Has Turning Point Brands Reached A Turning Point?

Summary

- Turning Point Brands' shares have suffered from its exposure to the controversial vaping industry.

- Its smoking and smokeless tobacco products are largely doing quite well, generating strong cash flows.

- Past cash flows have been deployed towards acquisitions, mostly in new categories like vaping and CBD, destroying value.

- The new CEO has indicated a different attitude towards capital allocation, preferring stock buybacks over acquisitions.

HighGradeRoots/iStock via Getty Images

In my analysis of tobacco products company Turning Point Brands (NYSE:TPB) published slightly over a year ago, I made the case that the company had become undervalued after the sell-off that followed the 2021 third quarter earnings report. Since then, the company has seen a further significant sell-off in its share price, as well as the appointment of yet another CEO. It is therefore clear that I was too early in declaring Turning Point Brands a buy. So what happened?

The short version is that the company's vaping products segment has continued to suffer from regulation-related revenue declines that started in the second half 2021 and that have continued until the last reported period of Q3 2022, while sales growth in both the Zig-Zag (smoking products) and Stoker's (smokeless tobacco) segments has moderated significantly following elevated levels of demand during the covid pandemic.

The result has been a declining topline for Turning Point Brands overall, which combined with margin pressure has led investors to revise the earnings multiple on its stock downwards from approximately 20x earnings to less than 10x earnings (my estimate). The most important mistake I made was that I underestimated the impact of the FDA's intervention in the vaping products market, which has led both consumers and resellers to change their buying behavior.

Secondly, I assumed that given the secular growth trends in the North American cannabis market, the momentum seen in the smoking products segment, such as rolling papers, cones and cigar wraps, would continue as the segment benefits from favorable demand trends. While this assumption proved correct for most products, it certainly did not for cigar wraps, sales of which have in recent quarters shown meaningful declines versus 2021.

While cigar wraps are oftentimes used to roll so called marijuana blunts, they are evidently also widely used by consumers to make their own cigars. The exact balance between both types of use is difficult to know, but the correlation between weaker demand for both cigars and cigar wraps since the end of the COVID pandemic, seems to suggest that cigar making is still a very large part of wrap demand.

From weak sales numbers by other cigar manufacturers such as STG and Swedish Match this year, we know that demand for cigars was significantly higher in the US during the second half of 2020 and most of 2021, which strongly indicates altered consumer behavior during the covid pandemic. Now that the pandemic has ebbed away, some of that demand has disappeared with it, also impacting Turning Point's wraps product sales. These effects will moderate going forward as the company faces more favorable bases of comparison going forward.

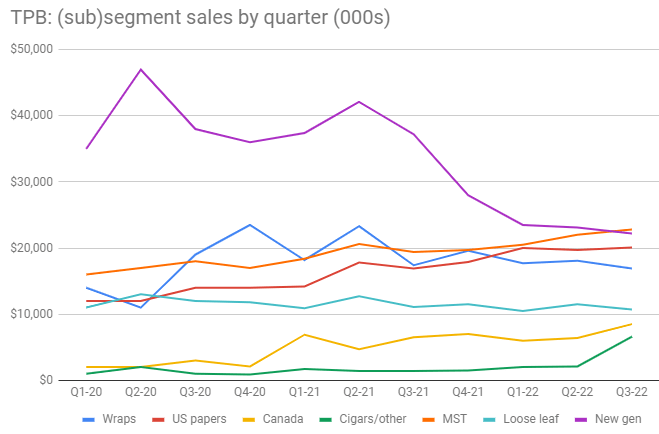

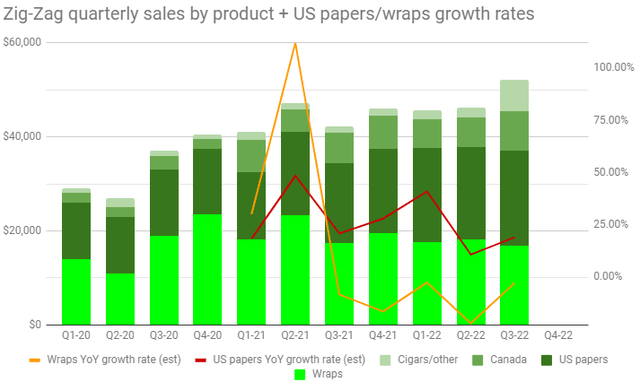

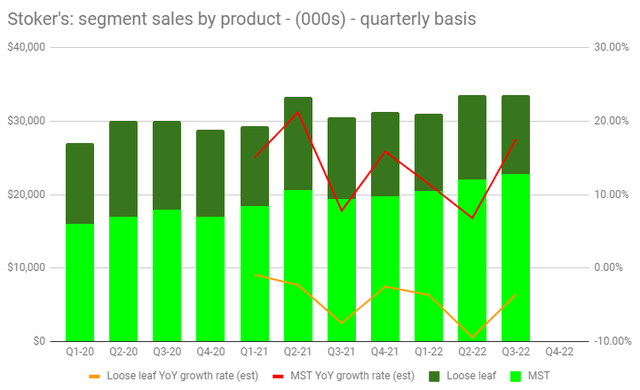

Turning Point Brands quarterly revenues by subsegment: Zig-Zag segment revenues are broken down into wraps, US papers, Canada and Cigars/other, while the Stoker's segment is broken down into loose leaf and moist snuff tobacco sales. New gen segment reported as is. (Author)

Vaping Products: Dark Clouds

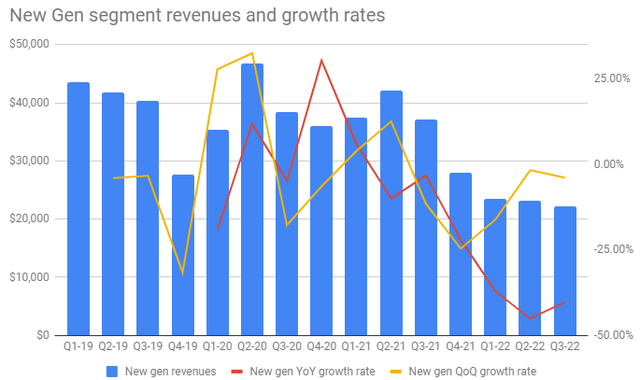

The graph above clearly shows the accelerating decline in new gen segment sales (purple line) from the third quarter of 2021 onwards. The declines have moderated somewhat during the first three quarters of 2022, but have continued to exert pressure on Turning Point's reported topline numbers. I believe there are cautious reasons for optimism going forward.

First of all, the forward comparison basis is becoming a lot easier for the new gen segment. For instance, sales achieved in the segment during the third quarter of 2022 were somewhat over $22 million, whereas in the same period a year ago sales were over $37 million. This translates into a year-on-year sales decline of -40% for the new gen segment in the third quarter, which needless to say is unusually large. However, in the fourth quarter a year ago, sales for the new gen segment came in at slightly over $28 million, meaning the percentage decline is likely to moderate significantly in Q4 2022.

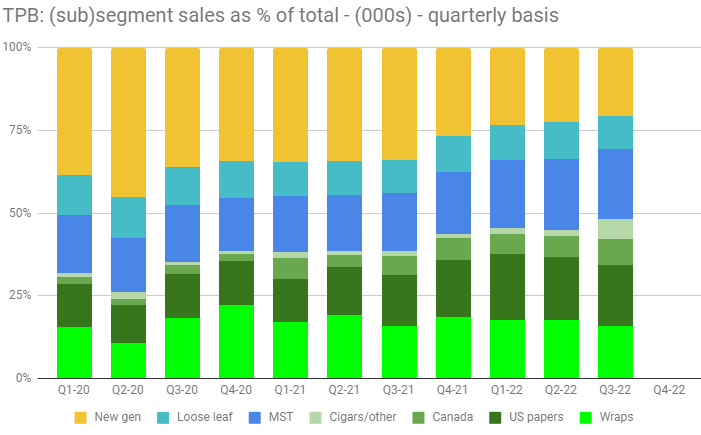

Turning Point Brands' subsegment sales as a percentage of total quarterly sales. New gen (vaping) sales in yellow have decreased meaningfully from close to 50% of total in Q2-20 to less than 25% in Q2-22. (Author)

This matters because it will diminish the overall impact the new gen segment has on Turning Point's topline numbers. After all, new gen has been the biggest segment in terms of sales for many years, but the large revenue declines registered during 2021 and 2022 have significantly diminished the segment's relative contribution to the company's total sales. In the third quarter of this fiscal year, for the first time, moist snuff product sales became the biggest contributor to Turning Point's overall revenues, while new gen dropped to being the second largest contributor to sales.

The new gen segment has suffered large sales declines since Q3-21 but the decline appears to have largely bottomed out. The sequential rate of decline has already shown improvement (yellow line, read against right axis). (Author)

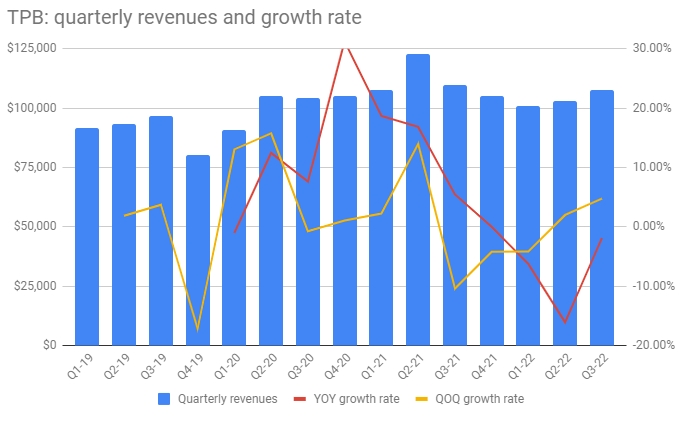

It seems likely that the new gen segment's relative contribution will drop further going forward, especially since the growing subsegment of US cigarette papers sales have closed in, and is due to become the company's second largest contributor to sales. In the graph below, we can see that the company suffered through three sequential sales declines between Q3-21 and Q1-22, but returned to sequential growth by Q2-22. On a year-on-year basis the company has however seen negative topline numbers all throughout 2022, adding to negative sentiment surrounding the company's stock. I believe the worst of this is now behind us, given the much easier basis for comparison going forward, as the weak sales performance during 2022 has laid a low hurdle to clear.

Quarterly revenues (in 000s) with the YoY growth rate and QoQ growth rate (right axis). Both the quarterly and the annual growth rate have trended positively in recent quarters, in that they showed relative improvement QoQ. All graphics by the author. (Author)

However, the diminished importance of the vaping products segment does not mean that its issues have become irrelevant. After all, the regulatory uncertainties surrounding the US vaping products category have not been cleared. On the contrary, the review process for the PMTA applications filed by Turning Point Brands with the FDA continues till the present day, while the 2021 Preventing Online Sales of E-Cigarettes to Children Act bans the USPS from shipping vaping products under most circumstances.

This ban impairs the ability of vaping companies to sell and distribute their products via online transactions, significantly impacting direct sales to consumers. Meanwhile, the continued uncertainty over which particular vaping products will receive marketing approval by the FDA has caused resellers to dramatically downsize their inventory levels, which has caused product availability at the retail level to decrease, leading to even more lost sales. Because the widely available disposable vaping products sold by competitors like Puff Bar and Bidi Vapor have not been subjected to any flavor bans, many consumers have turned to these products instead of the refillable products sold by companies like Turning Point.

All in all, the successive regulatory interventions in the vaping products market have caused industry-wide disruptions to the market that have made the vaping business in general a very unpleasant undertaking for most companies. While it remains possible that the new gen segment will recover going forward, I am not holding my breath for notable improvements in the short term.

My main reason for staying optimistic regarding Turning Point Brands is the far more favorable outlook in smoking and smokeless products. Given that I believe the underlying value of Turning Point Brands resides mostly in its Zig-Zag and Stoker's franchises, I believe redirecting capital allocation away from vaping and other new gen products will help unlock this value.

The company's Zig-Zag segment, which features smoking products like papers and wraps, has shown very favorable growth dynamics. The bars feature revenues by product (read against left axis, in 000s), while YoY growth rates for US papers and wraps are shown as well (lines, read against right axis). Sales of wrap products have not maintained the elevated levels seen during the heyday of the COVID pandemic. (Author)

New CEO, New Plan. Redux.

Although Turning Point has never commented on this, it seems likely that former CEO Larry Wexler stepped down as chief executive because his strategy to significantly expand the company's presence in vaping and other new gen products caused significant disruption to Turning Point's business (and share price) for the second time in just a few years. His successor Yavor Efremov, who touted significant experience in corporate deal-making, lasted less than a year in the CEO role, in contrast to Wexler's long term.

His abrupt departure from the executive office and the company's board of directors, raises some questions about the latter's handling of the succession process and their direction of the company in general. After all, recently appointed Graham Purdy is now the third person to serve in the CEO role in slightly more than a year's time. Having a revolving door in the executive office generally does not inspire much faith on my part, but Purdy has been with Turning Point Brands for a long time and he knows the company and its different business lines very well.

The reasons for Yavor Efremov's sudden departure have never come to light, but his exit makes it more likely that Turning Point's history of overactive corporate deal-making has come to an end. First of all, the rather mixed outcomes achieved with the string of acquisitions executed during 2016-2021 will give the company less leeway with investors. Secondly, financial conditions have tightened significantly over the past year, making debt-fueled acquisitions less attractive. Finally, Graham Purdy's long tenure with the company in a variety of roles suggests the board may have changed its mind regarding the strategic direction of the company.

Wexler was clearly an empire builder, and a poor allocator of capital, who directed the company into emerging categories like CBD and vaping products by investing the cash flows from the smoking and oral tobacco products in a string of deals. The appointment of Efremov as his successor, who previously worked in finance roles at Goldman Sachs and Liberty Media, suggested more of the same going forward. Purdy's appointment on the other hand, who most recently served as the company's chief operating officer, may signify a break from this past.

Given the organic growth opportunities available to Turning Point, especially in its smoking products division, which is well-positioned to benefit from the longer-running trend towards cannabis legalization in North America, my bet is that the company will focus more on organic business opportunities going forward. The size of its financial debt and the depressed level of its share price also favor a more conservative financial course. Buying back shares, which the company has already been doing quite extensively, seems a much safer bet to increase shareholder value than the pursuit of more deals in new product categories. This is roughly my interpretation of the commentary given on the Q3 earnings call, as seen below.

"It's not lost on anyone that tighter financial market conditions, coupled with an uncertain economic environment have made it more difficult to execute accretive transactions. The way I see it, every dollar we spend will be highly scrutinized versus our internal hurdle rate. The bar for synergistic M&A will be high, especially in the context of alternative uses, like returning capital to our stakeholders."

The big question remains what will happen to Turning Point's new gen business segment. As the main cause of disruption to the company's business prospects and a large part of its share price headwinds, the board of directors and the company's management team are likely to look for a solution to this festering problem. As stated by Graham Purdy on the company's most recent earnings call:

"Next NewGen, while we continue to monitor the regulatory backdrop, most of it is out of our control. Despite the regulatory disruption in this segment, as we navigate the process, we've maintained profitability and continue to explore ways to maximize the value of the strategic distribution asset we have built. While I'm optimistic we'll eventually get resolution that should benefit TPB, we are committed to finding a solution that reduces the volatility we have experienced in recent years."

The last sentence may be the most important. While sales in the segment are down substantially, and profitability has never been meaningful for this business, there may still be some value left in it. Most importantly, its direct-to-consumer and business-to-business websites are an important route-to-market for vaping products from manufacturers that are not aligned with the large pod-based players (Juul, Vuse) or the disposable vaping pen companies (Puff Bar, Bidi Stick). Retaining access to a viable independent online retail channel may therefore be strategically desirable to a number of companies, not in the least large Chinese manufacturers of vaping products like RLX Technology.

When Turning Point's management says it wants to reduce the volatility associated with the new gen segment, to me it sounds a lot like they are contemplating an exit from this business. This could be achieved in three different ways. First option is to close the business down completely, write down the assets associated with it and sell whatever is left of value. Since this would be a very painful decision, and would remove all potential upside, this is not a very likely outcome in my opinion.

The second option is to sell the business in its entirety to another company. Depending on the sale price, this could be an attractive option. The main issue with this scenario is that the vaping business is unlikely to fetch an attractive price given the uncertainty hanging over its future. The third and most likely option is to sell a significant stake in the business to a third party, thereby sharing the risk and financial burden. In the case of a majority stake sale Turning Point Brands no longer has to fully consolidate the financial results from the vaping business in its income statement; instead it could report the financial results from its remaining stake as a minority interest, which is generally included in the results from associates and joint ventures below the operating income line.

This would remove new gen sales from Turning Point Brands' income statements, thereby removing the segment's impact on the company's revenue line. This option is probably the most attractive and in my opinion has the highest probability of materializing. It would be easier to achieve than an outright sale, and has the additional advantage of giving Turning Point a chance to recapture any remaining upside in this business. The downside to this scenario is that you hand operating control to a business partner, which means you become dependent on a third party to achieve a desirable outcome.

The sale of a minority stake in the business in the vaping business is another possibility. Selling a minority stake has the advantage of retaining the option to share any potential operating losses and capital outlays with a partner, while opening the door to a complete divestment of the asset in the future. The downside is that the financial results from the business would still be reported on the financial statements of the owner, which means the financial volatility would not instantly be removed.

The company's Stoker's segment has seen its sales rise quite steadily, driven by the company's moist snuff tobacco products sold under the Stoker's brand. Loose leaf, which is better known as chewing tobacco has been in long term decline. Given the shift in sales mix towards MST products I am expecting mid-single digit growth in this segment going forward. Both product line-ups are highly profitable, highly cash generative and are known for industrywide upward pricing characteristics. (Author)

Conclusion

To answer the question posed by this article's title; yes, I do believe Turning Point Brands may have reached a turning point. In sum, my reasons for this belief are threefold. First, the diminished importance of the vaping products segment, which even with continued headwinds in this segment will lead to diminished drag on the company's reported topline numbers. This will matter foremost with regards to investor sentiment surrounding the stock.

Second, the appointment of a new CEO who has indicated a significantly different capital allocation policy, as well as a strategic reevaluation of the company's new gen business. These two things matter to a very significant extent because Turning Point Brands' Zig-Zag and Stoker's business segments produce significant free cash flows, and have very little need for capital expenditures due to the company's reliance on third-party manufacturing for most of its product requirements (capex amounted to less than $6 million annually over the past three year average, or slightly over 1% of sales). Since the company's current dividend commitment is also very modest the company has a large degree of freedom when it comes to the direction of its excess cash.

With free cash flow averaging approximately $42 million annually over the past three years, after capex but before dividends, and its market capitalization currently below $400 million, this implies the company's shares sport a free cash flow yield of well over 10%. In the past the company has largely directed its cash flows towards acquisitions, with most of the non-tobacco purchases ending up destroying value. Given that CEO Graham Purdy has indicated that we should not expect to see this kind of dealmaking going forward, the company has only two options left for its cash flows.

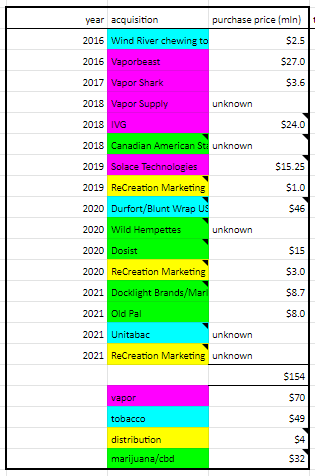

Since its IPO in 2016 Turning Point Brands has spent significant amounts of capital on acquisitions, with the cumulative amount well over $150 million, of which more than $100 million in vapor and marijuana/CBD. The information included in the table is not complete, as the price paid for several transactions was not, or only partially, reported. (Author)

The first option is to pay down its debts, which I will grant, are quite significant at $310 million on a net basis (as of Q3 2022), or to give the money back to its shareholders. It could do the latter either through higher dividends or through buying back more of its own shares, as it has already been doing this year. The latter option is heavily favored by me, as it presents the most obvious avenue for value accretive deployment of capital. The redirection of capital towards share repurchases will do much to improve the company's share price going forward.

I believe the fair value per share could approach $44 if the company sticks to a highly disciplined capital allocation policy, and if it manages to dispose of a majority stake in the new gen business. This estimate is based on a multiple of 11x underlying EBITDA of $100 million per year. This is a meaningful premium to the tobacco industry in general, but it is in my opinion justified given the company's lack of exposure to controversial cigarette products and a more favorable growth outlook for the majority of its business.

Using this multiple implies an enterprise valuation of $1,100 million, which subtracting roughly $310 million in net debt implies an equity component of $790 million. Dividing this by roughly 18 million shares outstanding implies roughly $44 per share fair value for the stock. This comes down to roughly 100% upside from the current share price level, using a quite reasonable scenario.

Well-informed observers may note that I am ignoring the diluted share count number of 21.5 million in this calculation. My reason for this is that the overwhelming part of this potential dilution is due to a far out-of-the-money option granted with certain debt obligations issued by the company a few years back. I do not believe this option will be exercised, and in case it is exercised, the dilution in Turning Point's shares would be roughly compensated by the correspondingly lowered debt component of EV.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TPB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.