Texas Instruments: Near-Term Macro Headwinds But Long-Term Benefits Of Leading Analog Market Share

Summary

- Texas Instruments’ Q4 earnings reflect weaker demand in all end markets with the exception of automotive.

- Texas Instruments has a leading market share position in the $80 billion analog semiconductor market providing scale advantage over competitors.

- Texas Instruments is the top chip company for industrial applications and fourth largest supplier to auto companies.

- Texas Instruments will be a beneficiary of the CHIPS Act, but rising capex spend for fab investment will offset the long-term benefits near term.

- This idea was discussed in more depth with members of my private investing community, Semiconductor Deep Dive. Learn More »

glegorly

Texas Instruments (NASDAQ:TXN) (referred to as TI) reported fourth quarter revenue of $4.67B (-3.3% YoY) that beat by $40M. Q4 GAAP EPS of $2.13 beat by $0.15. TI’s revenue decreased 11% QoQ and 3% YoY.

Last quarter’s guidance was for revenue to fall between 1% and 9% YoY in the range of $4.40 billion to $4.80 billion in the fourth quarter and earnings per share to fall between 7% and 19%, between $1.83 and $2.11.

TI's first quarter 2023 outlook is for revenue in the range of $4.17 billion to $4.53 billion vs. consensus of $4.42B and earnings per share between $1.64 and $1.90 vs. consensus of $1.87.

TI’s in Business Sectors

TI noted in its press release for the call that "as expected, results reflect weaker demand in all end markets with the exception of automotive." In Chart 1, I show that Automotive generated 25% of revenues in 2022, up from 21% in 2021.

The Information Network

Chart 1

For Q4, the automotive market was up about 5% QoQ. Automotive semiconductors from TI are used for Infotainment & cluster, Advanced driver assistance systems (“ADAS”), Passive safety, Hybrid, electric & powertrain systems, and Body electronics & lighting.

For Q4, the industrial market was down about 10% QoQ. Industrial semiconductors from TI are used for Factory automation & control, Building automation, Grid infrastructure, Medical, Aerospace & defense, Test & measurement, and Appliances.

TI’s Dominance in Analog

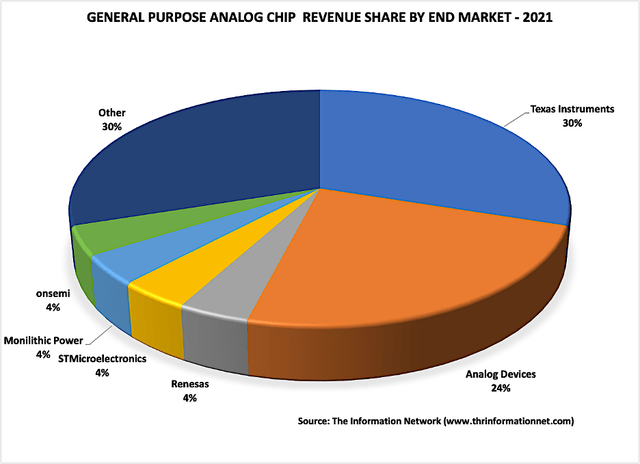

TI is also dominant in the analog semiconductor market with a 30% share as shown in Chart 2. Texas Instruments and Analog Devices (ADI) control over half the General Purpose Analog market, which also gives them high exposure to industrial markets.

The Information Network

Chart 2

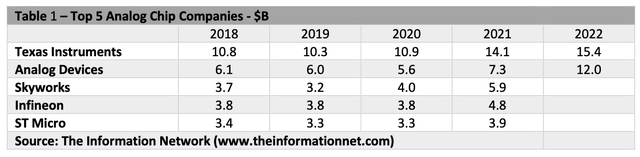

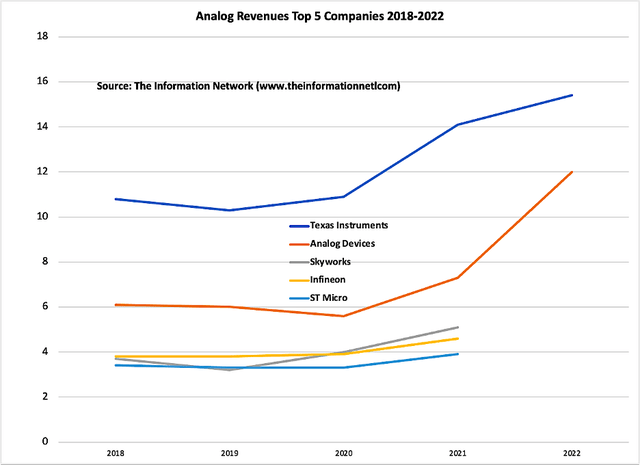

How large is Texas Instruments? Table 1 shows the top 5 Analog Chip companies by revenue for 2018-2022. Texas Instruments generated the largest analog chip revenues at $15.4 billion followed by ADI at $12.0 billion.

Importantly, ADI completed the acquisition of Maxim on August 26, 2021. Revenues for ADI include Maxim from the Acquisition Date. Thus, ADI’s 28% increase in F2022 ending October 29, 2022 reflect Maxim contribution to revenues in 2022.

The Information Network

Chart 3 illustrates the revenue increase for each of the companies. ADI finalized the acquisition of analog company Maxim Integrated Products in mid-2021, increasing its share of the analog market. ADI also acquired Linear Technology in 2017. Data for ADI includes the revenues from the Maxim acquisition for the whole fiscal year in 2022.

The Information Network

Chart 3

Investor Takeaway

Texas Instruments manufactures its analog chips in-house and has a strong U.S. manufacturing footprint, unlike most of its fellow U.S. semiconductor companies, allowing it to benefit from the CHIPS Act, which aims to boost semiconductor manufacturing in the U.S. Table 2 shows that TI will be one of a handful of chip manufacturers taking advantage of free money. I discussed this opportunity in a January 18, 2023 Seeking Alpha article entitled “KLA Corp.: My Top Equipment Company With Strong Tailwinds From National Chip Incentive Programs.”

The Information Network

The CHIPS Act represents a strong tailwind for TI. Rafael Lizardi – Chief Financial Officer noted in the earnings call:

“Next, to summarize the benefits of the CHIPS Act, we accrued about $350 million on our balance sheet under long-term assets in fourth quarter, in addition to the $50 million accrued in third quarter. These accruals are due to the 25% investment tax credit for investments in our U.S. factories. This will eventually flow through our income statement as lower depreciation, and we will receive the associated cash benefit in the future.”

Chart 4 shows TI’s capex spend between 2013 and 2023 showing that near term, the CHIPS Act long-term benefits will be limited because of the increased capex needed for new fab construction and equipment. I estimate capex spend will increase 40% in 2023 to $3.6 billion.

YCharts

Chart 4

One headwind the company faces is tied to the current macroeconomic environment, and in the first quarter, TI expects a weaker than seasonal decline, with the exception of automotive, as customers continue to reduce inventory levels. With customer inventories high, TI’s inventory was up $353 million from the prior quarter to $2.8 billion, and days were 157, up 24 days sequentially.

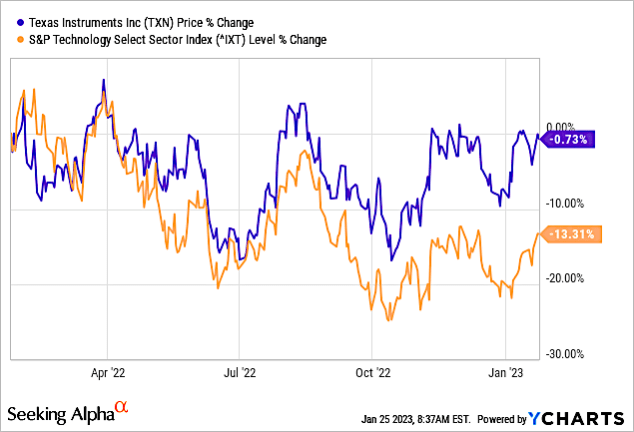

Despite the macro headwinds, TXN has clearly outpaced the S&P Technology Select Sector Index, as shown in Chart 5.

YCharts

Chart 5

The entire semiconductor industry has been in a down cycle on macro and geopolitical uncertainty. Thus, it's not surprising that TI provided weaker guidance. The company expects first quarter revenue to be between $4.17B and $4.53B, compared to the consensus estimate of $4.42B. Earnings are forecast to be between $1.64 and $1.90, with the midpoint below the $1.87 analysts expect.

The 3.3% YoY decrease in revenues is minimal compared to peers like Micron (MU), as its revenues during the last quarter period plunged to $4.09 billion from $7.69 billion a year ago. Indeed, TI's major Analog chip competitor ADI grew 28% YoY in F2022, but some of that revenue came from the acquisition of Maxim Integrated Products the year earlier.

With these near-term headwinds discussed in this article, I rate the company a Hold, in concert with Seeking Alpha's Quant rating of a Hold.

This free article presents my analysis of this semiconductor sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here and start a risk free 2 week trial now.

This article was written by

Dr. Robert N. Castellano, is president of The Information Network www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I've had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book "Technology Trends in VLSI Manufacturing" (Gordon and Breach), "Solar Panel Processing" (Old City Publishing), "Alternative Energy Technology" (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.