6 Ways To Beat Inflation With 'AIR' Factors - 2023 YTD Update

Summary

- Aswath Damodaran is an investing and finance authority on markets & valuation, among many other things.

- In a 2022 interview, he provided a masterclass in inflation, some lessons in history, and potential ways to protect your portfolio this time around.

- In a previous piece, I focused on what I call “AIR” Factors from Damodaran’s insights on how to position a portfolio against high inflation, and how they performed in 2022.

- In this piece, I revisit the AIR Factors and their performance in 2023 so far, and we see some interesting reversals in performance.

- I conclude with some ETFs and specific stocks based on the AIR factors.

mohd izzuan/iStock via Getty Images

In a piece I wrote in late December, I detailed some thoughts around inflation and practical applications from an interview with Aswath Damodaran mid-2022. In the piece, we covered some historical considerations around inflation, and looked at asset classes and factors with a reasonable chance of protecting against the value destruction of inflation.

Aswath Damodaran is a household name in finance. As a Professor of Finance at NYU's Stern School of Business, he is best known for detailing his approach to valuation, and his very direct communication style.

The month since the first piece has been a rollercoaster ride in the markets, starting with a return to highly speculative themes such as meme and profitless stocks, and very recently back to worry in response to a clearly hawkish fed.

In this piece, I'll revisit Damodaran's tips to see how they have fared in the last month, and check up on our Damodaran inspired "inflation resistant" portfolio.

"AIR" Factors to Beat Inflation

I've coined Damodaran's tips as "AIR" factors, or

- Aswath's

- Inflation

- Resistant

Factors.

I'll elaborate on each factor below, Damodaran's thoughts and how the factor has performed in 2023 YTD compared to 2022.

As always, all performance data, screens and equity curves are generated by Portfolio123.

AIR Inflation Factor #1 - Small Cap Value

In the 70's for instance, you found low 'P' stocks, small cap stocks did much better than high P stocks. So, in a sense, if you think about this as a very lazy categorization of value vs growth and the small cap premium, much of the small cap premium that people keep talking about in valuation was earned in the 1970s.

(Damodaran, 2022 interview)

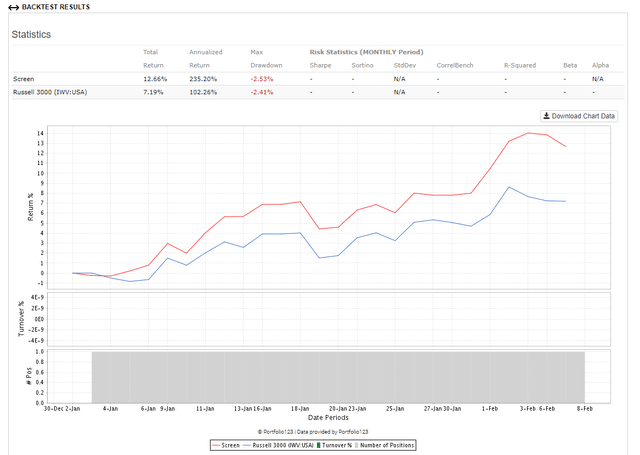

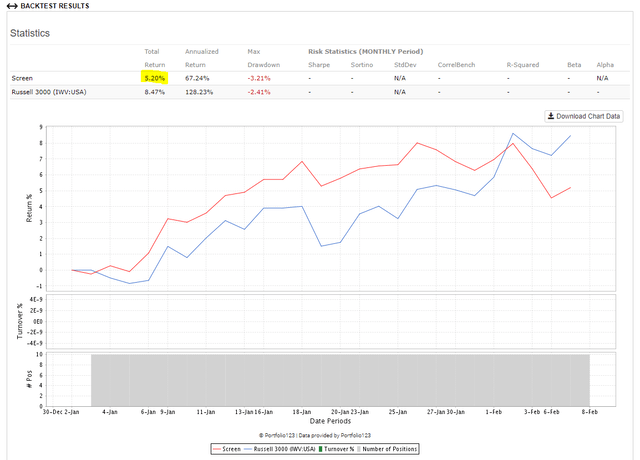

In the previous piece, we looked at the small cap value ETF IJS, and found that it outperformed in 2022. For 2023 YTD, the trend is continuing (red curve):

AIR Factor #1 - Small Cap Value (IJS) Performance, 2023 YTD (Portfolio123)

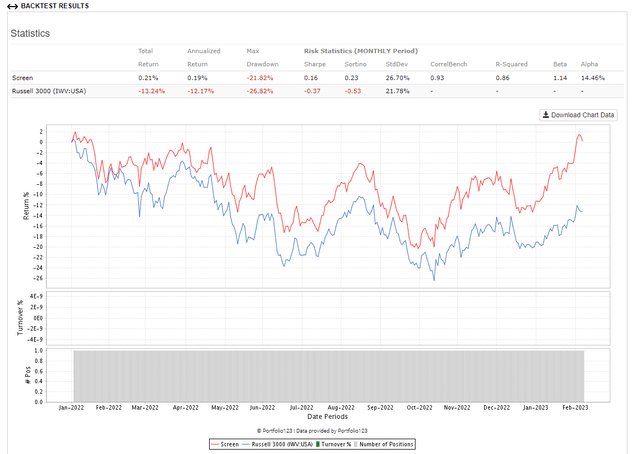

And if we tack onto 2022, we see a return to positive performance, while the broader R3000 (IWV) universe is still below water:

AIR Factor #1 - Small Cap Value (IJS) Performance, 2022 & 2023 YTD (Portfolio123)

So far so good, it appears our smaller 'P' stocks are continuing to perform.

AIR Inflation Factor #2 - The Smaller, The Better

So, for whatever reason, small cap companies had [1970s & 1980s] more flexibility to adjust inflation, and there's a reason why the more established you are as a company, the more your business model has already been set, the more adjustment is involved when inflation hits you, because you got to change the way you do business. I think the that the lesson from the seventies and the eighties is there's really no safe spot among financial assets, but among financial assets, there are relatively less damaged vs more damaged assets.

(Damodaran, 2022 Interview)

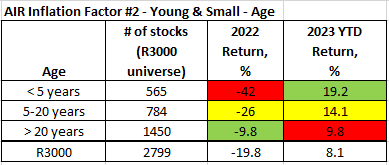

We looked at age as follows, and the respective 2022 returns within the R3000 universe:

- young companies, 5 years being public or less,

- middle age, 5-20 years, and

- mature, greater than 20 years.

To check that the younger companies were not skewed by tech, we found that these classifications were largely "tech agnostic", meaning each group contained roughly the same proportion of tech stocks.

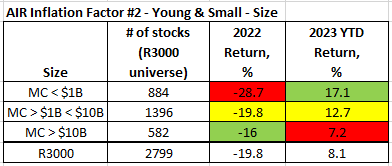

The table below summarizes performance of 2022 to 2023 YTD:

Portfolio123 data, Author Table

Where it seemed the market was seeking shelter in the more mature & established companies in 2022, there has been a clear reversal in 2023, with younger companies outperforming. While this is only 1 month compared to 12, the difference in returns is notable. This trend is more in line with Damodaran's comment above; let's see how it plays out for the rest of the year.

If instead we look at stock size thru market cap, we see the same trend - larger companies outperformed smaller in 2022, only for small and microcaps to outperform large caps 2023 YTD.

Portfolio123 data, Author Table

AIR Inflation Factor #3 - Pricing Power

Damodaran offers two suggestions here. First on "non-discretionary" stocks:

…you need pricing around the sense of not just setting prices, but being able to adjust prices quickly. Very few companies have that degree of pricing power, because that requires that your product be incredibly non-discretionary, that people buy it no matter what the price you charge, that the competition behaves the way you do, because you can't unilaterally just adjust prices if you're in an environment.

(Damodaran, 2022 interview, Author emphasis)

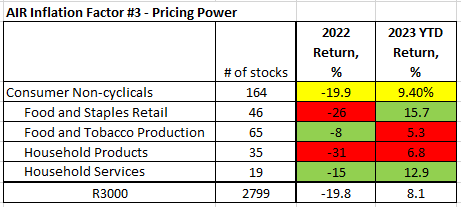

Non-discretionary industry group performance 2022 versus 2023 YTD:

Portfolio123 data, author table

Broadly speaking, consumer non-cyclicals has very closely tracked the R3000 index for both 2022 and 2023 YTD. Performance of the individual sub-sectors have varied widely, with some interesting reversals. Where food and staples retail underperformed 2nd worst 2022, it has reversed to be the outperforming of the group 2023 YTD, nearly doubling the return of the R3000.

Food and Tobacco Production (including alcohol), or a proxy for "sin stocks", are often historically the most recession/inflation proof due to their addictive nature, and outperformed all groups in 2022 (despite the ESG movement against them). The group has struggled to keep pace with the broader group and R3000 index 2023 YTD - a shift away from these?

Another category of stocks that is, in theory at least, inflation resistant is that of utilities due to their regulated nature. As Damodaran suggests:

utilities should be relatively protected against inflation. The reason is that there regulatory commissions that should allow you to set prices that incorporate inflation because you're supposed to earn a return equity roughly equal to your cost of equity.

He continues to warn however, that this protection may only be in theory:

The problem is regulatory commissions are composed of people appointed by politicians. So inflation is 12%, you know the right thing to do is pass on that 12%. "Well, why don't' we set it at 4 or 6%? People can't afford the 12%" So, during high inflationary periods, even though in theory, your prices should keep up with inflation as a regulated company, in practice, they don't.

That said, we did find in 2022 that the 65 utility stocks in the R3000 universe outperformed the R3000 universe by a wide margin (+4% vs -20%).

For 2023 YTD, we see yet another reversal in utility stocks:

Utility stock performance, R3000 universe, 2023 YTD (Portfolio123)

Utilities barely managed a positive return, while the broader index has nearly achieved 10% YTD.

Once again, we are comparing 1 month 2023 YTD to the year of 2022, but something to keep an eye on.

AIR Inflation Factor #4 - Less Discretionary, Less Debt, Less Risk

In my portfolio, this is the first time I have 5 of the 6 [FANGAM] stocks, everything but Netflix. One of the reasons for that is when I look at those companies, I see the capacity to that their products and services, they're actually done a very good job of making the products and services less discretionary, the have cost structures that are incredibly flexible, their investments tend to be short term and reversible. In terms of risk, they're low debt and very little failure risk, things that you worry about with inflation, because if you're a heavy indebted company and there's big failure risk, swings and inflation can very quickly put you under.

(Damodaran, 2022 interview, Author emphasis)

Damodaran continues:

…So, when I look for my list of "Hey , these are the things I want in a company", I find them more in technology companies than I do in old time, brand name, consumer product companies. It's kind of a shift away from what you might have seen in the early 80s as to where do I go for companies that are best protected against inflation. I think the places you go now are very different than 40 years ago.

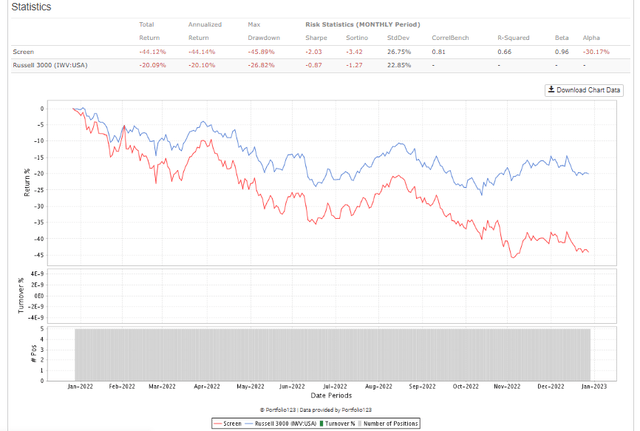

As we saw at the end of 2022, the FANGAM stocks (less Netflix (NFLX)), Facebook (META), Apple (AAPL), Google (GOOG), Amazon (AMZN) and Microsoft (MSFT), underperformed the market by a wide margin:

FAGAM stock performance 2022 (Portfolio123 )

For 2023 YTD, return of these stocks has more than doubled the R3000:

FAGAM stock performance 2023 YTD (Portfolio123)

All stocks managed double digit positive returns, Meta's impressive 53% recovery YTD being most notable.

Both AMZN and AAPL had less than impressive earnings releases recently, however they have managed to hold for now.

Once again, we're seeing a notable reversal with the FAGAM stocks compared to 2022, perhaps living up to Damadoran's thoughts.

AIR Inflation Factor #5 - Margins & Profitability

On the surface, it makes sense that high margins and profitability would be of benefit in a high inflationary environment. Higher margins allow more cushion against any rising debt service costs for example. In theory, any returns on capital should also need to exceed the cost of capital, which can be a very subjective value and is difficult to quantify.

Damodaran's thoughts:

The problem with return on invested capital as a metric, it's designed for mature or declining companies…You can be a great growth company. Its return on invested capital can be [utterly] meaningless. The ROIC if you take Apple is negative. Why? Because the cash actually exceeds a book value of equity and debt. If you take that to mean, hey, the ROI is that Apple takes terrible projects, you're completely mistreating the number. It's the denominator that's negative, not the numerator.

He continues:

For young companies, the ROIC becomes almost meaningless…if you have an investment strategy built around ROIC…this is going to leave you with a portfolio of older and declining firms, and some of them will be value traps, because what you're capturing with the ROIC is your past, that this company used to have great investments…ROIC is a backward looking accounting number to keep that in perspective when your investment strategy is driven entirely by ROIC.

(Damodaran, 2022 interview, Author emphasis)

On managing cost of capital:

It tells me that you're growing old as a company. You're a young company and your projects make 35%, who cares what your cost of capital is?...When you see a focus on capital structure, you're already conceding that your best days are behind you. Nothing wrong with that.

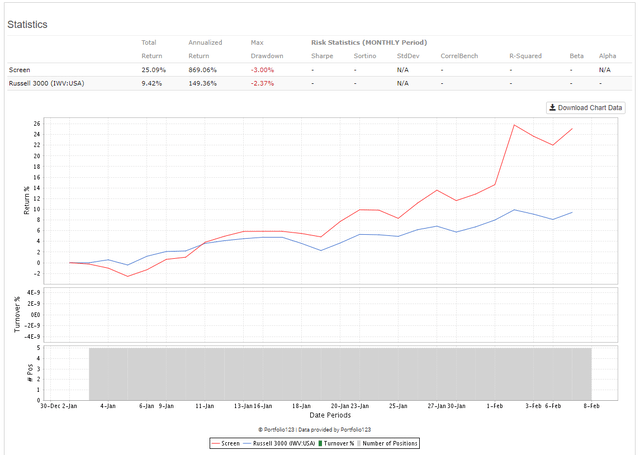

For 2022, we tested various profitability metrics and found that the top ranking 20% of stocks actually underperformed the broader R3000 index. Once again, for YTD we see a clear reversal on all metrics:

Portfolio123 data, author table

Most notable is the change in gross margin, with the lowest 2022 return, but highest 2023 YTD return. Has quality returned for 2023? Once again, we are looking at one month, so best to see how things turn out.

AIR Inflation Factor #6 - Ex-US Countries

Spread your bets across geographies. European stocks might not have done as well as US stocks in the last decade, but they might be the place to be if inflation is coming back more in the US than in Europe.

(Damodaran, 2022 interview)

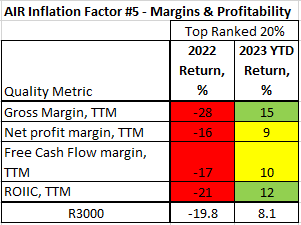

As we saw in the previous piece, several ex-US counties have had inflation rates much lower than the US or Canada. With passing into 2023, we have new inflation data available globally.

According to data from Trading Economics, there are 10 countries with lower inflation than US or Canada:

Global Inflation Rates, Ex-US/Canada, Jan 2023 (Trading Economics.com)

As we did in part 1, we can take the respective ETFs for each country and see how they've been performing:

China - GXC

Switzerland - EWL

Saudi Arabia - KSA

Japan - EWJ

South Korea - EWY

Indonesia - EIDO

India - INDA

Brazil - EWZ

Spain - EWP

France - EWQ

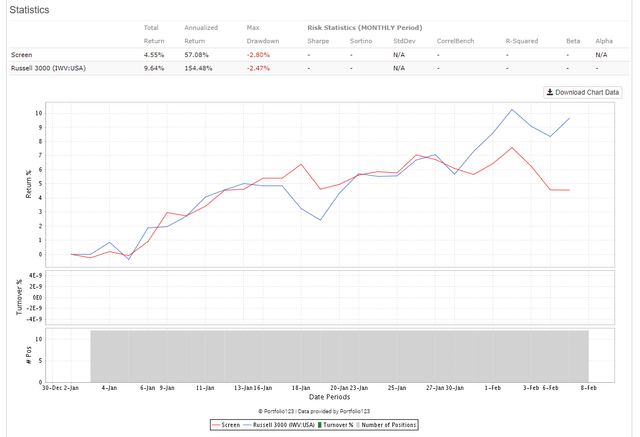

Holding these ETFs equal weight, we have the following equity curve for 2023 YTD:

Ex-US ETF performance 2022, 2023 YTD (Portfolio123)

For much of January, ex-US countries had the lead on the R3000, until very recently where there has been a reversal. This is a very short period, and perhaps will reset, however the spread is striking. Is the market suddenly discounting other countries as a hedge against inflation? Or just a bear market rally blip?

Combining the AIR Factors

We've seen some fascinating performance reversals in some of Damodaran's inspired AIR factors.

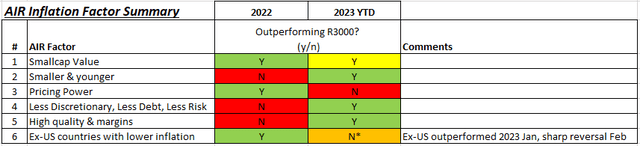

The table below lists the 6 inflation resistant AIR factors and compares their performance from 2022 to 2023 YTD:

We've seen clear reversals in younger companies outperforming more mature, non-discretionary & utilities underperforming the index, outperformance of the FANGAM stocks, and high quality stocks outperforming.

Small cap value continues to outperform from 2022 into 2023.

Ex-US countries with lower inflation outperformed the R3000 in 2022, and for much of 2023, however sharply declined in February. This is a very short period, but something to watch.

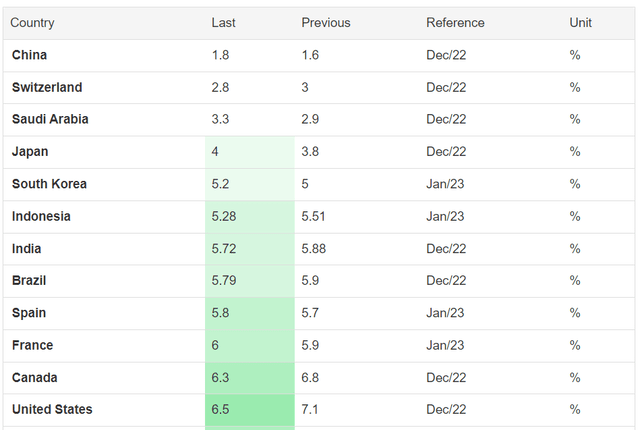

In the previous piece I provided a simple ETF strategy to combine some of these factors. If we replace the country ETFs with the revised list based on latest inflation data:

- Small cap value, IJS, 33%

- Non-discretionary & regulated utilities ( XLU only, a non-discretionary ETF does not exist), 33%

- Lower inflation geographies, 33%,

- China - GXC

- Switzerland - EWL

- Saudi Arabia - KSA

- Japan - EWJ

- South Korea - EWY

- Indonesia - EIDO

- India - INDA

- Brazil - EWZ

- Spain - EWP

- France - EWQ

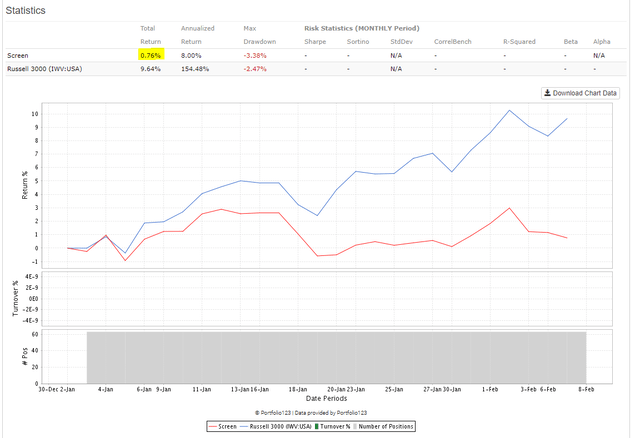

AIR Factor ETF strategy, 2023 YTD (Portfolio123)

The strategy has actually underperformed 2023, perhaps not surprisingly due to some of the reversals we've seen. That said, it is still early into 2023, and the very recent shift in sentiment may return to a more defensive stance.

We can also find stocks with AIR characteristics using a simple stock screen. We will screen for those stocks:

- AIR Factor #1 - Value - rank all stocks, take 20% cheapest stocks in R3000 (remove financials)

- AIR Factor #3 - Young - less than 10 years listed on exchange

- AIR Factor #5 - Quality - rank all stocks, take 20% highest quality

And we arrive at the following names:

Ticker | Name | Mkt Cap ($M) | Industry |

Alpha Metallurgical Resources, Inc. | 2,582 | COAL | |

AdvanSix Inc. | 1,176 | CHEMSPECIAL | |

Donnelley Financial Solutions, Inc. | 1,426 | SOFTW | |

Fulgent Genetics, Inc. | 978 | PATIENTCARE | |

Fox Corp. | 19,494 | MEDIAPUB | |

Warrior Met Coal, Inc. | 1,981 | COAL | |

Liberty Energy Inc. | 2,814 | OILGASSUPPORT | |

Magnolia Oil & Gas Corp. | 5,065 | FOSSILFUEL | |

Moderna, Inc. | 65,511 | BIOPHARMANONSYS | |

OneWater Marine Inc. | 419 | AUTORETAIL | |

Organogenesis Holdings Inc. | 340 | MEDDEVICESOTHER | |

Arcus Biosciences, Inc. | 1,456 | BIOPHARMANONSYS | |

REGENXBIO Inc. | 997 | BIOPHARMASYS |

(Source: Portfolio123 data, Author table)

The inflation story continues to develop, as new data is released the Fed responds with their continuing hawkish comments, and the market trying to either call the Fed's bluff or come to terms with further rate increases.

I don't have a crystal ball, but I do have these AIR factors, which I will continue to provide updates on. Stay tuned.

Until then, happy investing!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for informational purposes only. I am an individual investor and writer, not an investment advisor. Readers should always engage in his or her own research and consider (as appropriate) consulting a fee-only certified financial planner, licensed discount broker/dealer, flat fee registered investment adviser, certified public accountant, or specialized attorney before making any investment, income tax, or estate planning decisions.