I Called February's Big Reversal, Here's Why And What We're Doing

Summary

- The S&P 500 is just too expensive at this level.

- It will be brought to heel by rising rates and lower earnings.

- A long-short strategy along with hedging the indexes and maintaining a cash management discipline creates the right configuration for trading success.

- This idea was discussed in more depth with members of my private investing community, Dual Mind Research. Learn More »

CowlickCreative/E+ via Getty Images

In my last piece, I called the current sell-off for February 1st. I am starting to think I should just add two weeks to whatever turn in the market I am modeling for. Why am I so confident that a retreat is about to happen? Why: a) last year the market taught us a hard lesson, Price/Earnings Ratios can't grow to the sky. b) Profits matter as much as revenue growth c) stock price should be valued higher with profit growth, not hype. d) The historic P/E ratio is from 15 to 16 times, at January's peak the S&P 500 PE ratio was well higher. e) part of the rally in stocks was the retreat in interest rates, which was brought on by the mistaken notion that the Fed is going to pivot. So the Fed Presidents get to work to try to reverse Powell's interview where he appears to be sanguine, which only strengthens his re-introduction of disinflation to his description of our economy. They restate that interest rates still have a ways to go, and they are likely to remain elevated and restrictive for years. On Friday, February 3 market participants were treated to startlingly positive economic news - Total nonfarm payroll employment rose by 517,000 in January, and the unemployment rate fell to 3.4 percent meeting a +50-year record low unemployment percentage. This time "Good News was Bad News", lending credence to "Higher for Longer". This means higher interest rates for way longer.

This sets up for a "Key Reversal" and retreat on Thursday

I was surprised that the selling continued into Friday morning. I assumed that the dip-buyers would be coming in this morning to buy yesterday's lower prices. Instead, the dip buyers bought at the close, and the S&P close up 8 to 4090. That said, I think this reversal portends further selling to the end of February.

Last week we had the largest clearing of hedging in years as hedge funds and institutions closed out the most compared to mid-2022. In a massive repositioning to more risk-on tech names and junk stocks of January's massive stock rally. Money managers have cut $300 billion of bearish bets, robbing the market of pent-up demand just as the Federal Reserve warns its inflation-fighting battle is far from over. All good things must come to an end and so it goes for January's Rally. This sharp reduction of hedging is getting the VIX starting to revivify as a reflection of market fear. Since it is only inevitable that hedge funds start hedging via short positions.

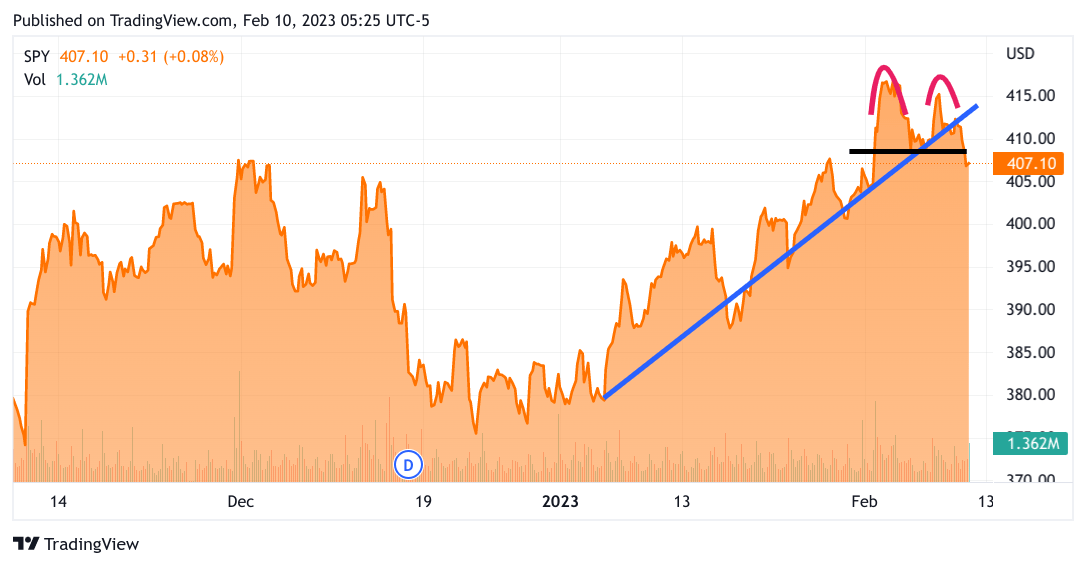

This chart was created on February 9

tradingview

The above chart of the S&P 500 where the market will move lower. We see a double-top, and the uptrend has been broken. The S&P 500 is going down.

It all depends on interest rates as the 10-Y is inching up above the trading range it has been in for weeks. Friday the 10-Year was above 3.75%, above where it's been Also, the CPI reveal on Tuesday is the catalyst right now. As I mentioned above the rising share prices of tech names are only rising because of the interest rates were benign. We have learned that the market eventually pays attention to shares that have inflated valuations. The higher the S&P climbs the more reactive to bad news and exhibit ennui on good news. The CPI (Consumer Price Index) could ignite even higher interest rates on a blip up in inflation or a retreat depending on whether it should further disinflation.

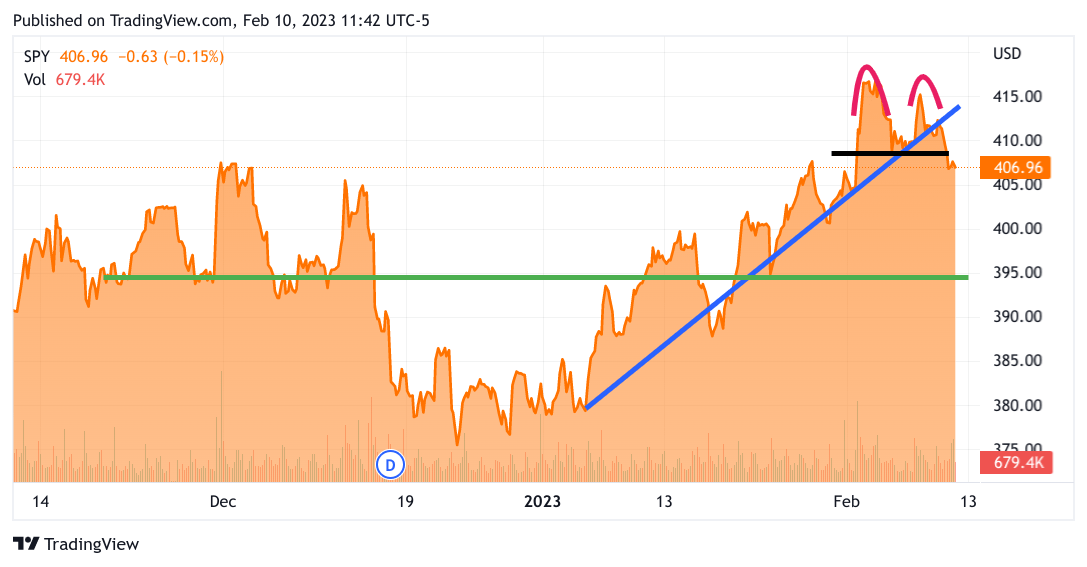

tradingview

The new horizontal green line marks where I could see support coming in. Dip buyers will be hard-wired to dip a toe back into the Tech and Junk names.

The hopeless dream of a Fed pivot was pushing the stock market higher in January, led by its riskiest assets. The market hasn't earned this kind of happiness, or at least Wall Street's definition of happiness. At 18.3 times expected profits, (4090/223 Friday's close divided by the estimated '23 earnings) the S&P 500 is nearing levels unmoored from reality. The market has sustained valuations above 18 times only twice in the past 30 years-in the tech bubble and during the peak of the pandemic rally. I'm thinking that the S&P will retreat enough to be in the 15 to 16 times range. Can the Index rise this year? Of course, as inflation continues to recede the Fed will finally stop raising. The S&P can go up in anticipation of the economy reigniting and profits rising. That's why I believe that we will be consolidating, I hate to repeat I covered this in my last article. Just let me add that we could get another jump like we had last month, but then gravity will take it back down. As the year goes on the range will narrow until a new direction will emerge. Odds are we will be back to a new bull market by 2024.

What we've been doing at the Dual Mind Community to take advantage of this market turn.

In my last piece in late January, I laid out the reason for our Long/Short approach to the market this year. Should we have embraced this strategy last year when the market was crashing? Yeah, well we started this approach last year when just hedging wasn't enough to stem the losses of one of the worst years for stocks in decades. I try to be as real as I can be, looking back we should have gone with much larger hedges on the indexes and more short positions on individual stocks. As we all know hindsight is 20-20. We have continued to select individual stocks to generate alpha on the downside. We also have been trimming positions to build cash, according to the Cash Management Discipline. Personally, this meant reducing my "Tech Titan" stocks like Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN), as well as Intuit (INTU), and ServiceNow (NOW). It hurt to cut shares from these positions but part of CMD is to harvest profits incrementally. Now, I wait for these positions to retreat and I will reload at prices lower than where I sold them. Let's talk about new positions that I added since in my last article I was talking about the single stock shorts via Put options. I took advantage of a momentary dive in the price of Eli Lily (LLY), and I got shares as low as $319 to $327. If the sell-off that is developing LLY retreats back to this level I will add to it. Right now LLY bounced to $345, I will likely hold this position for as much as 12 months. I think LLY is going back to its old highs at least. I also have been rebuilding my position in Biohaven (BHVN) the price action is great. I added Caterpillar (CAT) on the long side, as well as Schlumberger (SLB), Transocean (RIG), and ShockWave Medical (SWAV). I also added several more shorts via Put options: Expedia (EXPE), Affirm (AFRM), and PayPal (PYPL). All these names reported problematic earnings reports so if the overall market comes down further they should lose more than the overall market. I also have plenty of other longs but I have been holding them for months so I don't feel the need to list them. I am only saying this so that you don't think I am super bearish. I'm not, I refer back to my previous article and the beginning of this one. I just think the rally has gone way too far, and once it falls enough I will add back shares to older positions on the long side and start new ones. I was relating my moves to the short side. The title of this article is "What We are doing". In our community, we generally take positions together, but that doesn't mean I am always the leader. In fact, some of the members have gone short against Tesla (TSLA). I am going to follow them into this position if I get an opportunity to find an entry point. We chat, discuss, and sometimes debate, no one has to follow the strategy. If I can't convince members, then I need to rethink a premise or opportunity. Ok, that is it, If the S&P 500 rallies on Monday I might add to my shorts, and trim more longs.

If you enjoy my weekly stock analysis articles, You will be happy to learn that I offer a subscription service Dual Mind Research. Serop Elmayan, a brilliant young man who brings a quantitative approach to surface high probability fast-money trades, and I are partners in this service so you get the benefit of two unique investing approaches. My narrative style and his engineering approach will give you a unique value indeed. The first 2 weeks are free so check it out today for our latest ideas.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SWAV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The activities described in this article are regarding my trades and the activity of the Dual Mind Research Community. Don't take any of this content as a recommendation of what you should do. If you decide to make a trade or investment please do your own research, and make sure you understand the risks. The use of options can cause the loss of your entire investment in that option. If you don't understand options please avail yourself of your brokerage education regarding Options and all other forms of trading and investing. If your brokerage doesn't have a set of educational webinars and you are more of a beginner, consider moving to a different online broker.