Stocks Set To Benefit From China's Reopening In 2023

Summary

- China's reopening from strict COVID lockdowns is likely to lead to strong stock gains for certain companies.

- I'm expecting strong returns for Alibaba, Pinduoduo, China Automotive, and JD.com in 2023.

- China's large population can drive strong growth for these companies as the economy opens up.

- Looking for a helping hand in the market? Members of Margin of Safety Investing get exclusive ideas and guidance to navigate any climate. Learn More »

AsiaVision/E+ via Getty Images

China's strict zero-COVID policy had a negative impact on the sentiment for China-based stocks, driving them down over the past two years. China's recent announcement of discontinuing quarantine requirements for international arrivals has already demonstrated to change sentiment from negative to positive. As a result, China-based stocks have been rising in 2023.

I have identified four stocks that I expect to outperform in 2023 driven by the new optimism for China-based stocks and the expected increase in economic activity. China's large population of 1.45 billion people can help drive strong growth as economic activity increases this year.

Alibaba (BABA)

Alibaba's stock took a steep hit from multiple fears over the past two years. The strict zero-COVID policy in China was one factor driving the stock down. Another reason was fears of a delisting of the stock from U.S. exchanges. Both of these negative catalysts have changed to positive. The delisting fears subsided when the U.S. obtained access to audit data, giving more transparency to China-based companies.

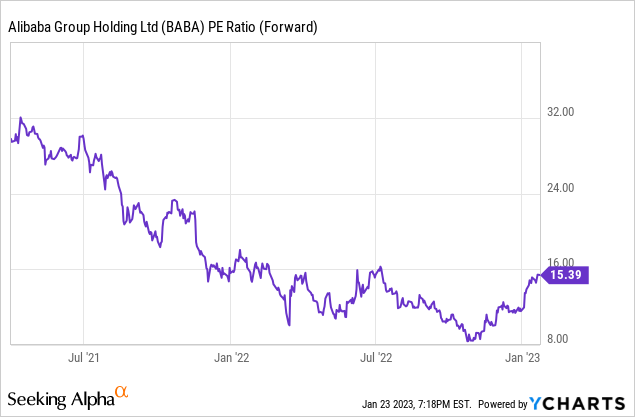

The stock may look fairly valued on the surface with a forward PE of about 15.5 and a PEG ratio of 2.24. However, Alibaba's EPS estimates have been increased which is driving the stock up. Furthermore, Alibaba historically has traded with an above-average valuation.

The chart above shows the large drop in the forward PE ratio over the past 2 years and the higher levels of where it was trading before the decline. It also shows a recent recovery, which I expect to continue for the foreseeable future. I expect investors to come back into the stock with the new positive sentiment.

Overall, I think there is a lot more room for the stock to run higher as investors revalue Alibaba for a prosperous economy in China and a return to the company's glory days. The run higher is also likely to occur because the negative sentiment regarding the COVID lockdowns and delisting fears are out of the way for now.

Pinduoduo (PDD)

Another China-based stock that took a big hit over the past two years, but is poised for a recovery in 2023 is Pinduoduo. This company operates as an e-commerce business which offers a variety of products including shoes, apparel, food, furniture, appliances, auto accessories, sporting goods, cosmetics, and more.

After a two year sell-off which more than cut the stock price in half, Pinduoduo is now valued attractively with a PEG ratio of 0.57. The PEG is based on PDD's 3 - 5 year expected annual EPS growth of 42%. The PEG ratio below one shows that the earnings growth rate is higher than the forward PE, giving the stock a low valuation.

PDD had a series of upward earnings revisions for 2023 which are likely to drive the stock higher from this low valuation level. The company's high profitability metrics such as an ROE of 33% and ROIC of 17% help drive PDD's strong earnings growth. PDD also benefits from wide profit margins: GM of 75%, EBITDA margin of 26%, and net income margin of 24%. These are significantly above the sector median GM of 36%, EBITDA margin of 11%, and net income margin of 5%.

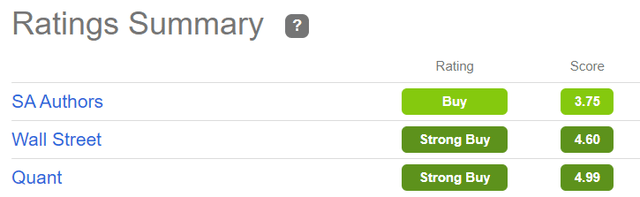

PDD has a strong buy quant rating according to Seeking Alpha's quant rating system. Stocks with a strong buy quant rating tend to outperform the S&P 500 (SPY). The high rating for PDD was driven by growth, profitability, positive momentum, and upward earnings revisions.

China Automotive Systems (CAAS)

China Automotive manufactures and sells auto systems and components such as rack and pinion/electronic/hydraulic power steering parts, sensor modules, motors, intelligent automotive technology R&D services, etc. CAAS is likely to benefit from the 3% expected increase to $27.6 million for auto sales in China in 2023. Higher demand for autos as China opens up is likely to increase demand for the parts that CAAS produces.

CAAS is trading with a bargain valuation with a forward PE of 10.8 and forward price/sales of just 0.38. China Automotive is trading much lower than the sector median forward PE of 15.5 and forward price/sales of 0.93. This leaves plenty of room for upside stock price potential as the company continues to grow.

CAAS is expected to grow revenue at 8% in 2023. The company struggled with a net loss in 2020. However, CAAS was profitable the past two years as the cost of revenue and SG&A decreased as a percentage of revenue since 2020. The company is expected to remain profitable in 2023.

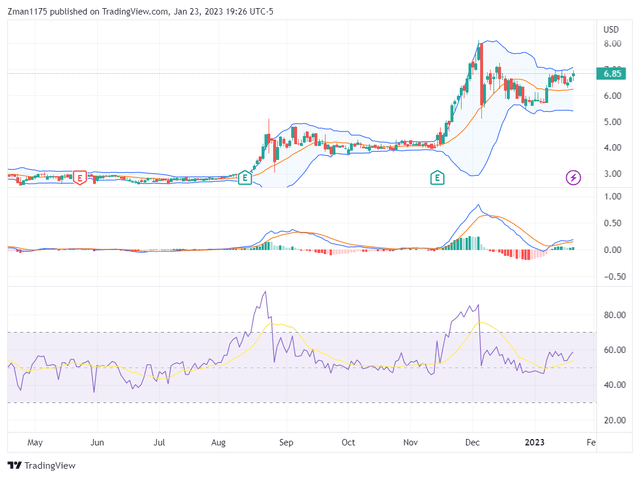

China Automotive (daily chart) (tradingview.com)

The chart above shows that CAAS might be poised to break higher from the current bull flag formation. The RSI (purple line) rose into the bullish zone above 50 and the MACD made a bullish crossover recently. It is possible that we could see another bull run similar to the one that occurred in November. CAAS also has a strong buy quant rating in SA's rating system.

JD.com (JD)

JD.com is China's largest online retailer which also operates brick and mortar locations. JD.com provides supply-chain based technologies and services. The company also offers computers, electronic products, appliances, furniture, food, baby and maternity products, cosmetics, jewelry, and other products.

The company made improvements in operating quality and stability while driving stable growth over the past year. For example, JD's cost of revenue and total operating expenses decreased as a percentage of revenue in recent quarters as compared to 2021. This allowed margins to widen for improved profitability. JD's margins are thin due to the nature of the business. So, any improvements in margins and profitability are positive.

JD.com is valued attractively with a PEG ratio of just 0.75. This is based on JD's 3 - 5 year estimated annual EPS growth of about 33%. I consider growth stocks with a PEG below one to be a bargain. The stock has plenty of room to run higher at this low valuation.

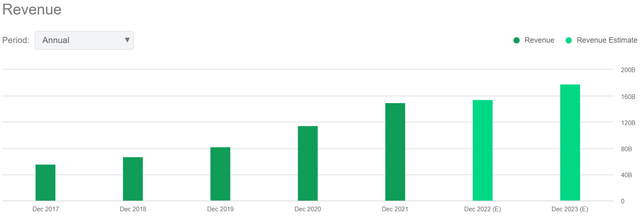

Revenue is expected to grow at about 15% while earnings are expected to increase by about 23% in 2023. This strong growth is likely to catalyze the stock higher for above-average gains from the low valuation. JD is also a 'strong buy' according to SA's quant rating system.

The chart above shows JD's steady revenue growth. There should be a sizeable jump from 2022 to 2023 as a result of the relaxing of the strict COVID lockdowns in China.

Conclusion

The reopening of China from the zero-COVID policy marks a positive change in investor sentiment. It should also help drive increased economic activity for these companies. I expect these companies to continue their new positive momentum in 2023 for both business and stock growth. The tailwinds from the reopening have a strong potential to allow these stocks to outperform in 2023. Of course, there are no guarantees. China could reinstate strict COVID policies if it feels the need to. It is important to understand that risk.

Consider joining Kirk Spano's Margin of Safety Investing which offers a more in-depth analysis of individual companies.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn the 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.

This article was written by

Through diligent analysis, he is ranked in the top 1% of blogging analysts on Tipranks.com for performance and accuracy. David previously contributed to Kirk Spano's Margin of Safety Investing [MoSI] Marketplace Service and Risk Research Inc.

David focuses on growth & momentum stocks that are reasonably priced and likely to outperform the market over the long-term. He is a long term investor of quality stocks and uses options for strategy.

David told investors to buy in March 2009 at the bottom of the financial crisis. The S&P 500 increased 367% and the Nasdaq increased 685% from 2009 through 2019.

He wants to help make people money by investing in high-quality growth stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.