ETO: Earn Income From Around The World With This CEF

Summary

- Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund invests in dividend-paying stocks from around the world.

- The ETO closed-end fund has underperformed the MSCI World Index, although that is not a perfect benchmark for the fund.

- The fund appears to be reasonably well diversified, particularly internationally.

- The fund recently cut its distribution, which is disappointing but it can probably maintain its current 7.20% yield going forward.

- The fund is currently trading at a discount to the net asset value.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

We Are

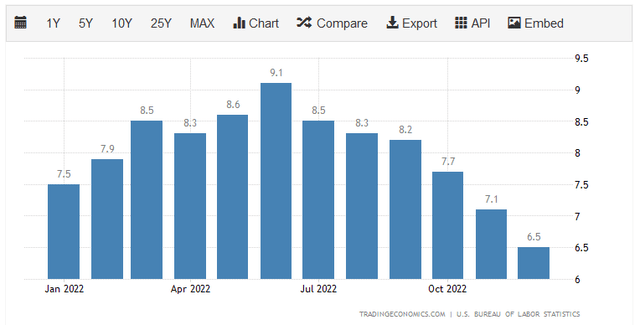

It is unlikely to be a surprise to anyone that one of the biggest problems facing most Americans today is the incredibly high rate of inflation that has dominated the economy over the past year. In fact, there has not been a single month over the past year in which the CPI did not increase by at least 6.5% relative to the prior year:

This has naturally pushed up everyone's cost of living. However, as much of the inflation has been centered on food and energy, which are necessities, those of limited means have been significantly impacted. A recent Prudential Pulse survey summarizes the struggles of many households today as it points out that approximately 81% of Generation Z members and 77% of Millennials have joined the gig economy as a way to get the extra money that they need to cover their expenses today. We have also seen credit card debt hit an all-time high as consumers are forced to borrow money in order to maintain their standard of living. Clearly, the rapid increase in prices has had a devastating impact on many households.

Fortunately, as investors, we can put our money to work for us in order to obtain the extra money that we need to support our lifestyles. One of the best ways to do this is to purchase shares of closed-end funds ("CEFs") that specialize in investing in income-producing securities. These funds comprise an asset class that is not often followed by many investors but they are a very good security type for income-focused investors. This is because they provide an easy way to gain access to a diversified portfolio of assets that can usually deliver a higher yield than any of the underlying assets actually possesses.

In this article, we will discuss the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (NYSE:ETO), which yields an impressive 7.20% at the current price. While this is admittedly not as impressive as some closed-end funds manage to deliver, it should still be acceptable to most investors that are seeking income. I have discussed this fund before, but more than a year has passed since that time, so a great many things have changed. This article will focus specifically on those changes as well as provide investors with an updated analysis of the fund's finances. Let us investigate and see if this high-yielding fund could be a good addition to a portfolio today!

About The Fund

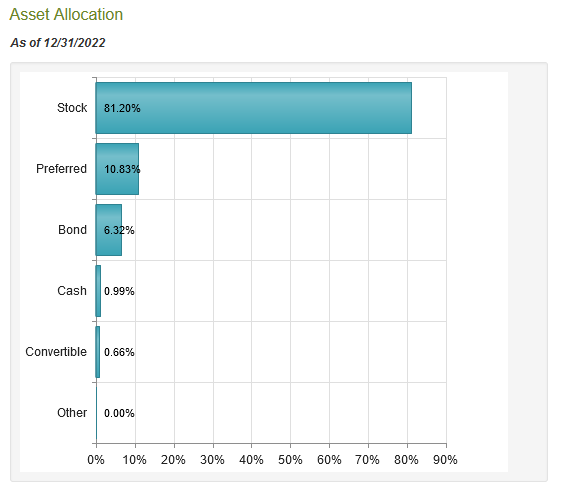

According to the fund's webpage, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund has the objective of providing its investors with a high level of total return. This is hardly surprising, as the name of the fund suggests that it will be investing in dividend-paying assets from around the world. This implies that it is a common stock fund, which is confirmed by a look at the fund's portfolio. As we can see here, 81.20% of the portfolio is invested in common stock:

CEF Connect

Common stocks are generally considered to be a total return vehicle. After all, we generally buy these assets for the dividend income that they pay out as well as for capital gains potential. This appears to be the fund's objective as well, although the fact that 17.15% of the portfolio is invested in fixed-income securities such as preferred stock and bonds indicates that the fund is not neglecting income.

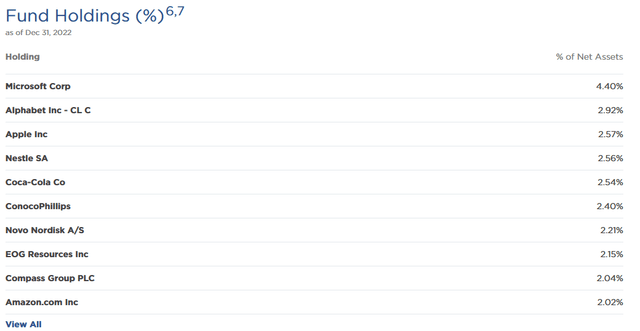

The fact sheet states that the fund attempts to achieve its goal by investing in dividend-paying stocks issued by both American and foreign companies. A look at its largest positions reveals that this is indeed what it is doing, although there are a few stocks that the fund is heavily invested in that do not pay a dividend:

In particular, Alphabet (GOOG) and Amazon (AMZN) do not pay dividends. We also see a number of companies here whose yields are so small that it hardly matters:

| Company | Current Yield |

| Microsoft (MSFT) | 1.03% |

| Apple (AAPL) | 0.61% |

| Nestle SA (OTCPK:NSRGF) | 2.54% |

| Coca-Cola (KO) | 2.95% |

| ConocoPhillips (COP) | 3.93% |

| Novo Nordisk (NVO) | 1.70% |

| EOG Resources (EOG) | 2.46% |

| Compass Group (CODI) | 4.57% |

As of the time of writing, the S&P 500 Index (SP500) yields 1.55%, so I would consider anything under that yield a questionable choice for a dividend fund. That would apply to all four of the mega-cap technology stocks in this fund. This is a problem that most of Eaton Vance's equity-income closed-end funds have. With that said, as I have pointed out before, the mega-cap technology stocks were responsible for an outsized amount of the total return of the S&P 500 over the past twelve years. It thus makes some sense for the fund to include exposure to them in order to avoid lagging the broader market index too greatly. With the exception of Microsoft, none of these companies account for a significant portion of the fund's assets anyway, so I do not consider their presence to be as much of a problem as I do with some of Eaton Vance's other funds.

There have been a number of changes since we last discussed this fund. In fact, the only companies on the fund's largest positions list that were also on it the last time we reviewed the fund are the four technology companies. The fund removed ASML Holding (ASML), Meta Platforms (META), Adidas AG (OTCQX:ADDYY), Boston Scientific (BSX), AMETEK (AME), and Zoetis (ZTS). These were replaced with Nestle, Coca-Cola, ConocoPhillips, Novo Nordisk, EOG Resources, and Compass Group. I cannot say that I object to most of these changes. After all, Adidas is suffering from the fallout with Kanye West and the problems at Meta Technologies do not even need to be mentioned. In exchange, we got two energy companies and energy has been one of the best-performing sectors over the past year. Novo Nordisk also has some very good prospects considering the growing prevalence of diabetes around the globe. Overall, these changes were for the best in my opinion.

The fact that so many of the fund's largest positions changed over the past year will undoubtedly lead some to believe that the fund has a very high annual turnover. This is actually not the case as its 52.00% turnover is about average for an equity closed-end fund. The reason that this is important is that it costs money to trade stocks or other assets and these expenses are billed directly to the fund. This creates a drag on its performance since management must generate sufficient excess returns to cover these costs and still deliver a performance that is comparable to the index. That is a very difficult task that few management teams manage to achieve consistently.

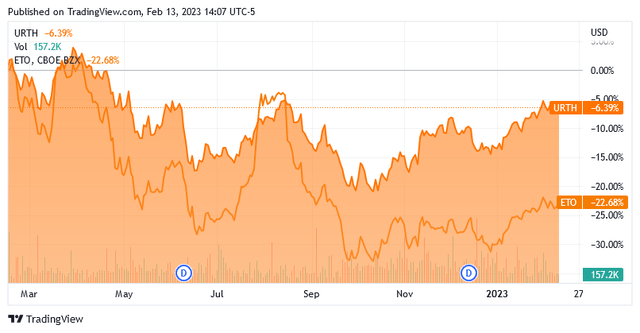

This fund is no exception to this general underperformance. The fund's own fact sheet compares this fund to the MSCI World Index (URTH) so here is how the two match up over the past twelve months:

As we can clearly see, the MSCI World Index substantially outperformed the closed-end fund over the same period. Admittedly, the index's 1.57% yield is nowhere near as attractive as that of the Eaton Vance fund but that does not change the fact that this fund greatly underperformed the index. With that said, this underperformance was not a constant event as there was a span of time during July and August when the closed-end fund was beating the index. However, investors in the index are probably still happier than investors in this fund.

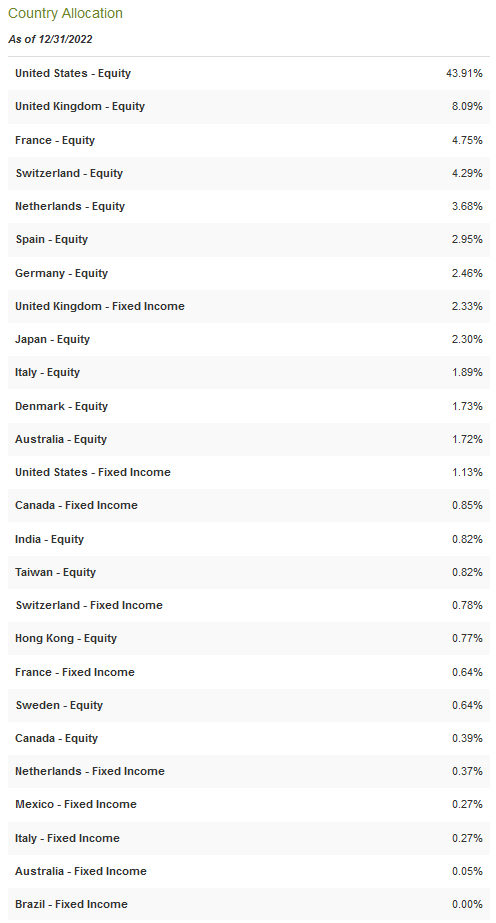

As mentioned earlier in this article, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund invests in securities issued by companies all over the world. We can see that reflected somewhat in the largest positions list as three of the ten companies are based abroad. In fact, only 43.91% of the fund is invested in American companies:

CEF Connect

This is surprising, in a good way. As I have noted in various past articles, the United States only accounts for a bit less than a quarter of the global gross domestic product. However, most global funds have more than 60% of their assets invested in the United States. This fund is still overweighted to that nation based on its actual representation in the global economy, but it is nowhere near as bad as some funds. This is nice to see because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take an action that has an adverse impact on a company in which we are invested. The only real way to protect ourselves against this risk is to ensure that only a relatively small percentage of our portfolios is exposed to any given country. This fund is certainly doing a better job of accomplishing that than most other global funds, which means that including it in a portfolio can actually help to reduce our total exposure to the United States.

We also see the fund's diversity simply by looking at the individual holdings in the fund's portfolio. As my regular readers on the topic of closed-end funds are no doubt well aware, I do not usually like to see any individual position in a fund account for more than 5% of the fund's total portfolio. This is because that is approximately the point at which the asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. this is the risk that we aim to eliminate through diversification. However, if the asset accounts for too much of the portfolio then this risk will not be completely diversified away. Thus, the concern is that some event will cause the price of a given asset to decline when the market as a whole does not. If that asset accounts for too much of the portfolio then this scenario may cause it to pull the whole fund down with it. However, as we can see above, there is no individual asset that accounts for more than 5% of the portfolio so we do not really need to worry about this risk. This is also better than some of Eaton Vance's other closed-end funds that have substantially outsized exposure to the mega-cap technology stocks.

Leverage

In the introduction to this article, I mentioned that closed-end funds like the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund have the ability to use various strategies to boost their effective yields beyond those possessed by any of the individual assets. One of these strategies that are employed by the fund is the use of leverage. In short, this fund is borrowing money and using those borrowed funds to purchase dividend-paying stocks. As long as the total return produced by the borrowed assets is higher than the interest rate that is paid by the fund on the borrowed money, the strategy works pretty well to boost the returns of the overall portfolio. As the fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword because debt boosts both gains and losses. Thus, the fund will go down faster than the market does during corrections, but it will also gain more than the market does during strong bull runs. Therefore, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I generally do not like to see a fund's leverage above a third as a percentage of its assets for that reason. Fortunately, this fund satisfies that requirement. As of the time of writing, its levered assets comprise 20.36% of the portfolio. This is a very reasonable balance between risk and reward. There is unlikely to be too much to worry about with regard to this fund's use of leverage.

Distribution Analysis

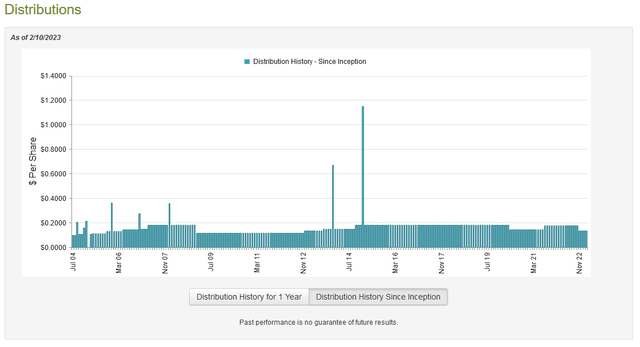

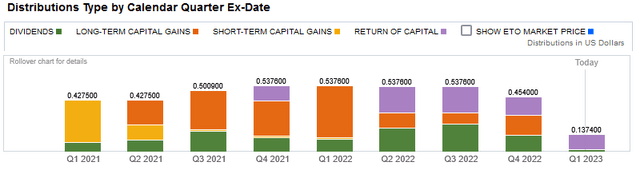

As mentioned earlier in the article, the primary objective of the Eaton Vance Tax-Advantaged Global Opportunities Fund is total return. As such, we might not expect it to emphasize distributions to the investors. However, most closed-end funds aim to pay out all of their capital gains and income to the investors. Thus, the ideal would be a fund in which the share price is relatively stable but the investors receive high distributions. The market was admittedly somewhat weak in 2022 but it had many years of strength prior to that and the fund uses leverage so it should have been able to generate better returns than the market during a multi-year bull run. This translates into a very respectable yield. As of the time of writing, the fund pays a monthly distribution of $0.1374 per share ($1.6488 per share annually), which gives it a 7.20% yield at the current price. The fund's distribution has varied quite a bit over the years and it was, unfortunately, forced to cut its payout a few months ago:

The fact that the fund's distribution has varied over the years is something that may be a turn-off to those investors that are looking for a stable and secure source of income to use to pay their bills and cover other expenses. However, as we can see, the fund's distribution cuts usually accompany market declines, such as we saw in 2020 and in 2022. Thus, it will probably be increased when the next bull market begins.

One thing that may be concerning is that the fund is estimated to have been making several return of capital distributions in recent months:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors' own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be considered a return of capital. For example, the fund might be distributing unrealized capital gains to its investors. As such, we want to investigate the fund's finances in order to determine exactly how it is paying for these distributions and thus how sustainable they are likely to be.

Fortunately, we have a very recent document that we can consult for this purpose. The fund's most recent financial report corresponds to the full-year period that ended on October 31, 2022. As such, it should give us a good idea of how well the fund handled the market turbulence that dominated 2022 alongside the Federal Reserve's monetary tightening policy. It will also give us some idea of the source of the fund's recent return of capital distributions. During the full-year period, the fund received a total of $14,196,787 in dividends and $3,758,447 in interest from the assets in its portfolio. When we combine this with a small amount of income received from other sources, the fund's portfolio delivered a total of $18,238,287 over the year. It paid its expenses out of this amount, which left it with $11,376,445 available for shareholders. That was not nearly enough to cover the $35,062,920 that the fund paid out over the period. At first glance, this may be somewhat concerning as the fund has insufficient net investment income to cover its distributions.

However, the fund does have other methods through which it can obtain the money that it needs to pay for the distribution. Chief among these is capital gains. As might be expected from the weak market over most of the period, the fund failed to accomplish this task. With that said though, it did achieve net realized gains of $23,260,173 but these were offset by $152,852,777 net unrealized losses. Overall, the fund's assets declined by $143,367,137 over the period after accounting for all inflows and outflows. This is concerning as we want the fund's assets to increase even after paying the distribution. With that said, its net investment income and net realized gains together were $34,636,618, which was very close to the amount needed to cover the distribution. This explains the distribution cut a few months ago. The fund should be able to cover its new distribution if it can generate anywhere near the same level of capital gains over the next year. When we consider the market's performance in January, this is quite possible. The distribution is probably safe at the new level but we should naturally keep an eye on it to ensure that is the case.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all of the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of the fund when we can buy them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the assets for less than they are actually worth. This is, fortunately, the case right now. As of February 10, 2022 (the most recent date for which data is available as of the time of writing), the fund had a net asset value of $24.58 per share but the shares only trade for $23.25 per share. This gives the shares a 5.41% discount to the net asset value at the current price. This is not quite as good as the 7.88% discount that the shares have averaged over the past month but it is still reasonable. This is not a bad price to pay for this fund.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund appears to be a reasonable way to get a 7.20% yield at the current price. The fund has admittedly underperformed the MSCI World Index, but that index does not specifically focus on dividend-paying stocks as the fund does, so it is not a perfect comparison. The portfolio of this fund does appear to be reasonably diversified and the fund can likely maintain the distribution at the current level going forward. The fact that it is trading at a discount is also nice. Overall, Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is not a bad CEF to keep an eye on.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.