eBay: Adding Liquidity To Collectibles Equals Profits

Summary

- Almost cut in half since its Covid highs, eBay has some catalysts on the horizon that could revolutionize the collectibles market.

- eBay screens in the top 50 stocks with a market cap of $3.5 billion and above on the Magic Formula Screener.

- eBay has a high earnings yield on a non-GAAP EV/EBITDA basis.

pressureUA/iStock Editorial via Getty Images

A beaten-down anti-bubble name

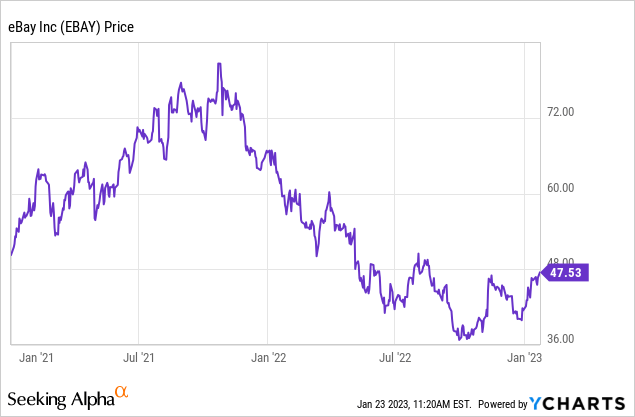

eBay (NASDAQ:EBAY) touched the low $80s during the height of the 2021 everything tech bubble and has fallen ever since. The stock shows up prominently for large-cap Magic Formula stocks on Joel Greenblatt's Magic Formula screener. The screener hunts for stocks that have a combination of a Non-GAAP high earnings yield combined with a high ROIC. It is one of my favorite resources for cloning and creating indexes of buy-and-hold stocks of high-quality companies.

I like to lump eBay into my anti-bubble bucket. A term popularized by Nick Sleep, previous manager at the Nomad Fund. It means that every market has a bubble and an anti-bubble. Tech is out and dividend plus energy stocks are in. While I wouldn't consider energy a bubble as of yet, I believe enough capital has flowed out of tech to create some great deals.

The collectibles market, especially in the football, basketball, baseball, and Pokemon card markets is one that I am very familiar with and one that is a bad addiction. eBay is about to transform this market, and it is one that I believe will be an amazing catalyst in 2023/2024. The stock is one that I own and a buy after taking a beating.

The card and collectibles market

I watch the card market fairly close. I'm a huge San Francisco 49er fan, and the Brock Purdy card market has been on fire. The card selection for him is limited in product lines due to just a handful of companies willing to produce "Mr. Irrelevant's" card combined with the amazing winning streak the team has been on, which has sent his product soaring. Wouldn't it be nice to take advantage of this run? Flipping the cards with each subsequent win could potentially make you a fortune as his popularity skyrockets. eBay might have a solution for you.

Launching this year, eBay will warehouse your cards and collectibles as well as authenticate them. This means you never have to take ownership of the product. You can control your holding period and then re-list the item with the click of a button, flipping it to the next dealer or enthusiast. When an actual owner wants to take ownership, eBay will send them the card, if they never want to, they never have to. This brilliant idea will basically turn cards and collectibles into NFTs. I think the liquidity such a move will create in the collectible market will be groundbreaking.

According to the FAQ page of the product, the vault is located in Delaware in a secured and guarded facility. It can currently only be used by the owner within the United States. You can only view pictures of your item thereafter and can never visit it due to security reasons. The minimum card value is $250, and you may withdraw your card at any time.

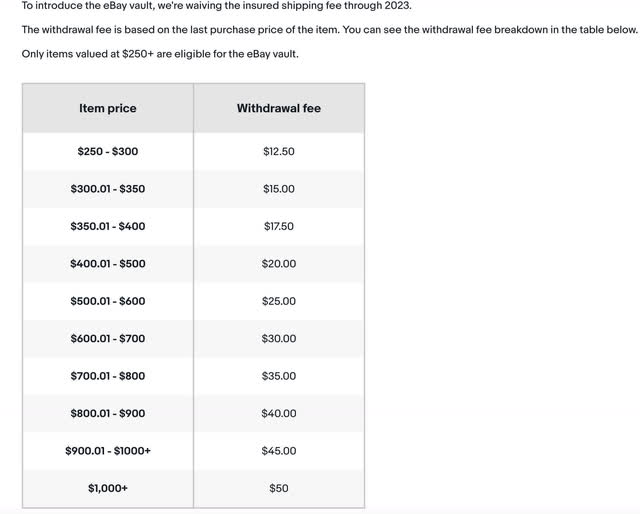

Vault fee structure (ebay.com)

Above is the initial vault fee structure for eBay, this is in addition to the average 12.9% sales fee that eBay takes. Here are a few highlights from 2021 eBay's state of the card market report:

- Interest in trading cards is hitting new heights. After crunching the numbers for our first-ever State of Trading Cards report, we're excited to announce a 142% surge in domestic sales - selling more than four million more sports, collectible card games, and non-sport trading cards in 2020 than in the year before - illustrating just how much the enthusiasm for this category has grown and the cultural foothold the category has taken.

- Gross sales in basketball cards have exploded in the past year, increasing by more than 300%. And in just the past couple of weeks, there have been cards selling for more than $500,000 in the collectible card game and sports cards industry on the marketplace.

- The latest trends show that not only are sports cards a top pick but collectible card games like Pokémon also saw sales increase by more than 500% last year.

This was the last report I found produced by eBay on the card market. 2020 saw 45 million trading cards sold on eBay. Above are some of the biggest sales from 2021 on eBay. While the numbers seem impressive, the largest card purchases get done through an auction or a dealer due to authentication purposes. Now with the vault, eBay will have a trusted authentication process, meaning more big sales. One multi-million dollar purchase at a 12.9% commission could net eBay a couple of hundred thousand on one sale. If you weren't aware, yes, there are multiple multi-million dollar cards sold every year.

Just on gross storage fees alone, let's say 50% of users end up using the storage option. At $25 a pop X 20 million, that's a half-a-billion-dollar opportunity that should only grow. We also have to assume because of the increased security and authentication, more high dollar sales and more commissions. Fantastic.

The balance sheet

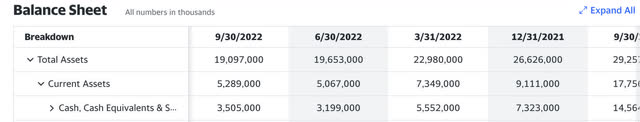

Any good analysis should take a look at the balance sheet first to see which direction current assets (mostly cash for operations) and debt are going.

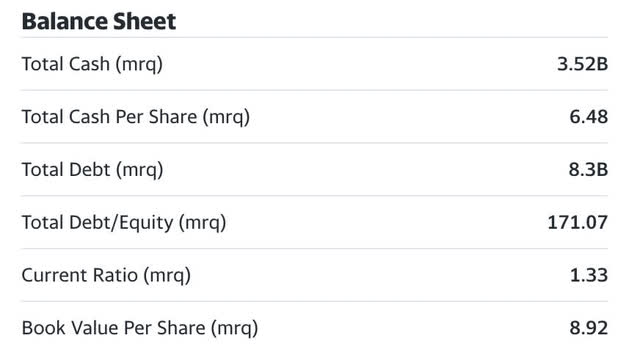

Current assets are falling quarter by quarter. Normally this would be negative unless they were using this cash for debt pay-down and share buybacks. Not many tech companies engage in share buybacks due to constant expansion chasing growth. A float reduction would also be a positive.

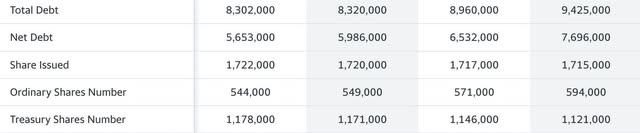

For the same period, we see a corresponding reduction in total debt of more than $1 billion, plus share buybacks reducing the ordinary share number from 594 million to 544. This appears to be more of a brace position to avoid refinancing too much debt at increasing rates, which would significantly alter their WACC. The share buyback is also positive as eBay is one of those rare tech companies that pay a substantial dividend. The buybacks will lessen the burden on free cash flow paid out as dividends going forward.

Income statement and cash flow

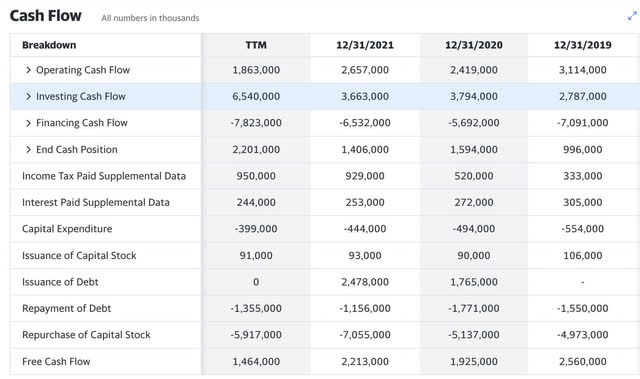

Total revenue for eBay has been flat since 2019. The company is yearning for a catalyst, and the card market auction place could certainly be an area to bump up the top line near-term and bottom line long-term.

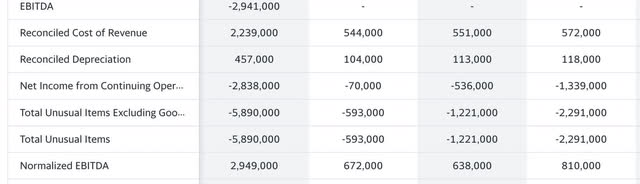

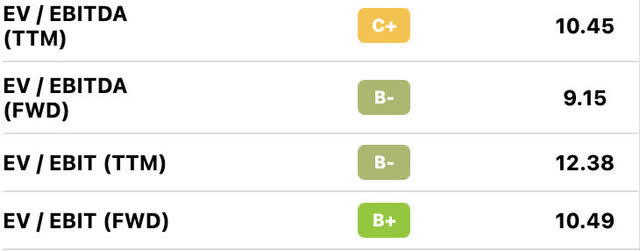

The above is a quarterly basis accounting of normalized EBITDA. Adding back in unusual items, the company is booking almost $3 billion. The EV/EBITDA is somewhere around 10 X current and 9 X forward according to Seeking Alpha:

With a Non-GAAP earnings yield of 9.5% TTM and 10.9% forward, this is a cheap name. The cheapness is valid, however, as eBay has also been flat to down on Non-GAAP earnings since the mid-2000s. A catalyst to increase the top and bottom lines is sorely needed to increase the value proposition.

The debt and the dividend

With $3.52 Billion in cash, they have almost half the value of their debt in cash and cash equivalents. This is a bit of a relief when the debt-to-equity ratio is approaching 200%. While eBay still clears 1X current ratio mrq, the debt load as a proportion of their entire capital stack is still a bit concerning.

Free cash flow is also trending downwards TTM but still positive. With a forward dividend of .88 cents per share and 544 million shares outstanding, this is a dividend commitment of $478 million, covered 3X by free cash flow. At almost 1.9%, having only paid a dividend since 2019, starting at .56 cents a share and ending 2022 at .88 cents, that's a dividend growth rate of 16.25%. Just looking at the dividend proposition plus the free cash flow coverage alone is a compelling argument for eBay stock.

Furthermore on the catalyst front

Another consistent focus item I've spotted on IR presentations for 2022 Q2 and Q3 is motors and eBay Refurb. If we are headed into a prolonged period of downward economics, cheaper refurbished items and auto parts should be great places to market. Maintaining the vehicle you have versus buying a new one is a popular assumption about consumers during tough economic times. The same goes for cheaper refurbished items. I enjoy both regardless of my economic situation because I'm cheap by nature. These are good focus categories for eBay at the moment in my view.

Downside and risk

The capital stack is unusually overweighted with debt for a tech company that seldom carries this much debt as a ratio to equity. If investments in warehouses that guard collectibles fail to generate a profit, we could further see more and more CAPEX required to maintain this project. Being very cheap on a Non-GAAP basis earnings yield, the debt is the item that concerns me the most. eBay has little room for error in new projects.

Conclusion

I am a recovering card addict and know the demand for sports cards and Pokemon cards is insatiable. There are other collectibles out there that I didn't intend to leave out but did for the sake of brevity (sorry Star Wars Fans). Digitizing physical assets in high demand to increase liquidity is reason enough for an individual like myself to want to buy eBay stock. The dividend prop is a second kicker play that adds a bit of icing to the cake. At 10X Non-GAAP earnings and a 1.9% dividend with catalysts on the horizon, I am buying eBay at these levels. It's a Magic Formula stock in the $3 Billion and up market cap segment.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of EBAY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.