Asian Paints is expected to report single-digit year-on-year growth in net profit in the third quarter of FY23 on the back of muted volume offtake and weak demand, a poll showed.

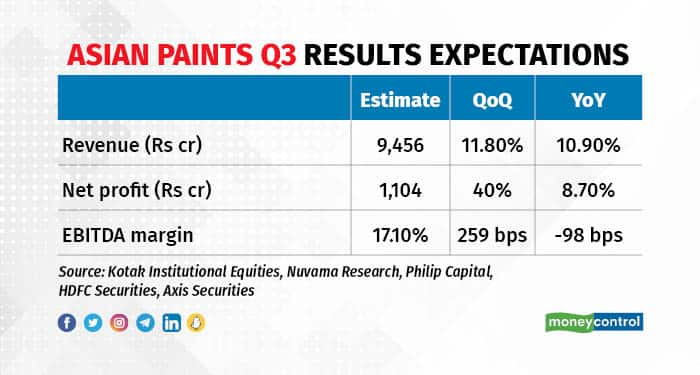

Net profit is expected to grow 8.7 percent to Rs 1,104 crore from a year earlier and sequentially by 40 percent, according to the average of estimates of brokerages polled by Moneycontrol. Revenue is expected to rise 10.9 percent YoY to Rs 9,456 crore.

The company is scheduled to announce its Q3 results during market hours on January 19.

The numbers are set to be hit due to muted volume growth, analysts said. One reason is the high base effect.

“We expect overall volume growth of 4 percent YoY on a base of 18 percent YoY in Q3 FY22,” analysts at Nuvama Research noted.

Volume growth will also be impacted due to extended rainfall in October, which affected festive demand. Moreover, pent-up after the COVID-19 lockdowns has eased and inflation has affected discretionary spending. All this will impact volumes, analysts said.

“However, November and December marked a good recovery, particularly in exterior paints, which is a higher-margin product,” Nuvama Research said.

EBITDA (earnings before interest, taxes, depreciation and amortisation) margin for the quarter has been pegged at 17.1 percent, higher by 250 basis points sequentially.

According to Kotak Institutional Equities, margin expansion will come on the back of a further fall in crude oil prices, but will be partly offset by deterioration in the product mix.

“We expect EBITDA margin to contract YoY due to lower operating leverage,” it added.

Asian Paints said on January 8 it will set up a water-based paint manufacturing facility with an annual capacity of 4 lakh kilolitres soon. The investment of Rs 2,000 crore for the project would be in addition to the Rs 6,750 crore expenditure announced in the Q2 results, said analysts.

Apart from the company’s capex plans, investors will also track comments on the demand outlook in the metros and tier 2/3 towns, raw material pricing, and increased competitive intensity.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.