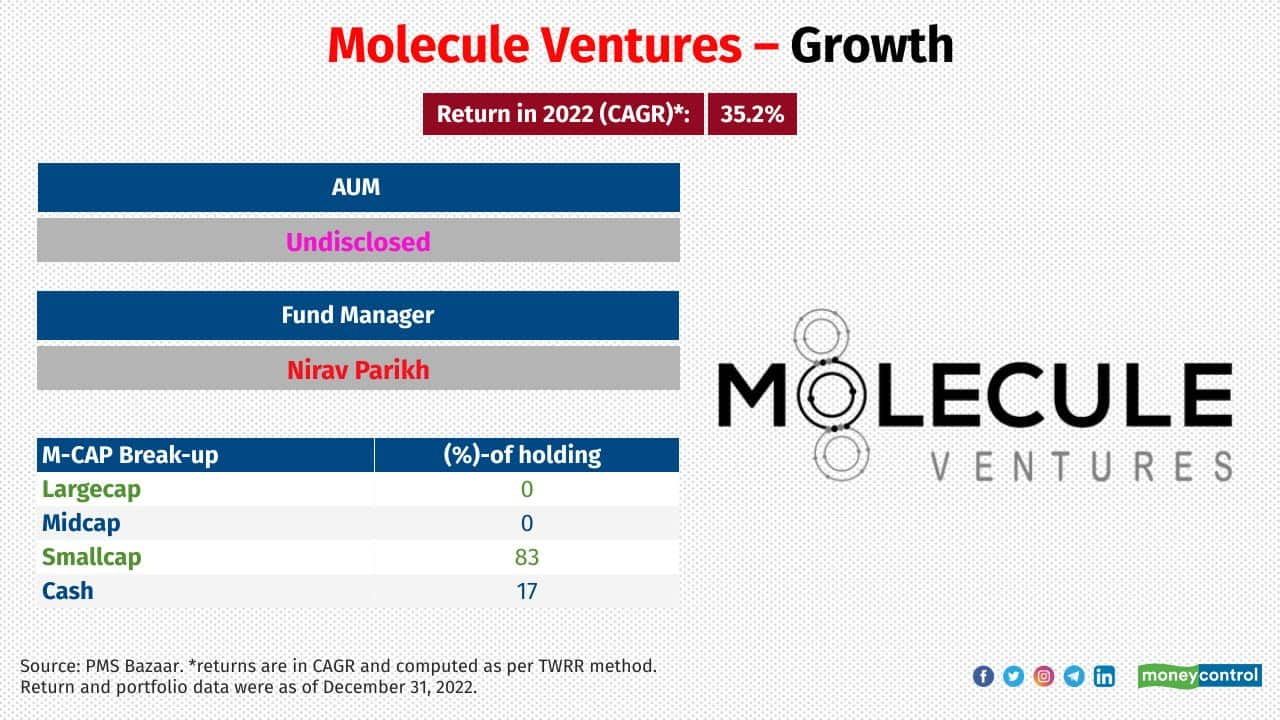

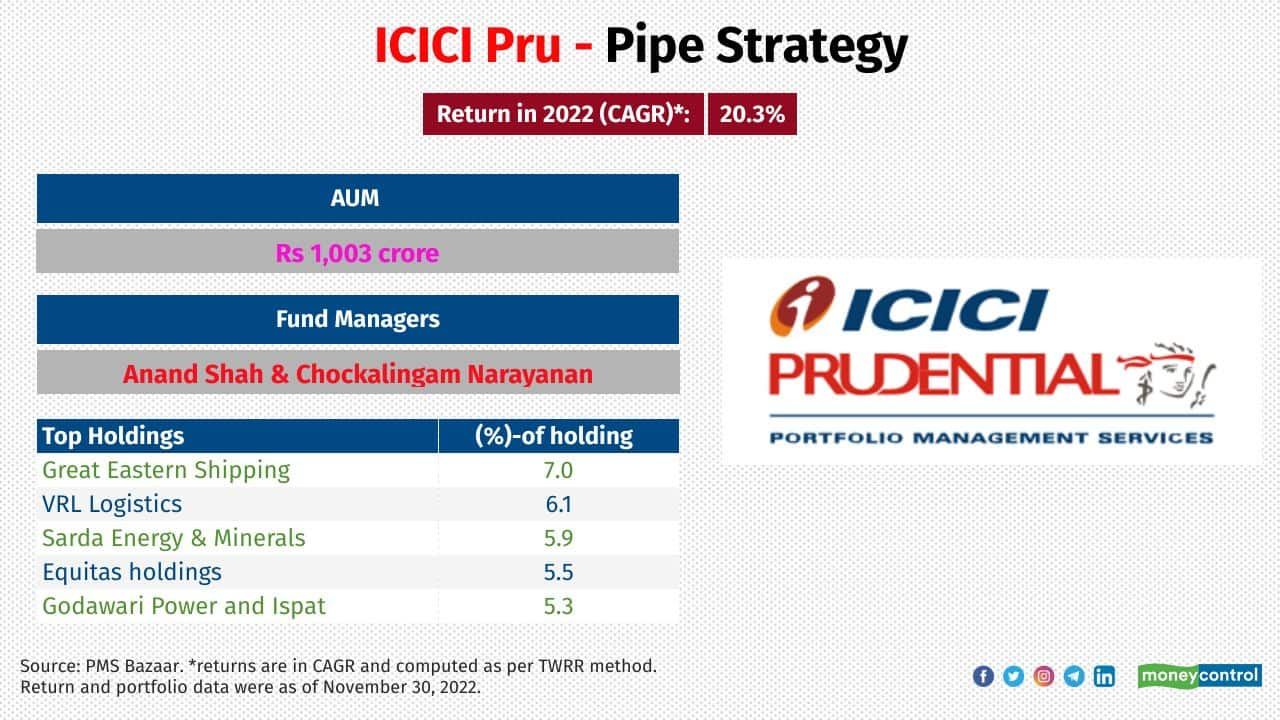

1/16

2/16

Category: Small-cap

Investment attributes: Investment objectives of the strategy is to achieve appreciation through medium to long term investments in quality companies with strong growth prospects, mostly in the mid and small cap

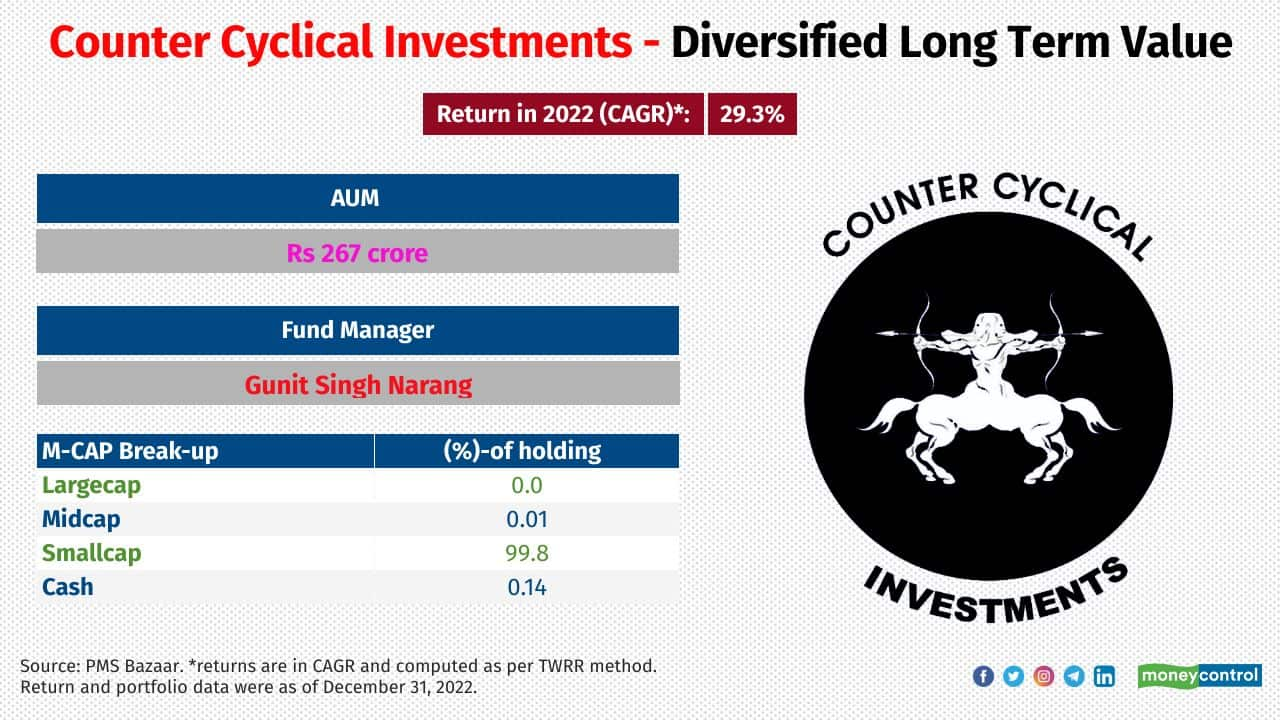

3/16

Category: Small-cap

Investment attributes: It manages a diversified portfolio of high quality small caps with strong, competent & honest management that are available at a discount

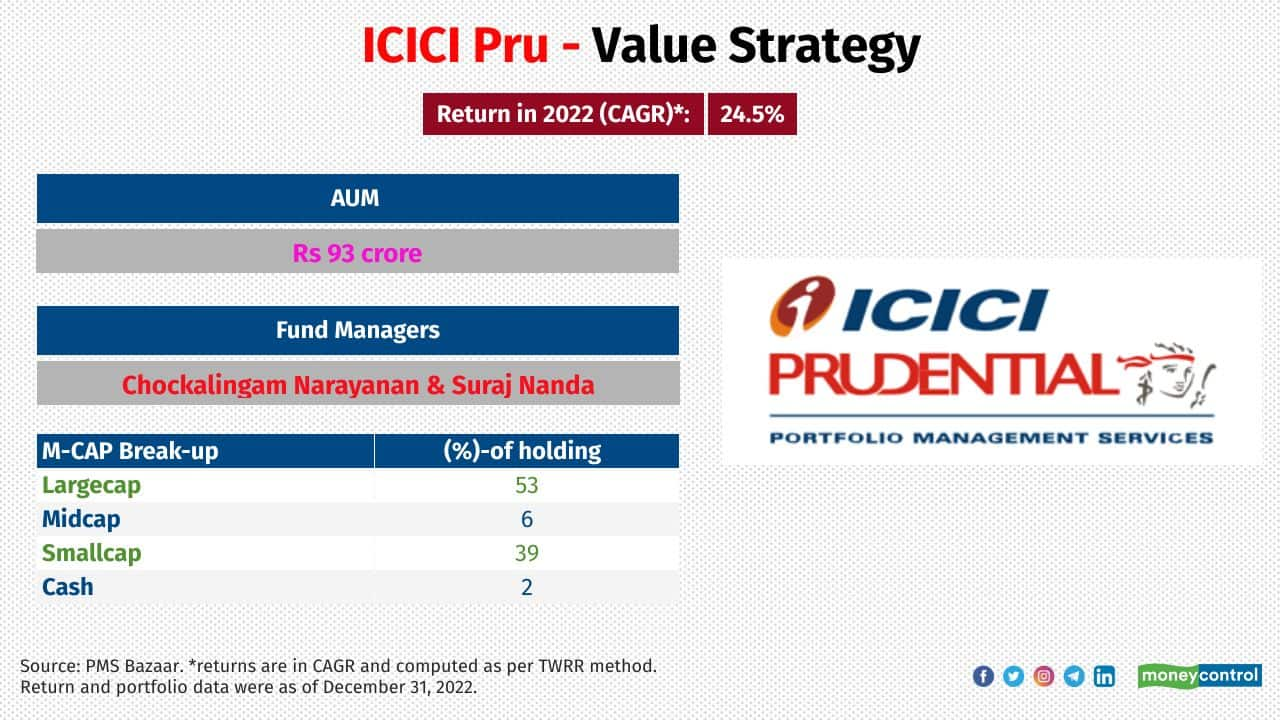

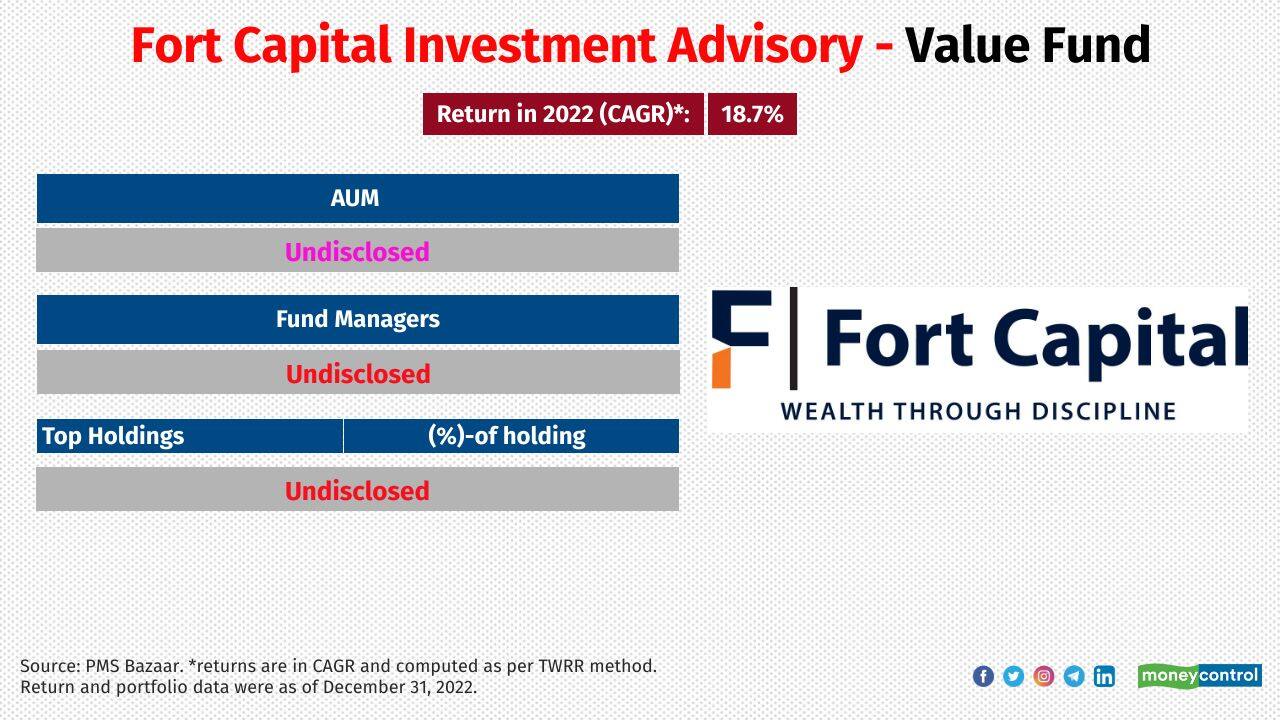

4/16

Category: Multi-cap

Investment attributes: It chooses to invest in stock which trades at valuations that are significantly below the estimated fair value of the company

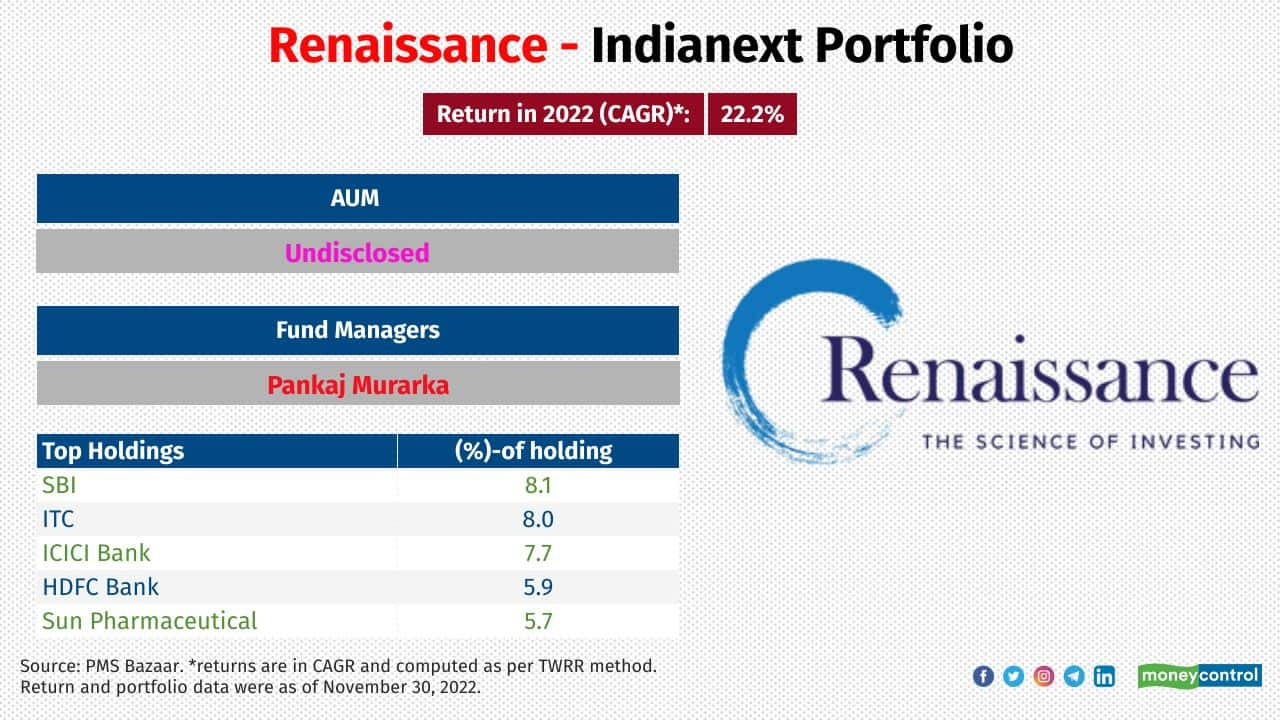

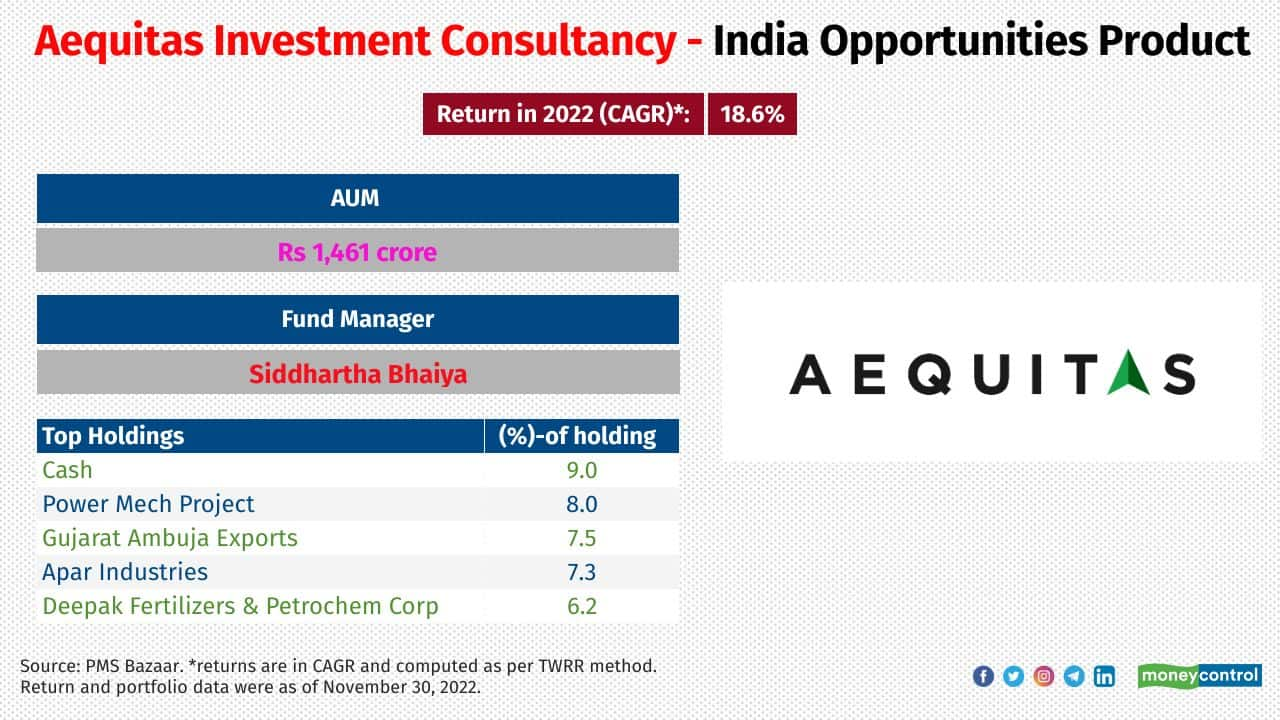

5/16

Category: Thematic

Investment attributes: It follows a theme based investment strategy

6/16

Category: Small-cap

Investment attributes: It invests in companies with market capitalization less than the largest market capitalisation stock in S&P BSE Smallcap Index

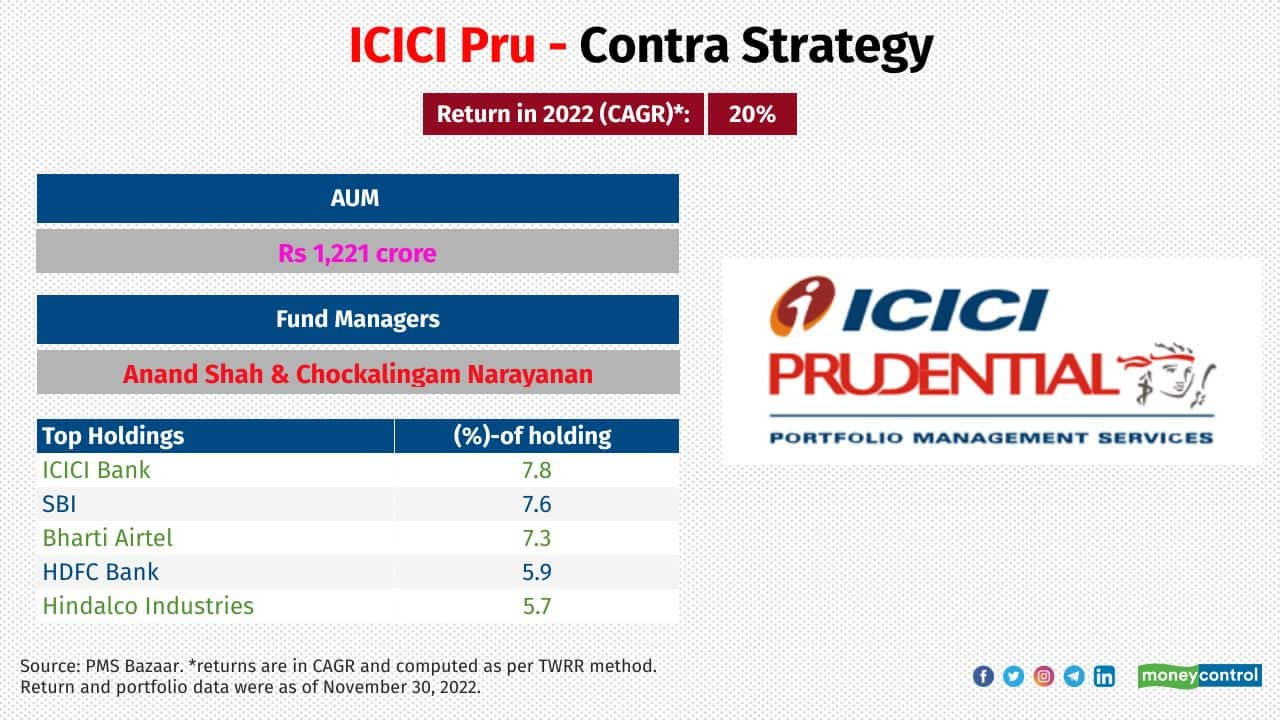

7/16

Category: Multi-cap

Investment attributes: It invests in under-performing sectors and stocks that are available at intrinsic valuations

8/16

Category: Small-cap

Investment attributes: It invests primarily in smallcap and microcap stocks

9/16

Category: Small-cap

Investment attributes: It invests mainly in smallcap stocks aiming to generate long term wealth

10/16

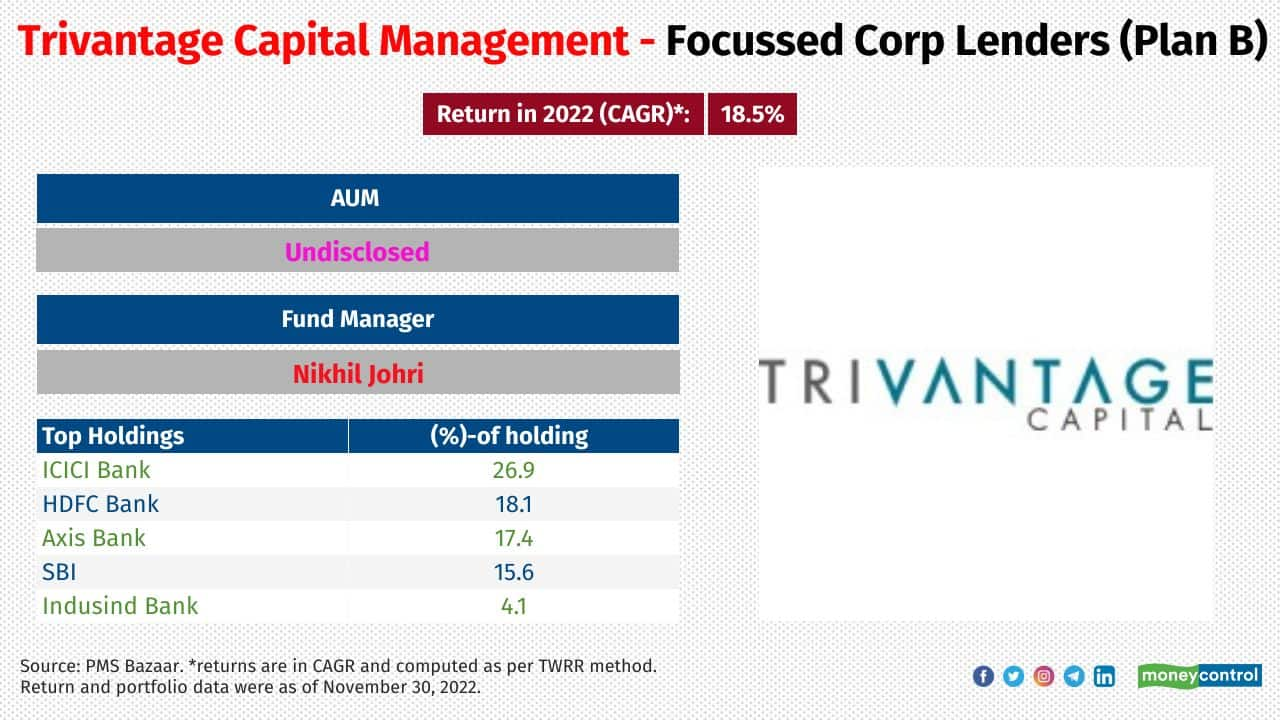

Category: Thematic

Investment attributes: It holds a portfolio of equity and equity-related securities of especially from Indian Financial Institutions

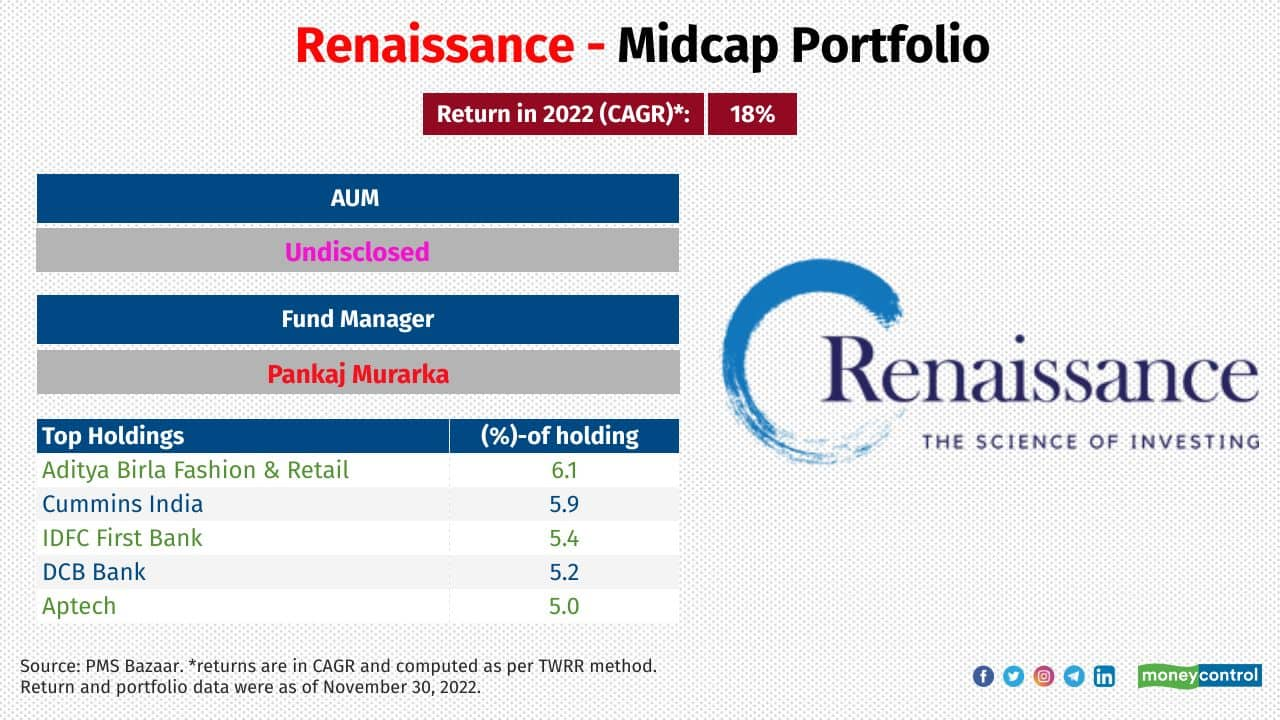

11/16

Category: Mid-cap

Investment attributes: It holds a concentrated portfolio of holding around 20 stocks. It tries to identify high growth businesses at their early stage

12/16

Category: Small-cap

Investment attributes: It holds a concentrated portfolio with 10-20 stocks

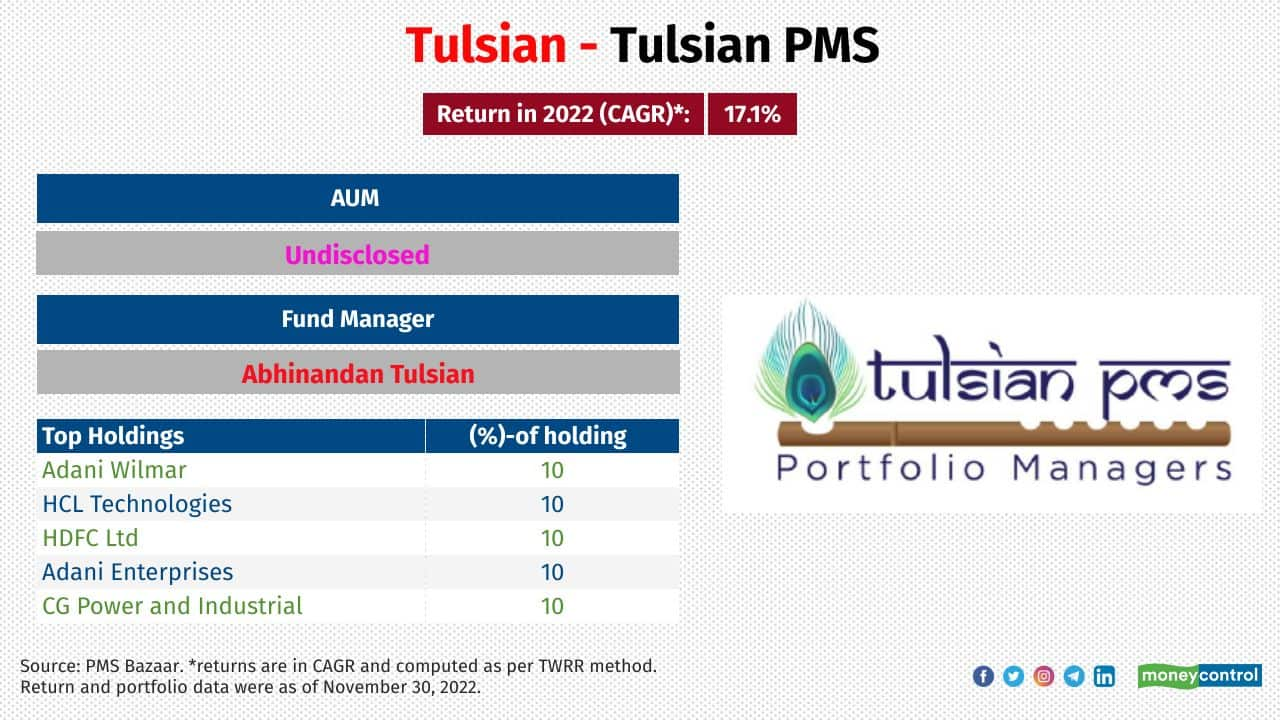

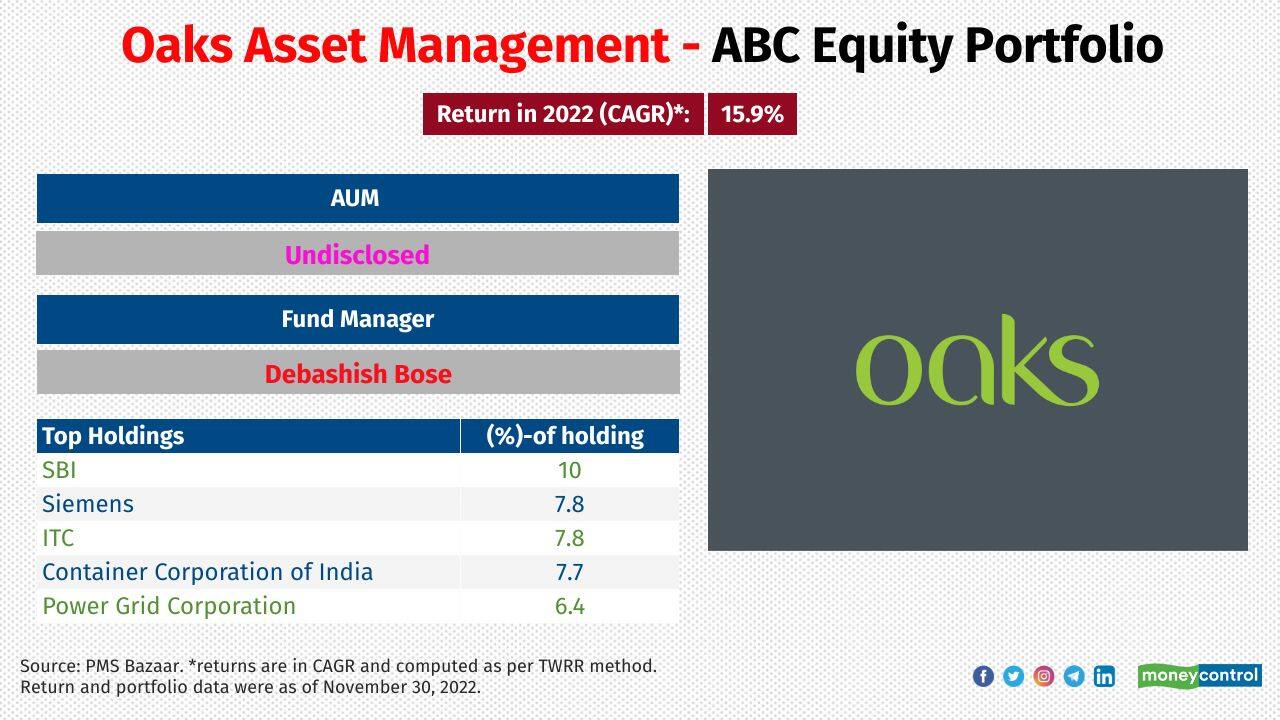

13/16

Category: Large-cap

Investment attributes: It holds a balanced portfolio consisting of a mix of large cap, mid cap, small cap and micro-cap stocks

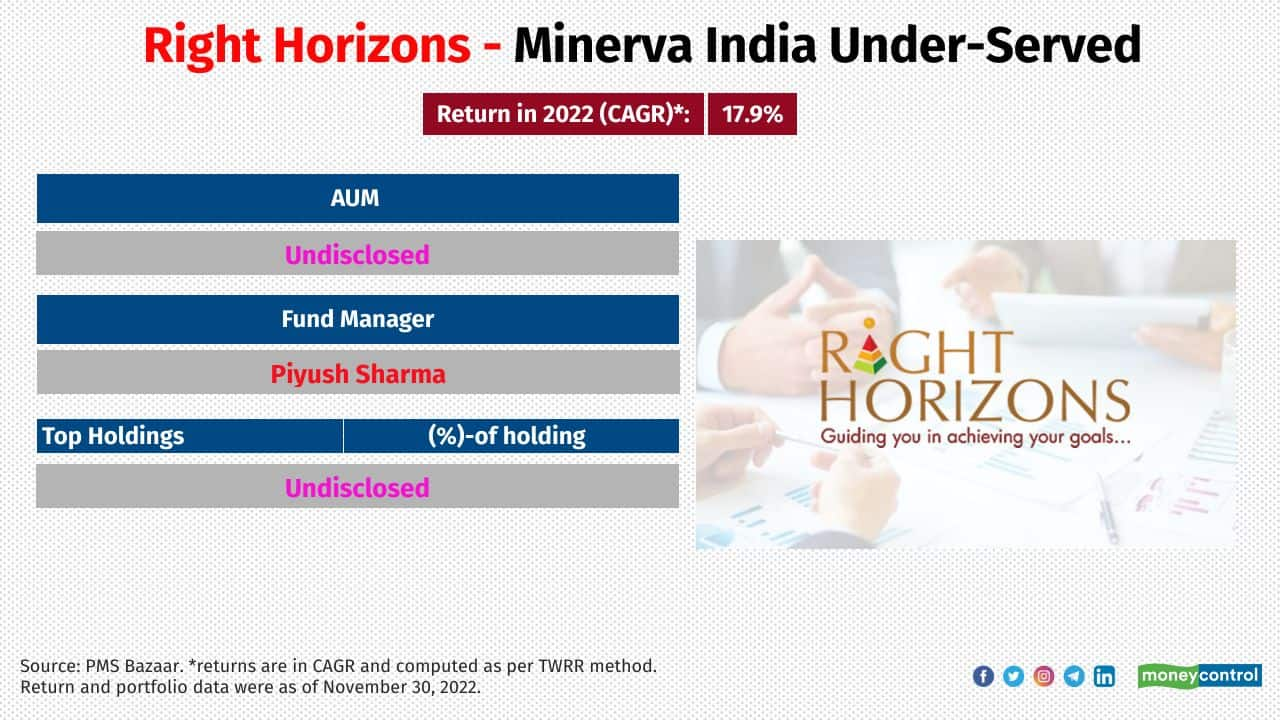

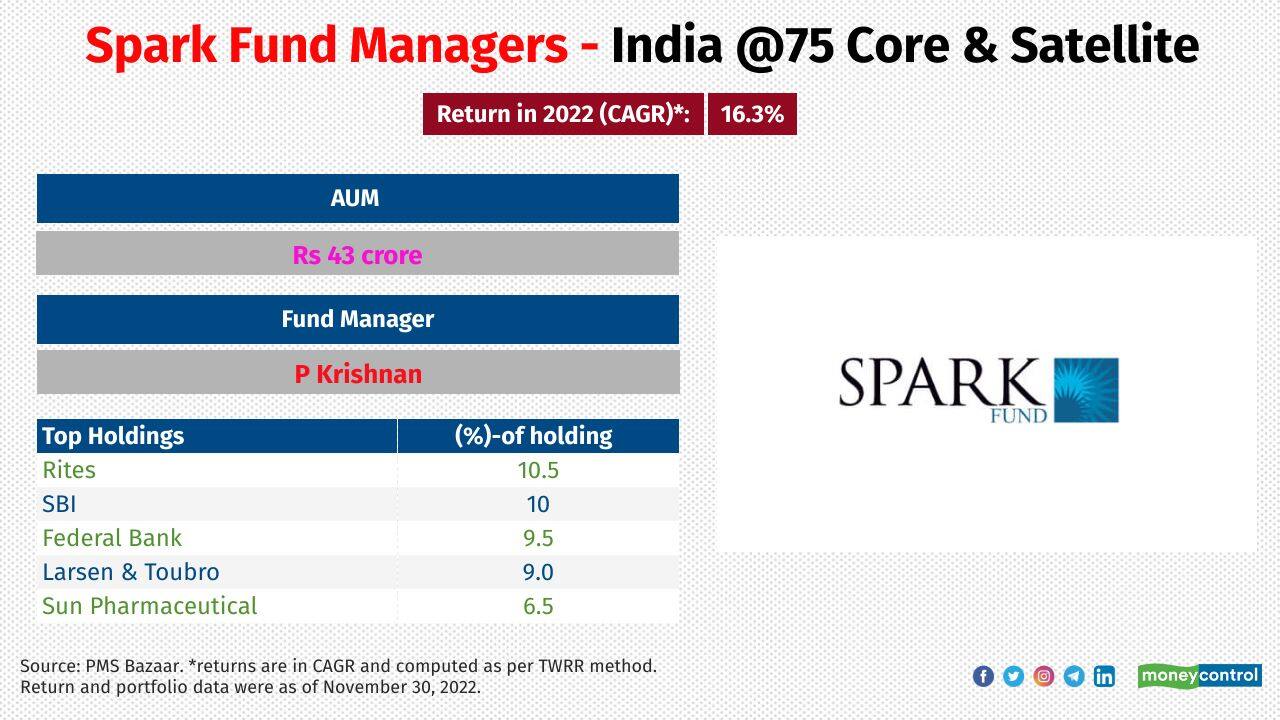

14/16

Category: Flexi-cap

Investment attributes: Portfolio of the strategy consists 12-18 stocks and is built using a flexicap approach

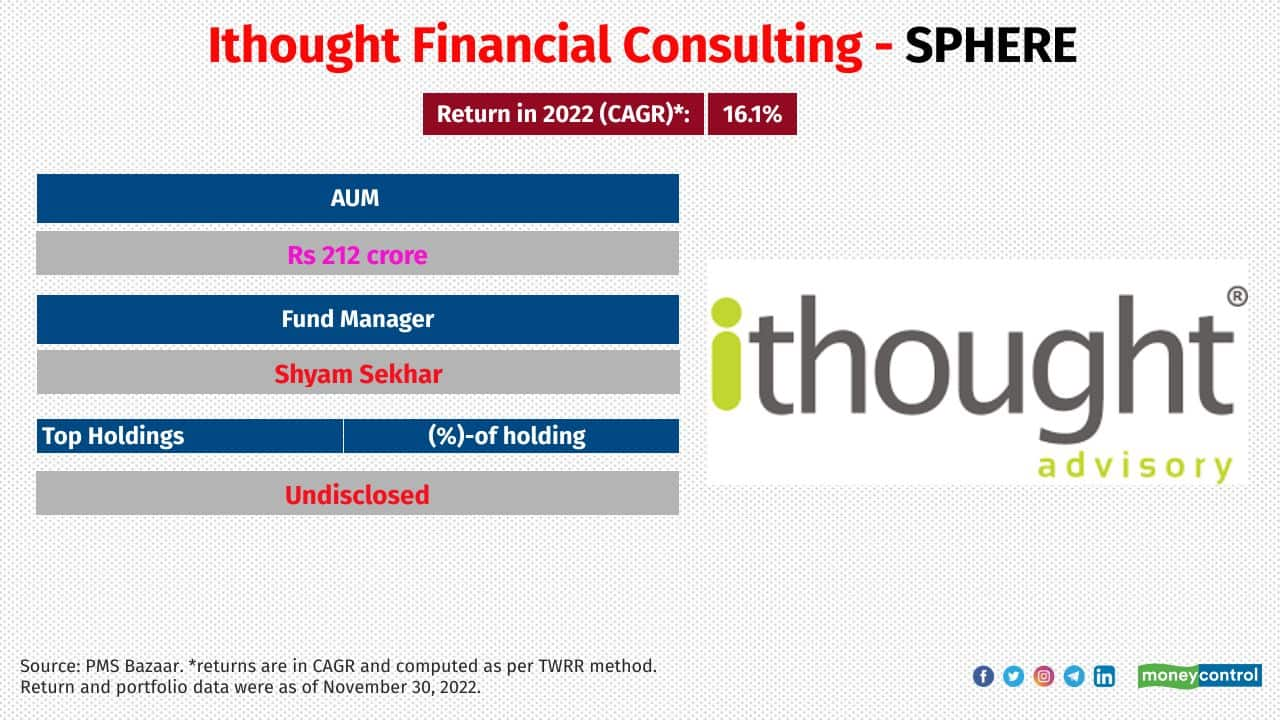

15/16

Category: Multi Asset

Investment attributes: Ithought’s Sphere strategy invests across multiple asset classes and to provide a holistic investment structure

16/16

Category: Flexi-cap

Investment attributes: This strategy tries to capture select transformative trends which are currently undervalued & under owned, via a concentrated portfolio