SOCL: Golden Times Ahead For Social Media Companies

Summary

- SOCL tracks the Solactive Social Media Total Return Index, which invests solely in companies involved in the social media business.

- The social media market is expected to grow at a CAGR of 19% annually.

- This ETF’s concentration in relatively few stocks is a double-edged sword for investors. Significant movement in one stock can significantly impact the fund’s performance.

- The ETF’s focus on virtual reality can significantly improve the fund’s returns.

- I rate SOCL a hold, following a 40% rally since November and current broader concerns about the global equity market.

Urupong

I rate Global X Social Media (NASDAQ:SOCL) a hold. I like this ETF, but, overall, market conditions and highly inconsistent investor attitudes toward the social media industry temper my enthusiasm.

Strategy

The Global X Social Media ETF tracks the Solactive Social Media Total Return Index. The ETF invests in the most liquid social media companies worldwide that provide services like social networking, file sharing, and other web-based applications. The fund is not actively managed, and investments are highly concentrated in one industry.

ETF Grades:

Offense/Defense: Offense

Segment: New Growth

Sub-Segment: Social Media

Risk (vs. S&P 500): Average

Source: Modern Income Investor

Technical Ratings*:

Short-Term (next 3 months): C

Long-Term (next 12 months): B

Source: Modern Income Investor

*Our assessment of reward potential vs. risk taken.

(Rating Scale: A = Excellent, B = Good, C = Fair D = Weak, F = Poor).

See the disclosures at the bottom of this report for a detailed description of MII's proprietary technical rating system.

Holding Analysis

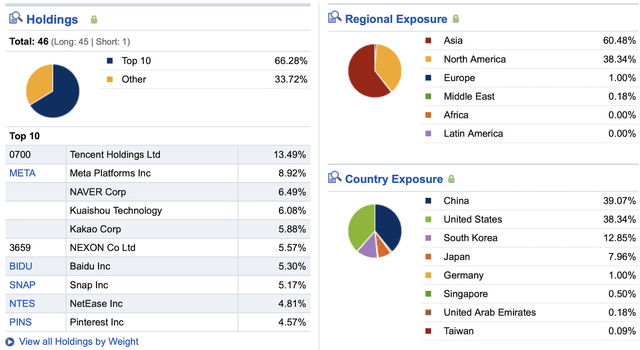

SOCL is a highly-targeted niche ETF investing in social media companies across the globe. The geographical exposure of the fund is highly focused in Asia (61%), followed by North America (38%); it's significantly less exposed in Europe (1%). SOCL's top holding is Tencent Holdings Ltd. (OTCPK:TCEHY) (14%). This is on the high side for any ETF, even focusing on one industry or theme as SOCL does. Although more than half of this ETF is invested across many of the largest companies, a decent mix of mid-cap names (23%) provides some balance.

Strengths

For many people, it is hard to imagine life without social media. For others, it might be viewed as a curse, not a blessing, so to speak. However, with an entire generation growing up with social media (as part of being "digital natives"), the secular trend appears to be decided. As per the 2023 Social Media Global Market Report:

Social media grew from $193 billion in 2022 to $231 billion in 2023, a compound annual growth rate (CAGR) of over 19%. More importantly for forward-looking investors considering SOCL, the social media market is expected to grow to $435 billion in 2027 at a CAGR of 17%.

If the earnings of social media companies even approach such expectations, SOCL has the potential to be a long-term winner. This creates the type of long-term tailwind potential for SOCL that I believe few thematic or industry ETFs have.

Weaknesses

Fund concentration is a double-edged sword. Focusing on a limited number of stocks might simplify the "look through" advantage of an ETF to know what you own vs. a stock ETF with hundreds or thousands of tiny positions. But that higher weighting in a small number of positions can be a game changer (good or bad) for a fund's performance.

For example, shares of Meta Platforms (META) have significantly declined since the company's earnings announcement in Q3 2022. This steep decline in META's stock price hit SOCL particularly hard during 2022 - the ETF was down a whopping 64%.

Opportunities

And therein lies the long-term opportunity with SOCL. While broad market swings due to recession fears, rising borrowing costs, and the impact of those two factors on social media businesses might dominate how the prices of ETFs like SOCL perform in the intermediate term, growing acceptance of social media as an advertising platform is one of the many opportunities that could lead to significantly higher interest in investing in a social media industry-focused ETF.

Compounding the long-term positive potential for SOCL is its role as a gateway for investors into the virtual reality (VR) industry. The VR market is expected to grow from about $7 billion in 2021 to over $50 billion by 2030. That's an annual growth rate of about 25%. While this industry has grown quickly in part due to a lack of regulation, even as it gradually matures, VR appears to be a promising technology that can be world-altering in the same way social media has been.

This ETF has shocked the system, given its 2022 performance and dramatic impact on its assets under management. Just two years ago, SOCL was a $500 million ETF. Its AUM now sits below $140 million. That big drop in assets and dollar trading volume might have taken this ETF off the radar of some more prominent investors, who handle too much money on behalf of clients to be able to take as prominent a position in SOCL as they would like.

But for retail investors investing smaller amounts of money than institutions do, this could be a tremendous long-term opportunity to invest in these types of stocks, with less single-stock risk than owning them outright. This could create a nice "fallen angel" situation for SOCL. But it will take some time for the shock of 2022 to wear off.

Threats

One of the many threats of investing in an ETF focusing on social media includes competition from other social media companies, changes in regulations and user privacy laws, copyright infringement, and cybersecurity risks. Additionally, data breaches, ideological polarization, and the potential for user burnout can negatively impact an investor's return on investment.

But the primary threat to this fund's performance is the standard deviation of 34%. A standard deviation of 34% for SOCL over the past three years is relatively high, which means that the fund's returns have been quite volatile and have deviated significantly from its average returns over the past three years.

Conclusions

ETF Quality Opinion

SOCL is a compelling choice for investors looking to profit from the rapid growth of the social media industry. Such a single-industry ETF should be viewed more as a piece of a portfolio puzzle and not the core of it. As niche ETFs go, this one rates toward the high side, albeit with some obvious risks, as noted above. I am going to track it closely from now on.

ETF Investment Opinion

Considering the positives and negatives noted above, I like this ETF. Overall, market conditions and highly inconsistent investor attitudes toward this recently poor-performing, but shocked, industry temper my enthusiasm. Thus, my current rating is a hold. That said, once some of the "noise" has been washed out and the stock market returns to focusing on long-term growth potential, SOCL is likely an upgrade candidate.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Modern Income Investor's proprietary technical rating system was created by the firm's founder, Rob Isbitts, a chartist for more than 40 years. The ratings emphasize risk management and the belief that while any investment can appreciate in price at any time, each investment carries a different potential for a major loss. The balance of reward and risk is calculated each night for thousands of securities using a formula that analyzes price trend, the strength of that trend, and key price levels. It analyzes data over multiple time frames to produce a short-term rating (looking three months out) and a long-term rating (looking 12 months out).