Cumulus Media: Time For A Dividend

Summary

- Last year, CMLS announced a $50 million share repurchase program, and through Q3 they had already repurchased $28.1 million in Class A shares.

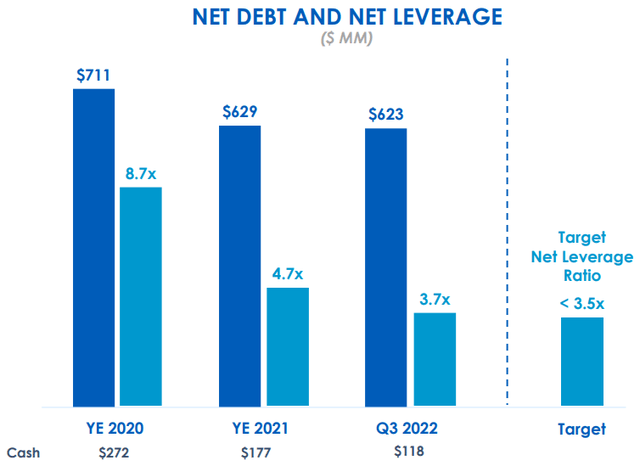

- Management has continued to pay down debt, with $65 million+ repaid through Q3.

- We think that CMLS has the ability to pay a dividend with a yield between 1.2% and just over 3% using interest expense savings from debt they repurchased in 2022.

kelleth/E+ via Getty Images

Cumulus Media (NASDAQ:CMLS) is set to report results for the fourth quarter and full year of 2022 in late February. The company has not yet announced the actual date, but it should be on or around February 23rd. While the fourth quarter is generally the strongest quarter of the year, we do not expect any fireworks or surprises due to the economic backdrop and the headwinds facing the advertising market. We do however expect more of the same; management focusing on paying down debt, the repurchasing of shares under the buyback program and more information on Cumulus Boost.

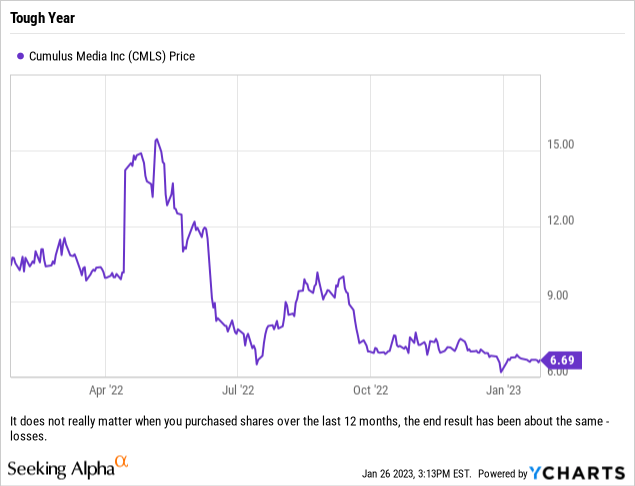

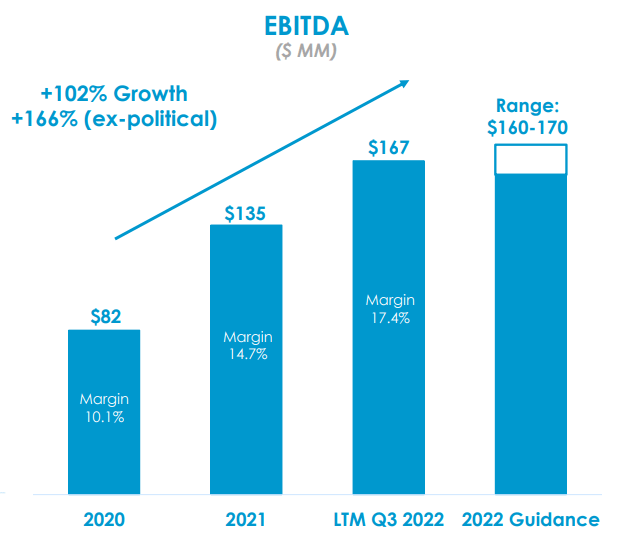

While it certainly has not seemed like it based on the stock price performance, Cumulus has made strides in improving the balance sheet and returning capital to shareholders. Debt levels continue to trend lower with management focused on deleveraging the balance sheet in order to get to their target of below 3.5x net leverage - which the company should finish the fourth quarter just above (assuming they deliver on last quarter's full year EBITDA guidance of $160 million to $170 million). Due to the deleveraging that has occurred, as well as the health of the business and cash flows, we think this opens up the next opportunity for management to create value for shareholders.

What Management Has Done

As someone who originally established core positions in Cumulus during COVID as part of our entry into media names, it is tough for us to complain about management and their game plan so far. With that said, we do think that management has overreacted to some events and focused too much effort (and in some cases capital) on certain initiatives.

A case in point; share repurchases. When an opportunistic takeover bid emerged (although one can debate how serious and committed the bidder was) Cumulus's management team moved up plans (slightly) for their capital return program and ended up spending half of the $50 million that the Board approved for share repurchases via a Dutch tender off for an announced price between $14.50 to $16.50 per share. Luckily the company ended up purchasing shares at $14.50/share, which was the low end, but it was a missed opportunity to display some restraint and give investors more bang for their buck. Yes, hindsight is perfect, but the whole situation played out almost like modern day greenmail - paying the investors who wanted out at around the supposed buyout price.

So since the $50 million share repurchase program was approved by the Board of Directors, management has announced the following each quarter:

- 1,724,137 Class A shares purchased at $14.50/share for total of approximately $25 million

- 415,063 Class A shares purchased at average price of $9.43/share for approximately $3.9 million

Through the end of Q3 the company has repurchased 2,139,200 Class A shares for $28.9 million. This leaves $21.1 million available under the share repurchase program, and at current stock prices, this would enable management to repurchase just over 17.9% of the Class A shares outstanding.

We have previously discussed our issues with how management went about their buyback program, so we will avoid going down that road again but we do think that the buyback program from current levels will be a good thing and with purchases over time should provide some support for shares.

We think management has done some really good work on reducing debt, and by extension annual interest expense. To quantify this, on last quarter's conference call the company's CFO, Frank Lopez-Balboa, stated, "During the quarter, we retired 2.79 (million) of senior notes at a discount, bringing year-to-date debt paid down to $65.1 million. This pay down results in $3.5 million of cash interest expense savings on a full year run rate basis."

Finally Time For A Dividend

With EBITDA still strong, the company doing reasonable-sized share repurchases while also paying down debt early and a strong cash position, we think that there is room for Cumulus to initiate a dividend. Class A and Class B shares total approximately 18,623,085 by our calculations, and while we previously discussed a quarterly dividend of $0.03/share per quarter, we think that management could go as high as $0.05/share per quarter for an annual dividend of $0.20/share. That would yield slightly over 3% and cost just under $3,725,000 - which is about the annual interest expense savings from paying down the debt in the first three quarters of 2022.

If management wants to be conservative and leave room for maneuvering, we believe even a dividend policy of $0.02/share per quarter, for an annual dividend of $0.08/share, would serve as another pillar to support the company's share price and potentially help move them higher. While a yield that is just over 1.2% on a company with a slow-growth, or no-growth, legacy business is not extremely exciting, it would further diversify the shareholder base and help bridge the next year or two before we see if management can make Cumulus Boost a revenue and earnings generator. With a cost of just under $1,490,000 (less than half of the savings realized from debt repurchases in the first three quarters) it seems like a slam dunk for everyone - and signals to the market that the management team has faith in their ability to continue to generate excess cash flow.

Moving Forward

We cannot stress enough that we think that the management team at Cumulus has, and continues to do, a great job. Overall they have done a very good job of navigating the company through some difficult times and digging it out of a large debt pile (especially when faced with COVID and everything that entailed for the economy). Moving forward though, they are going to have to manage the business harder in order to continue on their path of deleveraging as a lot of the low hanging fruit has already been harvested. There is less real estate to sell, fewer office consolidations to perform, and not many more expenses to cut that would generate significant, meaningful savings.

With no mid-terms in 2023 we should see some pullback on the top line, so management will have to increase productivity to help drive EBITDA higher, or at the very least maintain it, and look at additional debt repurchases to help maintain leverage ratios (based on what they have stated on the last conference call).

Net Debt at Cumulus was essentially flat from year end 2021 and the end of Q3 2022. (Cumulus Media Q3 2022 Investor Update)

As you can see from the above graph, net debt barely decreased over the first three quarters of 2022, even as the company paid down over $65 million in debt. This is because the company essentially utilized their cash to do this, rather than free cash flow, or FCF, generated through the year. The reason net leverage fell significantly has less to do about a debt repayment program and more to do with EBITDA ramping up, as can be seen by the graph below.

EBITDA has grown sharply, which has been the main driver of the company being able to deleverage. (Cumulus Media Q3 2022 Investor Update)

The above shows that management would be better served focusing on EBITDA growth rather than paying down debt. If we use the $167 million EBITDA from the last 12 months from Q3 2022, and the $623 million of net debt, it is easy to see the obvious path forward to 3.5x net leverage. If one were to focus on paying down debt, and EBITDA remained flat, it would require paying down $38.5 million in additional debt. That is certainly doable, as management has shown, but it would only take an increase of $11 million in EBITDA (with net debt remaining at $623 million) to reach 3.5x net leverage. The debt has to be paid, but management has other means to bring leverage down, and the company's own graphs show that the debt repurchases did very little so far this year to help in reducing net leverage...so yes there does appear to be additional avenues to pay a dividend and even increase share repurchases.

We fully expect to see additional debt repurchases made in Q4 2022 when management releases results.

Final Thoughts

We purchased more shares today and will continue to nibble over the next week or so as many of our other media names have moved sharply higher. The value is compelling here, really across the entire broadcast radio space, but we do hope that management might provide some commentary on additional capital return programs for shareholders (specifically a dividend policy) and further insight into the Cumulus Boost offering and their plans for that business moving forward. We think that management could double digital revenues in the next few years and that Cumulus Boost could potentially become the growth driver for the overall company.

Cumulus shares provide value at current prices, especially if the economy holds up and ad revenue does not take a significant hit. If management can continue to repurchase shares and potentially enact a dividend policy we think that Cumulus could outperform its peers and reward shareholders handsomely.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CMLS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own CMLS shares in personal accounts and client accounts. We purchased shares today and may continue to do so over the next few trading sessions.