VONG: You Should Wait For Another Bottom To Form Before Buying

Summary

- VONG invests in U.S. large-cap growth stocks in the Russell 1000 Index.

- The fund delivered a negative 29% return in 2022 but has since gained 9.6% YTD.

- The possible mild recession in 2023 means that there could be another bottom forming in 2023 and that is when investors should start accumulating.

Galeanu Mihai

ETF Overview

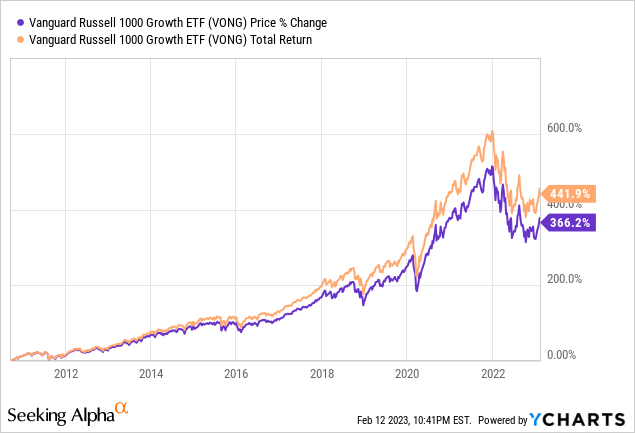

Vanguard Russell 1000 Growth ETF (NASDAQ:VONG) owns a portfolio of U.S. large-cap growth stocks selected from the Russell 1000 Index. The fund delivered a total return of negative 29% in 2022, the worst it has seen since its inception in September 2010. Looking ahead, we think growth stocks may be at risk since recession fears may mount as the year unfolds due to already elevated interest rates and an expected weakening economy. This will result in a decline in the broader stock market and negatively impact VONG. Hence, investors may want to wait for another bottom forming before investing.

YCharts

Fund Analysis

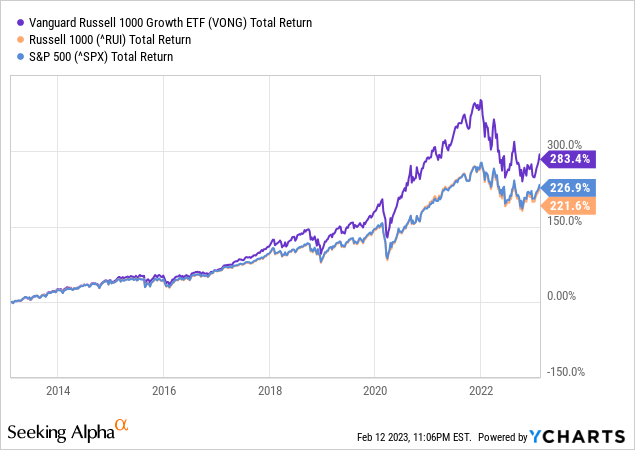

VONG has outperformed the Russell 1000 Index and the S&P 500 Index in the past decade

If you are an investor that has owned VONG for the past 10 years, the result likely looks amazing. Not only did you beat the Russell 1000 Index, you also outperformed the S&P 500 Index. As can be seen from the chart below, VONG’s total return of 283.4% in the past 10 years handily beat the S&P 500’s 226.9% and the Russell 1000’s 221.6%. This is not surprising as growth stocks have generally outperformed the broader index due to better business prospects and growth potentials. In addition, the extremely low-rate environment and quantitative-easing for the most part in the past decade also helped with multiple expansion for these stocks.

YCharts

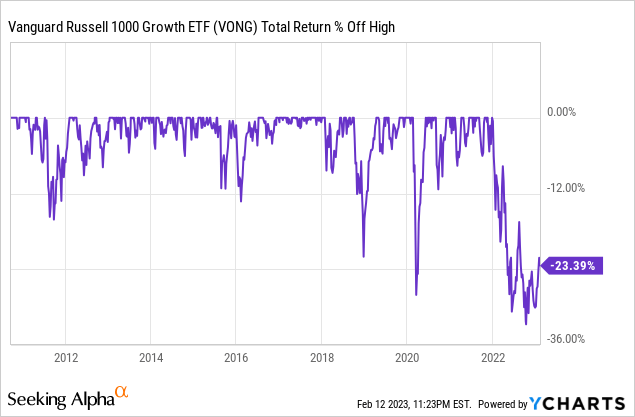

But, VONG underperformed in 2022…

However, this environment changed significantly in 2022 due to surging inflation. A combination of factors such as supply-chain constraints, the reopening of the economy that caused labor shortages, and the war in Ukraine caused inflation to shoot-up dramatically in 2022. The Federal Reserve had no choice but to raise rates aggressively and tightened its monetary policy. The result was brutal! Growth stocks have suffered multiple compression. VONG’s portfolio of growth stocks was beaten badly and registered a total return of negative 29.18%, the worst since its inception in 2010.

YCharts

Will this underperformance repeat again in 2023?

Since VONG's return was awful last year, many investors have been asking whether 2023 will be a year of rebound. The sign is encouraging year-to-date as the S&P 500 and Russell 1000 Index registered a positive return of 6.7% and 7.0% respectively. Likewise, VONG also delivered a total return of 9.6% YTD.

For the rest of 2023, we think investors need to be aware of 2 things.

First, the Fed fund rate will not likely drop this year. The rebound YTD appears to be due to the market’s optimism as the market believes that the Federal Reserve may be near the end of the rate cycle and maybe able to lower the Fed fund rate towards the end of the year. At the present, the market is giving it a 91% possibility that the Federal Reserve will raise the rates by 25 basis points in the upcoming March meeting and a 73% possibility for another 25 basis points hike in its May meeting.

While inflation has clearly peaked in mid-2022 and is declining every month, the job market is surprisingly still very strong. The latest January employment report showed that the nation added 517 thousand new jobs. This pushed the unemployment rate down to 3.4%, the lowest in several decades. This means that the Federal Reserve will have no choice but to keep the rate elevated, or perhaps to continue to move higher albeit at a slower pace. Therefore, we do not think rates will drop any time soon and hence the market may be too optimistic at this moment.

Second, a recession may appear this year. The Fed fund rate right now is the highest we have seen since 2007. This means borrowing costs are quite high and have the potential to tip the economy towards a recession. For reader’s information, a successful soft-landing only occurred 3 times in the past several decades. In a recession, company earnings will likely be revised downwards. This may result in share price declines. Historically, the stock market will not bottom until during the recession, and usually not before the recession. We have seen this in the Great Recession in 2008/2009 and in the 2000. Given a strong job market and many businesses continuing to grow their earnings in the latest earnings reports, we believe the economy is still quite strong. Therefore, we believe the upcoming recession will likely not be severe, but mild. The stock market will inevitably dip lower, forming the second bottom. However, this time, the bottom may not be lower than the low reached in October last year.

Given the above two factors we have analyzed, we believe investors may want to wait for a pullback before investing in VONG.

Investor Takeaway

VONG is a good vehicle to invest in large-cap U.S. growth stocks. These stocks generally outperform the broader market due to their growth momentum. While the beginning of 2023 shows signs of optimism, this optimism may quickly fade as recession fears arise. Given VONG’s portfolio of growth stocks, volatility will be high and investors should expect VONG's fund price to decline, forming another bottom in 2022. Hence, we recommend investors to wait for this potential bottom to form before investing.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.