After a tumultuous 2022, the budget event is all set for a renewed expectations of hope for every common man. Each of us have some expectation from the budget with opinions galore on what the Finance Minister can do to improve our lives, earn and take home more. So, how can the budget accelerate the growth agenda and present India as the growth engine of the world?

After three consecutive years of set back from “uncontrolled” events, now is the time to shift gears. The first gear being fiscal consolidation to reaffirm economic and financial stability. The pandemic has put the fiscal consolidation road map on a back seat. It is time to revise the targets and give a clear road map for fiscal consolidation. A roadmap is important to reinforce the confidence that government will not spend incessantly especially on the revenue front.

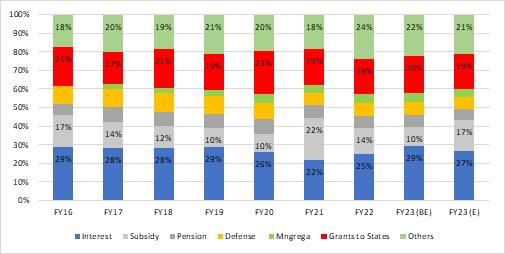

Fiscal consolidation can come from two levers – revenue increase and expenditure rationalisation. Tax revenues growth will be supported by nominal growth while indirect taxes could be limited to support from domestic activity as any fillip from external side (customs) or bounty from an oil price decline (excise) is unlikely. Divestment and its long-term vision are critical for support. The scope for rationalisation on the revenue front will come from holding back the impulse to any increase in subsidies.

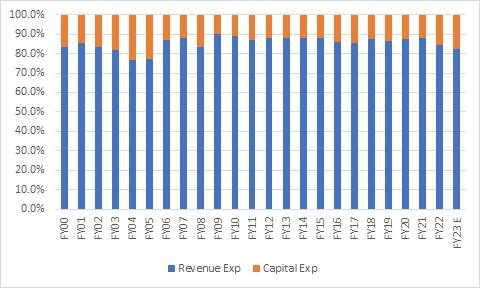

The next lever – Capital expenditure to take us to the $5 trillion economy. A rupee of capital spend has a potential GDP multiplier of ~3.25 times while revenue expenditure is less than 1. Last two years, government has pressed its foot on the capex, increasing the share of in overall expenditure. That should continue with spending focus in railways, roads, defense and encouraging states to spend as well.

Notably, the PLI (Production Linked Incentive) Scheme in 13 sectors, has been met with success with the Rs 2 lakh crore of capex implementation. More sectors could be added in this scheme which has potential for boosting revenues, jobs, exports, and reducing import dependency. Overall, government will clearly intend to boost capex not just from its own resources but also encouraging private capex.

That takes us to the third lever – Commitment to deliver the stated objectives in parts and whole. While we have seen government’s intent to deliver on its promises is strong, what we have seen in the past is that there is compromise on certain areas like divestment, subsidies, and slowdown in pace of execution especially capital spending (including states). The headlines and the intent has always been compelling while execution lagging. Commitment to execute should be strong.

Growth is the beneficiary of all the three levers. The three levers work in tandem. If capex will provide boost to growth, then fiscal consolidation is necessary. Otherwise, government borrowing will crowd out private capex funding. If government is pushing PLI with one hand, the other hand needs to balance out its borrowing as well. Despite external headwinds, domestic growth is holding up well. External headwinds while not in control, has been balanced well by policy makers over the last three years. Budget statement will reaffirm that India’s fundamentals will remain strong.

India is the shining star amidst a shallow global growth. This is the moment for India to capture and showcase a structural plan. Focusing on the first three gears can easily move the economy into auto-gear into the fourth and fifth step. This budget is all about shifting gears to accelerate growth!

Exhibit -1: Share of Central Govt. Budget Expenditure – Revenue and Capex: Share of capex increasing

Exhibit -2: Share of Revenue Expenditure Categories: Interest and subsidy occupy a major share

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.