NIO: 50% Growth In The Cards

Summary

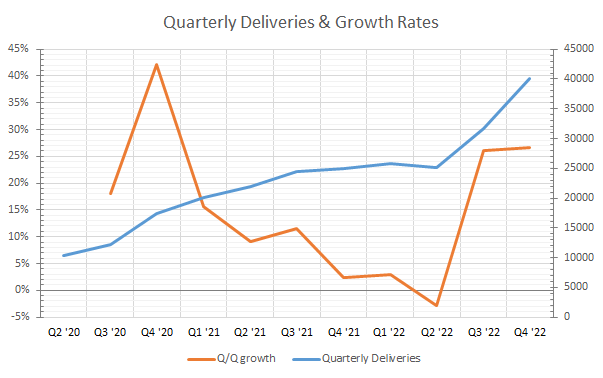

- NIO ended FY22 with ~34% y/y growth in deliveries to reach 122k units after Q3 and Q4 showed solid sequential growth.

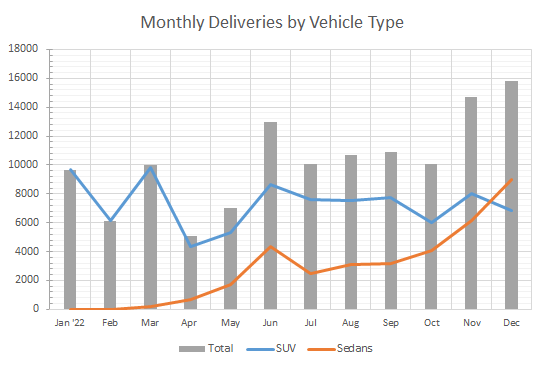

- Sedan deliveries are rapidly scaling, although a deeper look at deliveries by vehicle shows an overreliance on new models to drive growth.

- NIO has finally broken through a delivery ceiling to a 15k/mo run rate, putting it on a trajectory to exceed 180k units in FY23, for over 50% y/y growth.

- Should NIO execute accordingly, shares could find a ~130% upside to $27 at a 3x EV/revenue multiple.

Robert Way

NIO (NYSE:NIO) ended FY22 with 122,486 deliveries after two record months in November and December combined for nearly 30,000 units -- an annual 180,000 unit run rate. Looking ahead for 2023, differing EV market forecasts for China offer a bit of uncertainty around consumer demand and overall market growth, but the pieces are in place for NIO to potentially record 50% or higher delivery growth should demand remain firm for its models and production and covid-19 related headwinds ease.

Chinese EV Market Outlook

Forecasts for growth for the world's largest EV market offer some differing views for where the industry will end in 2023 -- the China Passenger Car Association is expecting growth of around 2.0 million vehicles to reach 8.5 million sales for the year, about 31% growth.

Other forecasts for growth suggest slightly lower growth to 8.4 million units on the basis that the EV "market is set to lose steam in 2023 as Beijing phases out cash subsidies and consumers shy away from big-ticket items over concerns about a gloomy economy." Subsidies phasing out could represent a major headwind to the market should consumer demand cut back as vehicles become relatively more expensive.

However, forecasts from UBS are suggesting "that passenger NEV sales would reach 8.8 million units in 2023, accounting for 38 percent of total passenger vehicle sales." This forecast sits about 4% higher than the CPCA's 8.5 million projection, seeing the renewed growth coming as "consumer confidence is restored and vehicle makers vie to launch new models."

So the main takeaway here is that the industry is widely projected to record at minimum 30% growth, to at least 8.3 million units, potentially up to 8.8 million or 8.9 million in upside forecasts.

Major Chinese OEMs are also targeting significant growth during 2023 -- Great Wall Motor (OTCPK:GWLLY) is aiming to launch 10 NEV models during the year to boost growth, Geely-backed Zeekr wants to double sales in 2023 to over 140,000 units, and Mercedes-Benz (OTCPK:MBGYY) is launching six models in the nation. For NIO, the question now circles back to growth -- will another ~30% y/y growth rate in deliveries be strong enough? Should Zeekr hit targets, it will be just 10k to 15k units shy of NIO with only two models, barely two years after launching sales -- this scenario would likely reflect poorly on NIO as it struggles against competitive pressure.

Q4 Deliveries Hit A New High

A very strong end to 2022 helped NIO reach new highs for Q4's deliveries, totaling 40,052 vehicles, +60% y/y. Q4 marked two consecutive quarters of greater that 26% sequential growth after Q3 broke past a 26k/quarter ceiling.

Essentially, NIO has quickly ramped up its average delivery run rate from around 8.5k per month up to 15k per month by the end of Q4, with November and December combining for just under 30k deliveries. However, maintaining this run rate is unlikely for the initial half of Q1 due to impacts from Lunar New Year affecting production and demand.

Author calculations

The above graph shows NIO's quarterly deliver totals [blue] alongside sequential quarterly growth rates [orange] from Q2 2020 to the end of 2022. What's noticeable here is that sequential growth rates have picked back up towards late 2020's levels, bouncing off a decline in Q2 '22 after NIO had struggled for multiple quarters showing less than 5% sequential growth.

Resumption of ~26% q/q growth rates is a strong positive for shares moving forward, because it represents near-exponential scalability -- a 26% q/q rate for each quarter in FY23 would land at 293k units, or 140% y/y growth. Reining that in to a more manageable ~11% average sequential rate would project deliveries at 210k for FY23, or ~72% y/y growth. Reaching 72% y/y growth for 2023 would be a major accomplishment and a major recovery from 2022's 34% growth.

Deliveries By Vehicle: A Red Flag?

For the first time in December, sedan deliveries overtook SUV deliveries, with over 2.1k more sedans delivered during the month as SUVs dropped. Sedan deliveries have recorded a fifth straight month of growth, with a trajectory easily suggesting NIO could ramp above 10k/month rate during the early stages of FY23.

However, the delivery breakdown by vehicle is raising some red flags about growth possibilities -- NIO is heavily reliant on its newest models, the ET5 and ET7 (ES7) for growth.

Author calculations

Looking deeper into NIO's deliveries shows that ET5 contributed 48% of December's total deliveries, while the ET5 and ES7 [EL7] combined for over 74% of that total. Demand for the ET5 has been particularly high -- the model scaled from 221 units in September to nearly 7,600 by December, NIO's fastest ramp of its newest models.

This suggests that NIO is extremely concentrated and extremely reliant on these two new models to drive growth -- either demand for NIO's five older models has fallen substantially, or production has been reallocated to prioritize the two new models.

From a growth standpoint, the former would be a huge negative for NIO -- as rivals aim to turbocharge growth in 2023, demand destruction for NIO's long-standing models points to a more challenging growth picture with more EV models hitting the market. The latter scenario is not necessarily a positive or a negative, rather it offers a glimpse into how NIO could allocate production with up to five new models launched as capacity expands towards 30k/month.

2023 Outlook

Effectively handling industry headwinds and keeping fairly consistent production through the year (unlike April and Q3 2022) could put NIO on track to record 180k to 195k vehicles, or >50% y/y growth, for FY23. Capacity certainly supports such growth, as NeoPark's operations should provide the ability to reach a 20,000 to 25,000 units/month run rate. A five-year agreement with CATL will provide the necessary battery supply to support such growth.

Financially, there's still room to improve -- vehicle margins dipped slightly q/q in Q3 while gross margin rose slightly. Net losses widened 50.2% q/q as operating expenses, particularly R&D, jumped. EBITDA is moving farther into the red, with Q3 posting negative $484 million EBITDA compared to Q1 2021's negative $5.2 million.

With break-evens still far from view, as gross margin has fallen 700 bp y/y as of Q3 while operating expenses continue to rise, upside may be limited through FY23 even as deliveries are projected to rise 50% or more. At an initial revenue estimate of $13.8 billion and 3x EV/revenue multiple for FY23, shares could find meaningful upside to $27 should NIO execute accordingly and scale deliveries to 180,000 units or above, while also reversing a trend of growing losses.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.