Walt Disney Is Worth $157 And Why Nelson Peltz Is Not Necessary

Summary

- The Walt Disney Company is in the middle of a proxy battle with Nelson Peltz from Trian Partners.

- We don't anticipate the Walt Disney board to give up any seats willingly, and the demands made by the activist are incompatible with the direction of the company.

- Growth thesis and earnings momentum remains compelling, giving us optimism on near-term results and long-term growth runway.

- We value Walt Disney at $157 per share, representing 50%+ upside, and estimate dil. EPS of $5.81 for FY '24.

- We recommend Walt Disney stock as a buy, and side with the existing management and board.

Drew Angerer

We love The Walt Disney Company (NYSE:DIS) and the films the franchise has produced over the course of its entire lifetime, and find ourselves at a difficult crossroads when describing the condition of the company. At present we value DIS at FY ‘24 $5.81 dil. EPS representing 41% y/y dil. EPS growth from FY ’23 consensus estimates. We value the firm at 34x FY ’24 dil. EPS or $197 per share, and discount the value by 9.56% or the firm’s WACC to arrive at a valuation of $157 per share representing 49%+ upside from present levels. Our price target estimate is higher than the consensus average price target estimate of $125, as we anticipate improving bottom line metrics will become top priority following the recent board seat battle with Nelson Peltz.

Walt Disney’s profitability should improve even without the involvement of an activist, as we anticipate added contribution revenue from resorts, and also Disney+. There’s also a transition path to linear-television, as we anticipate more successful service offerings will appeal to a global audience, like YouTubeTV. This diminishes the risks of losing carrier coverage fees as Internet-equivalent linear TV emerges. As such, we recommend Walt Disney stock as a buy, as we think the risk factors seem exaggerated and the underlying company is attractively valued for long-term growth.

The biggest issue on the minds of investors is whether there’s going to be another activist in the stock on top of Daniel Loeb from Third Point with his existing board member, Carolyn Everson. An argument could be made that the inclusion of a value-oriented fund manager could cause too many conflicting interests in a transformational shift at the Walt Disney company. In other words, there are too many chefs in the kitchen.

Biggest item to watch for? An activist by the name Nelson Peltz?

Walt Disney is in the fight for its life as it makes a hasty transition into the world of streaming while fighting an uphill battle in its resorts division. Expectations for a mature and profitable subscription model have gotten so ridiculous that it’s almost like investors have to watch another decade rerun of Netflix (NFLX) to arrive at the unenviable conclusion that with Walt Disney’s $200 million to $300 million movie budgets, there’s just no way in heck the Disney+ streaming model makes profits as quickly as NFLX’s lower-budget TV shows and films.

Not to mention, the inclusion of an activist by the name Nelson Peltz, a guy who has a great track record on Wall Street but no track record in the media industry, calling the shots on Walt Disney’s film budget sounds ridiculous and laughable. We doubt Walt Disney’s going to cut back on the special effects for the next season of The Book of Boba Fett just to keep Nelson Peltz happy on film budget. In fact, we don’t really think Walt Disney cares about what investors think about the transition other than they got to execute on a transition regardless of how much it actually costs.

Watching some random activist opine on Walt Disney’s film budget for the next five years is almost as offensive as watching the censorship China pulled on various Walt Disney characters this past decade. Basically, we don’t really think the Walt Disney board has any appetite or interest in entertaining Nelson Peltz for his board seat as he makes the confounding comparison of low-budget NFLX versus budget-heavy Walt Disney.

If anything, Disney CEO Bob Iger has already worked quickly to shut down Nelson and his bogus attempt at getting a board seat. From our perspective, we don’t think it’s intelligent, nor practical, to get a number-cruncher from New York behind the world’s most trusted consumer brand for entertainment.

The board seat would lead to all sorts of problems for the creatively minded company, and cheapen the perception of the Walt Disney brand while also damaging industry relationships. It’s the type of short-term Wall Street optimized excel spreadsheet model that leads many companies to make short-term decisions to the detriment of long-term stakeholders. Regardless of how well intentioned Trian Partners looks with its attempt at activism, we just don’t think the prescription for Walt Disney is to cater to this hedge fund, nor should a hedge fund manager have so much authority over a national treasure like Walt Disney.

What’s difficult to stomach about transition is that it’s costly

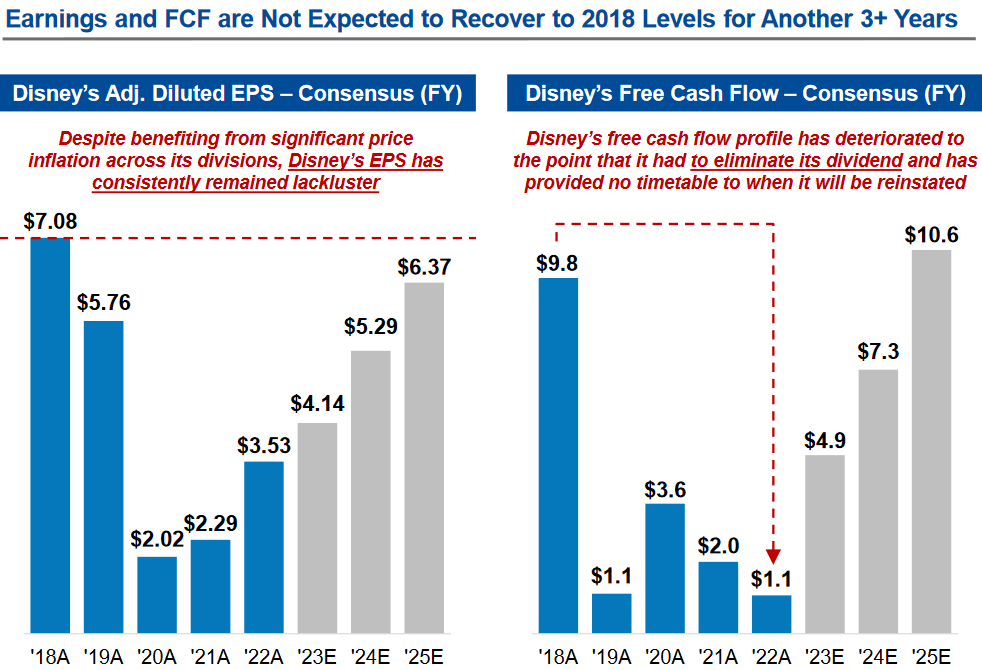

We might be in for a financial bloodbath to get to the promised land. And yes, we think Walt Disney will trade at a premium through all of this, because it’s a consumer brand that investors still love even if it’s not generating the big profit margins it was once known for. Even so, according to the presentation, Nelson wants Walt Disney to reinstate the dividend plan, and also generate profitability at a much higher rate.

Figure 1. Presentation on Adj. EPS and FCF metrics

Trian Fund Presentation (Trian Fund Presentation)

Hence, the company’s earnings may take a while longer to improve, but we can stomach loss of profits if sales were to materially accelerate, which is what will likely occur with additional subscriber growth. Markets care more about a compelling revenue growth story followed by the heroic achievement of a visionary CEO than they care about the optimization of profits at the expense of building long-term value for shareholders.

Walt Disney responds to the proxy threat very directly

Following the appointment of Mark Parker to Chairman of the board, Walt Disney released this statement publicly regarding Nelson’s attempts at winning a proxy battle against Walt Disney:

The Walt Disney Company remains open to constructive engagement and ideas that help drive shareholder value. While senior leadership of The Walt Disney Company and its Board of Directors have engaged with Mr. Peltz numerous times over the last few months, the Board does not endorse the Trian Group nominee, and recommends that shareholders not support its nominee, and instead vote FOR all the Company’s nominees.

We laude the management team and board for sticking through an expensive period of transition and making the necessary investments despite the criticisms from public market investors inclusive of Mr. Peltz and Trian Group Fund.

We think shareholders should stay the course and ignore profit optimization in favor of growth. Though our financial model does reflect an improvement in profitability, we’re more excited about the inherent global subscriber streaming opportunity of 500 million to 1 billion subscribers that Walt Disney can pursue over the next 10-year period. Meaning that if Walt Disney were to pull back on spending right now, it would diminish the likelihood of reaching a global viewing audience.

There actually is a future for linear live event programming - just dump the box

We think Walt Disney will transition its linear channels successfully to the Internet. Alphabet (GOOG, GOOGL) with $300 billion + in financial assets on the balance sheet, is the best-funded company to bridge the remaining bundle for linear channel programming on strictly the Internet… In fact, there’s no hedge fund on planet earth that has more money on the balance sheet to match Alphabet’s willingness to dictate the terms of the Internet TV transition at present. Among the big tech firms, Alphabet is the most committed to unloading its war chest to make YouTube the most dominant Internet TV brand at present. Amazon and Netflix ran out of money ages ago to keep up with Alphabet, and Apple (AAPL) is starting to realize how bad a dividend policy can be in an age where next-generation tech companies are capable of buying out entire content segments and thus likely forcing any type of programming into its TV ecosystem.

We think Walt Disney cut its dividend policy in response to the existential threat of co-existing with Alphabet, a $1.3 trillion company. We do not question Walt Disney in quickly modernizing its company to compete and stay ahead of the competition. Walt Disney needs to maintain its own market segment in the entertainment industry and become a growth oriented company as quickly as possible. Trust Bob Iger, and ignore the overnight value investor looking to make a quick buck.

We believe that from 2023 onwards, the primary argument for using a conventional TV box will end as YouTube has secured the NFL Sunday Ticket, thus closing the loop on all major sports networks inclusive of the most expensive broadcasting rights. Alphabet has also secured all major news rights for both broadcast, digital, and even digital print. You also probably found this article because of the Google News tab, and it’s not likely that Alphabet will lose live programming, news, and live events to the conventional cable box providers... given its overwhelming war chest, existing network, and already impressive content bundle.

We also think there’s a future for Internet linear television, with Alphabet and Walt Disney leading the transition given the vast content portfolio that YouTube will depend upon from conventional media brands like Walt Disney in order to generate subscription figures. The value proposition will gear heavily towards content creators as opposed to the Internet + channel bundle that has shrunk to a more modest 70 million United States subscriber pool.

At present, Alphabet will be the low-cost middleman looking to swipe the conventional box providers, i.e., Comcast, Time Warner Cable, Cox, by exerting much lower pricing as a middleman, effectively wiping out the TV broker/box model by providing the lowest cost Internet TV, and Google Fiber to subscribers. Instead, those who own the content and channels, i.e., Walt Disney, will likely survive and make money regardless because instead of being middle men. They own the underlying rights to their channels, and benefit from being able to earn money directly from consumers, or from emerging TV bundle alternatives such as YouTube TV.

Walt Disney must maintain and grow its content moat

The production cost of each Walt Disney movie is beyond that of any other streaming provider, and requires a mix of revenue sources to sustain. Furthermore, in this environment it would be devastating and harmful to the movie and production industry to demand a reduction in spending for achieving profitability when there’s clearly an emerging Internet TV opportunity that’s vastly superior to the existing cable model presented.

We appreciate the fact that Walt Disney has consolidated an even larger portfolio of media assets in an environment where it’s difficult to generate the type of approvals among large shareholders needed to execute transactions such as Fox, and also Hulu. We think retention of the ESPN brand in conjunction with the FOX Sports channels leads to an immense hold on the sports programming market, and it’s why Walt Disney’s channels will work well in an Internet TV transition, and also benefit the Disney+ app.

The market for linear TV might actually expand if people can just dump the box and keep the content programming in a linear format with choices on the amounts of ads for live programmed events. We also anticipate that with good execution, companies like Live Nation (LYV) which we also cover, can also distribute rights to watch live performances on various Internet platforms such as YouTubeTV or Disney+ creating a new revenue source for live programming and LiveNation performers as well.

There’s a lot of upside to the existing Internet digital transition. Bob Iger’s willingness to spend big to generate hit after hit movie and also his willingness to further expand the channel portfolio positions Walt Disney well among various competitors. We’re almost certain that the willingness to take risks and further expand upon The Walt Disney Company brand is what the founder, Walter Elias Disney, would have wanted.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.