Tata Motors: Upside Potential As It Shifts To EVs, But Currently Overvalued

Summary

- A subscriber recently contacted me via messages and asked me to take a look at Tata, because he's owned Jaguar cars for a number of years. His question was investment appeal.

- The company is the owner of luxury brands Jaguar and Land Rover - which in theory should be something relatively attractive. But the stock has underperformed for years.

- I give you my take on Tata after spending some time looking over fundamentals and valuation.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Mrinal Pal

Dear readers/followers,

Tata Motors (NYSE:TTM) is perhaps one of the more undercovered major automotive out there. When I think Tata, I think India, because, after all, it's an Indian-based automotive business. However, Tata also owns several appealing brands on the global market and could be interesting as an investment, if fundamentals are good enough and cheap enough.

However, this company has severely underperformed in the market for over a decade. The question is when is it cheap enough, and what's with the horrible performance here?

Let's review and see what we have here.

Tata Motors - Reviewing the company

It doesn't take long when looking at Tata Motors to find some fundamental issues with the company that would cause it to be a hard sell to conservative investors, despite some of the interesting advantages to the company.

First off, Tata is BB-rated. It's junk, and just a notch from Single-letter B, which is the worst automotive I've seen. Secondly, no dividend, in a world where automotive companies like Volkswagen (OTCPK:VWAGY) pay over 6% on their very safe prefs. Third, it's based in India, which isn't exactly known for stability and which has some real issues.

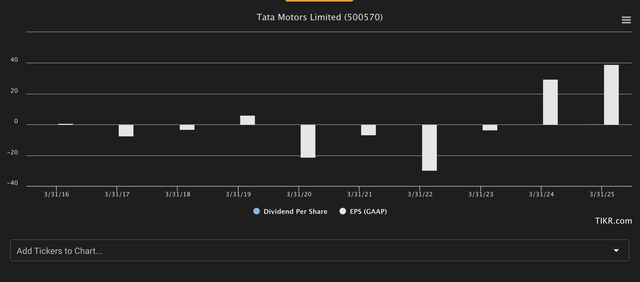

Third, it's pretty far from being a profitable and stable business over the past 10 years, looking at the more accurate native ticker, known as 500570.

Tata Motors Earnings/dividends (F.A.S.T graphs)

Now, on a high level, the company has some interesting brands. It owns things like:

- Daewoo

- Jaguar

- Land Rover

- Tata Motors

It also owns a number of JVs and other operations, including machinery, bus manufacturing, trucks, business outsourcing services, and some other things. The company is all over the map, really.

One of the things you need to understand is that the manufacturing of Tata is mostly based in India, Argentina, South Africa, and Thailand. It does have some plants in the UK owing to Land Rover and Jaguar, but it's mostly in Asia. Nonetheless, Tata is actually one of the largest 500 companies in the world, ranked around 250th or thereabouts depending on what year you look at.

It's also pretty famous for building the world's cheapest car, on a level with motorcycles and scooters, known as the Tata Nano, which sold for $1,300 MSRP, but with sales cratering due to a mix of engine fires, lack of safety, cost cutting (surprise surprise at $1,300) and it's generally turning out to be a money-loss project. To put it in modern terms, this was a 2018 production car that lacked power steering, had no airbags, and no external fuel filler cap.

However, the biggest challenge faced by international investors, such as those investing in the current TTM ticker, is the fact that Tata is going to delist its NYSE shares. That means that not only will you not be able to invest in the TTM ticker going forward, all OTC trading of the company is prohibited. This is fairly unique, but in accordance with Indian law, which given Tata's circumstances, does not allow for this to be done. If you do not voluntary sell your shares, you will be forcibly liquidated once this goes into effect.

This greatly influences Tata as an investment, because it means that the only way to invest in Tata is by investing in India on the BSE. Now, I can invest in BSE. IBKR allows investing in BSE stocks as well. It's not unworkable, but as with anything that becomes more complex or a hassle compared to the convenience of NYSE investing, it needs to be put into context of what else is available on the market.

More information can be found here.

Given that we're talking about an Indian stock with no dividend (at least at the moment), doubtful current profitability (but potential forward profitability) and tricky valuation in a volatile macro, it doesn't take much to consider here that we might be looking at a company that for most investors might not be "worth it" any longer.

Let's take a closer look here.

Tata is perhaps driving one of the most ambitious EV transformation programs in the current automotive industry.

This also includes the European portions of the company's brands, the JLR brands, including Jaguar and Land Rover. It combines both environment-friendly generation, as well as products, focusing on electrical and ESG-friendly products. If you're a fan of such a strategy, then Tata may be a perfect fit for you.

However, as of this particular time, the only things that Tata can present that give sort of advantages here, are things like lowered injury/accident ratios, higher renewable generation, planned operational changes, spending to wildlife reserves and nature organizations, and a whole slew of net-zero ambitions across the board of the company's operations.

You'll notice that such things are not the bottom line - they're not even top-line. They're fluff - that's currently all they are. I'm a hard numbers sort of analyst. And the hard numbers, as they currently stand for 2022 and the latest numbers we do have out of the company, are not that great.

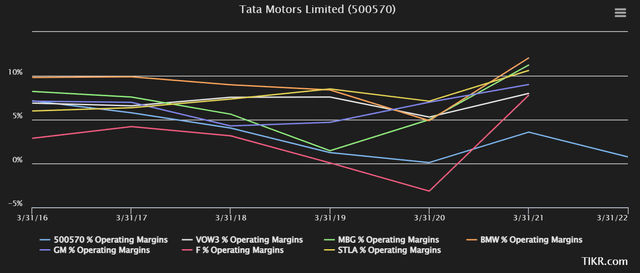

To illustrate this, I give you Tata's current operational margins compared to most of the peers that I either cover, or that are relevant next to Tata. As you can see, there is a substantial, 5%+ difference that the company has not yet recovered from - and the argument that Tata is currently doing EV transformation holds no water in this context - all of the companies have been doing this for several years. In terms of GM, OM, Profit margins overall, and overall returns, Tata is simply lagging the competition by a significant/non-trivial amount here.

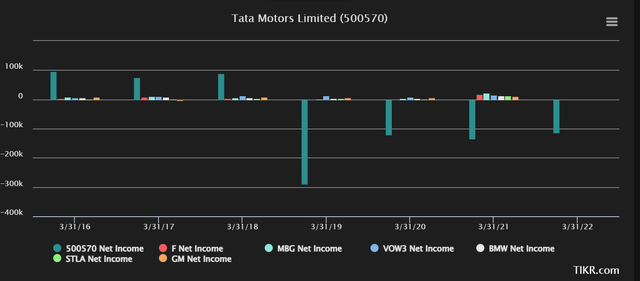

And I can make it look a lot worse. Let's take a look at once these numbers flow further towards the bottom line, towards the net results.

Tata is far more volatile than their already-volatile peers, and COVID-19 managed to completely destroy any net results the company might have generated. The last time the company paid any sort of dividend was back in 2016, and the lack of fundamental safety for the company is reflected in its corresponding lack of a good credit rating. BB- is just not that good.

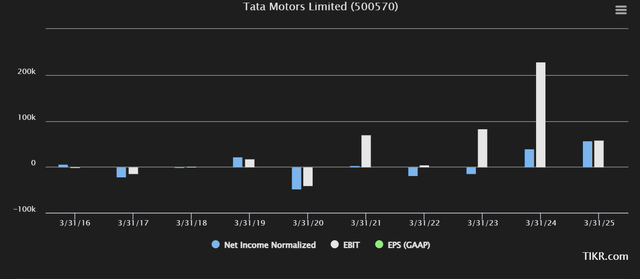

Now, the shining hope for Tata lies in the next few years, and the EV pushes and sales that Tata hopes will be able to deliver the company back to profitability. Here are the forecasts for those coming few years and what they are expected to bring overall.

It's going to be beyond 2024 before net income turns truly positive, and some time before an annual positive EBIT. A combination of jumps in sales, cost savings, efficiencies, and a shift to EVs is expected to bring about these changes.

For me, I regard Tata with both eyebrows raised when it comes to comparing its appeal to literally any of the currently listed major automotive companies out there.

Let's look at how this situation influences valuation.

Tata Motors - Despite a cheap valuation, not that attractive

So, one of the things I look for when investing in businesses is a fundamental level of safety, quality, a good dividend, and historical stability. Tata Motors offers none of these things. Other companies have better dividends, better fundamentals, better stability despite downturns, and better safety overall. This almost makes the company a no-go from the beginning for me, and unless the company is being traded at essentially dirt-cheap multiples for its assets, I wouldn't be interested in buying.

This is further expanded upon by the fact that the company is delisting from NYSE, making investing in Tata much more complex.

First off, you know the peer group - it's an international group of companies. Because the earnings are so poor, the company's P/E is actually very elevated at this time, almost 19x P/E. The peers are rated above a quarter of this, maybe a third. Even if we normalize adjusted earnings at a higher level, the P/E is still relatively substantial here, and not something I would consider all that attractive.

What illustrates how cheap Tata has become here is looking at revenue and book multiples, as well as sales multiples. Sales are below 1x, revenue below 0.8x and book multiples are below peers as well. However, all of that needs to be put into the context that all of the peers are BBB-rated or equivalent, and Tata is at least 3 notches below that.

The company forecasts massive increases across the board here. So, it becomes a question, just how accurate are those forecasts?

Yeah...no.

Tata forecast accuracy (F.A.S.T graphs)

This is the reason for the title of the article, the company being unstable as a Nano. This is the first company where the company/analysts have been successively unable, even with a 10% margin of error, to forecast results without it being more than 10% below par. That means that I consider the company's forecast and the analyst forecasts about as useful as this data implies - not very useful at all.

The current average targets for Tata Motors, compared to the current native of ₹403.10, come to ₹491, which implies an upside of around 22% from a range of ₹320 to ₹575. But again, my using these targets to indicate any sort of a realistic upside for Tata Motors, is not really relevant given the volatility of the company.

30 Analysts follow the native Indian ticker - 22 of them are at a "BUY" and equivalent. I am not one of them. Because of the company's historical underperformance and how bad things have been, coupled with how difficult it seems to forecast, or for the company to deliver on its promises, means that I am unwilling to give the company a peer-average multiple next to another automotive. This is further justified by Tata's lack of a credit rating, all lack of a dividend for the past few years.

So, it's with a heavy heart (to my follower) that I'm going to have to issue the following stance on Tata.

I think Tata Motors is probably the least attractive investment in the automotive sector at this time, barring perhaps Tesla (TSLA) - remember, I'm not a growth investor. The combination of these incredibly negative trends, coupled with the extremely poor forecast accuracy, coupled with the lack of any sort of good fundamentals, makes this an absolute no-go for me.

I would be willing to pick this company up on the extreme cheap - and this is going by what I would need in order to pick up the phone, call my broker, and ask him to place an order on the Bombay Stock Exchange.

So, this is my thesis for Tata Motors.

Thesis

- Tata Motors is perhaps the least-attractive company in the automotive sector based on the company's valuation, the company fundamentals, and the company upside. I see an upside for how the company shifts to EVs, but the timeframe and how certain it is that it will happen with the costs that the company expects. Couple that with having to buy on the BSE, and I don't like what I see with Tata here.

- I would be willing to pick up Tata on the extreme cheap - at this point, I consider that being ₹ 275 per share, implying a below-0.5x sales and revenue multiple.

- That means Tata is actually too expensive here, and I take a different tack here, consider it a "HOLD" with an overvaluation.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This is an unusual situation, where the company fulfills most of the pricing criteria, but none of the quality ones. This one is a "HOLD" here.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of VWAGY, MBGYY, BMWYY, STLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. The author's intent is never to give personalized financial advice, and publications are to be viewed as research and company interest pieces.

The author owns the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in the articles. The author owns the Canadian tickers of all Canadian stocks written about.