Shimano - Bike Component Monopoly At An Attractive Price

Summary

- Shimano is the world's largest bike component manufacturer, with ~50% market share for all parts and ~70% for the high-end range.

- The business has endured the test of time (+100years) and competition, and the stock has returned 6x over the past ten years.

- Value creation has been exemplary, with revenue and free cash flow per share growing consistently in the past 15 years.

- Reinvestment opportunity in the rapidly growing e-bike market provides strong upside potential.

- Importantly, the current price provides a wide margin of safety even in the worst-case scenario.

Lilkin/iStock via Getty Images

Intro to Shimano

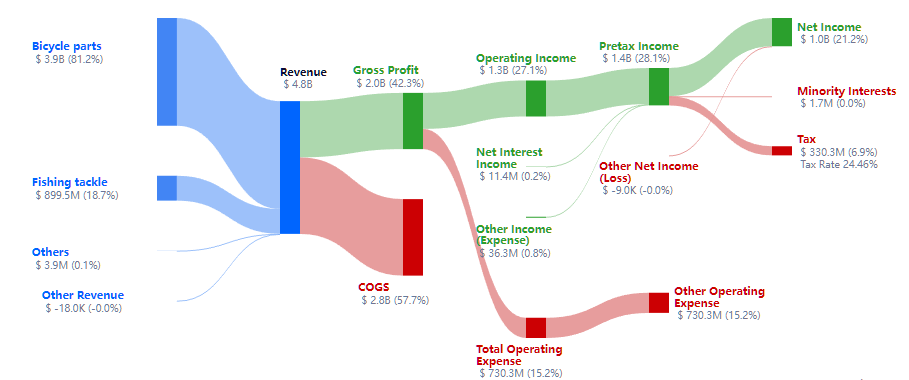

Shimano (7309.T, OTCPK:SMNNY, OTCPK:SHMDF) is the world's largest bike component and second-largest fishing tackle manufacturer, with ~50 percent market share for all parts (~70 percent market share in mid-high-end components). It was founded in 1921 by Shozaburo Shimano in Sakai, Osaka. The company's first product was the single freewheel, and through a century of incremental improvements, it has become the foundational mechanic and the most technical component of bikes today. Impressively, it's still run as a family business at ~$5B in sales and ~$15B market cap (~$12B enterprise value). The grandson, Yozo Shimano is the current CEO, Taizo Shimano is the President (the 5th), and two other Shimano family members as executive directors. The company was listed on the Osaka Securities Exchange in 1972 and has returned 10x since 2000.

The investment case in Shimano is two-fold. It is a proven productive and anti-fragile business that will likely endure the test of new competition in the e-bike segment and current macroeconomic turbulence. This is a high-quality business and rarely trades cheaply. However, after falling 40% from its peak in September 2021 to Y21,000/share on the JPX Tokyo Stock Exchange (or ~$16/ADR share in the OTC market, ticker: SMNNY, 10 ADR shares equal one share), I believe the base case valuation at $23/ADR share presents an attractive BUY rating with a 35% margin of safety. It's also ~20% below the worst-case scenarios where we assume a decline similar to the 2008 financial crisis. Shimano scores very high under my sleep well investment checklist, with 15.5 points out of the possible 20. I am happy to accumulate shares at the current price, targeting a 3% position.

*This is a shorter version of the analysis. For the full writeup, please read in Sleep Well Investments

A sleep-well investment

In Shimano, you would own a business that produces the building block of an essential transport mode, bike components (~80% of revenue). You would also be investing in an inspiring corporate mission to bring people closer to nature and live a happy and healthy life. Shimano has been producing bike components for over a century and fishing tackle for 50 years. It's hard to imagine these products will disappear anytime soon. People will still want to get from A to B, enjoy life in nature, and, importantly, in an eco-friendly way, which also aligns with the global fight against climate change.

Gurufocus

Shimano's business model is also proven and time-tested over many economic crises and industry cycles. One of the underlying reasons is that the bike value chain is very stable and unlikely to be disrupted in the foreseeable future. You have aluminum, plastic, steel, and titanium suppliers at the upstream part of the chain. Then you have the component manufacturers like Shimano, SRAM, Campagnolo, and others. At the end of the value chain, bike brands assemble, sell and service after the sale. Shimano sits most comfortably as component manufacturing is the least competitive area. The main reason is that the barrier to entry is very high, being the most complex and innovation-intensive part of the value chain; consequently, the high-margin business is well protected. On top of that, Shimano has the most differentiated offerings aiding the longevity of the business model. Shimano is superior to its peers in four aspects:

i) the most technologically advanced manufacturing capability that produces lighter, stronger, longer-lasting parts. ~80% of teams in the Tour de France and ~70% in the Giro d'Italia cycling race used Shimano-equipped bikes.

ii) the most comprehensive product range, including bike gears, brakes, wheels, and accessories. This allows them to offer a complete solution for customers (bike assemblers/resellers) and cater to both

(iii) road bikers and mountain bikers at different levels. For road bikers, Shimano has a full range of products from professional racing (Dura-Ace Di2) to enthusiasts (105), recreation (Tiagra, Sora), and entry-level (Claris). For mountain bikers, they also have a full range from professional racing (XTR Di2, Saint) to enthusiasts (SLX, Zee) and entry-level (Alivio Acera, Altus, Tourney).

iv) global manufacturing and distribution network. Japan, the US, and Czech Republic facilities manufacture higher-end products, Southeast Asia (Singapore, Malaysia, Indonesia, and the Philippines) manufactures the mid-range, and China (Lianyungang, Kunshan, Tianjin) manufactures the entry-level range. The global footprint enables the company to be close to customers while reaching a large customer base.

In comparison, rivals such as SRAM (USA), Campagnolo (ITALY), and other companies have different strengths in different markets. For example, Campagnolo, an Italian company, was a market leader in road bike racing in the 1970s and carried a strong reputation for the high-end road bike products used by professional cyclists. SRAM, the younger and more innovative peer, is known for its lightweight and high-performance mountain bike products. Out of the two, SRAM is a more formidable competitor and is the one to look out for. It has good coverage of products for mountain bikes at all levels and mid-high-end products (Red eTap) for road bikes.

*For a more detailed analysis of the competition, please visit the full writeup here

Financials like compounders

Shimano's stock performed like a true compounder; it returned six times in the past ten years. The underlying driver is its powerful economic model forged by a wide range of differentiated products, as seen above, the largest advanced production network and global reach, and a 100-year reputation of high performance and reliability.

It overthrew Campagnolo just after a decade of launching into the pro-race category in the 1970s when Campagnolo was the market leader. With SRAM coming to the scene about 30 years ago, Shimano's market leadership is still strong, with ~70% market share in the high-end market and ~50% in all categories. Over the decades, it translated directly to higher revenue, higher profitability, greater capital velocity, and more substantial returns on invested capital.

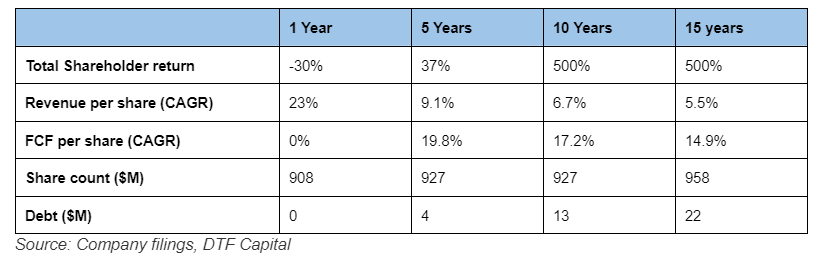

DTF's Sleep Well Investments

In the last 15 years, revenue per share compounded by 5.5% and free cash flow (FCF) by 14.9% while maintaining a debt-free balance sheet and shrinking outstanding shares (0.4 %/year). The compounding effect has accelerated in the past 10 and 5 years, respectively, as Shimano maintains market share and enjoys higher overall market growth. Additionally, Shimano requires little capital to maintain and grow for a manufacturer, with CAPEX to sales averaging 5% in the past 15 years.

Breaking down Shimano's capital allocation policy and we see a very disciplined and conservative business. We also see a company maintaining a balanced structure between growth and profitability. The capital allocation section tells us why.

Capital allocation and value creation

Shimano's operating cash flow (OCF) goes into

30% in CAPEX,

10% in intangible investments,

15% in paying dividends (currently, 1.2% yield),

4% in opportunistic buybacks (2008-2012, 2021 totaling $350M or 0.4% of shares a year).

~40% remaining as free cash, which helps build the $3B cash position as of Q32022, rising from $500M in 2008.

Shimano invests roughly ~40% of OCF on maintenance and growth, ~20% on shareholder returns, and puts aside ~40% for rainy days.

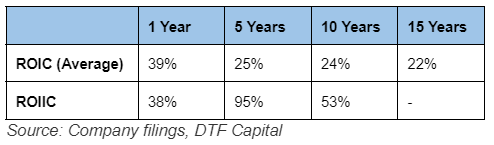

Shimano's return on invested capital (ROIC) has averaged 22% in the past 15 years (!), creating value over a very long period. Return on incremental invested capital (ROIIC) has been equally impressive at 95% and 53% for the 5-year and 10-year periods, respectively. These numbers are exceptional and indicate a very efficient and shrewd management team.

Sleep Well Investments

The high ROIIC also indicates that Shimano will likely create more value as it puts more capital to work. But where? Plenty (!) as it is emerging.

Reinvestment opportunity

+First, Shimano's core market is far from saturated. In developed nations, bike ownership still has room to grow. In the UK, 37% of the population owns a bike. Similarly, bike penetration in the US and France stands at 47% and 49%, respectively. As bike ownership is correlated with GDP per capita, emerging nations have lower ownership at ~20%. The only saturated market is the Netherlands, where 87% of the nation owns a bike. Perhaps, this is the level many countries can strive for as over 50% of our travels from home are short trips (< 2 miles from home).

+Second, a lot is going on with smart bikes. Traditional bikes can be retrofitted with onboard-diagnostic sensors, cycling GPS, and the new Shimano's Alfine internal gearbox.

+Then, the most significant emerging trend is the resurgent of the e-Bike. This market is estimated to reach $80B in 2027 from $50B in 2022, growing at a CAGR of 10%. The European Cyclists' Federation estimates that European will be buying 10M bikes each year by 2030. This is also Shimano's biggest market, with ~40% of sales.

Similarly, in the US, the European Bicycle Manufacturers Association estimates a 20% growth per year for the next five years. This region saw a 73% CAGR since 2014 (!). Globally, e-bikes are expected to take up 10% of the overall bike market. The opportunity is big, but the competition is fierce (more on this later) and likely cannibalizes sales from the traditional bike market.

+Lastly, Shimano is entering other sporting categories, such as rowing, following the success in the fishing tackles, which is now 20% of Shimano's total sales.

Overall, the bike market still has plenty of growth spots as it remains the most eco-friendly mode of transportation, supported by increased political attention to sustainable and active mobility, driving a higher than the global GPD growth rate of 8.2% until 2030. Meanwhile, the fishing market is also expected to grow steadily at 4% per annum for the next decade.

I don't expect Shimano to initially capture most of the growth opportunities, as competition is fierce when a new market emerges. However, I believe Shimano will be among the top e-bike component producers in the long run as its manufacturing capability and traditional bike reputation spill over.

The management team

is an owner-operator and has an exceptional record of creating value. The CEO, Yozo Shimano, has over 50 years of experience at the company. The President, Taizo Shimano, has over 30 years of experience at the company. Two other family members of the late founder Shozaburo Shimano are executive directors. Combined with other insiders, they have an 11.3% interest in the company (over $1B worth of shares). Judging from the corporate message, mission, and financial record, I believe they have proven to be good stewards of the business-

(+) by maintaining the long-term mission of focusing on customer happiness and delivering high-quality products, carrying on the legacy of the founder,

(+) by allocating capital efficiently that yielded consistent topline, bottom line growth per share, and high ROIC over WACC with ample cash for rainy days.

(+) by being transparent in disclosures. They break down the invested capital each year. Their remuneration is aligned with the shareholder's interests. The composition is approximately 60:40 of fixed remuneration to performance-linked remuneration.

Anti-fragile

Shimano has been a resilient business over difficult periods. Over the last 20 years, it survived the 2001 and 2008 financial crises and the 2016 European recession. All periods presented the industry with excessive inventory build-up problems and a subsequent decline in bike sales and profit margins. However, Shimano remained profitable and cash flow positive throughout. I have little doubt that Shimano will struggle in the current slowdown. It might even benefit as smaller competitors suffer. The $3B war chest also ensures it can weather future shocks and buy back shares opportunistically. The big question is can Shimano thrive under emerging competition in the e-bike market?

Competition

Traditional bike component market

As introduced in the investment case section, SRAM is the biggest threat in the mountain bike category, and Campagnolo (or Campy) is the biggest in the road bike category. We can also segment the bike market into four major components: drivetrain components, brakes, wheels, gears, and accessories. The full breakdown of the market share is provided in the full writeup - here

Fishing tackle market

Finding a specific market share breakdown for the fishing tackle market is difficult. The market is more fragmented and has more players. Still, Shimano is considered one of the leaders with ~20% market share in a wide range of products, including reels, rods, and lures. Some other global players include:

Abu Garcia

Rapala - who is mainly known for its lures.

Daiwa

Okuma

Eagle Claw

TICA

AFTCO

Weihai Guangwei

Decathlon

Daiwa

Pure Fishing

Other notable companies in the fishing tackle market include Bass Pro Shops, Ugly Stik, St. Croix, and many other companies that produce various fishing tackle products.

E-bike component market

The global e-bike components market is expected to be worth ~$86B by 2027, growing at a CAGR of 7-10%, depending on the region. As such, it attracts a lot more players. Some of the leading ones include:

Bosch eBike Systems is the largest, with a market share of around 25%. They produce many e-bike components, including motors, batteries, and displays.

Shimano is the second largest, with around 20% market share.

Yamaha is the third largest, with around 15% market share.

Panasonic is in fourth place with around 10% of the market share.

Brose is fifth with around 5% of the market share.

Other companies include Continental, Mahle, Trelock, ZF Friedrichshafen, and others. Some bike brands have their own, for example, Specialized.

It's difficult to predict if Shimano will overthrow Bosch in the e-bike market. However, with the most profound experience, brand reputation, and connection with the bike brands and key suppliers, they should at least maintain as one of the key competitors. I will watch the market share movement as success in this market can provide a significant multiple expansion and considerable upside for the investment.

Moats

Shimano possesses a formidable business model, reputation, and heritage in the bike market. So, I believe it has durable competitive advantages over peers in

+Branding - spanning over 100 years, supported by constant innovation, high reliability, and endorsed by the best professional racers.

+Scale and cost advantage - it has the largest production and distribution scale, making it difficult for peers to compete on cost and new entrants to enter the market. Shimano's cost competitiveness has also increased due to the recent expansion of in-house production, efficiency gains, and automation at the company's headquarters in Sakai (Osaka Prefecture), built in 2014.

+Switching cost - is high for customers as once the bike assemblers design the bike frames to fit with Shimano parts, they would not want to switch to other parts readily. As the manufacturer of the broadest range of components, Shimano's solution is desirable for ease and compatibility of installation. Compared to SRAM, for example, it may pose a challenge for assemblers to fit different SRAM components together as it has a history of acquiring other companies that specialize in different parts.

Risks

(-) The covid-infused boom in bicycles could mean that everyone who wants a bike in the next few years has already got a bike. This creates an excessive inventory backlog which can last for longer than anticipated. But as history suggested, this would be a temporary headwind.

(-) Supply chain disruption in China (Lianyungang, Kunshan, Tianjin), impacting the lower-end components.

(-) Forex risk - Shimano manufactures over 40% of its bicycle parts in Japan and less than 60% overseas; sales of Japan-made parts to domestic and exports to overseas customers are denominated in Yen. As a result, roughly 60% of its sales in foreign currency, mainly US dollars, will see fluctuations.

(-) Counterfeiting of products. A minor risk, but it costs to control the spread.

(-) The e-bike market cannibalizes existing bike sales or fails to take off as expected.

(-) Lack of share buybacks - can limit value creation to shareholders when the share price is low and when reinvestment opportunities are poor.

Valuation

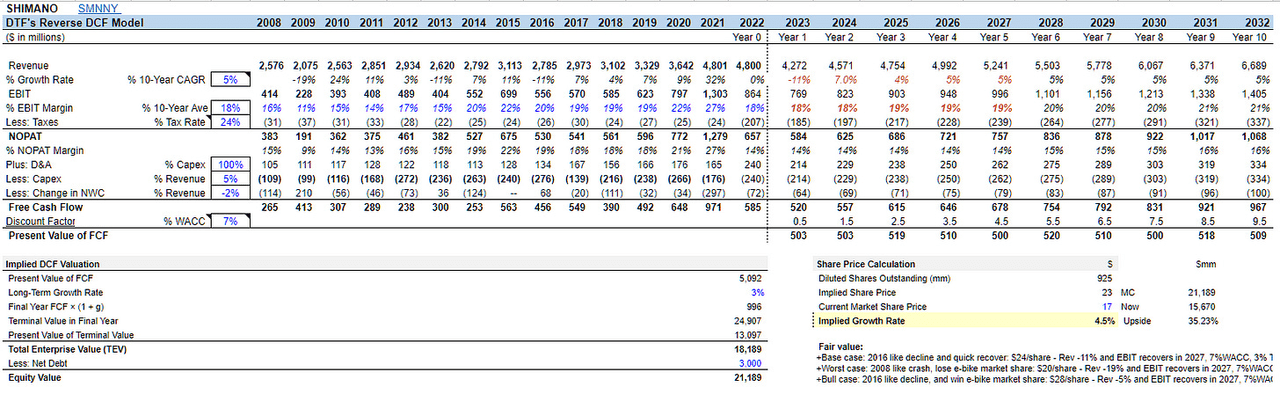

Shimano appears undervalued using the DCF method and on multiple valuation bases.

My DCF model indicates a fair value of $23/ADR share as a base case, $20/share in a bear case, and $28/share in a bull case. Below are the results and assumptions

+Base case - $23/share: A moderate decline like the slowdown in 2016, where revenue falls 11% in 2023 and grows by 5% from 2028-32, EBIT improves gradually from 18%, the average of the last 15 years to 21% in 2032, 7% WACC, 3% Terminal Growth.

+Worst case - $20/share: In a crash like 2008, Shimano loses the e-bike battle and suffers a loss in market share. Revenue falls by 19% in 2023 and grows by 4% between 2028-2023. EBIT recovers to pre-covid level in 2027, 7%WACC, 3% Terminal Growth.

+Bull case - $28/share: A moderate decline like the slowdown in 2016 and wins e-bike market share. Revenue falls by 11% in 2023 and grows by 8% between 2028-2032. EBIT recovers to pre-covid level in 2027, 7%WACC, 3% Terminal Growth.

An increase of 1% in WACC removes value by ~$3/share. WACC is at 7% because Shimano is a Japanese company operating in a lower interest rate environment and has no debts.

Sleep Well Investments

Source: DTF Capital's DCF model

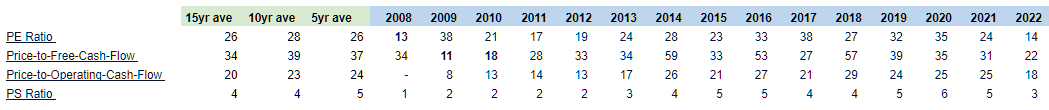

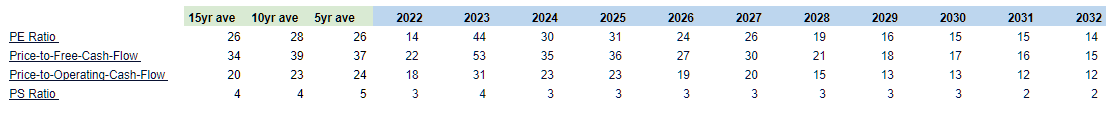

The 15, 10, and 5-year average multiples are much higher than today's. However, as I assume a decline in the topline and margin in FY2023, valuation only makes sense if one owns the stock for at least five years. By that time, the 'E' would be ~$800M, and with a multiple of 26x, the company is valued at $21B, or 38% upside from today's value of ~$15B.

Sleep Well Investments

Sleep Well Investments

Source: DTF Capital's workings

The odd is on the investors' side at the current price of ~$16/share. Assumptions are conservative, and buyback could be on the card.

The company has ~$3B of excess cash, which can provide further upside if it can buy back shares. This is in the company's control, and it seems like a reasonable use of cash as they face an aging population, a shrinking domestic market, and a strong currency. At the same time, there are limited domestic investment opportunities.

Share buybacks have been a trend among Japanese companies in recent years. In 2019, they spent a record JPY 3.4 trillion ($31 billion) on buybacks, up from JPY 2.6 trillion ($24 billion) in 2018 and JPY 1.7 trillion ($15 billion) in 2017. The trend continued in 2020, despite the pandemic of COVID-19 and the economic downturn.

I have set the EBIT margin to be lower than the historical numbers. In good years, it has been between 20-22%. I have also set the topline lower than the market growth rate to reflect that substitutes might be invented and competition intensifies. Nevertheless, I am optimistic as Shimano has survived over 100 years. The odd is on investors' side that it will survive another 100 years.

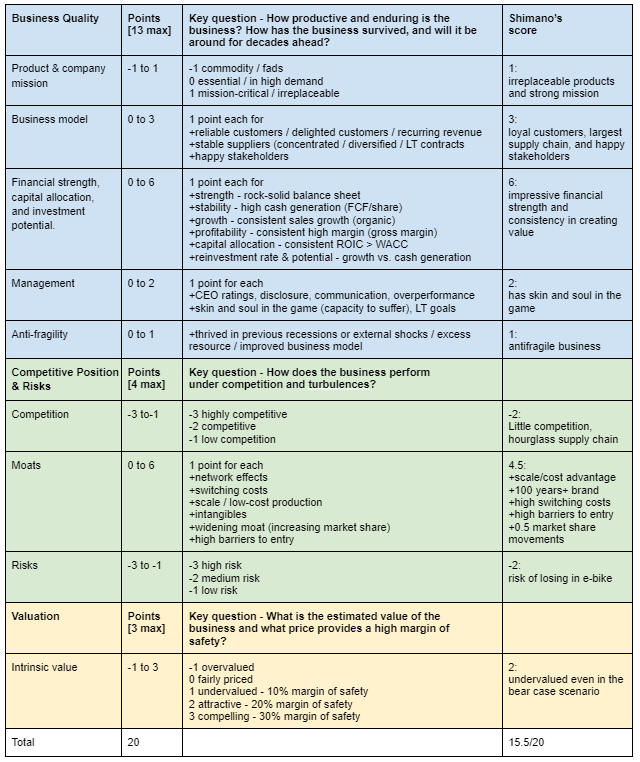

Sleep well scores

Let's see how Shimano fares under my Sleep Well Investment stress test.

This final step aims to filter out only businesses that can perform over multiple economic cycles and keep winning market share. Inspired by Nassim Taleb's anti-fragile concept and studies from various reputable investors, it divides investment criteria into three groups in order of importance:

Business quality [13 points]

Competitive position and risks [4 points]

Valuation [3 points]

Points are deducted for an unconvincing corporate mission, commoditized products, intense competition, and business risks.

The following table shows how I assess these categories and the corresponding Shimano score.

Sleep Well Investments

No business gets full points, but from 13 points, I rate a business as robust and investable. A score above 15 means the business is anti-fragile, thus, time-tested. A score above 16 points means the business is both anti-fragile and durable, which likely keeps it winning against competition and future external shocks. Below is how much capital I am comfortable allocating to my portfolio accordingly.

13 = robust business - 1% of the portfolio at cost-basis

15 = antifragile business - 3%

16+ = sleep well business - 5%

Additionally, scoring high doesn't automatically mean an investment. A quality asset that everyone knows about would often mean a high price. Thus, each stock would need to have a price below the bear case scenario and provide a necessary margin of safety (depending on the type of the business and range of outcomes) - to constitute a good investment. Each to its own, and all method has trade-offs. No investment or checklist is perfect.

Shimano scores 15.5/20. This is one of the highest-quality businesses in my stock universe. It's also available at an attractive price (currently). There are some uncertainties in the ability to win in the e-bike market, so it doesn't get a full point in the 'widening moat' criteria but scores full points in the rest of the categories.

At the current price of ~$16/ADR shares, it offers a 20% margin of safety below the worst-case scenario, at which point we are happy to accumulate shares to a 3% position.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SMNNY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.