The Revenue Doth Cometh With Cirrus Logic

Summary

- Cirrus Logic, Inc. reported record December quarter revenue.

- But more importantly, vision into the long-term plan grew brighter.

- Even more important, Cirrus Logic management offered generally unusual insight into higher than estimated ASPs for the CLC product.

- Short-term weakness might still be in vogue, but that only creates a buying opportunity for Cirrus Logic, Inc.

Khanchit Khirisutchalual

Cirrus Logic, Inc. (NASDAQ:CRUS) just reported another quarter with record revenue, when technology companies such as Qorvo (QRVO) reported approximately half the typical December revenue. An investor might re-coin the phrase, the revenue doth cometh for Logic. It seems even more important that during the information exchange, the company expanded investor knowledge concerning the forward path for revenue gains. The numbers discussed are indispensable for investment decisions.

December Quarterly Results

Beginning with a review of the quarter and guidance, investors can see the gigantic steps Logic has made in winning new meaningful business. The company reported:

- Record revenue of $590.6 million, above the top end of our guidance range as sales were driven by demand for smartphones.

- GAAP and non-GAAP earnings per share of $1.83 and $2.40, respectively.

- A decrease in the number of shares to 55 million.

- Progress on the development of both audio and high-performance mixed-signal (HPMS) solutions that we expect to be introduced within the next two years in optimized products for laptops.

- Cash at $500 million.

- One supplier, Apple (AAPL), made up 88% of the total revenue.

Management included this statement regarding the sources for the record revenue, "The year-over-year increase in sales was driven by higher ASPs, . . . partially offset by a reduction in smartphone units compared to the prior year." Ming-Cho Kuo, a top of the top Apple prognosticator, had predicted this short-fall back in November of 2022. His report stated that Apple lost approximately 20% of its production and would sell 70-75 million units in the December quarter. IDC confirmed Kou's beliefs in early January.

The company offered light guidance of $340 - $400 million. But it was a comment made during the conference to a question about December quarter deliveries asked by Blayne Curtis of Barclays that caught our eye concerning the guidance. John Forsyth, Cirrus' CEO, answered;

"From our perspective, demand signals from our customers throughout the quarter were strong and sustained, and that included request for expedites, drop shipping, a lot of material and so on; the kind of things that carry additional costs. . . . really tend to be things that customers are asking for if they really need it. . . . the general market did see some softness, and that's part of also why we saw the mix between the top customer and the rest of the business. And we expect that to kind of continue, and that's part of our guidance for the March quarter."

What Cirrus management saw in December was a demand requisite of companies ordering what was needed rather than trying to stack inventory. With the light guidance given, investors with Apple must ask how much of a miss might be expected in March for Apple? Or did it stack inventory regardless of cost?

Missing ASP

Before continuing about the future, a discussion of the existing ASP in the iPhone for Cirrus is in order. In the past, we have estimated Cirrus iPhone ASP for the Pro models at slightly below $6 ($1.80 for the codec, $0.80 for the two amplifiers, $0.60 for the Haptic device, $1.00 for the power management chip and finally $1.40 for the 4 CLC parts in the cameras.) Stemming from an other discussion during the question-answer portion, we suspect that our totals are significantly low.

Forsyth added significant detail about the closed loop controller (CLC) product ASP.

Obviously, beginning at baseline back in – back three generations ago where we indicated it was in line with an amplifier, and then we saw a step up that was of the order of $0.20-ish from there and then saw something similar beyond that."

A common initial ASP was believed to be $0.35, then add $0.20, then add a smaller amount for the third generation places the ASP at approximately $0.60. Another lift is coming this year, with a 4th generation making it north of $0.65? With four in some Apple phones, the ASP is likely closer to $2.60.

The Coming Event

With a more realistic total Cirrus ASP defined, we begin a journey toward defining the future. Let's stop at the SAM slide found in every presentation.

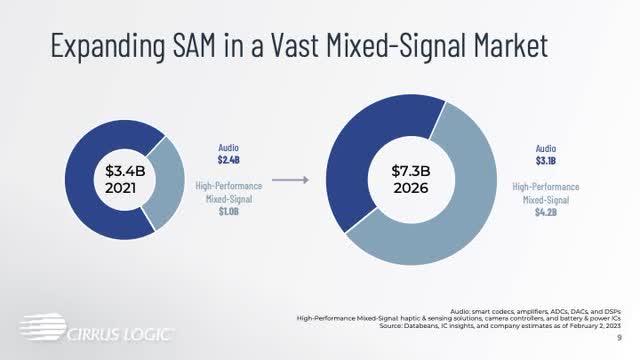

The four-year SAM continues strong, reaching a possible $7.3 billion.

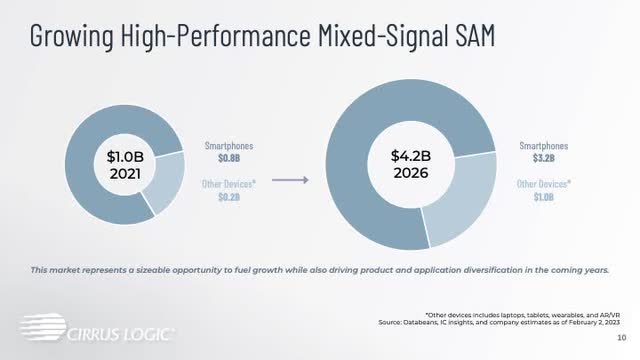

Next, the slide for the HPMS reaches more than half of the total in the same period.

With a SAM defined, next let's look at the individual pieces for a better understanding of the future. Management included the following in the once fab starved audio portion of the company, "In audio, we continue to see significant customer interest across our portfolio of amplifiers and codecs." This likely references laptops and Android hand sets.

The next lift coming for Cirrus is the replacement of the hard buttons on iPhones, which purportedly adds $1 a phone. The first rendition adds purported functionality to only the Pro-line. But in time, this approach will drift down into the iPhone models.

Next let's look into the new codec and amplifier under-development.

"We remain on track with the development of our next-generation 22-nanometer smart codec, which we taped out during the quarter, and our next-generation custom boosted amplifier. We expect to see both components introduced within the next couple of years."

Additional features include:

- Significant power and efficiency improvements.

- Design flexibility.

- Long lifespans yielding more efficient use of company resources.

- Introduced in 2 years. (Likely included in the iPhone 17 2025.)

- Increased ASP for both amplifiers and codec (amplifier design unloads passive parts normally used in conjunction.).

In the past, management noted that ASP increases in the $1 plus are needed to justify the 22 nm development. The removal of passive components adds $0.25 or something similar. The ASP increase is in the $1.50+ range with a target ramp date for September 2025. The shareholder letter included this thought:

Given these products tend to have very long lifespans and above corporate average gross margins, we believe there is a good opportunity to drive revenue and profitability growth by refreshing and upgrading certain products where we can offer sustained differentiation."

Shall we continue with the exciting new market in laptops. Cirrus just introduced a new set of codec, amplifier, haptics and power products designed for the PC market. Advantages include:

- Higher ASP, the amount undisclosed.

- Enable one fan or zero fan designs.

- Unprecedented performance. ([T]hey absolutely blow the competition away.)

- 2/3rds of the revenue comes from audio products with the rest from HPMS.

The total SAM in 2026 will likely be more than $1.0 billion with the major revenue impact beginning in calendar year 2024.

Continuing, CLCs, as noted above, will migrate downward into basically all Apple phones and others, a trend that management expects to continue. ASP ranges will be $1-$3 with maximum volumes closer to $3.

On a side note, other initiatives are in the works. An effort to increase ASPs with several older legacy products is in progress. These tend to be above average gross margins with long-term design-ins. Second, the first of several new products, a digital conversion component, taped out last quarter. The company plans to introduce a new unspecified HPMS component in the 2nd half of the year. Another Cirrus product has been selected for use in new SoundWire® platform that is expected to ramp in the latter half of the year.

The company has a lot of new functionality coming over the next four years. We assembled a few tables to summarize the paths. The first concerns iPhones.

| iPhone ASPs | Codec/Amp | Haptics | Power | CLC | Charge | Totals |

| 2023 | $2.6 | $1.60 * | $1.0 | $2.60 | $7.8 | |

| 2024 | $2.6 | $1.60 | $1.0 | $2.60 | ||

| 2025 | $4 - $5 ** | $1.60 | $1.0 | $2.60 | $10 | |

| 2026 | $4-$5 | $1.60 | $1.0 | $2.60 | $1.5 | $11 - $12 |

*Apple begins elimination of physical buttons. Cirrus adds $1.0 of content.

** Apple adds 22 nm codec and new amplifiers. Cirrus adds $1.5-$2.0 in content.

*** At some point, we believe Apple adds Cirrus' fast charging technology. We just picked a year out of thin air. It is also important note that Cirrus has said nothing about Apple adding this.

The revenue numbers grow to staggering heights being in the $2-$2.5 billion with announced paths and almost $3.0 billion certainly possible. At 220 million units, we estimate iPhone revenue in 2022 is $1.2 billion ($5.5 blended ASP).

Continuing with iPads, the following table summarizes ASPs.

| iPad ASPs | Codec/Amp | Haptics | Power-Management | Charge | Max Totals |

| 2023 * | $2.6 - $5.0 + | $0.60 | $1.0 | $7.0 | |

| 2024 | $2.6 - $5.0 + | $0.60 | $1.0 | ||

| 2025 | $2.6 - $5.0 + | $0.60 | $1.0 | $7 + | |

| 2026 | $2.6 - $5.0 + | $0.60 | $1.0 | $1.5 | $9 |

* One iPad product has 11 Cirrus parts, with an estimated ASP at approximately $7. In the past, we have estimated a blended product ASP at $4.

At sixty million units per year, iPads generate approximately $250 million. In the past, applicable technology that first appeared in phones migrates toward tablets. Investors might expect a level of growth at a few hundred million over the next few years.

Next, a table showing ASPs for laptop computers follows.

| Laptop ASPs | Codec/Amp | Haptics | Power | Charge | Totals |

| 2023 | $2.6 | $0.60 | $3.5 | ||

| 2024 | $3.0 + * | $0.60 | $1.0 | $1 - $2.5 | $6 + |

| 2025 | $3.0 + | $0.60 | $1.0 | $1 - $2.5 | $6 + |

| 2026 | $3.0 + | $0.60 | $1.0 | $1 - $2.5 | $6 + |

* New amplifiers and codec are expected for laptops with higher ASPs.

Placing fix ASPs for laptops isn't a productive exercise. Some models might have six to eight amplifiers, meaning $3 - $4 ASPs just for those parts. What we attempted to accomplish is defining a lower bound. With approximately, 250 million laptops a year sold during normal years, Cirrus' SAM size of significantly over a billion makes sense and demonstrates the enormous potential. In our view, $800 million plus isn't unrealistic, a number we have in the past forecasted.

A final note positively effecting earnings is that its tax rates will drop by 2% in the coming year and continue dropping at that rate for four more years.

Risk & Reward

The semiconductor sector has been under distress for more than a year. China phone OEMs are bleeding. PC sales, in general, are weak. The world is facing higher interest rates in order to slow economies. Perhaps, in our view, one of the unknowns is figuring out meaning for the low March quarter guidance. Management stated clearly that the major customers acted as if they needed parts to keep up in December. If Apple didn't stack inventory, expect a very weak March quarter from Apple. For example: Cirrus delivered $520 million in the December quarter with a likely maximum of $320 million for March (0.8 times 400). Analysts are guiding $92 billion for March, this 40% or more drop by Cirrus equates to $80 billion or less. In all honesty, our belief is that Apple will do better then $80 billion, but it is likely that revenue will be much less than the $92 now estimated.

We believe that another major Apple miss is coming.

We see a level of unknown weakness coming through the next few quarters, but management charted a long-term path with much investor certainty. Moving forward, between iPhones, iPads and laptops, Cirrus could gain $2-$3 billion in revenue in a few years. A table shown below shows how compelling this buying Cirrus on any weakness is becoming.

| Cirrus Earnings (Billions) | Revenue | Margin | Costs | Tax Rate | Stock (millions) * | Earnings |

| 4.0 | 4.0 | 0.5 | 0.600 | .13 | 50 | $25 |

| 4.0 | 4.0 | 0.5 | 0.600 | .13 | 40 | $30 |

| 5.0 | 5.0 | 0.5 | 0.600 | .13 | 50 | $33 |

| 5.0 | 5.0 | 0.5 | 0.600 | .13 | 40 | $41 |

* As a practice, management has chosen to repurchase stock at inordinate rates.

In the past four years, Cirrus Logic, Inc. management repurchased over 4 million shares. We expect that to continue. With the current number of shares at 55 million, five years from now, investors might expect the number of shares to drop below 50 million. Thus, we included a broad earnings range. The revenue doth cometh with Cirrus Logic, Inc., and for savvy long-term investors, picking opportunistic prices will likely generate well boding long-term growth.

A note: please read our disclosure carefully included with this article.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CRUS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own a large portion for a smaller retail investor. With Cirrus above $100, our ownership represented 75-80% of our net worth, an untenable situation for a person in his 70's. We sold 5% of our shares and plan to sell another 5%. It is the first time in years that we have done so.