Big 11.65% Yield On Unique NuStar Baby Bond

Summary

- NuStar baby bond symbol NSS is unique because it is the only MLP baby bond and one of only 3 baby bonds in the entire market that are fixed-to-floating rate.

- NSS currently floats at LIBOR plus 6.734%, and with LIBOR currently at 4.87%, that puts the current yield at 11.65% with it likely to go higher in the near term.

- NSS is grossly undervalued relative to its credit rating and relative to the 3 NS preferred stocks.

- I consider NSS a very strong buy and suggest anyone owning NS preferred stocks swap them for NSS.

- Looking for a portfolio of ideas like this one? Members of Conservative Income Portfolio get exclusive access to our subscriber-only portfolios. Learn More »

SL_Photography

NuStar Energy

Company Website

NuStar Energy (NYSE:NS) is an energy midstream MLP owning primarily pipelines in one of the best locations in the USA, in the Permian Basin, and also owns oil storage facilities. Here is how Yahoo Finance describes NS.

NuStar Energy L.P. engages in the terminalling, storage, and marketing of petroleum products in the United States and internationally. The company also engages in the transportation of petroleum products and anhydrous ammonia. It operates through three segments: Pipeline, Storage, and Fuels Marketing. The Pipeline segment transports refined products, crude oil, and anhydrous ammonia. The Storage segment owns terminal and storage facilities, which offer storage, handling, and other services for petroleum products, crude oil, specialty chemicals, renewable fuels, and other liquids; and pilotage, tug assistance, line handling, launch, emergency response, and other ship services. The Fuels Marketing segment is involved in bunkering operations in the Gulf Coast; blending operations; and purchase of petroleum products for resale. As of December 31, 2021, it had 3,205 miles of refined product pipelines and 2,230 miles of crude oil pipelines in Texas, Oklahoma, Kansas, Colorado, and New Mexico; a 2,050-mile refined product pipeline originating in southern Kansas and terminating at Jamestown, North Dakota; a 450-mile refined product pipeline originating at Marathon Petroleum Corporation's Mandan, North Dakota refinery and terminating in Minneapolis, Minnesota; a 2,000-mile anhydrous ammonia pipeline; and 29 terminal and storage facilities, which offer approximately 44.2 million barrels of storage capacity. The company was incorporated in 1999 and is headquartered in San Antonio, Texas.

NS just reported a record 4th quarter in terms of revenue and EBITDA. They beat earnings and revenue estimates and gave strong forward guidance for 2023. They expect 2023 net income in the range of $202 to $240 million and adjusted EBITDA of $700 to $760 million.

The company also reported that they bought back around 1/3 of its private preferred “D” shares as the yield on these shares will jump to 13.75% in September if not called. NS has been talking about their goal to rid themselves of these high yielding preferred stocks but now we see real action.

NuStar’s Preferred Stocks and Baby Bond

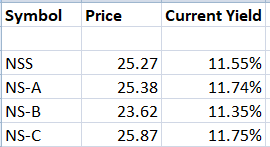

NS currently has 3 publicly traded preferred stocks. All 3 are now floating with LIBOR. Here are the details:

NS-A (NS.PA) Floats at LIBOR plus 6.766% Callable anytime

NS-B (NS.PB) Floats at LIBOR plus 5.643% Callable anytime

NS-C (NS.PC) Floats at LIBOR plus 6.880% Callable anytime

And as I mentioned above, they also have a non-publicly traded preferred stock, its preferred “D” stock, that currently has a 12% yield but will jump to 13.75% in September of this year if not repurchased by NS.

NS also has a floating rate baby bond, symbol (NSS). Its price is currently $25.27.

NSS Floats at LIBOR plus 6.734% Callable now. Matures on 1/15/2043.

NSS is a junior bond. That means that it sits above the preferred stocks in the capital stack but below other unsecured debt. Being a junior bond also entails the fact that NS could conceivably defer NSS interest payments for up to 5 years without having to declare bankruptcy. But they must pay off the bond in full at maturity including any missed interest payments.

I believe a deferral of interest payments on NSS is extremely unlikely and I will talk more about this later.

NSS Looks Much Better Than The NS Preferred Stocks

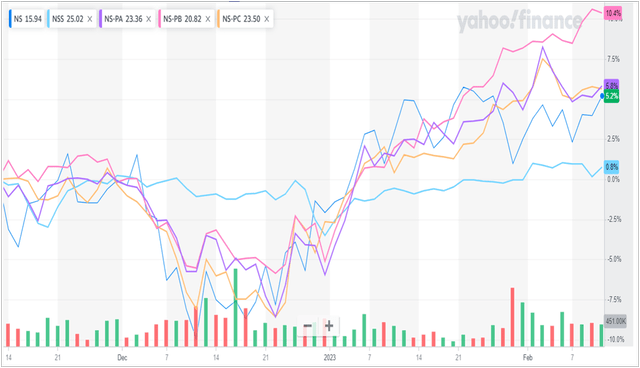

Author

As you can see from this chart, NSS offers pretty much the same yield as the preferred stocks but is significantly safer as I will explain a bit later. It is quite unusual for an investor to get the same current yield from a bond from a company that you get from the same company’s preferred stocks, especially when these preferred stocks do not pay qualified dividends.

Additionally, NSS investors do NOT get K-1s whereas the preferred stock owners do have to deal with K-1s at tax time.

Safety of NSS Versus NS Preferred Stocks

Why I believe that NSS is so much safer than the preferred stocks is that there is a massive amount of NS preferred stock outstanding – approximately $1.2 billion of preferred stock. Since NSS is higher in the capital stack than these preferred stocks, this $1.2 billion of protection that NSS gets from being ahead of the preferred stocks is huge. The whole market cap of NS is $1.9 billion which gives you an idea of how large their preferred stock issuance is for a company of this size. And when you combine the common stock market cap with the preferred stock outstanding that provides $3.1 billion of common and preferred equity covering a mere $400 million of NSS bonds outstanding. That is over 6 times coverage.

Safety of NSS In General and the Excellent Buying Opportunity

NS has given guidance for generating $700 to $760 million of adjusted EBITDA in 2023. Total interest expense for 2023 looks to be around $230. So using the low end of EBITDA estimates, we have more than 3 times coverage of the NSS baby bonds. I estimate preferred stock dividends to be around $144 million in 2023, so when you calculate preferred stock coverage, you get only 1.87 times coverage versus 3 times for NSS. When calculating preferred stock dividend coverage, you must also include interest expense since that must be paid before preferred stock dividends.

In terms of call risk, since the stripped price of NSS is actually below par, a call is not really a risk except for the difficulty of finding such a good high yielding bond to replace it if called. But a call is currently quite unlikely. The reason I am not concerned about a call is that the company is now focused on trying to buy back its high yielding preferred “D” shares which will jump to a 13.75% interest rate in September if they do not call them. And there are still $400 million of preferred “D” shares outstanding.

It is my belief that the market is pricing NSS like it could be called any time which I don’t believe is correct at all. That is why you can get NSS at such a cheap price and why you are able to get NSS with such a high yield – as high as the riskier preferred stocks. I see this as a real opportunity to ride NSS for as long as it remains outstanding which could be a very long time.

NSS Lagging

As you can see from the 3 month price chart above, NSS has significantly lagged the move in the NS preferred stocks and even the common stock. I can only explain this by assuming that investors are worried about a call that isn’t coming any time soon if at all. As I just wrote, NS still has a very large $400 million of their high yielding preferred “D” shares to buy back before they are going to consider calling NSS, and it will likely take quite some time after they rid themselves of the preferred “D” shares before they will have the funds to start buying back NSS. So it looks like we have an excellent price for entering a position in NSS now.

NSS Is Mispriced Relative To Other Similarly Rated Bonds

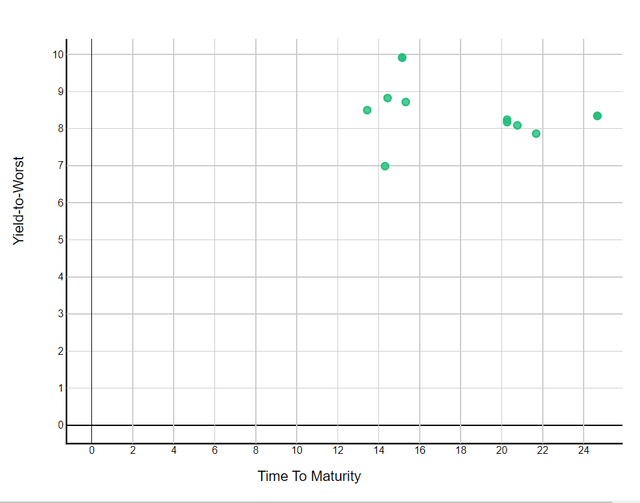

Currently Moody's rates NS unsecured debt at Ba3 and S&P rates it at BB-. Those are equivalent ratings. Generally junior bonds are 1 notch lower than this while preferred stocks are 2 notches lower, although in this case I think the size of the preferred shares outstanding should give NSS a 2 notch advantage over the NS preferred stocks.

But regardless, if we look at other bonds with a Moody’s rating of B1, the median yield looks to be around 8.5%. This makes the 11.65% yield and YTM on NSS look outstanding. There are not a lot of other long term bonds with a B1 rating but here is a plot from Interactive Brokers.

One last important point is that despite the fact that NSS could eventually see its yield decline if LIBOR goes lower, NSS still trades around the same price it did 1 year ago when LIBOR was much lower. So even if we return to the much lower rate environment we had, the price of NSS should hold up well. The large spread over LIBOR of 6.73% should make this bond relatively attractive in any interest rate environment, so we have a decent amount of price safety along with a huge yield. And LIBOR, along with the yield on NSS, could go even higher from here as the Fed does not seem totally finished hiking short term rates yet.

Important Note to Foreign Investors

A am not a tax expert at all, but I understand that there is now withholding of 10% on the sale of MLP common stocks and preferred stocks when purchased by foreign investors. I presume MLP bonds are also subject to this withholding, but I can’t verify that. So unless you know that NSS will not be affected by this new withholding rule, foreigner investors should avoid any U.S. MLP products.

Summary

NSS is a floating rate baby bond which is very rare and it is also the only MLP baby bond. The current yield and YTM of 11.65% on NSS is outstanding relative to the 8.5% yield on similarly rated bonds and relative to riskier NS preferred stocks. To get this kind of yield on a company that is performing fine and with good interest and equity coverage is quite unusual in the current market. NSS just announced an earnings and revenue beat in the 4th quarter and strong EBITDA and earnings guidance for 2023.

If the “experts” are correct, short term rates may go another quarter or half point higher and then pause lifting the yield on NSS even higher for some time to come. And the high floating rate formula of LIBOR plus 6.73% should make NSS relatively very high yielding in any interest rate environment. Even when LIBOR was much lower a year ago, NSS traded around the same price as now so downside price risk on lower interest rates looks relatively low.

It appears that NSS is very undervalued because of fears of a call. But the current stripped price is below par so there really is no risk. Additionally, NS is focused on calling their large $400 million of very high yielding preferred “D” shares and is unlikely to even consider a call on NSS until these preferred shares are called. Thus, it should be a long time before NSS is called if it is called at all.

I consider NSS a strong buy and core holding in a fixed-income portfolio and strongly suggest that those who own NS preferred stocks swap them for the NSS baby bond.

Are you looking to start building a Fixed Income Portfolio?

Conservative Income Portfolio targets the best Preferred Stocks and bonds with the highest margins of safety. We strongly believe that the next decade will belong to fixed income irrespective of whether you are conservative or aggressive in your approach! Get in on the ground floor of our recently started Bond and Preferred Stock Portfolios.

If undervalued fixed income securities, bond ladder, “pinned to par” investments and high yielding cash parking opportunities sound like music to your ears, check us out!

This article was written by

Trading preferred stocks and fixed income securities for more than 25 years and stocks in general for 35 years. Author of many Seeking Alpha articles and Editor's Picks articles.

Disclosure: I/we have a beneficial long position in the shares of NSS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.