Camping World: Lower RV Sales And Margins Likely Ahead For 2023

Summary

- The RV Industry is expected to see a big drop in RV sales in 2023.

- Margins also peaked in 2022 and will likely come down this year.

- Variable interest rate debt rounds out CWH's risks.

Karel Stipek/iStock via Getty Images

Recreational Vehicles, or RVs, are generally considered to be an expensive luxury toy - one that often needs to be financed and consumes a lot of gasoline when used. Thus, surging interest rates, high gas prices, and a weakening economy aren't exactly working in the industry's favor. This is especially true for RV dealership Camping World Holdings (NYSE:CWH), which has a bit of a cult following from investors who like its tweet-happy CEO Marcus Lemonis and nice dividend payout.

Company Profile

CWH is the largest RV dealership in the U.S. The company sells both new and used RVs at its namesake dealerships, as well as an assortment of RV products and services through its Good Sam brand.

In 2021, new RVs represent nearly 48% of revenue, while used vehicles accounted for over 24%. Products made up nearly 16% of revenue, while service plans were 3% and finance and insurance 9%.

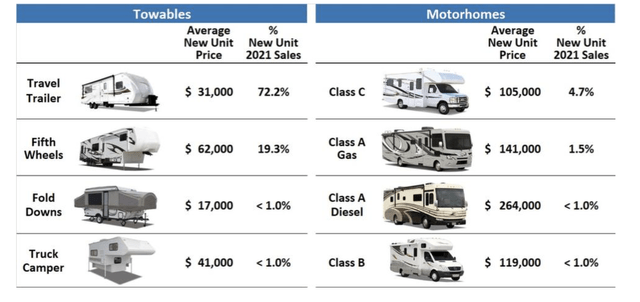

Towables make up the bulk of its new RV sales, at over 90%. More expensive motorhomes make up the rest.

THOR Industries (THO) is its biggest OEM brand, representing over 72% of its new RV inventory in 2021. Forest River, meanwhile, accounted for 24%.

Opportunities

CWH's biggest opportunity comes from its roll-up strategy of other dealerships. The company can often buy local dealerships at attractive multiples and then get cost synergies with them being a part of its larger network. This strategy has also allowed the company to create local monopolies in many areas, giving it strong pricing power.

There has also been a solid secular trend towards the RV lifestyle over the last decade. This has been seen not only with Boomers as they retire, but also younger generations as well. In fact, Gen Z and Millennials have been the fastest-growing segment of new campers. According to the KOA 2022 North American Camping Report, camping accounted for 40% of all leisure trips and there were 11 million RV owners and 2 million renters.

RV makers are very positive on the long-term outlook for the industry. For example, on its last earnings presentation, THOR said:

"Our confident long-term outlook is supported by favorable demographics, strong interest in the RV lifestyle, adequate current availability of RV dealer and consumer credit and favorable perception of RVing as promoting a safe and healthy lifestyle. Numerous studies conducted by THOR, RVIA and others show that people of all generations love the freedom of the outdoors and that RVers are extremely satisfied with their RV experience. The recent growth in industry-wide RV sales has also resulted in exposing a much wider range of consumers to the lifestyle.

"We believe many of those who have been recently exposed to the industry for the first time will become future owners, and that those who became first-time owners due to the pandemic will become long-term RVers - resulting in future trade-in sales opportunities. In addition, we view the significant investments by independent dealers, campground owners and various governmental agencies into camping and RV facilities to be positive long-term factors, which should only further enhance the experience of current RVers and encourage new buyers to enter the lifestyle."

Downside Risks

The RV industry faces a number of near-term headwinds, the most obvious being surging interest rates, high gas prices, and a weakening economy. RVs are expensive and generally financed, so higher interest rates only make the payments higher. They also are more expensive to use when gas prices are high. Finally, they are an expensive discretionary item, and likely a purchase many people may delay until there is more certainty in the economy.

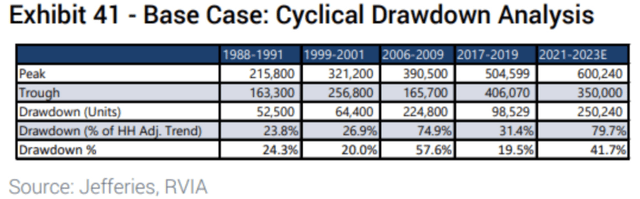

RV sales peaked in 2021 at just over 600,000 units. The Recreational Vehicle Industry Association said that 493,268 units were sold in 2022, a decrease of -18%. However, units sold really decelerated as the year went on, down -50% in December.

For 2023, the RVIA has projected wholesale sales of 379,000-404,000 units. Jefferies has projected sales to be even lower, near 350,000 units.

Industry backlogs for new RV, meanwhile, are way down. THOR, CWH's largest OEM, said North American backlog was down -70% at the end of October to $4.4 billion. For Q3, rival Winnebago (WGO) reported that its Towable backlog was down -66.2%.

Both THOR and WGO said that Towable American dealer inventory was at normalized dealer inventories. However, inventory positions were previously below normalized levels. This means that new vehicle dealership margins likely peaked in 2022 and will fall this year.

In the first half of 2022, it wasn't uncommon for dealers to be selling their RVs for only a 10% discount to MSRP to even above MSRP in some cases. That is no longer the case.

Discussing dealer pricing, WGO CEO Michael Happe said:

"We are seeing dealers be more aggressive in terms of pricing in the market, particularly on Towables, but even in some categories like Class B vans where there's significant consumer demand and dealers are fighting for share themselves as well. We don't see that pricing as irrational by the dealer community. And as I said earlier, I think a lot of their margins have been trending back towards sort of historically normal margins here over the late summer and the fall months".

Valuation

With the stock around $25, CWH is valued at about 8x the 2023 EBITDA consensus of $516 million and 7.5x 2024 estimates of $573.4 million.

On a PE basis, it trades just below 8x 2023 EPS forecasts of $3.19.

The company has $2.2 billion in net debt, or about $3 billion when including operating leases. Most of its debt is variable rate, and thus it will likely face interest rate pressure given the rise in interest rates. The company projects a nearly $24 million impact for each 100bps move in interest rates.

Conclusion

Most likely, the RV industry will see a huge drawdown from peak units produced in 2021 to wherever they trough this year. While the RVIA is predicting a big drop, sales could easily fall below its forecast if the economy worsens.

Meanwhile, dealership margins will also come under pressure compared to last year, given that Towables inventory levels have normalized. A large decline in unit sales together with lower margins is a bad combination, but if the industry overestimates 2023 unit sales, it is just going to get worse on both fronts for a dealership like CWH.

The company also carries a fair amount of variable-rate debt, and leverage could quickly spike if results come in worse than expected. If investors begin to fear an economic slowdown, companies with high leverage often take a hit.

Thus, while I see the interesting roll-up story that CWH has in front of it and the current valuation doesn't look too expensive, I think 2023 is going to be a difficult year for the RV industry and CWH in particular. If RV sales come in weaker than expected, leverage creeps up, and the company decides to cut its dividend, things could get ugly before they get better. As such, I think the stock could fall into the teens.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.