Among Big Tech earnings in India, Wipro is the fourth in line to report its October-December 2022 numbers. The company might post revenue growth of 1 percent sequentially in constant currency (CC) terms, believe analysts, which will be in line with the management’s guidance of 0.5-2 percent.

The numbers are expected to be released after market hours today. Comparing the growth forecast to TCS, Infosys and HCL Tech, there’s not much to cheer about in Wipro’s estimates. It is significantly lower than TCS’s 2.2 percent, Infosys’ 2.4 percent and HCL Tech’s 5 percent.

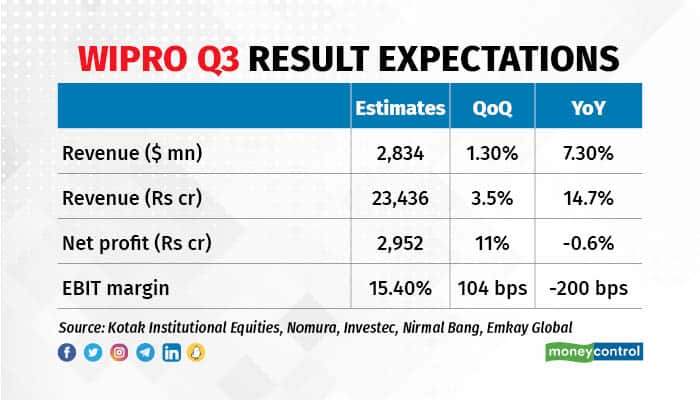

According to a poll of brokerages, consolidated revenue might come in at Rs 23,436 crore, registering 14.7 percent year-on-year (YoY) growth, while consolidated profit after tax is expected to be flat at Rs 2,952 crore. These numbers indicate sequential growth of 3.5 percent for revenue and 11 percent for net profit.

Commenting on the muted expectations, analysts at Kotak Institutional Equities said, “Weak consulting, high furloughs and slowdown in Europe are partly to blame.” While overall EBIT (earnings before interest and tax) margins are expected to rise by 104 basis points sequentially on rupee depreciation, IT services EBIT margin might remain flat around 15.1 percent. Headwinds include a two-month wage hike impact and high furloughs, said analysts.

One basis point is one-hundredth of a percentage point.

Wipro’s medium-term margin target is 17-17.5 percent but Nirmal Bang Institutional Equities believes that it is a long road to reach that target. “Margins might have bottomed out but will not hit the medium-term target even once in any quarter of FY23 and possibly even in FY24 because of heavy investments in talent and capabilities, and some slowdown in the macro economy,” it noted.

According to Investec Securities, the company’s IT services revenue is already seeing weakness from European capital markets, retail and manufacturing sectors amid recessionary fears. Thus, it expects revenue growth guidance of -1 percent to 1 percent for the January-March quarter (Q4 FY23). Analysts expect total contract value to also be lower than $725 million clocked in Q2 FY23.

Key things to watch out for

-Impact of macro headwinds on demand

-Q4 FY23 guidance and FY23 outlook

-Attrition and hiring trend

-Updates on core geographies

-Measures to increase margins above 17 percent

-Performance of acquired companies like CAPCO

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.