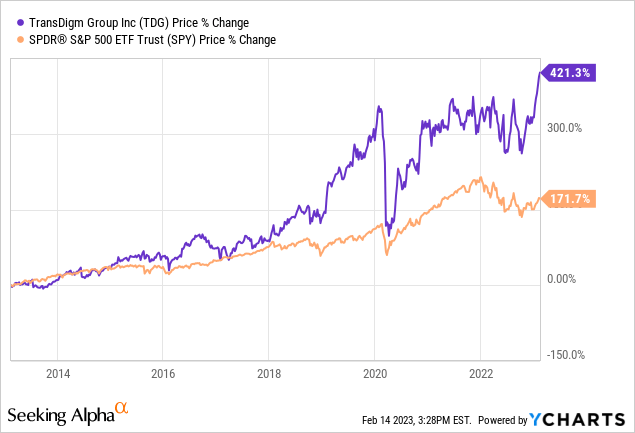

In other words, TDG is doing what it does best: Outperforming the market.

Over the past 10 years, the stock has risen 420%, which includes almost three years without gains. The S&P 500 is up 170% during this period, which isn't bad either.

With that said, let's dig a bit deeper.

What Makes TDG So Special

The company's business model is centered on acquisitions, and it has a track record of successfully integrating and improving the performance of the businesses it acquires. Essentially, TDG is a private equity company holding close to 70 different operating subsidiaries which operate 100 manufacturing facilities. Most companies hold their own names, which also is typical in the private equity space.

We have a decentralized organizational structure and a unique compensation system closely aligned with shareholders. We acquire businesses that fit this strategy and where we see a clear path to PE-like returns. - Kevin Stein, President & CEO

In addition, TransDigm's focus on proprietary products with high barriers to entry and strong pricing power has helped it maintain attractive profit margins and generate significant free cash flow.

In essence, TransDigm's business model is based on identifying and acquiring players in specialized aerospace niches and then optimizing their businesses. This includes leveraging the company's strong pricing power, which is supported by its focus on smaller, proprietary components. By raising the prices of these components, TransDigm is able to drive increased profitability and generate strong free cash flow.

TransDigm's market position is strengthened by the fact that it's often the sole provider of its products, with 80% of its products having no viable alternative. This makes it easier for the company to maintain its pricing power and sustain a high level of customer loyalty. Additionally, over 75% of the company's products are used for aftermarket sales, which provides significant potential for long-term customer relationships and recurring revenue.

In summary, TransDigm's success can be attributed to...

- Its ability to identify and acquire smaller suppliers with limited competition

- Build a portfolio of niche products with high-pricing power

- And generate increasing free cash flow, which is used to reduce M&A-related debt

This allows the company to continue to dominate every stage of the aerospace supply chain, creating a virtuous cycle of growth and profitability.

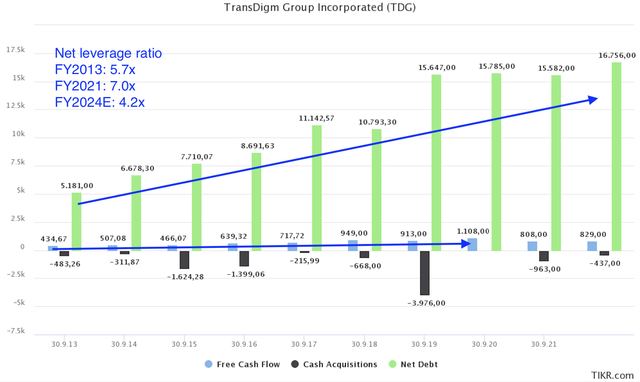

As the chart below shows, the company has engaged in a number of major deals in the past 10 years. These deals have significantly increased net debt, but they also increased free cash flow. Note that between 2013 and 2021, net leverage rose from 5.7x EBITDA to 7.0x EBITDA. This also was caused by lower EBITDA. Note that I also added FY2024 net debt estimates, which are much lower. Essentially, if the company were to refrain from major M&A deals, it would be in a good spot to quickly deleverage its balance sheet, but more on that later.

TIKR.com (Author Annotations)

With that said, growth is back, as we're finally in a post-pandemic world. Even China has reopened its economy.

Global Aerospace Is Back On Track

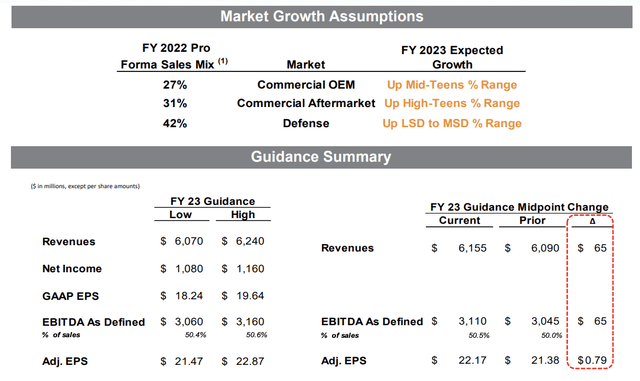

Earlier this month, TransDigm did what it does best: Beating earnings and raising guidance.

As reported by Seeking Alpha, the company did $1.4 billion in 1Q23 revenue. This was in line with estimates and 17.6% higher compared to the prior-year quarter.

It helped to boost adjusted EPS to $4.58, which was $0.28 higher than expected.

Full-year sales guidance was updated as net sales are anticipated to be in the range of $6,070 million to $6,240 million compared with $5,429 million in fiscal 2022 (an increase of $65 million at the mid-point) vs. consensus of $6.08B.

TransDigm Group

Moreover, the company sees outperforming growth in its commercial segments, which include both OEM and aftermarket. In 2022, these sales accounted for 58% of total revenues.

Additionally, the company achieved an EBITDA as defined margin of 50% in the quarter. While the commercial aerospace market is recovering, demand for air travel remains depressed, and the industry still has progress to make to return to pre-pandemic levels. The company believes that trends in the commercial aerospace market remain favorable as demand for travel is robust, with international air traffic closing in on the domestic travel recovery and China reopening its air travel in January with the lifting of its pandemic restrictions.

We are encouraged by the progression of the commercial aerospace market recovery to date, and trends in the commercial aerospace market remain favorable as demand for travel remains robust.

[...] International air traffic is closing in on the domestic travel recovery, and China reopened its air travel in January with the lifting of its pandemic restrictions. However, there is still progress to be made for the industry as our results to continue to be adversely affected in comparison to pre-pandemic levels since the demand for air travel is still depressed.

These are the expected (by analysts, not company guidance) revenue, EBITDA, and free cash flow growth rates going forward (excluding M&A, as that's impossible to predict):

- FY23. Revenue +13%, EBITDA + 18%, FCF +51%

- FY24. Revenue +9%, EBITDA + 7%, FCF +25%

- FY25. Revenue +8%, EBITDA + 8%, FCF +17%

With that said, one major thing we need to discuss is the company's balance sheet. After all, we discussed in this article that leverage is elevated as a result of the company's M&A-focused business model.

The good news is that the company remains in great shape despite high rates. The company has a cash balance of $3.3 billion, which (according to the company) leaves it with significant liquidity and financial flexibility to meet any capital requirements in the foreseeable future.

Moreover, it needs to be said that the company's debt is protected against rising rates. 75% of its debt has a fixed rate. This is achieved via a combination of interest rate caps and swaps, which are hedging instruments used to turn variable rates into fixed rates. This is done with a counterparty that's looking to do the opposite.

Hence, a surge in LIBOR rates from 4.9% to 7.0% would increase the company's pre-tax interest rate by just 40 basis points to 6.2%. The current weighted average interest rate is 5.8%.

It also helps that TDG has no maturities until 2025, which buys the company a lot of time.

TransDigm Group

Hence, the company commented that it's actively looking for M&A opportunities in the market.

Regarding the current M&A pipeline, we are actively looking for M&A opportunities that fit our model. Acquisition opportunity activity continues and we have a decent pipeline of possibilities as usual, mostly in the small and midsize range. I cannot predict or comment on possible closings, but we remain confident that there is a long runway for acquisitions that fit our portfolio.

With that said, let's look at the valuation.

Valuation

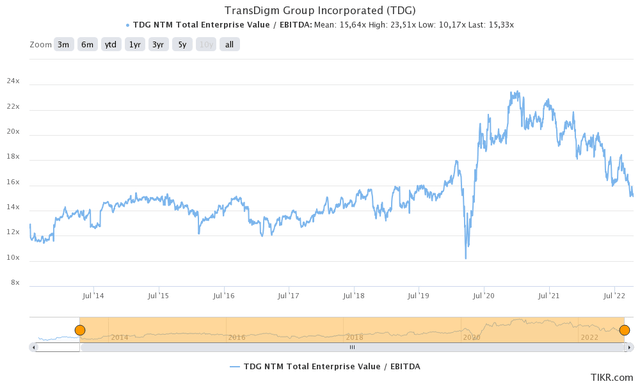

Based on its expected FY2024 EBITDA of $3.4 billion, TransDigm is currently trading at 16.4x, with a market capitalization of $41.3 billion and anticipated net debt of $14.4 billion. Looking at the company's historical valuation range, it appears to be trading at a fair value. The current consensus price target for TDG is $777, which represents a modest 3% increase from its current trading price.

TIKR.com

With that said, here are my final words.

Takeaway

In this article, we delved into TransDigm, an industrial stock that has gained significant attention for its fascinating business model. The company's strategic focus on mergers and acquisitions enables it to capitalize on pricing and synergies, in addition to benefiting from sustained growth in aerospace demand.

Furthermore, recent developments in commercial aerospace present a favorable environment for TransDigm to accelerate revenue growth. This, coupled with anticipated higher margins, sets the stage for continued impressive pre-pandemic EBITDA and free cash flow growth.

Since the publication of my latest article, TransDigm's stock has surged by approximately 50%, making it one of the most attractive industrial stocks in the market.

While I believe that the company will continue to outperform over the long term, it's worth noting that the stock is fairly valued at present. Therefore, I would suggest waiting for a market correction before considering any purchase.

(Dis)agree? Let me know in the comments!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.