IEO: Energy Index ETF, For Aggressive Oil Bulls

Summary

- A reader asked for my thoughts on IEO.

- IEO is an energy index ETF, investing in companies on the exploration and production of oil and gas, but excluding integrated energy majors.

- An overview of the fund follows.

- Looking for a portfolio of ideas like this one? Members of CEF/ETF Income Laboratory get exclusive access to our subscriber-only portfolios. Learn More »

Chanin Nont/Moment via Getty Images

The iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) is exactly what it says on the tin: a U.S. oil & gas exploration and production index ETF. IEO provides sufficient, diversified exposure to the U.S. energy industry, making the fund a reasonable investment opportunity for energy bulls.

Unlike most of its peers, including the Energy Select Sector SPDR ETF (XLE), IEO explicitly excludes integrated energy majors from its portfolio, including Exxon (XOM) and Chevron (CVX). In exchange, the fund invests in some smaller energy companies, including Laredo Petroleum (Vital Energy, Inc. (VTLE)) and CVR Energy (CVI). As smaller companies tend to be riskier than larger ones, IEO is somewhat riskier than average for an energy index fund. As such, and in my opinion, the fund is only appropriate for more aggressive, risk-seeking energy bulls.

IEO - Basics

- Investment Manager: BlackRock

- Underlying Index: Dow Jones U.S. Select Oil Exploration & Production Index

- Expense Ratio: 0.39%

- Dividend Yield: 3.82%

IEO - Overview

IEO is an equity energy index ETF, tracking the Dow Jones U.S. Select Oil Exploration & Production Index. It is a relatively simple index, including all U.S. companies focusing on the exploration and production of energy products. Companies focusing on other aspects or areas of the energy industry, including refining and distribution activities, as well as integrated energy companies are not included in the index. Of these, Exxon and Chevron are the largest, most important exclusions. As with most indexes, applicable securities must also meet a basic set of inclusion criteria. It is a market-cap weighted index.

IEO's underlying index seems reasonable enough, in my opinion at least. Excluding integrated energy companies is a very noteworthy, distinct policy, and an important fact for investors to consider.

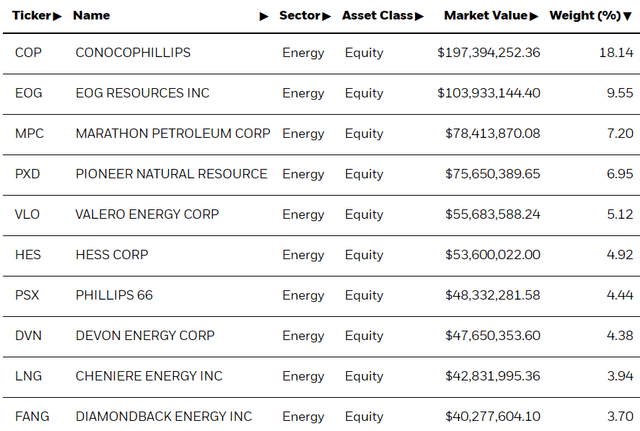

IEO currently invests in 48 different companies. This is a relatively low number of holdings, and lower than average for an equity fund, although in-line with most other equity industry funds. IEO's portfolio is quite concentrated, with the fund's top ten holdings accounting for 68% of its value. Largest holdings are as follows.

IEO

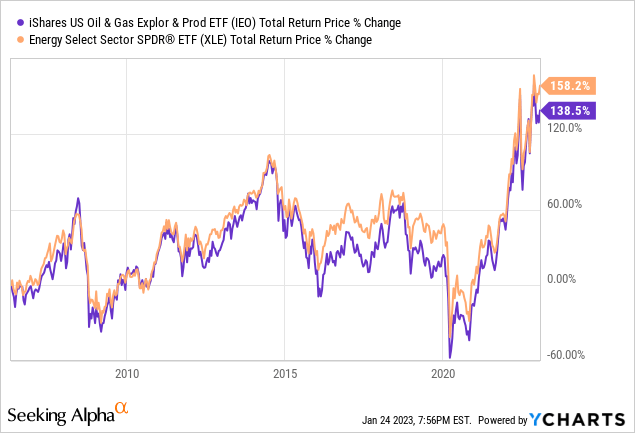

In my opinion, and considering IEO's underlying strategy and holdings, the fund provides broad-based, diversified exposure to the U.S. energy industry. The exclusion of Exxon and Chevron from the fund is notable, but the impact is muted. Energy companies are all heavily correlated with each other, as most move alongside energy prices plus industry sentiment. IEO tends to move in-line with XLE, the industry benchmark, as expected.

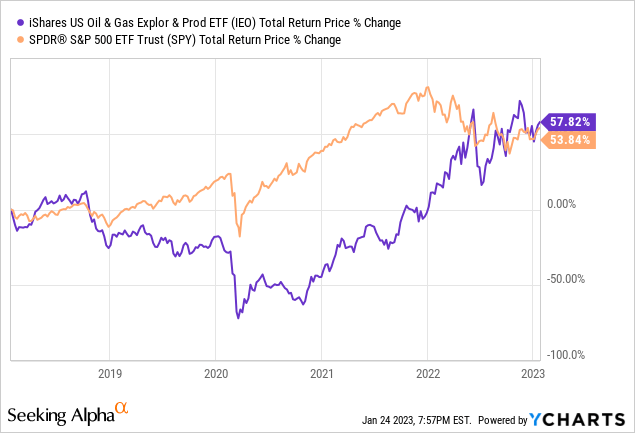

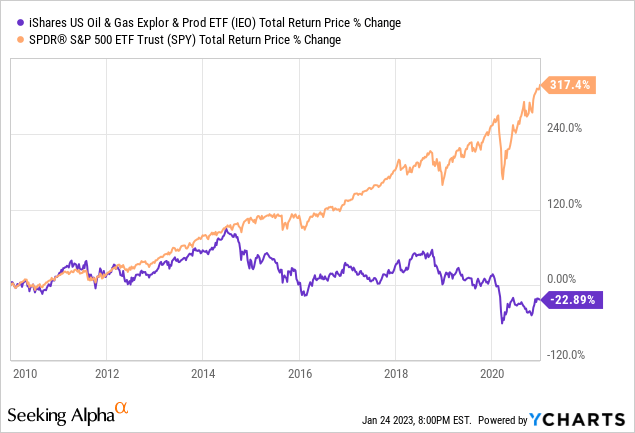

IEO is a relatively concentrated fund, focusing on a specific industry: the energy industry. Concentration increases risk, volatility, and the potential for significant under and overperformance. IEO's performance could significantly differ from that of broader equity indexes, including the S&P 500, as the fund is much more concentrated / different than most indexes. Comparing IEO and S&P 500 performance might be instructive.

As can be seen above, even though IEO and the S&P 500 have broadly similar performance these past five years, their performance for any individual year or month is sometimes significantly different. IEO was down from 2019 to 2021, a period of strong equity market gains. On the flipside, the fund has seen significant gains these past twelve months, even as equity markets tumble. As such, and in my opinion, IEO is an inappropriate investment for (most) risk-averse investors, especially those looking for index-like performance. IEO could go down even as the market, as a whole, goes up, much more so than most equity funds, which might be a deal-breaker for many investors.

Besides the above, not much else stands out about IEO, its strategy or holdings. With this in mind, let's have a look at the fund's investment thesis.

IEO - Investment Thesis

IEO provides broad-based, diversified exposure to the U.S. energy industry, and so should perform well when said industry performs well. There are several reasons to think that this will be the case, especially improved economic fundamentals and industry capital discipline, which form the core of the fund's investment thesis. Let's have a closer look at these two points.

Improved Economic Fundamentals

Energy industry performance and returns are strongly dependent on energy prices. When demand is high, energy companies can sell a lot of oil, natural gas, and other assorted energy products for very high prices. As revenues increase earnings skyrocket. Share prices and shareholder returns should skyrocket too, contingent on markets reacting rationally, which they generally do. When demand is low, energy companies can't sell their products at high prices, and are instead forced to shutter their most unproductive, marginal oil wells and production sites, and sell their remaining production for very low prices. Earnings plummet, as do share prices and returns.

Energy industry performance is strongly dependent on energy demand, and demand seems set to boom. Economic conditions in the U.S. are steadily improving, with 2.9% GDP growth last quarter, and strong job growth this past December. Inflation is slowing down too, and quite rapidly. China is relaxing coronavirus controls, likely a preamble to their total shutdown. As China reopens, oil demand will almost certainly increase, pressuring energy prices. Improved economic fundamentals should increase energy demand, benefitting the energy industry and, by extension, IEO.

Inflation slowing down also serves to significantly reduce the risk of reduced demand / a recession. The Fed might be forced to engineer a recession to combat inflation. This seemed somewhat likely when prices were increasing +8.0% annualized month after month, with no sign of abating. A recession would almost certainly have led to significantly reduced energy demand and prices, a disaster for IEO and its investors. With inflation slowing down these past few months, the possibility seems much reduced, at least if current trends continue.

Capital Discipline

Strong energy demand leads to higher energy prices, and energy industry revenues and earnings. Energy industry share prices and returns should increase too, but they might not, for a myriad of reasons, including misallocation of capital. Earnings can be squandered, wasted in unprofitable projects and mergers, which should lead to subpar returns even when energy prices are high. As an example, the U.S. energy industry responded to moderately elevated oil prices in the 2010s by massively ramping investment in unprofitable shale plays, leading to $300 billion in losses, and to a lost decade for energy investors.

Importantly, the energy industry seems to have learned its lesson, and seems committed to avoiding repeating the same mistake. Energy companies are, by and large, committed to capital discipline. CAPEX is being restrained while dividends are being increased and buybacks doubled.

Capital discipline helps energy investors in two key ways.

First, it significantly reduces industry risk. CAPEX might be profitable; buybacks and dividends almost always are. Investors should feel much more comfortable investing in companies with sizable dividends and buybacks programs compared to those with massive CAPEX, although returning cash to shareholders does somewhat reduce potential returns.

Second, capital discipline means somewhat reduced supply, which helps sustain energy prices, and hence energy revenues, earnings, and returns. Insofar as the energy industry refrains from massively ramping up investment, energy supply should remain somewhat constrained, which should help keep prices high moving forward.

Combine improved economic fundamentals and capital discipline, and the stage seems set for elevated energy prices, and strong energy returns. In my opinion at least.

IEO versus XLE

IEO provides broad-based, diversified exposure to the U.S. energy industry, as do many other funds, including XLE, the industry benchmark. IEO does not significantly differ from most of its peers, with these sharing most of the same fundamentals, characteristics, and investment thesis. XLE should also benefit from improved economic fundamentals and capital discipline, as should most other energy funds.

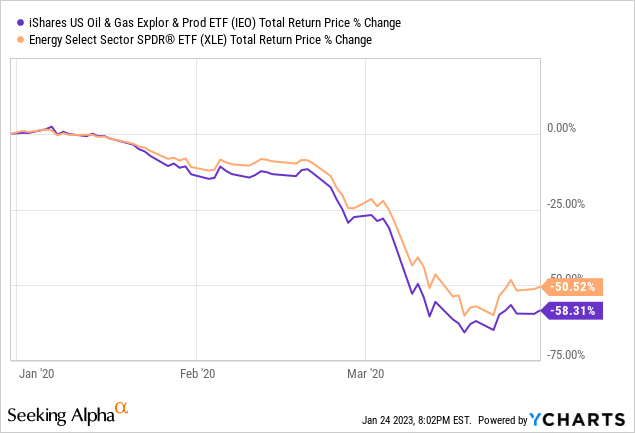

Even though IEO is very similar to most of its peers, there are a few differences which might merit a closer look. Chief among these is the fund's exclusion of energy giants Exxon and Chevron. Their exclusion serves to tilt the fund's portfolio towards smaller, riskier energy companies. Volatility is increased, as are potential losses during downturns. IEO suffered above-average losses during 1Q2020, the onset of the coronavirus pandemic, as the most recent recession. Average energy losses were extremely high regardless.

Due to the above, IEO is moderately riskier than the average U.S. energy equity index ETF. As such, the fund seems like a broadly inappropriate choice for more risk-averse investors, and seems only suitable for more aggressive, risk-seeking investors. Still, these are questions of degree: the energy industry is, writ large, quite risky.

IEO - Quick Valuation Analysis

As a final point, a quick look at IEO's valuation.

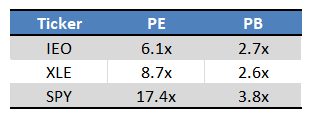

IEO trades with a somewhat cheaper valuation than XLE, somewhat of a benefit for investors. Both IEO and XLE trade with significantly cheaper valuations than the S&P 500. In my opinion, although IEO's cheap valuation is something of a benefit for shareholders, the same is true for approximately all energy funds right now. As such, IEO's cheap valuation is not a significant advantage of the fund versus its peers.

IEO

Conclusion

IEO provides sufficient, diversified exposure to the U.S. energy industry, making the fund a reasonable investment opportunity for energy bulls.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.