GoldMining Inc.: Recent Ounce Additions Overshadowed By Uncertainty

Summary

- GoldMining Inc. was one of the best-performing gold developers in 2022, declining just 5% vs. a 15% decline in the Gold Juniors Index.

- This outperformance may be related to it being the first year of solid results across its portfolio, with a PEA completed at La Mina and PEA work underway at other projects.

- However, while the advancement of its La Mina Project and recently added ounces are positives, the negative is that permitting the project may be more difficult under the new government.

- Given the fact that this looks to be a best-case 2027 production (assuming permitting success) and I see further risk of share dilution, I continue to see far more attractive ways to play the sector.

eyjafjallajokull

Just over a year ago, I wrote on GoldMining Inc. (NYSE:GLDG), noting that while the company looked cheap on a per-ounce basis, its projects were being advanced at a snail's pace, which made it cheap for a reason. Since then, the stock has suffered a more than 30% drawdown and is flat on a year-over-year basis. Although this outperformed some of its developer peers, it has significantly underperformed high-quality producers like Agnico Eagle (AEM) and Alamos Gold (AGI), especially on a total return basis when including dividends paid out to shareholders and share buybacks.

The good news for GoldMining Inc. ("GoldMining") is that its projects have been moving along at a brisker pace under new CEO Alastair Still, who was appointed to this role at the beginning of Q2 2021. However, the outlook for its Colombian projects has become a little less clear after two years of inflation and a Gustavo Petro Election win (planned new mining code), resulting in additional uncertainty for the investment thesis. This is because not only have inflationary pressures resulted in 30%+ capex increases to build greenfields projects, but we could also be seeing a more challenging road ahead for open-pit projects in Colombia, where two of GoldMining's projects are located. Let's take a closer look below:

La Mina Project Mineralization (Company Presentation)

2022 Recap

While GoldMining had a relatively quiet few years from an exploration standpoint after assembling its massive portfolio in 2013 through 2017, it has seen significantly more progress across its portfolio since Alastair Still took over as Chief Executive Officer in 2021. This included the release of a positive Preliminary Economic Assessment [PEA] on its La Mina Project in Antioquia, Colombia, continued work on PEAs for its Sao Jorge Project in Brazil and its Whistler Project in Alaska, and optioning its Almaden Property in Idaho to NevGold in exchange for cash and or share consideration of up to $16.5 million, which would be a very nice payback relative to the ~$1.0 million that the project was acquired for in 2020.

GoldMining's new CEO, Alastair Still, has over 25 years of experience in the mining industry, including previous positions with heavyweights such as Kinross (KGC) and Newmont (NEM) as Chief Geologist at Hoyle Pond and Macassa in the former case and Director of Corporate Development in the latter case.

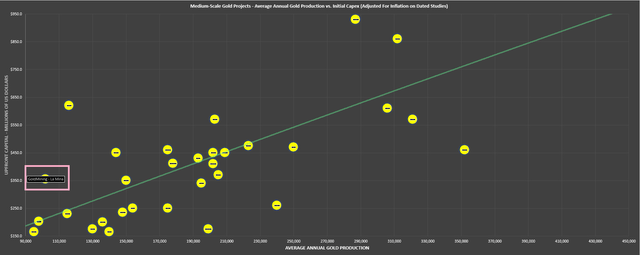

Regarding the La Mina Project PEA, the company envisions a 10,000 tonne per day open-pit mining operation producing ~102,000 gold-equivalent ounces [GEOs] per annum over a 10-year mine life. Given that this is a gold-copper project, the estimated all-in-sustaining costs [AISC] are relatively low at $700 per gold ounce on a by-product basis using a conservative $3.39/pound copper price. That said, I wouldn't call the capex modest or "relatively low" as discussed in the PEA release, with upfront capex estimated at ~$300 million and likely above $345 million when incorporating inflationary pressures. In fact, if we look at how this project stacks up to other small and mid-sized undeveloped gold projects, its upfront cost is actually above the sector average.

La Mina Project Upfront Capex & Average Production vs. Other Undeveloped & Construction-Stage Projects (Company Filings, Author's Chart & Estimates)

Fortunately, while these costs aren't low, they are at least manageable for a company of GoldMining's size vs. other juniors with massive capex bills that will likely never head into production, such as International Tower Hill (THM) with its Livengood Project. Besides, GoldMining has seen continued exploration success on the project, adding ~1.2 million GEOs (0.2 million indicated, 1.0 million inferred) to the project with the nearby La Garrucha discovery. This has pushed the total indicated resource to 1.15 million ounces at similar grades, with the total La Mina resource growing to ~2.60 million GEOs. Given the low cost of adding ounces (~$6.00/oz on indicated ounces) and the ability for these ounces to increase the mine life potentially, I see this as a positive development.

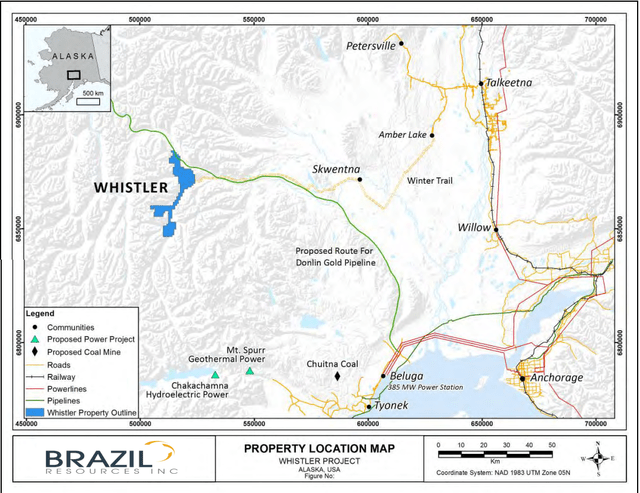

Finally, while we have yet to see the results of PEA work being completed on the Whistler Project (Alaska), the company appears to be looking to spin out this relatively large project (~3.0 million indicated GEOs) to help highlight the value of its portfolio on a sum-of-the-parts basis. This isn't a bad idea, given that the company has too much on its plate, and I see optimizing its portfolio through a potential spin-out and the recent option agreement with NevGold as a step in the right direction.

Although a spin-out through an initial public offering or similar transaction is a bonus, and GoldMining will no longer incur expenses related to the project, it's hard to put a value on this project until we have a Feasibility Study in place. Given that inflationary pressures have led to significant increases in upfront capex on greenfield projects, the increase in the copper price on future project economics will likely be offset by a much more expensive project to build than previously envisioned (pre-COVID-19). Hence, I'm hesitant to assign a valuation to this project until we understand whether upfront capex is manageable, especially with it being somewhat remote, 150 kilometers northwest of Anchorage, Alaska.

Whistler Project Location (Project Technical Report)

Other Recent Developments

Although it's a positive sign to see some projects within GoldMining's portfolio advancing and others being either farmed out through option agreements or being prepared for spin-outs, the one negative development last year was a change in the guard from a political standpoint in one of its primary jurisdictions where it has three projects (La Mina, Titiribi, Yarumalito): Colombia. For those unfamiliar, we saw a surprise win by left-wing leader Gustavo Petro in last year's Colombian Election, and GoldMining's La Mina Project is already in a state of Colombia (Antioquia) where AngloGold (AU) has struggled to move its Quebradona Project forward, with ANLA (Colombia's environmental regulator) shelving AngloGold's permit request in October 2021, and the appeal over the license shelving also being rejected in May 2022.

I view the new administration as a negative for mineral resource companies that are developing projects in Colombia, especially open-pit projects, given that Colombia's new President, Petro, proposed to ban "large-scale open-pit mining" in the country. There was no clear distinction whether this applied to current operations or just new projects, and while the definition of large scale is not in stone, GoldMining's La Mina is not small by any means (10,000 tonnes per day), even if it is dwarfed in size by the very large scale Gramalote Project (proposed 30,000 tonnes per day) where B2Gold (BTG) is exploring a sale process, citing a lower IRR than it was hoping for, though this could also be partially related to the view that it could be a lengthier or more challenging permitting process for the massive project.

To summarize, while GoldMining can be commended for finally starting to make some decent progress on this gold-copper project under its new CEO, the landscape from a permitting standpoint may have become less favorable, which won't be clear until a new mining code is drafted, with the current one being issued in 2001. At the same time, it isn't getting any cheaper to build new projects due to increased labor, steel, and cement prices. So, if this project had been permitted and moved into construction by 2022 ahead of the election, it might be easier to have a favorable outlook. However, with the upfront capex number of $300 million looking stale after double-digit inflation last year and the permitting landscape for projects potentially being stricter, the path to first production here has become less clear.

Finally, although GoldMining has a significant balance of equity investments, including shares in Gold Royalty Corp. (GROY), the company has been actively using its At-The-Market Equity [ATM] facility over the past year (7.0+ million shares sold last year). It announced an update to this ATM at year-end, with this new ATM replacing the previous ATM that expired on January 1st, 2023. The new ATM allows for the distribution of up to $50 million in shares through a syndicate of agents at the company's discretion and with a negative working capital position and just ~$1.0 million in dividends per annum from its position in Gold Royalty Corp, investors will likely see GoldMining quite active on this ATM this year as well.

Valuation

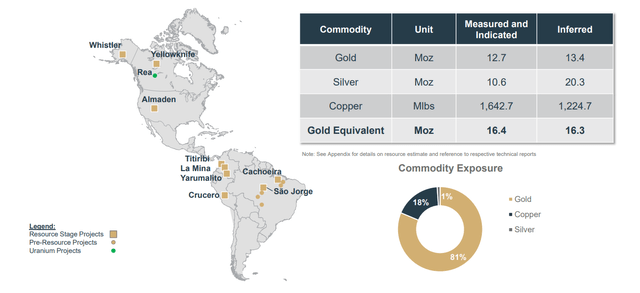

Based on ~170 million fully-diluted shares and a share price of US$1.31, GoldMining trades at a market cap of ~$223 million, a valuation that is typically reserved for an early-stage developer with a sub 4.0 million-ounce resource base. In GoldMining's case, the company's mineral resource inventory stands at 16.4 million gold-equivalent ounces in the measured & indicated category, which would suggest at first glance that the stock is significantly undervalued, given that GoldMining trades at a valuation of just ~$14.00/oz. However, there are two issues with using this crude valuation metric to conclude that GoldMining is undervalued.

GoldMining Assets & GEOs (Company Presentation)

For starters, its share count is a moving target, with ~7.5 million shares sold under its At-The-Market Equity program from January through October 2022 alone, and continued use of the ATM looks likely (negative working capital position as of August filings). Secondly, although its resource inventory is large, it's spread across several projects, with none looking like they'll head into production before 2027. In the case of projects that are not yet permitted, financed, and are located in Tier-2 jurisdictions (Brazil, Colombia, Peru), we typically see a much lower value ascribed to these ounces.

Aris Mining (OTCQX:TPRFF) is one example of the jurisdictional discount in South America, being a mid-tier gold producer with a ~$500 million market cap, a very cheap valuation for a company of its caliber. However, this discounted valuation is likely due to the perceived risk related to the jurisdictions where it currently operates (Aris Mining operates in Colombia, where GoldMining has three projects). So, while GoldMining may look cheap on a per-ounce basis compared to fully-financed Tier-1 jurisdiction developers like Marathon (OTCQX:MGDPF) and Sabina (OTCQX:SGSVF), it's important to note that these developers command a higher premium due to these projects being permitted, and construction-ready.

It's also worth noting that companies like Marathon and Sabina have a singular focus on one asset vs. spreading themselves thin across multiple assets, which is one reason that I believe GoldMining has advanced its projects at such a slow pace.

The last issue that cannot be overstated is that the future of its Colombian projects looks cloudier than it was previously following the Colombia Election Result (Gustavo Petro win). As discussed earlier, Petro proposed to ban large-scale open-pit mining in Colombia ahead of his election win and recently pledged at Davos that there would be no new oil/gas exploration licenses or new titles for open-pit coal mining, according to mines and energy minister Irene Velez. While this doesn't apply to the gold industry, AngloGold Ashanti (AU) has already had its fair share of difficulty advancing Quebradona, which is an underground project, so I don't have a very optimistic view on Colombia suddenly being lenient when it comes to new open-pit mining permits for gold and copper projects in the country.

Given the cloudier outlook when it comes to permitting new open-pit projects in Colombia, it's difficult to assign much of a valuation to these projects, even if La Mina has completed a PEA and the company recently added considerable ounces at La Garrucha. Meanwhile, its other projects are less advanced and still working towards PEAs. Hence, it's difficult to get a solid idea of the economics of these projects, especially after the industry just experienced low double-digit inflation in 2022, which will negatively impact project economics. To summarize, while GoldMining is certainly not expensive if it can advance one of its projects to production, I don't see a clear path to this by 2027, with its most advanced project (La Mina) potentially having an uphill battle from a permitting standpoint.

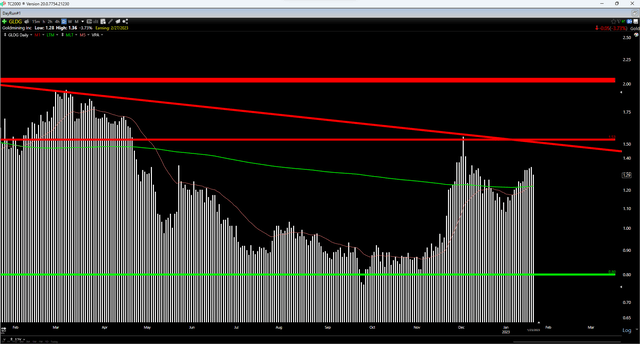

Technical Picture

Moving over to the technical picture, GoldMining has rallied to the upper portion of its trading range with the improving sentiment we've seen sector-wide, with resistance overhead at US$1.53 and no strong support until US$0.80. If we measure from a current share price of US$1.31, this leaves $0.22 in potential upside to resistance and $0.51 in potential downside to support, translating to a reward/risk ratio of 0.43 to 1.0. This represents an unfavorable reward/risk ratio and is nowhere near the 6 to 1 reward/risk ratio that I require to justify starting new positions. For GLDG to enter a low-risk buy zone, the stock would need to decline below US$0.91 at a bare minimum. Hence, this does not appear to be a low-risk buying opportunity.

Summary

While several developers have made significant progress since the end of gold's secular bear market (2016) to take advantage of hopefully pouring gold into a stronger cycle for the yellow metal, GoldMining continues to inch along at a relatively slow pace. In fact, while some companies with a laser focus have gone from first drill hole to first pour in the same period, like SilverCrest (SILV) from 2016 to 2022, GoldMining (previously Brazil Resources) has made limited progress on a relative basis (2017 acquisition of Bellhaven) and will be lucky to pour first gold at La Mina by H2 2027, assuming permitting goes smoothly. Hence, although it may have a large global gold resource, there's no clear path to the company becoming a producer.

This doesn't mean GoldMining's stock can't still do well if we see a healthy bull move in gold. Still, when shopping for riskier names, I prefer to be concentrated among those with exceptional investment theses and, ideally, world-class projects in safe jurisdictions. While La Mina isn't a bad project, I wouldn't call it world-class, and I am not anxious to own an early-stage developer with an elevated risk of further share dilution. In summary, I continue to see far more attractive ways to play the sector, and I would view any rallies above US$1.42 before April as an opportunity to book some profits in GLDG.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.