HYDB: Optimistically Backing High-Yield Corporate Bonds

Summary

- Softening credit spreads raises the appeal of non-investment grade corporate bonds.

- The BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF provides exposure to companies still on a post-pandemic recovery course.

- Moderating inflation and lower credit spreads mean cyclical companies in the BBB region could outperform investment-grade corporate and default-free government bonds.

- BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF's monthly dividend distributions allow for favorable compounding. Moreover, the ETF serves easy and affordable access to the U.S. Bond market.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

Torsten Asmus

We might get a reasonable amount of flak for this article, as many investors fear a recession, and concurrently are staying away from high-yield bonds. However, credit spreads are narrowing, and the equity market is receiving substantial support. Thus, we believe the time is right to "risk it" on cyclical, high-yield corporate bonds with favorable interest rate sensitivity.

Today's article discusses a highly lucrative option within the high-yield corporate bond space, namely, BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF (BATS:HYDB).

The analysis assumes a quantitative vantage point with a theoretical overlay; here are a few of our key findings.

First, a top-down analysis

For those unaware, the primary determinants of a corporate bond's performance relate to the risk-free rate, inflation, inflation uncertainty, and credit spreads. Additionally, a credit spread is a parsimonious description of a company's operational health, given the current economic climate.

Fundamentally, investors want to invest in bonds while interest rates are high while speculating that interest rates will settle lower than the yield curve's estimates. By doing that, the inverse relationship between coupon payments and price returns stacks up favorably.

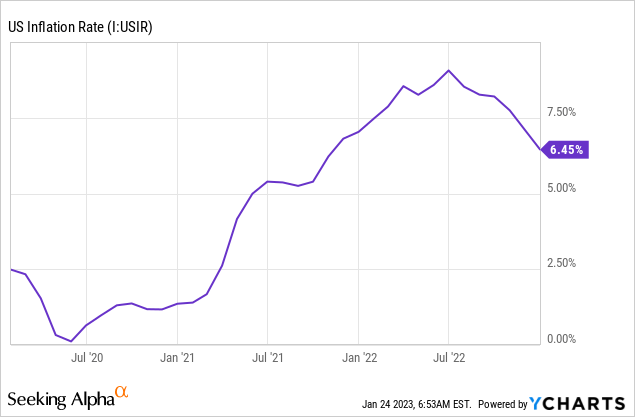

As mentioned before, the risk-free rate, inflation, and inflation uncertainty are critical in determining a bond's performance. Recent observations show that U.S. inflation is moderating, and more importantly, inflation uncertainty has softened. In tandem, these features add much desire to corporate bonds.

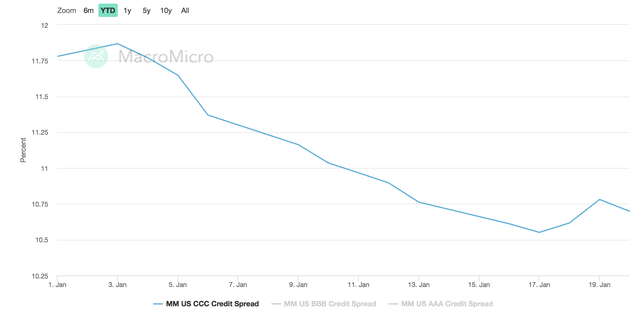

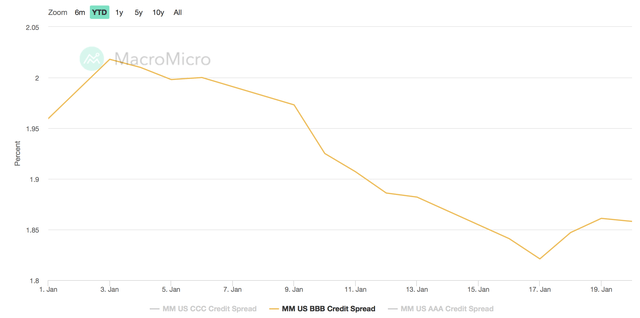

Furthermore, U.S. credit spreads for BBB and CCC-rated bonds are trending lower. Although not yet at desirable levels (1.86% and 10.7%), a year-to-date downward trajectory provides an inflation point and, more importantly, conveys investors' outlook.

U.S. CCC Credit Spread (Macro Micro) U.S. BBB Credit Spread (Macro Micro)

Theoretically, cyclical companies with lower credit ratings outperform higher-rated corporate and government bonds whenever credit spreads start narrowing. Conversely, higher spreads give rise to lower-risk bonds.

Receding credit spreads and an improved economic outlook driven by moderating inflation, re-openings in China, and a consolidating U.S. dollar provide us with enough evidence to justify a bet on higher-yield bonds. Moreover, the previously mentioned declining spread argument augments an argument for pro-cyclical industries. Keep in mind that cyclical bond exposure serves less risk than cyclical stock exposure; thus, an unfavorable cyclical equity market does not necessarily equate to an undesirable cyclical bond market.

Delving Into HYDB's Prospects

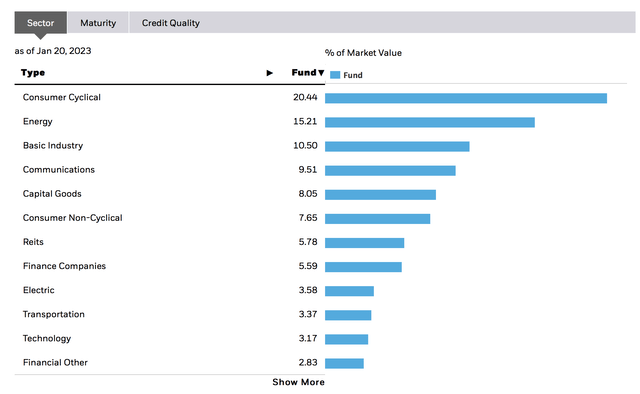

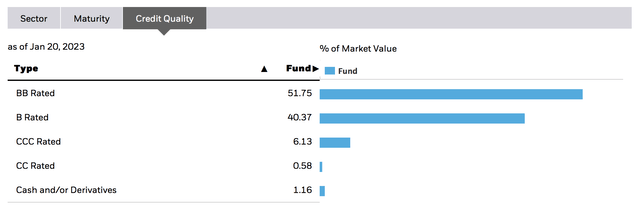

Although the exchange-traded fund ("ETF") is labeled "high-yield," more than half of its portfolio consists of investment-grade bonds (BB and above). A birds-eye view suggests its sweet spot lies within the BBB tranche, where it taps into companies with underrated credit scores.

Constituent Credit Ratings (iShares)

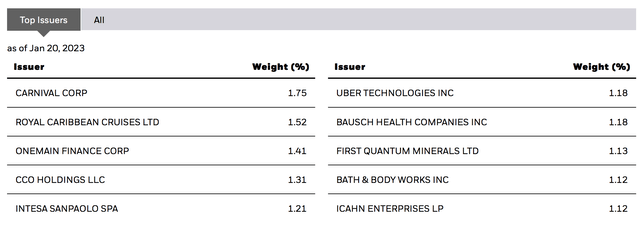

An overview of BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF's holdings communicates intelligent asset management. The fund's portfolio managers are betting on two recovery plays, namely Carnival (CCL) and Royal Caribbean Cruises (RCL), in the wake of a post-pandemic resurgence.

In addition, the ETF holds exposure to prolific companies with high capital structures amid an unfavorable year in both the equity and debt markets. The likes of Uber Technologies (UBER), Bath & Body Works (BBWI), and Icahn Enterprises (IEP) are once-in-a-decade deals, which are primarily available due to last year's macroeconomic and financial market slumps.

Primary Constituents (iShares)

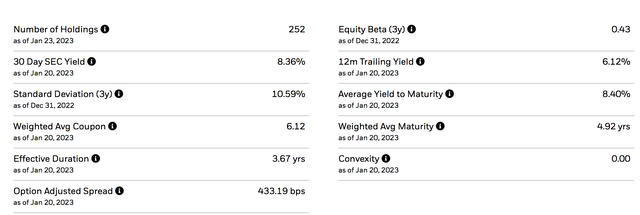

BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF possesses a fair amount of interest rate risk with its elevated effective duration. However, interest rate sensitivity is typical for high-yield bonds.

The ETF's flat convexity is an interesting feature, as it indicates that little secondary interest rate risk exists. Therefore, a preface implies that the ETF bears moderate interest rate risk for a high-yield bond vehicle.

Dividends & Expenses

A significant advantage of investing in BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF is its monthly dividend distribution policy, which enables investors to compound their money effectively.

It is estimated that the ETF's annual dividend yield will sustain above the 6% region during 2023, which is believable on the premise of its previous distributions and the possibility of the bond market reaching an inflection point this year.

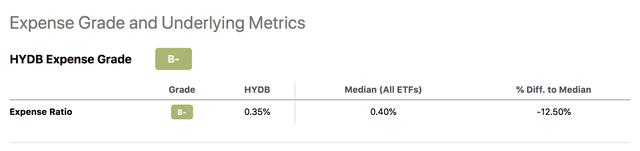

On top of its attractive income-based attributes, the ETF provides inexpensive access to a broad range of corporate bonds with an expense ratio of merely 0.35%. Into the bargain, BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF is a managed fund that provides investors with a premium service at a minimal cost.

Noteworthy Risks

As mentioned in the introduction, a possible global recession presents a substantial risk. Therefore, BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF remains a speculative bet, irrespective of credit spreads' changing trajectory.

Another concern pertains to interest rates. Although U.S. inflation has moderated, U.S. interest rate policies remain uncertain due to an opaque Federal Reserve and inconsistent global supply chains. The latter is of grave concern as inconsistent global trade challenges the U.S.'s capital and current accounts, concurrently adding risk to the bond market.

Concluding Thoughts

Today is the day we officially turn bullish on U.S.-corporate bonds amid a changing trajectory in credit spreads. Moreover, inflation is becoming easier to forecast, softening the risk premiums baked into the bond market. In our opinion, pro-cyclical U.S. corporate bonds with non-investment grade ratings will outperform highly rated bonds, which means BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF is the ideal cyclical investment.

Furthermore, the ETF possesses little secondary interest rate risk and serves investors with alluring monthly dividends at a minimal cost. Even though macroeconomic risks remain, we believe now is the time to delve into high-yield corporate bonds, and BlackRock Institutional Trust Company N.A. - iShares High Yield Bond Factor ETF provides an optimal solution.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: Global Stocks, ETFs, CEFs, and REITs.

Methods: Factor Analysis/Smart Beta, Neural Networks, Street Gossip, and Common Sense.

This is Independent Research and Not Financial Advice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.