Expedia And Hilton: A Pair Trade For The Streamlined Travel Sector

Summary

- The pair trade I suggested weeks ago based on the changing consumer landscape has performed extremely well.

- The same dynamics that apply to retail consumption apply to travel.

- Expedia and other stocks that operate as travel agents face demographic challenges and an overall margin squeeze.

- Proprietors like Hilton have positioned themselves to operate seamlessly, without travel agents, in today's evolved information age.

400tmax/iStock Unreleased via Getty Images

On January 2, Seeking Alpha published my pair trade recommendation to go long shares of LVMH and short shares of Ross Stores (ROST). To date, LVMH is up 15.1% and ROST down 0.77%, yielding a tidy net profit 8% for the market neutral trade thus far. I believe there is plenty of room to run, as the fundamental story continues to play out.

For consumer discretionary spending as a whole, Macy's (M) is the proverbial canary in the coal mine. On January 6, Macy's issued weak guidance and a somber description of the current state of the US consumer. Any hope for Macy’s to be written off an as anomaly was eliminated by Nordstrom's (JWN) the following week, when the Company cut earnings estimates and also warned of tightening consumer spending habits.

Prices remain inflated in a US economy simultaneously subject to quantitative tightening by the Fed. Diminished consumer budgets dictate that 2023 and foreseeably beyond will be defined by different spending patterns, and a whole lot less consumption overall in low-middle income households.

Frequent travelers, be it for business or leisure, will continue to use rewards programs with their favorite landlords rather than allowing middlemen travel agents to earn said rewards, and then some, as commission. Owner operators such as Hilton (NYSE:HLT) and Marriott (MAR) face macro headwinds, yet they have largely affluent clientele whose loyalty amounts to almost subscription-like revenue streams. Additionally, prices offered directly through proprietors' websites now match those offered by widely used online travel agents. In early years, travel websites offered discounted rates on specific blocks of rooms while brands like Hilton focused on customers less concerned with price or looking for luxury amenities and service. Consumers were trained in an almost Pavlovian manner to avoid direct bookings in favor of sites like Priceline.com, now Booking.com, in order to get the best deal. The name change is quite telling in that discounts are no longer part of the equation.

More sporadic travelers, primarily those looking to compare all rates with minimal standards, will largely continue to use convenient websites that easily compare different options, but how much will these consumers actually travel and how much will they spend going forward? 2022 was a unique aberrational boon for travel and entertainment, defined by temporary pent-up demand from COVID induced shutdowns.

It is quite clear that if the current economic environment persists, in which margins are persistently being squeezed, online travel agents will effectively disappear in time as did their strip mall predecessors. To make a Seinfeld analogy, the pool in which Expedia, Booking, TripAdvisor and the like operate has become frigid. Their top lines are due for, as George Costanza would say, “significant shrinkage.”

Consolidation will be inevitable amongst the online travel agents, with Expedia and Booking the only likely survivors. Before that occurs, each stock will endure a brutal revaluation based on a consumer landscape that leaves less meat on the bone for all businesses, especially those that depend on low-to-middle income discretionary spending.

Only in recent days, Booking Holdings (BKNG), the pronounced worldwide leader in this sector, trades at an earnings discount to second fiddle Expedia (NASDAQ:EXPE). McDonald's (MCD) trades at a premium to Burger King (QSR), JPMorgan (JPM) trades at a premium to Citi (C) and Wells Fargo (WFC), Nvidia (NVDA) trades at a premium to Advanced Micro (AMD). There is always a best in breed and in all the above examples, as well as the case of BKNG vs EXPE, there is no debate. BKNG operates with EBITDA margins recently just above 30% and pre-COVID typically around 40%, while EXPE has been more consistently around 20%. EXPE now garners a higher P/E, in excess of 39x, with a higher debt to equity ratio to boot!

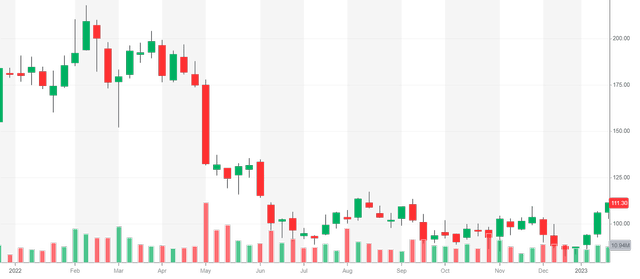

On a technical basis, the EXPE chart is an absolute disaster. The stock didn’t bottom with the overall market in August, it continued to decline in the following months despite short interest reaching multi year lows. With shares in the $80s, short interest in the stock shrank to 2% in late 2022 from over 10% in 2021. This strongly indicates that smart money was heavily short with shares over $150 and covered profitably under $100.

Expedia bubble bursts (Yahoo Finance)

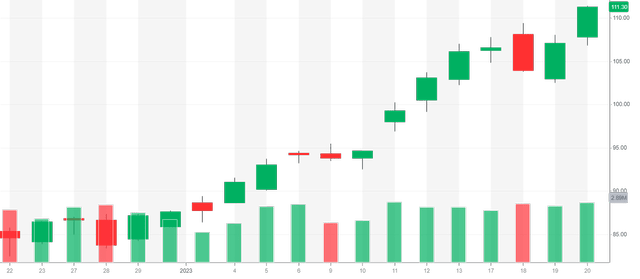

Since bottoming Dec 22, shares of EXPE are up a whopping 35%. In the same period, BKNG shares are up a relatively paltry 16%, which fully explains the valuation discrepancy. Notably, shown below, shares of EXPE gapped up from $94.64 at the close on 1/10/23 to $97.98 at the open on 1/11/23 and haven't looked back since. Over the last 2 years, every gap on the daily chart has filled, suggesting an imminent return to $94.64 or below. Short interest quickly climbed back to 4% after the first trading week of 2023 and likely sits much higher as shares went up in unsustainably parabolic fashion following the aforementioned gap up.

Gap up in EXPE (Yahoo Finance)

Expedia, like Ross Stores, saw peak demand in 2022. The Company is not positioned for growth in 2023, despite a valuation that says otherwise. With multiples cratering in traditional growth sectors such as tech, it seems unsustainable that travel agents will continue to garner such massive multiples.

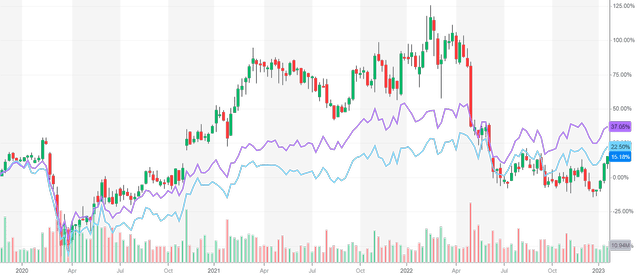

Clearly, my higher conviction play here is shorting EXPE, however managing beta is vital to any portfolio and the stock is quite volatile. A pair trade keeps the bear in me balanced and can generate alpha without leverage, regardless of overall market direction. There are several reasons I choose Hilton over Marriott for the long half of this trade, despite it being more expensive based on most metrics. Marriott, like Expedia, accrued additional debt in the third quarter of 2022 while Hilton reduced debt. Hilton properties cater to a significantly more affluent clientele as a whole. Additionally, the stock has showed relative strength in recent years, as shown in the chart below.

EXPE vs HLT (purple) vs MAR (blue) (Yahoo Finance)

Some business models have fundamental staying power, others are merely designed to capture excesses when the water is nice and warm. Hilton constitutes the former, Expedia the latter. Investors looking for more certainty before shorting the volatile stock can wait until EXPE reports earnings February 9. I'll probably initiate a short position before then, as the reaction will likely be negative if the Company reports a disappointing cash burn of $2B as it did the quarter prior.

Short Expedia, Long Hilton.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in EXPE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.