ETG: This CEF Is Improving And Could Play A Role In An Income Portfolio

Summary

- Most people are desperate for more income today as it is becoming ever more expensive to maintain our lifestyles.

- Eaton Vance Tax-Advantaged Global Dividend Income Fund invests in a portfolio intended to provide investors with a high level of total return that is delivered via direct payments to them.

- The closed-end fund's portfolio has improved a bit since we last looked at it, but ETG could still stand some improvements.

- The fund cut its distribution due to heavy losses from its sub-optimal portfolio. We have to see if it will be able to sustain the new distribution.

- The CEF price is attractive and the fund could be worth buying as long as you personally build your portfolio to include the areas in which the fund falls short.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

da-kuk

Without a doubt, one of the biggest problems facing investors today is the incredibly high inflation rate that has dominated the economy over the past year. This has pushed up the price of food, which is something that we have all certainly noticed at the grocery store. It now seems that almost daily I see an article (like this one), that discusses how many middle-class Americans are now being forced to choose between eating and heating their homes. The Federal Reserve has been hiking interest rates in an effort to combat this, which has made the fact that credit card balances have been climbing even more onerous. It is little surprise then that people all around the nation are taking on second jobs or entering the gig economy simply to obtain the extra money that they need to tread water in today’s economy.

Fortunately, as investors, we have things a bit easier. We can put our money to work for us in order to generate the extra income that we need to maintain the standard of living that we have become accustomed to. One of the best ways for us to do this is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are nice because they provide easy access to a professionally-managed portfolio of assets that in most cases can deliver a higher yield than just about anything else in the market. They are also normally able to pay out a higher yield than any of the underlying assets actually have.

In this article, we will discuss the Eaton Vance Tax-Advantaged Global Dividend Income Fund (NYSE:ETG), which is one closed-end fund ("CEF") that we can use for this purpose. As of the time of writing, this fund yields 7.32%, which is certainly enough to provide extra income since that works out to $73,200 annually on a $1 million investment. I have discussed this fund before but was admittedly a bit disappointed with its portfolio. However, a few months have passed since that time and a few things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances.

About The Fund

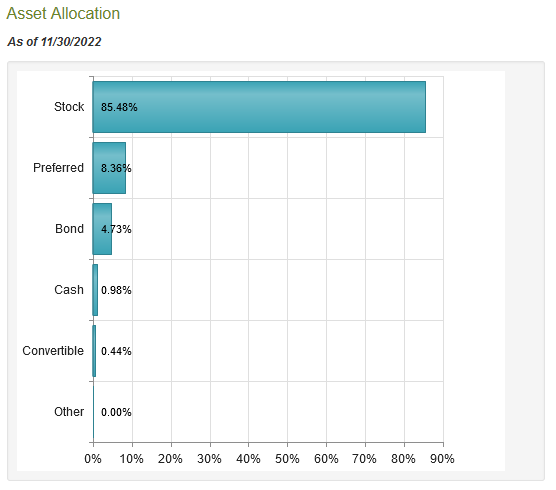

According to the fund’s webpage, the Eaton Vance Tax-Advantaged Global Dividend Income Fund has the stated objective of providing its investors with a high level of after-tax total return. This is not particularly surprising, since the name of the fund implies that it primarily invests in equities. After all, those are the only securities that actually pay dividends. This is certainly the case as 85.48% of the portfolio is invested in common stock and an additional 8.36% is invested in preferred stock:

CEF Connect

Equity, especially common equity, is by its very nature a total return vehicle. After all, most people that purchase shares of stock are interested in both capital gains and dividend income. The fund’s objective is, therefore, to invest in these securities and then pay out both the capital gains that it generates as well as the dividends that it receives to the investors. This is hardly unusual, as it is the same thing that most equity closed-end funds do. This is the reason why the fund tends to have a fairly stable price over time. This differs from an exchange-traded fund that will not pay out its capital gains but instead pay out the dividends while relying on share price appreciation, resulting in a climbing share price over the long term.

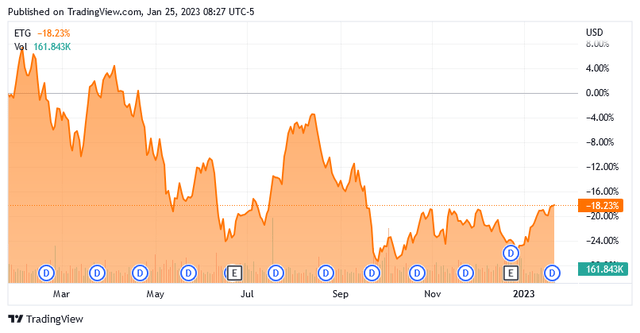

Unfortunately, the Eaton Vance Tax-Advantaged Global Dividend Income Fund has failed to maintain a relatively stable share price over the past year. In fact, the fund’s market price has declined by 18.23% over the past year:

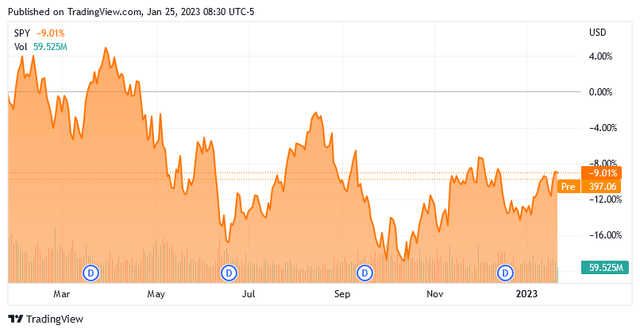

This is quite a bit worse than the S&P 500 Index (SP500), which is only down 9.01% over the same period:

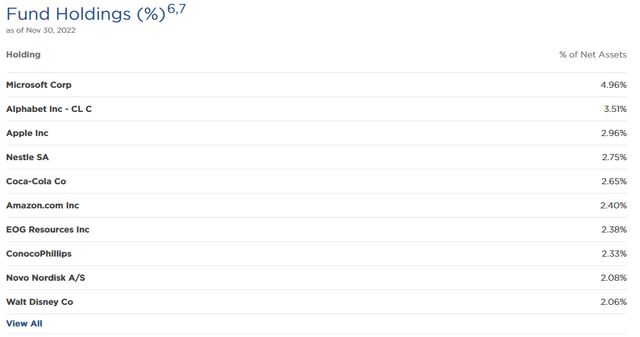

The fact that the Eaton Vance fund has a much higher yield evens out the difference somewhat, but it has still underperformed the index over the period. We can see one reason for this by looking at the Eaton Vance fund’s portfolio. Here are the largest positions:

This portfolio looks remarkably similar to the Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG), which I discussed earlier today. In fact, it is difficult to tell the difference between these two funds.

As I observed in my last article on the fund, the Eaton Vance Tax-Advantaged Global Dividend Income Fund claims that its strategy is to invest in “dividend-paying” equities from both domestic and foreign issuers. That makes this portfolio very strange, since both Alphabet (GOOG) and Amazon (AMZN) pay no dividends. Microsoft (MSFT) and Apple (AAPL) both have such a low yield that their dividends are all but irrelevant. Thus, the fund does not appear to be abiding by its own strategy. I am also a bit stunned that it is not including any of the large shale oil drillers like Devon Energy (DVN) or Pioneer Natural Resources (PXD), as many of these companies are now yielding just under 10% and are substantially undervalued relative to their earnings growth. The inclusion of these firms would boost the fund’s income and probably give it better capital gains than the weak performance of the mega-cap technology companies over the past year. This is especially true in today’s inflationary environment, which is limiting the ability of consumers to engage in discretionary spending and will thus likely weigh a bit on Apple’s and Amazon’s revenues going forward. In fact, Amazon’s recent announcement that it is terminating its charitable donation program is a clear sign that revenues are under a great deal of pressure. Thus, the comments that I made about this fund’s portfolio not really being the best for the current environment remain valid.

There were surprisingly few changes to the fund’s portfolio since we last looked at it, although the weighting to Amazon was substantially reduced. That could be a sign of other stocks in the portfolio outperforming it though and may not necessarily be due to the fund actually selling the stock. The only other change is that the fund used some of the cash in its money market fund (MSILF Government Portfolio) to purchase other stocks, including Novo Nordisk (NVO). This may not be a bad move, as Novo Nordisk is one of the better healthcare companies to be invested in right now given that the diabetes epidemic is likely to continue to get worse over the coming years.

The fact that there were so few changes to the fund’s portfolio may lead one to think that the fund has a relatively low annual turnover. This is not exactly correct, though, as its 59.00% annual turnover is middle-of-the-road for an equity closed-end fund. The reason that this is important is that it costs money to trade stocks or other assets. These expenses are billed directly to the shareholders and thus create a drag on the portfolio’s performance. The higher the fund’s expenses, the more difficult management’s job becomes because they will need to generate sufficient returns to both cover the fund’s expenses and still have enough left over to provide a return that is acceptable to the shareholders.

This is something that few management teams are able to accomplish on a consistent basis, which is the reason why actively-managed funds tend to underperform index funds. As we have already seen, the Eaton Vance Tax-Advantaged Global Dividend Income Fund underperformed the S&P 500 Index over the past year, although it was able to deliver a much higher yield. This is probably due to the fund excluding certain sectors of the S&P 500 that performed reasonably well in 2022, such as the shale oil drillers.

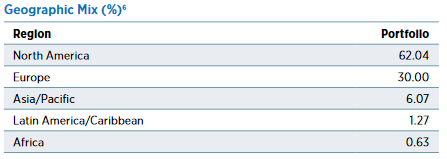

As the name of the fund implies, the Eaton Vance Tax-Advantaged Global Dividend Income Fund is a global fund that invests in equities issued by companies all around the world. However, a look at its largest positions casts some doubt on this, as Nestle (OTCPK:NSRGY) and Novo Nordisk are the only foreign companies on the list. However, a look at the entire portfolio reveals a somewhat different story. Only 62.04% of the portfolio is invested in North America, with the rest invested elsewhere:

Eaton Vance

Unfortunately, the fund’s documents do not break down how much of that North American allocation is to the United States as opposed to Canada. It is likely that most of it is in companies from the United States, however. The United States only accounts for just under a quarter of the global gross domestic product and Canada is less than 1% of the global gross domestic product. Thus, the fund is substantially overallocated to North America relative to their actual representation in the global economy.

This is not exactly unusual, however, as most global funds suffer from the same problem. In fact, many global funds have 60%+ allocation to the United States. This one does not state exactly what percentage of its portfolio is allocated to which nation but its U.S. weighting is probably in the upper 50s. Thus, this fund is probably better diversified internationally than many, but it is still more domestically focused than we really want.

The reason why international diversification is important is because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take an action that has an adverse impact on a company in which we are invested. The only real way to protect yourself against this risk is to ensure that only a small percentage of your assets are invested in any individual company. This fund is certainly accomplishing that to a degree but I would like to see greater balance in the portfolio. In particular, a higher allocation to the Asia/Pacific region would be nice since that area is likely to see much greater economic growth going forward than either North America or Europe.

Leverage

Earlier in this article, I stated that closed-end funds like the Eaton Vance Tax-Advantaged Global Dividend Income Fund have the ability to pay out higher yields than any of the underlying assets possess. One of the ways in which this is accomplished is through the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase common stocks. As long as the returns that it gets from the purchased assets are greater than the interest that it needs to pay on the borrowed money then the strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which are lower than retail rates, this will usually be the case.

However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s debt exceed a third of its assets for this reason. Fortunately, this fund appears to be satisfying this requirement as its levered assets comprise 21.32% of its assets as of the time of writing. Thus, this fund appears to be striking a reasonable balance between risk and reward. This is certainly nice to see.

Distribution Analysis

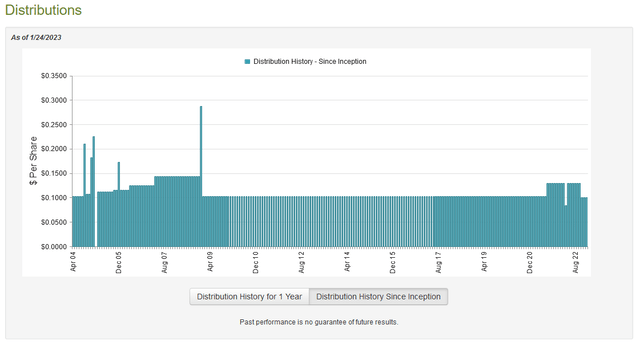

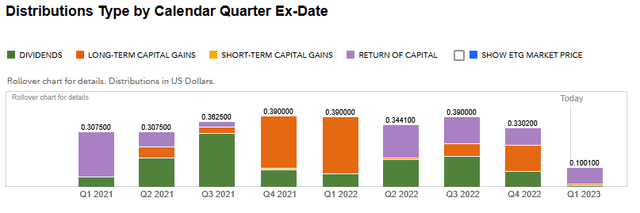

As stated earlier in this article, the primary objective of the Eaton Vance Tax-Advantaged Global Dividend Income Fund is to provide its investors with a high level of total return, which will primarily come from the fund paying out its received dividends and capital gains to the investors. The fund also uses leverage to attempt to boost its returns over what it would ordinarily receive. As such, we might expect that the fund would pay out a high yield to its shareholders. This is certainly the case as it currently pays out a monthly distribution of $0.1001 per share ($1.2012 per share annually), which gives it a 7.32% yield at the current price. The fund has generally been consistent about this distribution over the years, although it did cut it back in November 2022:

The current distribution is lower than the $0.1025 per share that the fund paid monthly prior to its previous increase in 2021. The fact that the fund did have to cut in November is likely to be somewhat disappointing to many investors, especially those that are looking for a safe and secure source of income to use to pay their bills. This is not unusual though as most of Eaton Vance’s other closed-end funds cut their distributions. This is probably due to the very disappointing performance of the mega-cap technology companies that all of its funds had heavy exposure to and thus lost a lot of money on. However, anyone buying today will receive the current distribution at the current yield so that is going to be the most important thing for anyone buying today as the past does not really matter at this point.

The fund has been making a substantial number of return of capital distributions lately, which may be concerning to many investors:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, there are other things that can cause a distribution to be classified as a return of capital, such as the distribution of unrealized capital gains. As such, we want to investigate the fund’s finances in order to determine exactly how it is financing these distributions and how sustainable they are likely to be.

Fortunately, we have a very recent document that we can consult for this purpose. The fund’s most recent financial report corresponds to the full-year period that ended on October 31, 2022. This is a much more recent document than we had the last time that we looked at the fund and it should give us a pretty good idea of how well the fund handled the market volatility that resulted when the Federal Reserve began its monetary tightening policy and caused many stocks to fall significantly. During the full-year period, the fund received a total of $50,361,870 in dividends and another $9,943,433 in interest from the investments in its portfolio. When we combine this with a small amount of income from other sources, the fund brought in a total of $61,819,964 during the period. The fund paid its expenses out of this amount, leaving it with $38,670,263 available for the shareholders. Unfortunately, this was nowhere close to enough to cover the $119,073,693 that the fund actually paid out during the full-year period. At first glance, this is likely to look rather concerning.

However, there are other ways that the fund can obtain the money that is needed to cover its distributions. The most important of these methods is by earning capital gains. As might be expected from the market’s disappointing performance in 2022 though, the fund failed miserably at this task. It did manage to achieve net realized gains of $82,416,737 but this was more than offset by net unrealized losses of $505,718,500 during the period.

Overall, the fund’s assets decreased by $501,004,691 over the course of the year after we account for all inflows and outflows. This certainly explains the distribution cut as the fund failed to cover its distributions and now it has fewer assets to generate the gains that are needed to maintain it. With that said though, the fund’s net realized capital gains and net investment income combined was just barely enough to cover the distributions, but the decline in assets makes it very difficult for the fund to generate comparable gains going forward. We will have to wait and see if the fund manages to sustain the current distribution. While January will be helpful, there is evidence that this may be just a dead cat bounce and the market will soon begin declining again so the fund’s ability to continue to generate gains is questionable.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a sub-optimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Advantaged Global Dividend Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is certainly the case with this fund today. As of January 24, 2023, the Eaton Vance Tax-Advantaged Global Dividend Income Fund had a net asset value of $17.86 per share but the shares only trade for $16.21 per share. This gives the shares a discount of 9.24% to the net asset value at the current price. This is a more attractive price than the 8.21% discount that the shares have traded for on average over the past month. Thus, the price certainly appears to be quite reasonable today.

Conclusion

In conclusion, closed-end funds like the Eaton Vance Tax-Advantaged Global Dividend Income Fund can be a good way to obtain the extra income that is needed to support your lifestyle today. This fund is certainly a reasonable way to accomplish that task given its fairly high yield and attractive valuation. The fund has also improved its portfolio a bit from the last time that we looked at it. Unfortunately, I can still see some significant flaws with its current holdings and there could be room for improvement.

Fortunately, Eaton Vance Tax-Advantaged Global Dividend Income Fund is not the only asset that we have to hold, and combining Eaton Vance Tax-Advantaged Global Dividend Income Fund with some high-yielding undervalued companies could be a good way to boost your income and sleep well at night. Overall, that is not a bad strategy and I can see this fund playing a role in such a portfolio.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have long positions in various energy-focused funds that currently hold long positions in DVN and PXD. I exercise no control over these funds and their holdings may change at any time.