Newmont: The Next Gold Bull Market Gains Momentum

Summary

- Gold has returned near its peak value as the US dollar reverses lower and real interest rates slip.

- Gold continues to reach new all-time highs in foreign currencies such as the Yen and Euro, suggesting a new gold bull market began last year.

- Mining stocks, like Newmont, offer a potential recession hedge as a strong "Fed pivot" could send gold soaring to a new all-time high.

- Based on its guidance estimates, I expect NEM will generate up to $4.9 in EPS over the next year, with gold at $1950/oz.

- NEM offers value potential that may be catalyzed if gold's rally lasts much longer.

hallojulie

The gold market has consolidated considerably over the past two and a half years as the monetary system transitions to a "new normal." The price of gold declined materially after reaching a new peak in 2020 as real interest rates rose on a more hawkish Federal Reserve stance. Additionally, the rise in US real interest rates caused the US dollar's exchange value to skyrocket to an all-time high, weighing on gold in terms of US dollars.

Fortunately, gold's consolidation pattern may be ending. Gold has risen over 20% since late Fall, back near its peak value. This rally is driven by a slight decline in US real interest rates and a significant reversal in the US dollar's strength. In the past recession in 2020, gold performed extremely well as the contraction was met with immense Federal Reserve QE stimulus and interest rate cuts. Assuming a similar pattern emerges, backed by a decline in the inflation outlook, gold may face another wave higher. The spread between gold futures and physical gold bullion is exceptionally high, indicating more robust retail demand for the metal than may be apparent in the futures market.

In my view, one of the best ways to gain liquid exposure to gold is through large gold mining stocks like Newmont (NYSE:NEM). Newmont is the largest global gold miner, producing around 6M oz yearly with diversified operations worldwide. Newmont also has considerable gold reserves, securing its long-term value, and pays a higher dividend yield of around 4% - likely to rise if gold enters another phase higher. NEM may also be undervalued in the short run as it is still trading below its 52-week high despite a sharp rise in the price of gold. Of course, NEM is subject to numerous risks that investors should account for, such as rising production costs due to global labor shortages.

Is Gold Beginning A New Bull Market?

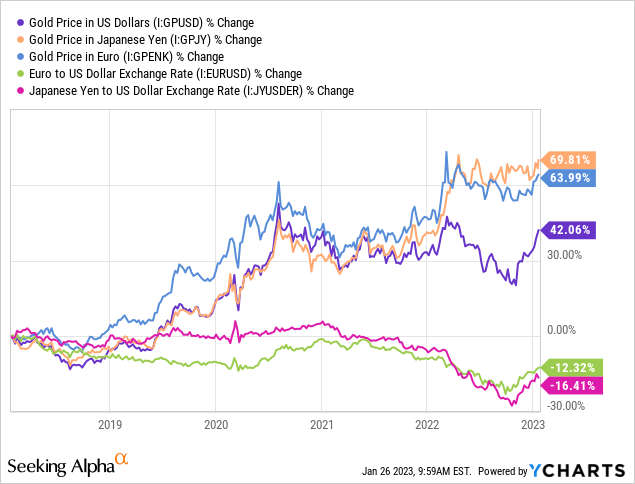

The US dollar price of gold has not risen since its 2020 spike. That rally occurred as investors weighed the potential of massive quantitative easing and record-low real interest rates on the market. Currently, the Federal Reserve is still a ways away from shifting toward such a dovish strategy. Still, increasing instability within the global fiat currency market may sufficiently boost gold. Gold rose considerably last year in Japanese Yen and Euro terms and is now rebounding in US-dollar terms due to the reversal in the dollar's strength. See below:

The fact that gold is a global commodity, with a "different" price in each currency, is often overlooked. Indeed, Newmont's fortunes largely depend on gold's "pan-currency" value since its operating costs (in foreign currencies) decline as the US dollar strengthens. The Euro and Yen have partially recovered against the dollar in recent months. However, gold has risen quickly enough that it has not fallen in value in Euro or Yen terms and has risen slightly higher. Of course, because the dollar has declined, gold has grown most quickly in US dollar terms. From this standpoint, I believe it is clear that the recent "global gold bull market" began in late 2021, benefiting from increasing monetary volatility worldwide.

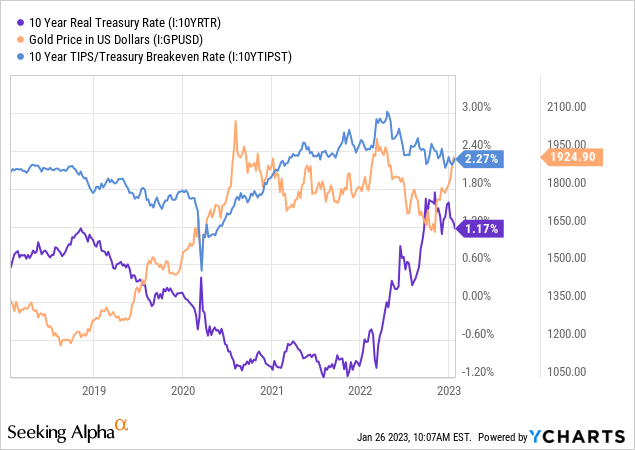

Gold is usually closely negatively correlated to the US real interest rate on Treasury bonds or the Treasury bond rate minus the expected long-term average inflation rate. Today, inflation is "expected" to average 2.27% over the next ten years; However, that figure has declined as the Federal Reserve hiked interest rates; it appears unlikely to fall below current levels due to its strong support. However, the real interest rate is now beginning to decline as bond investors brace for an end to hawkish monetary policy. See below:

Over recent years, gold has had an extremely strong negative relationship with real interest rates. Of course, real interest rates rose exceptionally quickly in 2022, while gold hardly declined in value (not falling back to pre-pandemic levels despite higher real interest rates). Further, gold rose promptly in recent months despite a relatively small decline in real interest rates. This pattern suggests that demand for gold is strong with lower regard for short-term monetary policy. To me, it seems the gold market (or gold investors) believe that any hawkish shift in monetary policy will eventually be met with a more significant dovish change in the event of a recession.

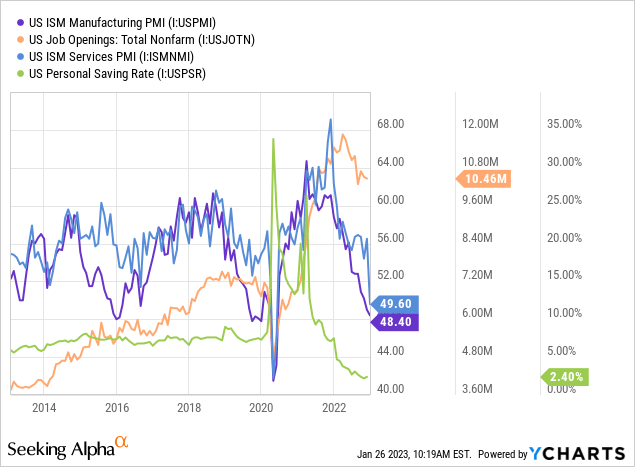

In my view, the statistical evidence for a 2023 recession is generally strong. For one, the manufacturing and services PMI is below 50, strongly indicating a contraction. Additionally, due to higher living costs and falling real wages, personal savings levels are shallow - suggesting a need to cut spending in many households. That said, high job openings may support the labor market. See below:

The Federal Reserve aims to maintain price stability and aid full employment. Today, the economy has extreme employment levels overall, although higher paying "white collar" jobs are seeing a sharp rise in layoffs while "blue collar" jobs face immense worker shortages. This fact, and inflation in general, complicates monetary policy - specifically regarding the gold market and the possibility of a recession. While a "recession" seems likely, it also appears that the economy is in a fundamentally different position due to a bifurcation between "digital" and physical aspects. Specifically, the "digital economy" seems to be in a significant recession, while the "physical economy" (which has a larger workforce) appears to be quite strong.

With "most" inflation slowing and the labor market "strong," the Federal Reserve will unlikely make any significant policy changes soon. That said, given that higher-paying labor segments face weaknesses (with lower-wage labor strength obfuscating the data), a solid dovish argument could eventually be made to lower interest rates or pursue QE. In my view, the Federal Reserve may race toward QE in the event of a recession to maintain economic liquidity. That said, doing so may spur even more significant inflation due to the large increase in volatility across the global monetary system. Additionally, such results may occur without the Federal Reserve if the Treasury tries to produce a "~$1 Trillion-Dollar Coin" to avoid the debt ceiling, thereby adding an ample money supply without significant oversight.

Value Potential In Newmont Corporation

I believe that gold is in a new bull market that could push the metal to even higher highs, potentially $2300+, based on gold's dollar-adjusted price. The primary catalyst is a decline in the US dollar, which does not require a "dovish" Federal Reserve pivot, but a more hawkish pivot in Europe or other large economies. That said, if the US economy does enter a recession, I believe gold's strength will increase due to the likelihood of a return to dovish policy stances despite monetary volatility.

I believe NEM is one of the best investments to take advantage of this trend. NEM is trading on the low end of its 2020-2021 range and is over 35% below its 52-week high. Of course, NEM may have had too much momentum last year and was pushed to an unsustainably high level. However, that rally occurred as the Yen and Euro were collapsing compared to the US dollar, indicating NEM is a go-to trade to hedge against such monetary instability.

My bullish thesis for NEM depends on the broader economy, which I believe increasingly supports gold. That said, NEM must also trade at a sensible valuation to provide safe and steady exposure to the price of gold. According to the company's last update, it produces around 6M oz of gold annually and 1.3M oz in gold-equivalent "GEO" metals. Most precious metals have risen recently with the price of gold, so I believe NEM's financial outlook will be best predicted using the price of gold. With gold back at a high of $1950/oz, I expect NEM to generate around $14.24B in annual revenue (at 7.3M oz GEO total). The firm's overall AISC guidance is currently $1130/oz, so it should earn an operating income of around $820/oz with prices where they are, or ~$5.99B per year. While that is well-above its TTM operating income, the company was generating nearly that figure when gold was at its peak in 2020. Subtracting the firm's ~$200M in interest costs and accounting for an estimated 32% tax rate, NEM's net-income outlook is around $3.95B per year or an EPS of ~$4.87.

Based on this outlook, NEM would only have a forward "P/E" of ~11X today. In my view, this makes NEM likely slightly undervalued, given it is a large mining company with perhaps the lowest operational and balance sheet risk profile of all gold mining firms. Of course, it is likely that NEM AISC will rise as the US dollar declines (as some international costs rise in dollar terms), so NEM's net income could be below the estimate provided. That said, I believe gold will likely rise by a few hundred dollars per ounce over the next year, potentially significantly increasing Newmont's income.

The Bottom Line

The macroeconomic backdrop facing gold is the primary driver of the value of almost all gold miners since their income closely depends on gold. Newmont is among the best ways to gain exposure to gold since it does not carry the potentially problematic counterparty risks in the gold futures market. While it does have operational risks, its immense diversification gives it a lower risk than many regional gold miners. Thus, I view the company as an indirect and far more liquid investment in physical gold. Even if gold does not rise in value, I believe NEM may increase due to its seeming undervaluation, given the most recent rally in gold. If gold and its AISC remain constant, NEM's forward "P/E" would be well below its normal range.

In a best-case scenario, continued volatility in international currency markets will push the US dollar lower and cause gold to rise considerably in US dollar terms. While a recession may be around the corner, abnormal trends conflict with the data and potentially increase the likelihood of monetary policy contention (creating fiat-currency volatility - as seen last year). Of course, NEM is a strong hedge today because it will likely rise considerably in a recession that spurs a dovish pivot by the Federal Reserve. Lastly, the debt-ceiling issue may benefit gold if the Treasury takes measures to accelerate currency printing (to avoid a debt-ceiling shutdown).

In a worst-case scenario, falling inflation and renewed economic strength will cause a broad economic normalization that lowers monetary volatility and depresses the value of gold. If gold falls below pandemic levels, then NEM should decline, but its overall downside risk is reduced since it is trading below its 2020-2022 range. This scenario can be seen as a return to the 2013-2019 paradigm of weak commodity prices. In my opinion, based on the data available, this does not seem likely, but it is possible. Of course, in this scenario, stocks would likely perform very well, so if one owns a portion of NEM (and peers) and traditional stocks, then more excellent portfolio stability is likely. Overall, I am very bullish on NEM and believe it is a solid risk-reward trade-off for 2023.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NEM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.