3 Reasons To Buy Western Midstream Instead Of Energy Transfer

Summary

- Both Energy Transfer LP and Western Midstream Partners, LP are high-yielding midstream businesses.

- Both slashed their payouts in the wake of the COVID-19 outbreak and energy market crash.

- We share three reasons to buy Western Midstream Partners instead of Energy Transfer at the moment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

MicroStockHub

Both Energy Transfer LP (NYSE:ET) and Western Midstream Partners, LP (NYSE:WES) are high-yielding midstream businesses. Furthermore, both slashed their payouts in the wake of the COVID-19 outbreak and energy market crash. WES halved its quarterly distribution from $0.622 to $0.3110 in Q2 2020 in response to the energy market crash in the wake of the COVID-19 outbreak and lockdowns. Meanwhile, $ET also halved its distribution from $0.305 per quarter to $0.1525 beginning with its 11/19/20 payout, as it felt pressure to prioritize deleveraging in the wake of the carnage in the energy industry that year.

Since then, the energy market has recovered dramatically and today is generally booming. As a result, both businesses have experienced significant improvement in their fundamentals and have increased their distributions considerably from their 2020 lows. While we are bullish on both ET and WES, in this article, we will look at three arguments for why WES is a better buy than ET at the moment.

#1. Greater Total Capital Return Potential

While ET is cheaper than WES across the board, according to the primary midstream valuation metrics:

| Metric | WES | ET |

| P/DCF | 6.65x | 4.93x |

| EV/EBITDA | 8.19x | 7.76x |

| EV/EBITDA (5-Yr Average) | 9.35x | 8.80x |

| 2023E Quarterly Distribution Yield | 7.0% | 9.4% |

It is important to note that WES' distribution yield is vastly understated for two reasons:

- It has adopted a policy of paying out a fixed $0.50 quarterly distribution per unit along with an "enhanced" distribution alongside its first quarter distribution based on the excess free cash flow generated in the previous fiscal year. In our recent conversation with WES, they mentioned that they expect their enhanced distribution to be a meaningful portion of their capital allocation policy moving forward, so the distribution yield based solely off of the quarterly payment is a bit misleading and it should be considered meaningfully higher.

- WES is also aggressively pouring capital into unit repurchases. In contrast, ET is not repurchasing any units at the moment and is unlikely to do so in the near term given that it is pouring its excess cash into CapEx, distribution growth, and deleveraging. In fact, through the first three quarters of fiscal 2022, WES repurchased $461 million worth of units (4.2% of the current market cap), and increased the repurchase authorization to $1.25 billion. In fact, as of the end of Q3 2022, they had the highest trailing twelve month total capital return yield in the midstream sector.

Why is this important? Well, capital returns are a lower risk form of creating value for investors than investing in growth projects. This principle is particularly true when looking at ET, given that Kelcy Warren is infamous for his often overly aggressive and controversial approach to growth investments, which has destroyed considerable unitholder value over the years.

As a result, with WES you know that you are going to get a very high percentage of the distributable cash flow returned to you, whereas with ET the return profile is much less certain. As the saying goes:

One bird in the hand is worth two in the bush.

#2. Significantly Better Financial Flexibility

Without a doubt, ET is focused on deleveraging. It has made significant progress over the past few years by paying down debt aggressively, and it appears poised to continue doing so. As management stated on its latest earnings call:

we're clearly looking at paying down as much [debt] as we can. There is still a little bit to go as far as getting what our free cash flow is going to be. But in fairness, we do have a very good capacity left on our revolver from our credit facility. So we've got options as to how to navigate that, and we're going to be careful. I don't really want to get out in front of it and try to preannounce. But you nailed it when you said looking at trying to pay down as much as we can of [2023 debt maturities] if not moving some of it to the revolver only because when you look out over the remainder of the year and you see what the free cash flow continues throughout the year.

That said, their leverage is only likely to come in at a little bit below 4.5x at the end of Q4. In contrast, WES is expected to end fiscal 2022 at a below 3.4x leverage ratio (it is currently sitting at 3.3x on a trailing twelve month basis), end fiscal 2023 with a 3.2x leverage ratio or lower, and end fiscal 2024 with a 3.0x leverage ratio or lower.

WES also has a much more attractive financial flexibility profile. It had significantly greater relative liquidity at over $1.5 billion in total liquidity (over 8% of its enterprise value) as of the end of Q3, whereas ET had a little over $2.3 billion in total liquidity (over 2% of its enterprise value) as of the end of Q3. Meanwhile, WES only has $213 million of debt maturing in 2023, with no debt maturing in 2024. In contrast, ET has $3.25 billion of debt maturing in 2023 and $3.7 billion maturing in 2024.

This means that WES is in a much better position than ET to not only address its near-term financial obligations, but also to return excess cash flow to unitholders via enhanced distributions and unit repurchases.

#3. Vastly Superior Returns On Capital

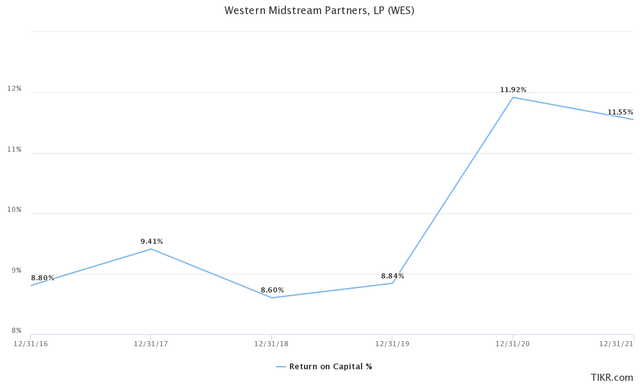

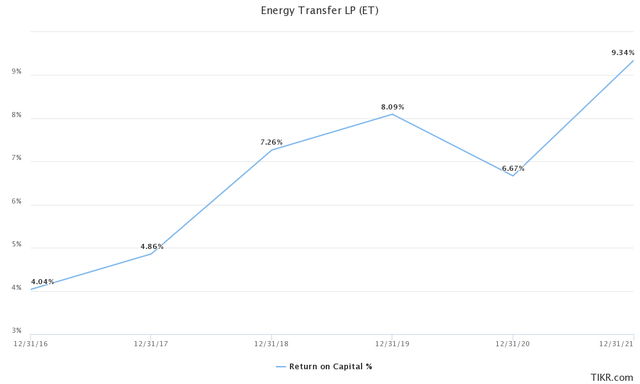

A third reason to be much more optimistic about WES relative to ET moving forward is that it is generating vastly superior returns on invested capital. As the graphs below illustrate, WES' return on capital is generally a few hundred basis points higher than ET's:

WES ROC (TIKR.com) ET ROC (TIKR.com)

In fact, over the last six years, WES' return on capital has averaged 9.9%, whereas ET's return on capital has never reached that level even once and has averaged 6.7% over that span. This is largely due to the fact that ET has aggressively spent its excess cash flow, whereas WES has exercised far greater discipline.

In fact, management at WES has been selling off non-core assets to further high-grade the profitability of the portfolio and has taken a very disciplined approach to capital spending. ET is improving in this area, but still has a ways to go and has also recently expressed a desire to resume M&A along with other CapEx spending once it gets its leverage ratio back within its long-term targets.

Investor Takeaway

We really like and own units in both of these midstream businesses. In fact, we actually have a larger position in Energy Transfer LP because there are several things that we like about it relative to Western Midstream Partners, LP (and just about every other midstream business out there as well). That said, as we have pointed out in this article, there is certainly a case to be made for holding WES as well.

Western Midstream Partners, LP's investment thesis is simpler than Energy Transfer LP's, as there is much less uncertainty about how excess cash flow will be used moving forward. ET could definitely deliver better long-term total returns than WES if management can allocate its distributable cash flow effectively, but based on past history that is anything but guaranteed. We rate both as Buys at the moment despite their strong recent performance and hold them in our Core Portfolio at High Yield Investor.

High Yield Investor

Our 2023 Blowout Sale of the Year is Here!

For a Limited-Time - You can join Seeking Alpha's #1 rated community of high-yield investors at a steep discount!

Try it Free for 2-Weeks. If you don't like it, we won't charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

(Limited to only 50 spots!)

This article was written by

Samuel Smith is Vice President at Leonberg Capital and manages the High Yield Investor Seeking Alpha Marketplace Service.

Samuel is a Professional Engineer and Project Management Professional by training and holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point. He is a former Army officer, land development project engineer, and lead investment analyst at Sure Dividend.

Disclosure: I/we have a beneficial long position in the shares of WES, ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.