The Reasons We Are Downgrading Target To Hold

Summary

- The profit margin has contracted substantially in 2022. While the improving macroeconomic environment may improve profitability, inventory management is likely to offset the benefits in the near term.

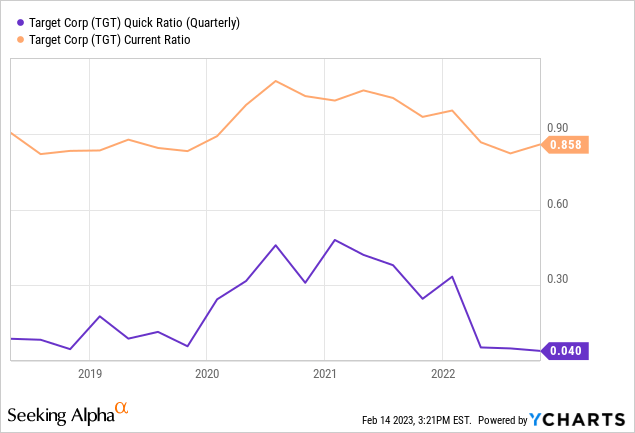

- Better inventory management is also needed to improve the quick ratio, which has also fallen sharply in 2022. We would like to see TGT's financial flexibility improving in general.

- Accounts receivable have been growing faster than sales, which is a warning sign. However, the improving consumer sentiment may spark demand for TGT's products.

- For these reasons, we downgrade TGT's stock to "hold".

JHVEPhoto

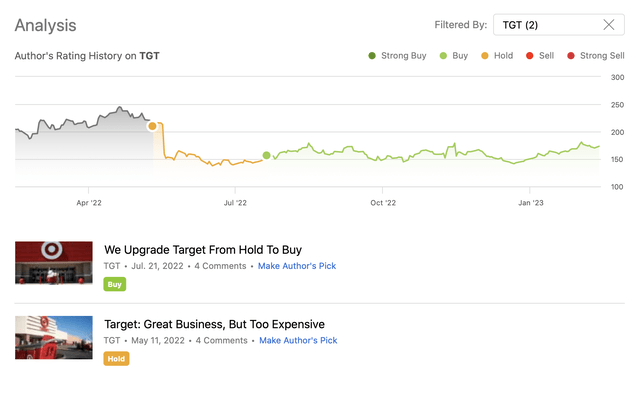

Target Corporation (NYSE:TGT) operates as a general merchandise retailer in the United States. We have published two articles on Target in 2022, first having a neutral view on the stock, then upgrading it after the sharp drop in the share price.

The primary reasons for our initial neutral view have been the firm's strong financial performance in 2021, along with its commitment of returning value to its shareholders. On the other hand, at that time, we believed that the stock has been too expensive. After the drop in the share price, we have updated our view and we became more bullish.

Today, we are going to take a look how the firm's efficiency and profitability has been changing since then. We will highlight, how certain macroeconomic factors may influence these measures going forward. We will be also emphasising inventory management, as earlier this year Target, as well as Walmart (WMT), have been struggling with this issue.

Let us start our analysis now by looking at the net profit margin.

Net profit margin

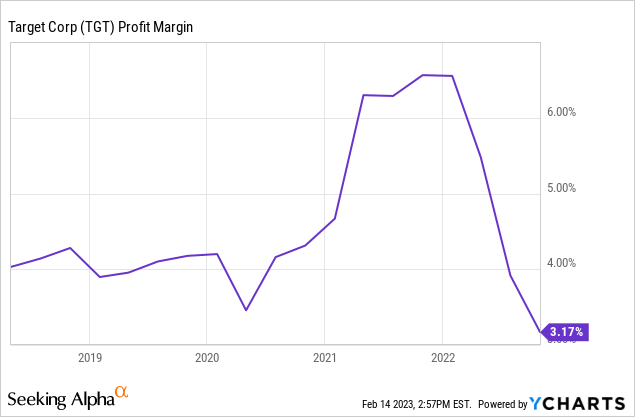

Net profit margin is a widely used measure of profitability. It is a ratio of earnings to revenues, and essentially indicates how much profit the company has left after accounting for all expenses. The following chart shows the development of Target's profit margin over the past 5 years.

We can see that after the pandemic, TGT's profit margin has almost doubled, however since the beginning of 2022, it has been falling rapidly. The current profit margin is even below pre-pandemic levels.

Going forward, we believe that there are several factors that are likely to influence this measure.

Let us start with potentially the most critical one: inventory management.

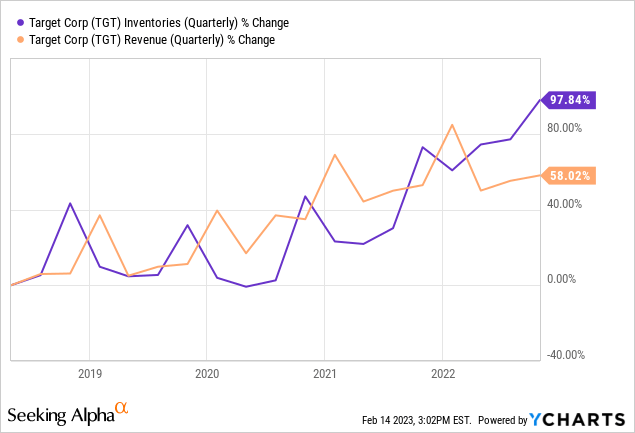

Over the past year, TGT's inventory growth has outpaces its revenue growth by far. First of all, we would like to see the inventory growth slow significantly. But, Target has been already having issues with inventory reduction in 2022. The firm has using significant promotional activity and discounting to get rid of excess/obsolete inventory, likely contributing significantly to the margin contraction.

Going forward, we believe that this is going to keep negatively impacting the firm's financial performance.

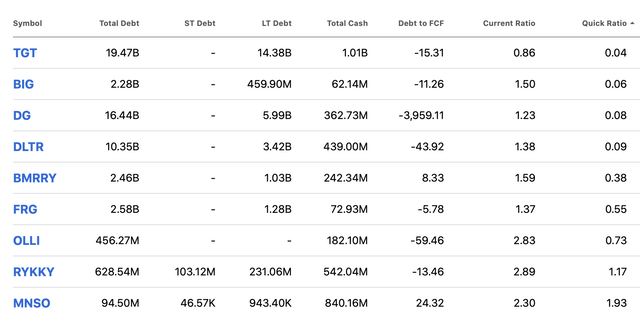

The inventory does not only have a negative impact on the margins, but also on the liquidity. The following graph shows the development of the current- and quick ratios over time. While the current ratio has remained fairly constant, slightly below 1, the quick ratio, which excludes inventory from the calculation is at extremely low levels.

To put these liquidity ratios into perspective, currently TGT has the lowest quick- and current ratios in the "General Merchandise Store" industry.

We also have to mention that some analysts are expecting that the "highly promotional period for retail sparked by bloated inventory levels could be nearing its close." We will be definitely watching out for TGT's next earnings report to see whether this expectation materialises or not.

On the other hand, since our last writing, the macroeconomic environment has improved significantly. Energy prices, along with freight costs and raw material prices have been decreasing. We do not expect these prices to reach 2022 highs in the coming quarters. For this reason, we believe that going forward the improvement of the macroeconomic environment is likely to have a positive impact on the margins, especially starting from the second half of 2023.

All in all, from a profitability point of view, especially when we focus on inventory management, our view is much less bullish than it was in the first half of 2022. We would like to see inventory levels falling and liquidity improving, particularly from a quick ratio perspective.

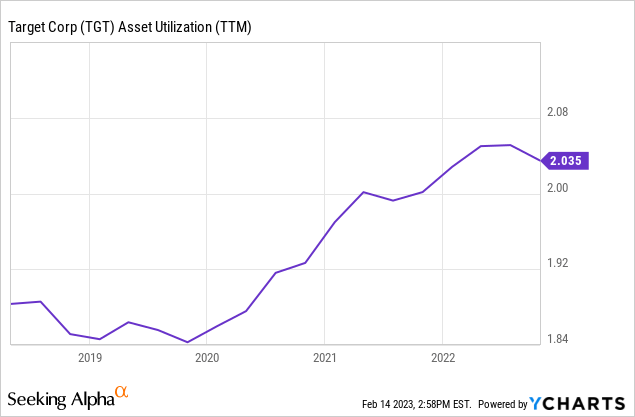

Asset turnover

Asst turnover, or sometimes called asset utilisation is an efficiency ratio. It measures, how efficient the firm is generating sales using its assets. Normally a stable or increasing ratio is preferred.

In fact, TGT's efficiency has been improving steadily over the past years.

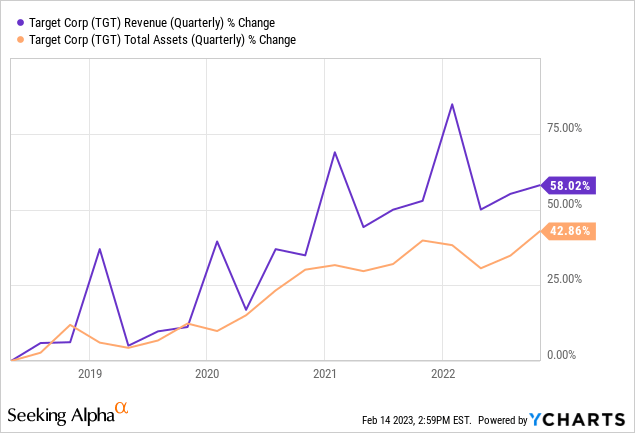

This improvement has been primarily driven by the fact that sales growth has outpaced total asset growth.

At this point, we always ask ourselves, but is this sales growth sustainable?

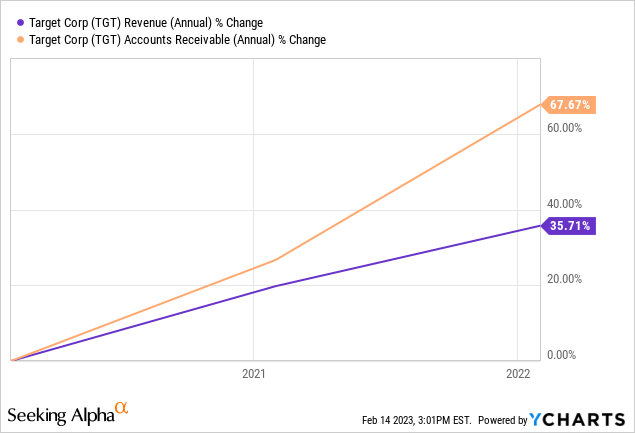

To give an answer, we normally compare the sales growth, with the growth in accounts receivable. If the growth in accounts receivable outpaces sales growth, it can be a warning sign. It may indicate more aggressive accounting or more sales on credit. It may distort the picture about the demand for the firm's products, as demand may have been "pulled forward" from future periods, on the expense of the future.

In fact, TGT's accounts receivable growth has been far higher than the sales growth. This is something that we do not particularly like.

On the other hand, the improving macroeconomic environment may fuel the demand for Target's products in the quarters to come.

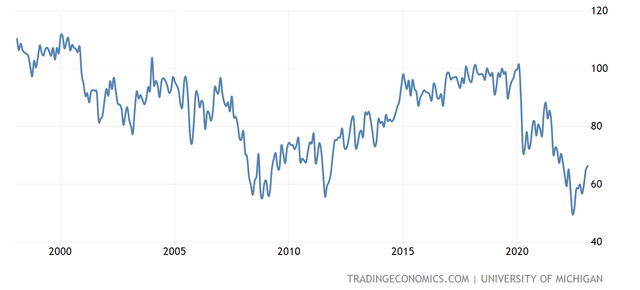

Since our last article, consumer confidence has substantially improved.

U.S. Consumer confidence (Tradingeconomics.com)

This development can have a positive impact on the spending behaviour of the consumer. Improving sentiment may lead to increased spending on discretionary, non-essential goods, which could fuel Target's sales growth in the coming quarters.

Another factor that analysts believe could positively impact TGT's sales is the bankruptcy of Bed Bath & Beyond (BBBY).

To sum up

Profit margin has been gradually declining in the previous quarters, falling below pre-pandemic levels. The improving macroeconomic environment may have a positive impact on the margins, however the elevated inventory levels may lead to substantial promotional activity, potentially offsetting the macro tailwinds.

We would like to see the improvement of the liquidity ratios.

We would like to see sales growing faster than accounts receivable. The improving consumer confidence, along with the BBBY's struggle, may positively impact the demand for TGT's products and therefore the sales figures.

For these reasons, we are becoming more cautious on TGT's stock. We downgrade the stock to "hold".

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article was co-authored by Mark Lakos.