Invesco DB Agriculture ETF: Expect 28% Upside In 2023

Summary

- Agricultural shortage continues even into 2023. One of the best ways to trade a food shortage is with Invesco DB Agriculture ETF or DBA.

- DBA doesn't produce returns over long-term time horizons and is mainly a trading vehicle. However, we anticipate that supply shortage doesn't play out evenly in agricultural sector stocks.

- Upside isn't fully priced-in and expect pricing to reach $25 per share or +28% upside from current levels.

- We also expect the shortage to hit grocers and that consumer mayhem could cause hype in the shortage trade causing pricing to go higher across all agricultural products.

- We recommend DBA as we like the underlying fundamentals and view it as an alternative hedge to volatility given poor performance of bonds this past year.

Empty shelves of vegetables in a supermarket Julia Gomina/iStock via Getty Images

We anticipate the onset of another food shortage in 2023, and this time it’s going to be worse than the one we experienced in 2022, and could be even worse than initial pandemic shortages from March of 2020. Yes, we think the grocery aisles might actually empty out in certain parts of the country due to a wide range of factors that are beyond the ordinary control of the United States Government. We also think added food price inflation will factor into the core-CPI reading, and will cause even more inflationary risk then oil prices did last year.

It’s why we’re discussing the Invesco DB Agriculture ETF (NYSEARCA:DBA) in this article, as we like the basket-weighting of agricultural commodities and the fact that it’s widely anticipated we’re due for a major shortage in the United States. In some commodities the shortages tend to be more severe due to certain weather factors and anomalous events that make it compelling on a shorter time horizon to buy agricultural futures, especially when considering allocations away from fixed income if in the event we're in for a continued rate hiking environment.

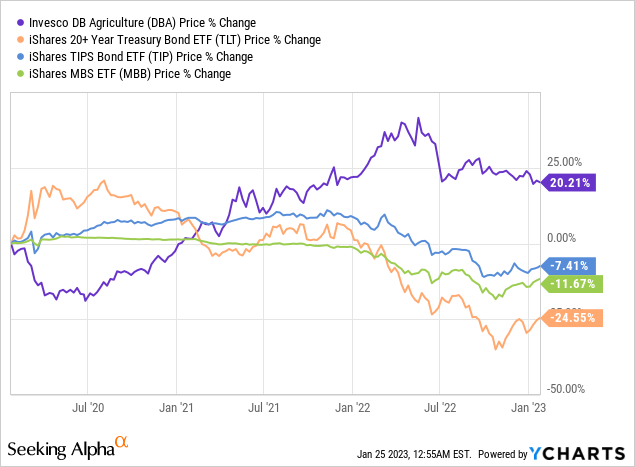

Figure 1. Agricultural commodities beat fixed income for three years in a row

We think most smart investors at the beginning of 2022 got into commodities as a means of getting out of negatively yielding bonds. We think that theme continues, but it's going to be based on where the sentiment and returns likely favor some baskets like agriculture versus energy, gold, platinum, aluminum, ore, timber, cryptocurrencies.

We think conventional commodities that are in shortage should be bought directly on the benefits it has to producers, whereas grocers and retailers have to be measured on a bottoms up fundamental basis with a number of factors tying into whether or not a stock price can go up based on business fundamentals versus strict supply/demand imbalance in agricultural commodities leading to price falls/increase. It's why when we review data of further weakness in cocoa harvesting or coffee beans the data benefits the price of the commodity but it's harmful to companies further upstream.

For example, we might not like the Starbucks (SBUX) gross margin line, as they depend on cocoa beans and coffee beans for both its chocolate and caffeinated beverages. If those costs go up by +50% how much can a national coffee chain hope to recapture with price increases up-front from their customers? Perhaps some gross margin compression is inevitable in that scenario. If cocoa beans, the cost for chocolate goes up, how does that affect companies like Hershey (HSY) who primarily market chocolate as a product?

The same could be said for the anticipated increase in cattle prices if that too becomes short in supply would that hurt McDonald's (MCD) margins, or what about the absence of chicken as a protein substitute because of the ravaging avian flu? Doesn't this hurt the fundamentals of some of the chicken chains like KFC, which is owned by Yum Brands (YUM) and also to some extent Chipotle Mexican Grill (CMG)?

Thesis to investing into Invesco DB Agriculture ETF

We anticipate that agricultural shortages will continue from 2022 into 2023 and that the underlying thesis of buying some commodities baskets as a means of hedging inflation risk still applies here. We're not certain if the economy is going to enter into a recession just because inflation rate and interest rates are trending higher. Most people with backgrounds in finance either have no experience dealing in a hyper-inflationary environment or have very few memories from a time when interest rates have traded at such levels.

Bullish Scenario

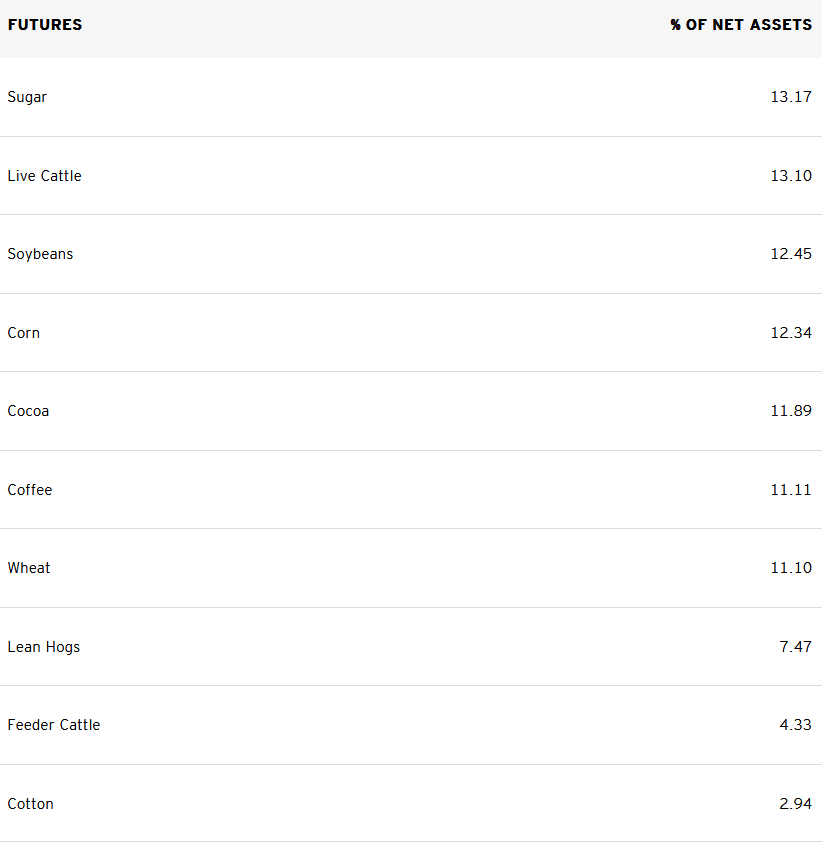

If immense agricultural shortages continue and crops continue to fail there's a path to $30 for DBA or +50% upside, especially if it’s a squeeze like we’ve witnessed in certain commodities throughout the past five-years. (For those who recall), we’ve gone through oil shortages, timber/wood shortages, chip shortages, cargo container shortages, heck even toilet paper going missing in the aisles and the price of used cars went up in the United States rather than actually depreciating. The reality is, we’re due for a massive shortage of agricultural products this year and we think it's worse than the trends outlined in 2022. Assuming there's a major agricultural commodity squeeze, the price would be reflected in the short-term futures markets across agricultural commodities composed of the underlying ETF, i.e. sugar, cocoa, cattle, hogs, wheat, corn, soybeans. A sudden price spiral across proteins cattle/pork would affect DBA as cattle/pork is weighted 24.9% of the portfolio. Failure of Amazonian crops and Ivory Coast (Cape of Africa) crops favors the composition of the ETF given the exposure to coffee and cocoa or weighted 23% of the ETF. Finally, corn and soybean in the United States, Ukraine, Brazil impacts 34.65% of the weighting. Basically, 82.55% of the portfolio is weighted towards categories affected by shortages or lost acreage and assuming those shortages get sensationalized into a food shortage crisis in the United States the price of agricultural commodities in this basket could rally by +50%.

Neutral Scenario

DBA reaches $25, appreciating +28% from current levels beating the projected return of the S&P 500 to the delight of cattle ranchers across the United States of America. Three year uptrend continues into its fourth year as agricultural commodities continue to rally, but not to the extent that a major global food crisis starts to impact every neighborhood grocery store with way less news sensationalism. In this case scenario, we see the continued up-trend playing out in a similar trend-line, but a bit more aggressively in the 2023 year versus 2022 given the shortage of agricultural components like fertilizers and inflation still trending higher reflecting higher input costs such as wage growth and interest rates impacting costs. We anticipate that in this more neutral scenario the remaining 18% of the basket mostly cotton performs better than the -20% drop in Texas cotton projected by third-party sources. Keep in mind, cotton demand is set to go up, because domestic textile manufacturing in the United States has picked-up in response to Chinese trade protectionism measures and because more garment makers have managed to open up in response to favorable manufacturing tax breaks in the United States. Basically, the entire portfolio of commodities could go up on any number of agricultural shortage factors some having more devastating consequences on hunger than others. We look to invest into this category depending on Federal Reserve interest rate policy and the likelihood of further curve steepening rather than inversion trade in the interest rate markets. Because the interest rate curve is inverting, we're seeing the long-end of the curve trade at lower rates, which is why long-dated treasuries started to gain whereas commodities started to give back some gains towards the latter half of 2022.

Bearish Scenario

DBA drops -22% and trades at $15 at the low point of its upcoming 52-week trade range. This could occur, because of a counter-inflationary trade where the Fed suddenly signals an interest rate drop causing money to flow out of commodities as the interest rate sensitive bears flock back into the safe money swan trade. The bias becomes lower interest rates if CPI indicators flash negative, and so the fixed income markets will provide a guaranteed interest rate and appreciation. In this case scenario, commodities could still exhibit shortages, but what propped up the entire commodity market were fixed income investors. Furthermore, we could see some positives in the way of unexpected rains in the southwest region helping the mega drought scenario marginally though farming restrictions already went into effect in the southwest region and any increases in water will go towards replenishing existing water reservoirs along the Colorado river.

The factors causing shortages in agricultural commodities in 2023:

1) Avian flu has knocked out a significant amount of chicken stock, it’s way worse than the episode out of Billions and it’s expected that the next wave of Avian flu will wipe out more chicken stock this upcoming year putting demand pressure on substitute proteins like cattle and pork. Loss of 58 million birds according to Fortune in just the United States. It’s why prices on eggs and chicken are higher than usual.

2) There was a -50% drop in the supply of corn crops and vegetable oils in 2022 from Ukraine. It’s also forecasted that there will be an additional -45% drop in grain crop acreage in 2023, which implies another output drop, or approximately a -75% reduction in total production from 2021 levels causing a major global output gap.

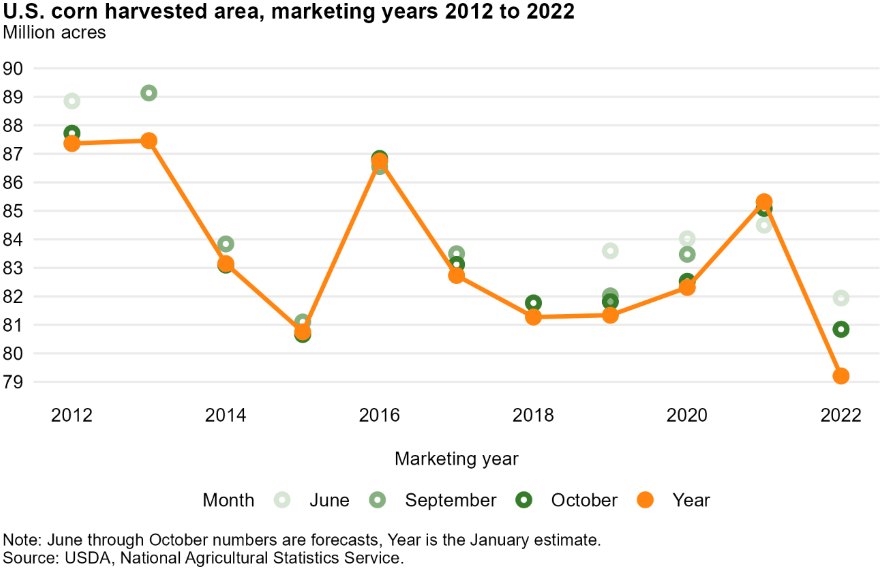

3) United States corn crop production has actually shrunk over the prior-year, we think it will take a while before corn farmers can actually catch-up with demand given the shortages in global markets. USDA estimates a 2% month on month shrinkage in United States corn acreage as of the most recent report.

4) The Colorado river is drying up, and drought conditions in California are affecting the amount of agriculture output in California’s Central Valley. In Southern California (In-land empire, Palm Springs, Indio) next to the Salton Sea, and along the Colorado River, which splits water between five different states (California, Nevada, Arizona, New Mexico, Colorado) farming area has shrunk due to the megadrought hitting the region. Unfortunately, the water levels at Lake Mead have reached levels where farming communities further up the Colorado River have indefinitely suspended farming as a means of providing just enough water to the lower basin states causing sharp reductions in farming output along the Colorado river, which is a huge source of agricultural products in the United States.

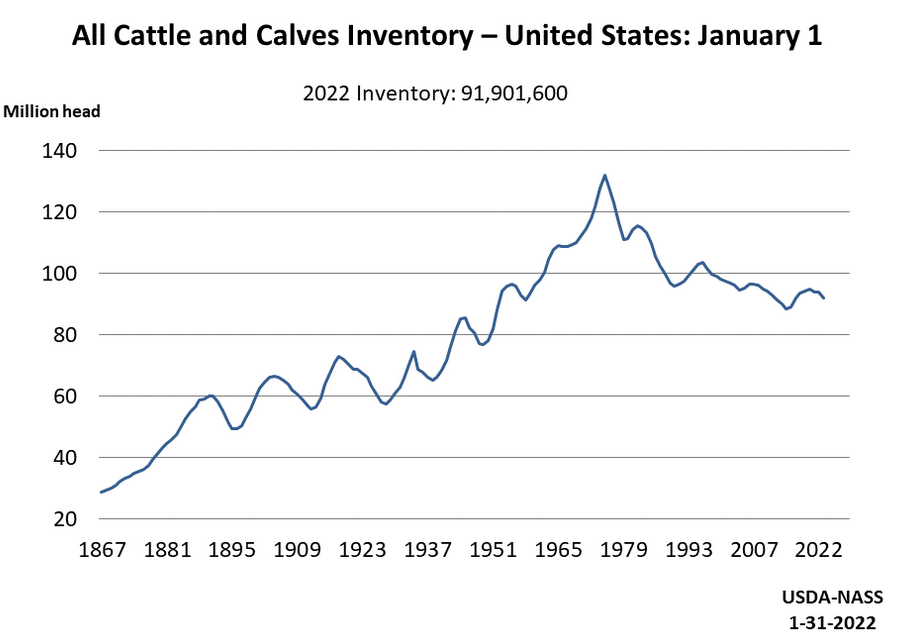

5) Beef or cattle stock is unusually low, and unlikely to build-up available stock for sale given the recent wipe-out of cattle stock from the Pandemic causing less demand to be available over the next couple years. The cattle stock is at 1950s-1960s levels implying less available supply at the grocery market by really long historical measures.

6) Florida citrus crops were affected by hurricanes this past season, and on-going assessment of the damages to various citrus crops suggests less productivity in the orange market causing more shortages among produce categories putting more pressure on derivative corn products instead, which there is likely to be a shortage of. A recent news report from FoxWeather states that this is the smallest orange crop in 76 years.

7) Rice and wheat production are negatively affected by California’s Central Valley production drop this year, and various regional markets that export vast sums of rice and wheat products are also forecasting a drop in output this upcoming year including Brazil. January data from Argentina is negative as well, meaning the Amazon river is going to disappoint in agricultural production to start the year.

Global food pricing is linked and can send prices lower

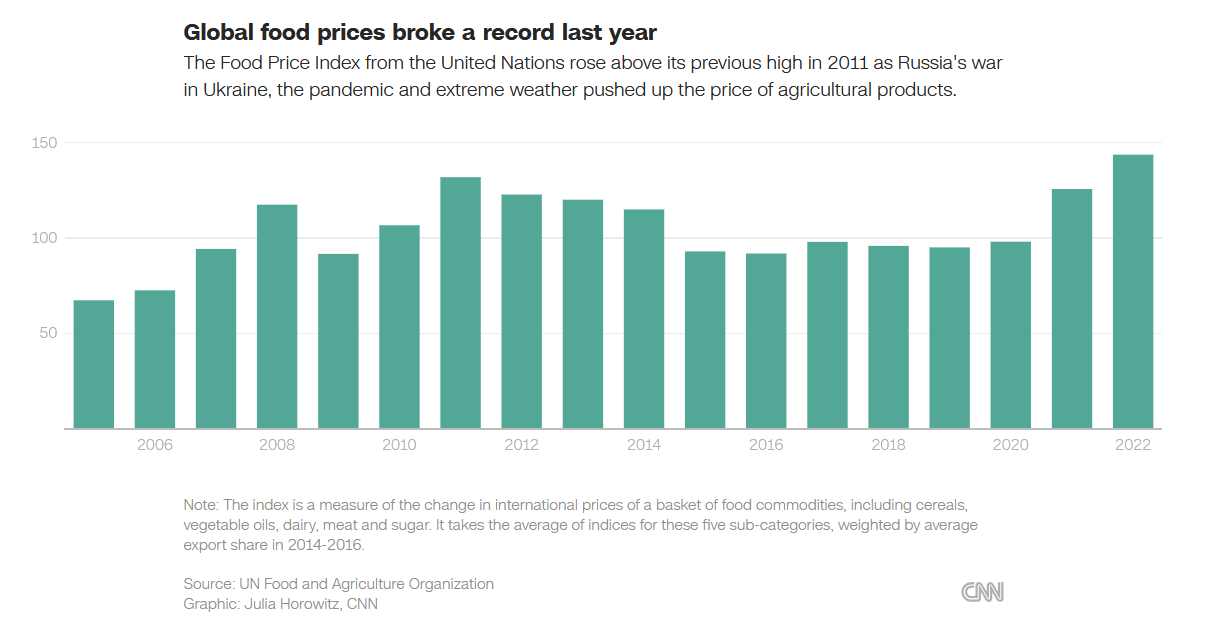

Figure 2. Global Food Price Index 2006-2022

CNN (CNN)

At present, the price of food is at the highest levels we’ve seen globally, for the past 17 years. This marks a stark change from where things have been historically, and based on our gut instinct, we’re not getting a very good feeling about this. California’s drought season is causing rice production to drop, implying the need to import more rice from other regions of the world.

While the price of gasoline has dropped (major cost input), which favors margins for farmers.. The cost of fertilizers has also increased, and prices remain sticky. Agriculture market is interlinked and it starts to affect the price of broad commodities baskets, which is why we’re having a bullish bias on DB Agriculture ETF, which holds positions in many of the agricultural products we discuss in this report.

Furthermore, we’ve also read a troubling Reuters article indicating that weakness in rainfall along the Ivory Coast indicates weakness in crop activity for Cocoa. Now, the Ivory Coast accounts for 66% of all global Cocoa production, which could be affected by weakness in global weather patterns causing yields from the crop to drop.

Figure 3. Drop in Cattle Inventory Continues in the United States

United States Department of Agriculture (United States Department of Agriculture)

To put in context how bad the cattle herd situation in the United States is… we’re trending towards 1950s-1960s levels, which is alarmingly low for total inventory. If we hit 80 million in cattle inventory you’d start to approach the post World War 2 inventory levels, which is ridiculously low given the population of the United States.

At the start of the 1950s, the US had a population of 151 million versus the present United States population of 331.9 million (US census 2021). Basically, we have twice the population, and a similar amount of cattle before the start of the Cold-War era (1950s onwards), which is why we think supply/demand rebalance will force higher cattle prices over time.

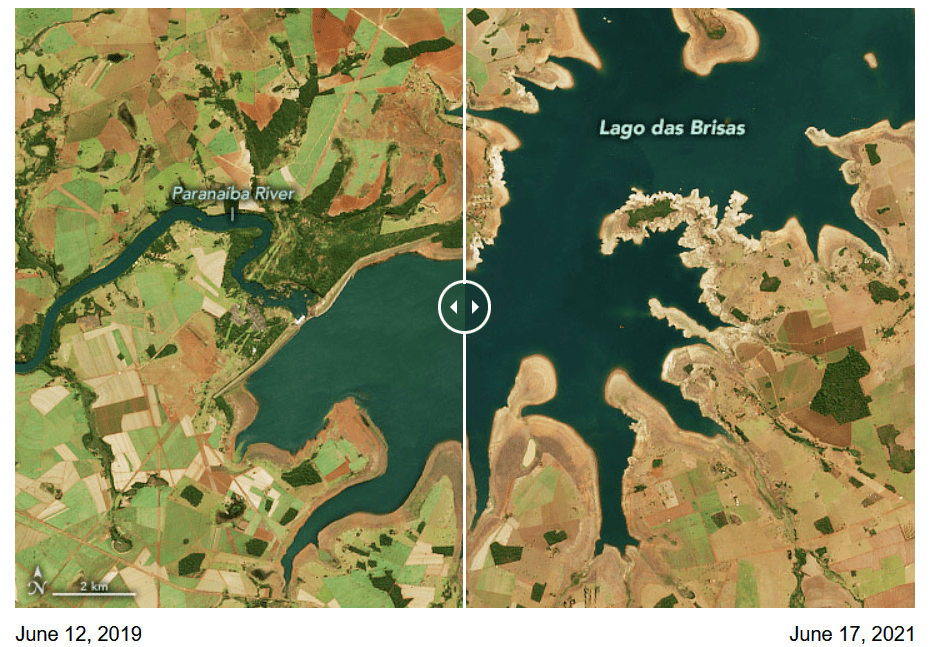

Figure 4. Satellite imagery of droughts in Brazil should make you worried

NASA Observatory (NASA Observatory)

When people talk about the sudden change in agricultural output from Brazil’s various agricultural regions, look at the image above. It’s almost a barren wasteland in such a short span of time. According to Nasa, “The drier-than-normal weather is also affecting the production of important Brazilian crops such as coffee, corn, sugarcane, and oranges. A Brazilian agricultural consulting agency forecasted that yields for the second corn crop could hit a five-year low. Coffee production in São Paulo state was forecasted to drop as much as 20 to 30 percent from normal levels.” Agriculture also reported that Argentina soybean crops are likely to fail given the late rainfall in the region and toughest drought conditions in 30-years in 2023. Expect crop failures along the Amazon river this year.

Figure 5. U.S. Corn Harvested Levels at 10-Year All-Time Lows

USDA (US Department of Agriculture)

The trend in corn harvesting is so bad, it’s not even a joke in the United States of America. With data on shrinking acreage in so many different parts of the country it’s likely that corn harvested area still shrinks regardless causing the price of feed products to go up as well this year. We’re probably in for the worst crop price spiral we’ve seen in quite a while.

Figure 6. Grocery stores are going empty in the United States right now

Kroger shopper (Yahoo Finance)

We think there’s the possibility that stores have already gone empty again to start 2023 just like 2022. When people think about food shortages they do not think of Kroger (KR) Foods contributing to all of this, but yes as of a couple weeks ago the image of a Kroger grocery store missing items in the United States went viral on Twitter again. There are also separate reports from mashed that aluminum could go short in supply. This could make canned foods disappear from the shelves, and why various independent reports point to a shortage of canned vegetables driven by the drop in California produce also exacerbated by the absence of aluminum cans as well.

Perfect storm makes investing into agriculture viable this year

Nobody has a perfect crystal ball, but we think this year is going to be a bad year for grocery shoppers and a great year for farmers, which is why we think alternative assets can be used to hedge risk. For example, if you need to hedge some of your bond portfolio risk to interest rates hikes you could also consider commodities.

We think bonds will drop in value, so maybe agriculture could be an alternative hedge, probably exhibits less volatility than some of the longer-end treasury fund ETFs, and has better upside features. Given the broad context of commodity shortages, drop in production across almost all key agricultural products and price inputs going up in response to already heightened index prices, we can see why we’re entering a period of extended price gains in the agricultural commodity indexes.

It’s why we’re looking to hedge some of our downside risk, and reduce portfolio volatility by investing into some agricultural ETFs at some point this year. To get things started we like the Invesco Agriculture ETF, because of the portfolio composition and direct exposure to future contracts.

Figure 7. Asset distribution of DBA ETF

Portfolio composition (Invesco)

Almost every category shows potential for sudden price increases. Consumers could hit the panic button as the shortage becomes more noticeable and we start to see various grocery stores empty out on unexpected demand.

We think a 10%-20% price increase on DBA across the entire basket seems reasonable with more upside ahead given the poor performance of bonds, and the emerging interest in alternative assets due to the interest rate environment.

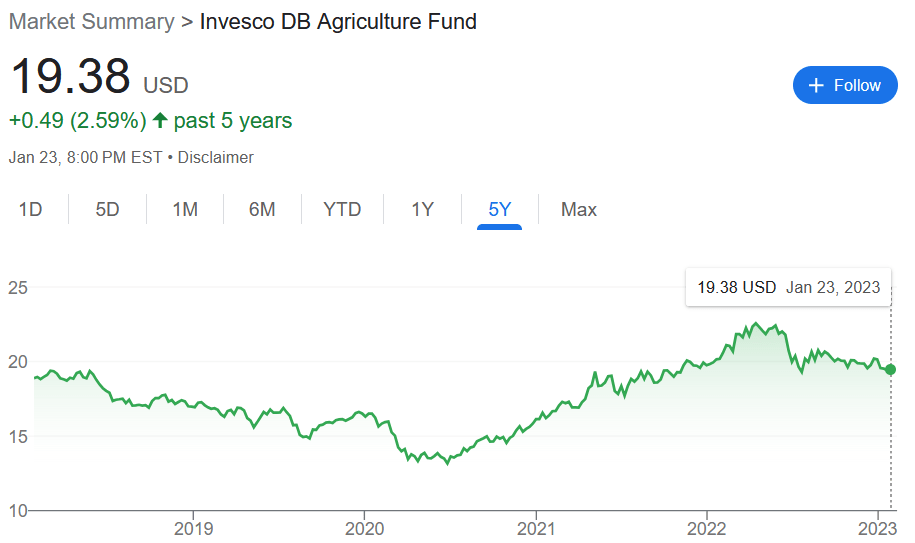

Figure 8. Price chart of DBA stock

5-year price chart (Google Finance)

Looking over the past year the price seemed to pick-up before eventually trending lower into the later part of the year. Again, the price moves slowly, and it still seems like the long-term up-trend is still intact from 2020. Heading into 2023 with awful weather data forecasts and further supply, and production cuts across agricultural commodities, we expect upside to DBA. Now, if we start to see grocery stores empty out like in the beginning months of the pandemic, but heading into 2023, we think prices could easily escape above the $25 level implying 28%+ upside as just a baseline scenario.

As such, we recommend DBA as a buy and expect the underlying farming fundamentals to be supportive of the multi-year uptrend in price. Obviously, the Biden Administration will work hard to address any emergency shortage of food in certain pockets, but we don’t think there’s much that can be done to stop the multi-year price uptrend in agricultural products. Aside from importing more products into the United States in an effort to oversupply food, which could be disastrous and anti-competitive to local growers as many would consider that a form of dumping.

In other words, we think it’s impossible to escape the year without major food price inflation, and disruption in the supply chain. We don’t think the added interest rates help. It seems like consumers will experience more pain at the checkout, as both the interest rate on the credit card plus the grocery bill came out even higher. Meanwhile, farmer America likely benefits from even higher prices, and we think readers could benefit from this trend rather than fall victim to the grocery aisle by holding some ETFs in the Invesco DB Agriculture Fund.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.