FLTR: A Great Way To Earn 5.35% This Year Without Headaches

Summary

- VanEck IG Floating Rate ETF is a short-dated, floating rate fund.

- The fund is composed of investment grade bonds solely, being overweight 'A' credits.

- 2023 is shaping up to be another very tough year for markets, with no consensus view emerging regarding a 'soft' vs 'hard' landing.

- Short-dated floating rate funds, which capture the move higher in yields are a great way to keep your cash safe this year while earning a 5.35% yield.

- This article covers Portfolio Strategy.

GOCMEN

Thesis

One of the themes circulating in the financial media late last year was that of having just kept your hard earned capital in cash in 2022. Analysts were benchmarking that very simple strategy and its return, versus the carnage in the wider financial markets. 2023 is shaping up to be another very tough year, with no clear-cut answer to the 'soft' versus 'hard' landing scenarios. A 'hard' landing would entail substantial further weakness in equities, while a 'soft' landing should see us range bound, with a downward bias.

Timing the market is virtually impossible, but as we navigate this year and the economic data it will bring we will be able to better ascertain what economic scenario is developing in front of our eyes. 2023 is going to be the year of the 'wait and see' for many asset classes, with a downward bias for many of them. Following the same logic as the one applied for 2022, but with much higher rates nowadays, we think the VanEck Vectors IG Floating Rate ETF (NYSEARCA:FLTR) is a very good investment vehicle for this environment. With a very high 30-day SEC yield of 5.35%, an investment grade portfolio and shallow drawdown profile (the maximum drawdown in 2022 was -3%) we feel the fund is well set-up to provide a retail investor with a headache free return above 5% this year, irrespective on how the wider market shapes up.

Short-dated investment grade floating rate instruments funds have suddenly become very attractive in our mind. We feel the current environment is not one where we are going to have a financial Armageddon scenario marked by sudden defaults of large financial institutions (similar to what we saw in 2008/2009). What we think we are witnessing is move out of very speculative assets (crypto, unprofitable tech) and into more value oriented investments, peppered with a stubbornly high inflationary environment and a weeding out of fundamentally weak companies (companies with negative operating earnings). Default rates are going to tick up for sure, but it is not going to be an uncontrolled spike, and it will be companies which the market has already flagged.

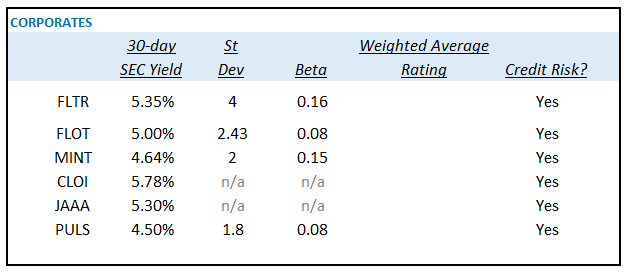

Let us have a closer look at how FLTR benchmarks against some of the other vehicles available in the market:

Corporate Funds (Author)

- For the above cohort, the average 30-day SEC yield is 5.1%

- For the above cohort, the average standard deviation is 2.56

- FLTR is on the higher side of the 30-day SEC yield, but at the same time it has a much higher standard deviation

- The standard deviation is a good proxy for a max drawdown profile, with FLTR having a maximum -3% drawdown in 2022

- Basically this means your investment in FLTR, statistically speaking, can draw down to only -4%

- Any risk-off environments in 2023 will be followed by a normalization, hence we feel FLTR will end up with a flat price performance this year

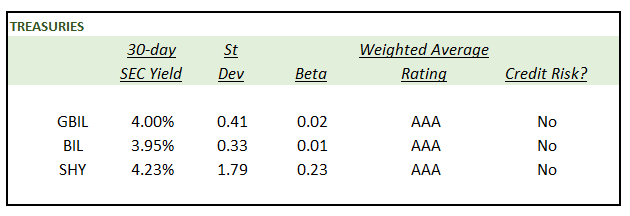

Treasury Funds (Author)

- For the above cohort, the average 30-day SEC yield is 4.06%

- For the above cohort, the average standard deviation is 0.8

- Generally speaking, short dated Treasuries funds yield 100 bps less than the corporate counterparts

Performance

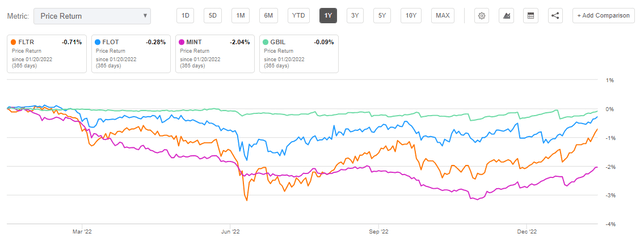

We can see how each fund's drawdown profile in 2022 closely followed its standard deviation as measured on a 3-year time-frame:

FLTR gives investors an extra kick via a higher 30-day SEC yield, but at the same time it has a wider drawdown profile. A pure AAA fund like GBIL (treasuries fund), gives up around 100 bps of yield, but it virtually has no drawdowns. However, due to the low duration of the fund assets, always expect FLTR to come back to the same price point, unless an asset in the underlying collateral defaults (we do not expect such an event).

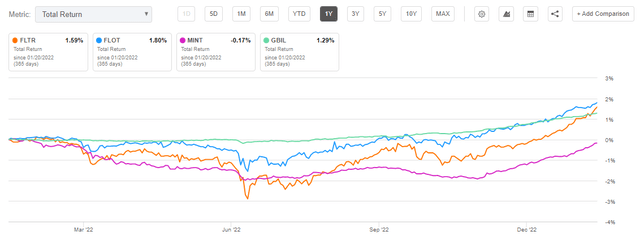

On a total return basis, we can see how the higher yields are now pushing up the total returns of the funds:

As a reminder, if we started 2022 with 4% Fed Funds rates, then the total return profiles above would be somewhere closer to the 5% mark. Higher rates today really make a difference for these floating rate funds.

Conclusion

2023 is going to be another tough year in the markets. We are witnessing a rally in risk assets currently, but without a solid improvement of the fundamental picture. We feel peak inflation is indeed behind us, but we feel inflation is going to be stickier than what the market is currently pricing. We do not see a Fed pivot or rate cut in 2023. We feel investment grade floating rate assets offer very compelling value these days, especially very short-dated funds. The article examines FLTR and benchmarks its analytics versus a cohort of peers. FLTR offers slightly higher yield but for a higher risk (via its drawdown profile). We feel this fund offers a very compelling profile for investors who want to see the investment landscape offer better transparency regarding a 'hard' or 'soft' landing. For investors looking to earn 5% plus this year without headaches, FLTR is a great choice.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.