DGRO: An Average Fund With Pros And Cons

Summary

- The iShares Core Dividend Growth fund has minimal holdings in the energy and basic material sectors, this ETF isn't likely to offer inflation-adjusted returns or substantive income.

- DGRO should appeal to growth investors who want to take a more moderate risk since this fund allocates assets to both more cyclical as well as less volatile industries.

- This fund is unlikely to offer significant dividends or income-moving forward for some time.

Torsten Asmus

Finding investments that offer inflation-adjusted returns is hard right now. With inflation rates still well above average and most of the broader indexes at or near all-time highs even after the recent sell-off, finding traditional equity investments that offer inflation-adjusted returns and income is difficult.

The iShares Core Dividend Growth Exchange Traded Fund (NYSEARCA:DGRO) is an ETF that was designed to offer strong total returns and stable dividend payouts.

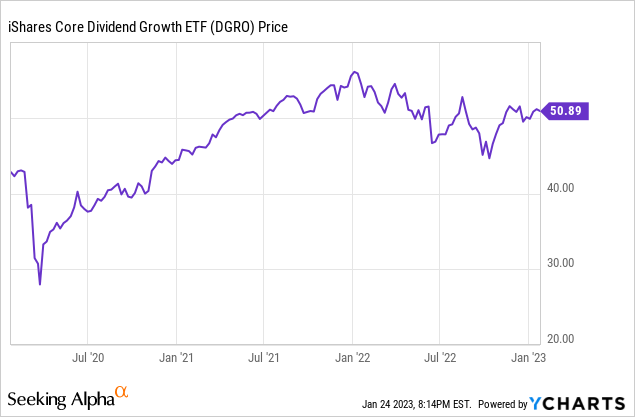

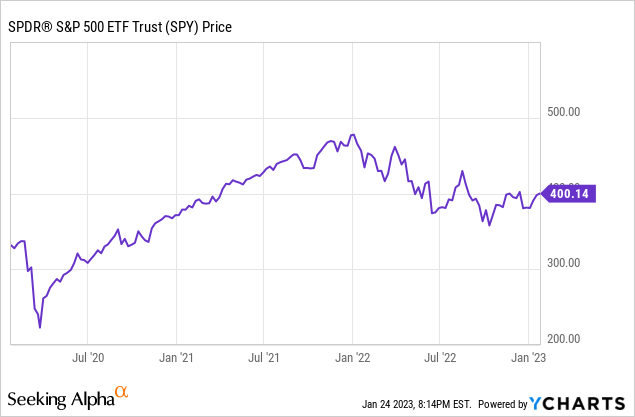

This fund has performed reasonably well over the last 3 years, despite underperforming the S&P 500 during that time period by nearly 7%.

This ETF is up nearly 70% since the lows the fund hit during the pandemic, primarily because of the heavy exposure this ETF has to large-cap technology stocks and the industrial sector.

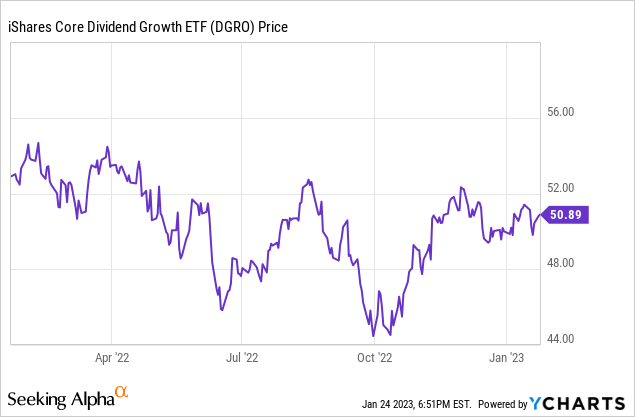

Still, this fund has also gone nowhere over the last year, and the current yield is also just 2.3%.

Two of the four biggest holdings of this fund are Microsoft (MSFT) and Apple (AAPL), and technology stocks make up 16.46% of this fund. This ETF's large-cap technology investments are the primary reason why this fund performed well over the last 3 years.

Still, even though the fund has performed well over the last 3 years, this ETF has still offered minimal income and dividends. The dividend growth rate of 8.97% is below average for an ETF focused on dividends.

The holdings of this fund are 19.35% financials, 18.11% health care, 16.46% technology, 11.21% the industrial sector, 10.19% the consumer defensive sector, 7.72% the energy sector, 6.54% utilities, 6.2% consumer cyclicals, 2.47% basic materials, and 1.74% the communication sector. This ETF has a .08% expense ratio $24.92 billion dollars in assets under management, and a current yield of 2.3%.

The two main problems that this ETF has in the current investing environment are that this fund has minimal holdings in key sectors that tend to do better in an inflationary environment, and the fund also has significant holdings in the underperforming financial sector. The iShares Core Dividend Growth Fund has only 10% of the fund's assets in the energy and basic material sectors combined, and this fund also has just 10% of its assets in the industrial sector.

The energy and basic material sectors have obviously been two of the best-performing sectors in the market since prices began to rise significantly in early 2021, and energy companies have consistently paid out impressive dividend payments as well. Rising energy costs and increasing prices are also hurting a lot of retail companies in the consumer staple industry, and this fund also has 10% of the fund's assets allocated to that sector as well. This ETF is not positioned well to offer inflated adjusted returns or income in the current inflationary environment, therefore.

This fund also has significant financial holdings, even though this sector has consistently and significantly underperformed most of the broader indexes for some time. This ETF is unlikely to offer inflation-adjusted income or dividends since this fund is significantly underweight the energy and basic material sectors, and the fund also has minimal exposure to the industrial sector.

The iShares Core Dividend Growth Exchange Traded Fund has some pros as well, though. The primary appeal of this fund is for growth investors who only want to take moderate risks. The largest holdings of this ETF are in large-cap tech stocks. Most large-cap tech companies can be volatile, and these stocks also rarely pay significant dividends since they usually find it more efficient to reinvest in their businesses. Still, large-cap tech has consistently outperformed the broader indexes over the last 2 decades.

This fund enables growth investors who want to be long industries such as technology to take less risk than usual, since this ETF also has significant holdings in less volatile sectors such as health care and consumer staples. The primary appeal of the iShares Core Dividend Growth Exchange Traded Fund is that this ETF offers a more balanced approach with less risk to growth investors, since the fund balances growth stocks with more conservative investments.

This exchange traded fund has performed well over the last 3 years primarily because this ETF is overweight large-cap tech stocks, but this fund also has only minimal holdings in key sectors that usually perform best in an inflationary environment. The iShares Core Dividend Growth Exchange Traded Fund has very few holdings in the energy and basic material sectors. The current yield is also just 2.3%. This fund has also grown the dividend over the last 3 years at just 8.97%, which is below the average for income and dividend-based exchange traded funds. While this fund is a decent option for growth investors who only want to take moderate risk, dividend and income investors can find better options in the current investing environment.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.