WNS: A Relatively Unknown Compounder With A Market Beating Track Record

Summary

- WNS have made their customers dependent on the service they provide.

- They have a premium price tag, but they also have a premium performance.

- They have enough room to continue to grow their revenues and profits.

Maria Vonotna/iStock via Getty Images

Thesis

I think WNS (NYSE:WNS) is a quality compounder and it is priced like one. It is never really cheap, but they still deliver and you get a nice return on your investment. They also have nice growth opportunities in a market that is going to grow. Let me show you these points, in the next few chapters.

Short Introduction

WNS is a global BPM company that uses robotic process automation, AI, natural language processing, machine learning, blockchain and IoT, and they also like to use a lot of buzzwords. But with the outsourced processes they take care of, they deliver good performance for their clients. They're also focusing their offerings on more complex processes. In recent years, they have also gained extensive knowledge of the processes that are specific to the industries. As a result, they handle many of the company's core competencies.

Analysis

As you can clearly see in the chart above, WNS outperformed the S&P 500 by a wide margin over a 10-year period. Its CAGR over this period was ~19%. Despite its stellar performance, WNS is still relatively unknown to many people. An unknown company with plenty of room to grow over the next few years that could really help investors achieve market-beating performance.

WNS Prospects

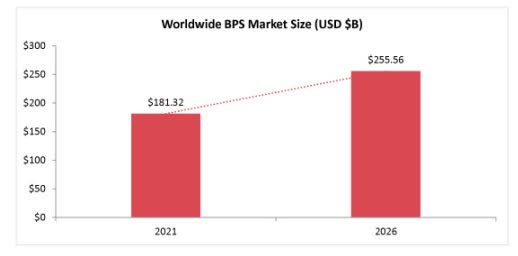

The picture above illustrates the market opportunity over the next few years. They are in a growing market and have recently acquired 3 new companies to help them grow even more. Vuram, OptiBuy and The Smart Cube are these 3 new acquisitions. These companies will help WNS to strengthen their business as they are within their area of expertise. And as they stated in their last earnings call, the new acquisitions are in areas that will be in demand in the future.

Metrics

At the moment they have a P/E ratio of around 30 and an EV/EBIT ratio of around 24, so as you can see it is not a cheap price to be paying for this company. But if you look at the historical EV/EBIT over the last 10 years, you will see that this has been the case most of the time. And you have clearly outperformed even by buying at this valuation. I for one like to buy more shares when they are temporarily cheaper because of the market volatility and as you can also see, sometimes you get the chance to buy the company at a better price.

Unfortunately, due to the high valuation, there will not be much room for multiple expansions. So you have to rely on earnings growth or share buybacks. The annual revenue growth rate over the past 10 years has been ~10% and they have ~2,000,000 million shares left in their share buyback program, or about 4% of market cap at a share price of $87.

Other ratios such as ROE, which is ~16% over the same 10-year period, are good but not outstanding. But if you have a good management team that mostly gives conservative guidance and then beats it, you get outstanding long-term returns because they just deliver good results over the long term.

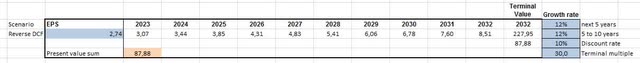

Reverse DCF

I like to look at the reverse DCF of a company to see what growth rates are priced into the stock. In this scenario I took the TTM diluted EPS of $2.74 and the historical multiple of 30. The discount rate, as always, is 10%. This is my hurdle to overcome. With these inputs I get the result that at the current share price they need to grow their EPS by 12% over the next 10 years.

This is not an easy task, but if you look at the EPS for WNS over the last 10 years, they have managed to grow it by ~20% per annum. We know that past results are no guarantee of future events, but we get a good idea that it is definitely possible for WNS to beat the 12% per year.

Business

WNS aims to provide business-critical processes that they can manage better than the companies themselves. As a result, they are deeply involved in their customers' business and are not easily changed. As a result, switching costs are high and WNS also gets a lot of intellectual property. They do the highly specialised outsourcing work, not the call centre work. There are probably cases where WNS knows more about the business processes than their customers because they have run them for so long.

Risks

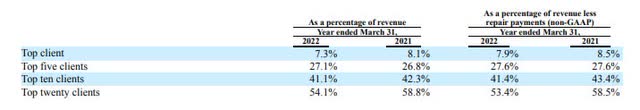

The biggest risk is that the top 5 customers account for 27% of revenue. If one of these customers were to stop working with them, there would be a very significant loss of revenue. They are also highly dependent on different industries. So they were hit pretty hard by COVID because they had a lot of customers in the travel and leisure industry. Currently, ~24% of customers are in the insurance industry, ~17% in the healthcare industry and ~15% in the travel and leisure industry.

They try to manage this risk by being as mission-critical and important to their customers as possible. In addition, they benefit from the fact that switching costs are relatively high. Over the past few years, they have also had quite good customer loyalty figures. They are also dependent on the low wages in India because they really help them to make a good profit margin. If wages were to rise sharply in the future, their business would be hit hard.

Conclusion

WNS has a deep understanding of the industry in which it operates and reinvests its cash flow in growing the business. With an ROC of ~15%, this is a valuable strategy. They also buy back some shares but do not pay a dividend. But in my opinion, the cash is better used to grow their business because dividends would be taxed. What they are doing is a more effective way of returning money to shareholders. A slightly better price for the shares would be favourable, but a premium company usually comes with a premium price. I think that even at this share price, there is a good chance that WNS will compound at a double-digit rate over the next 5 to 10 years. They have done so because their customers are dependent on their work and, in addition to that, they are also investing for future growth.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of WNS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.