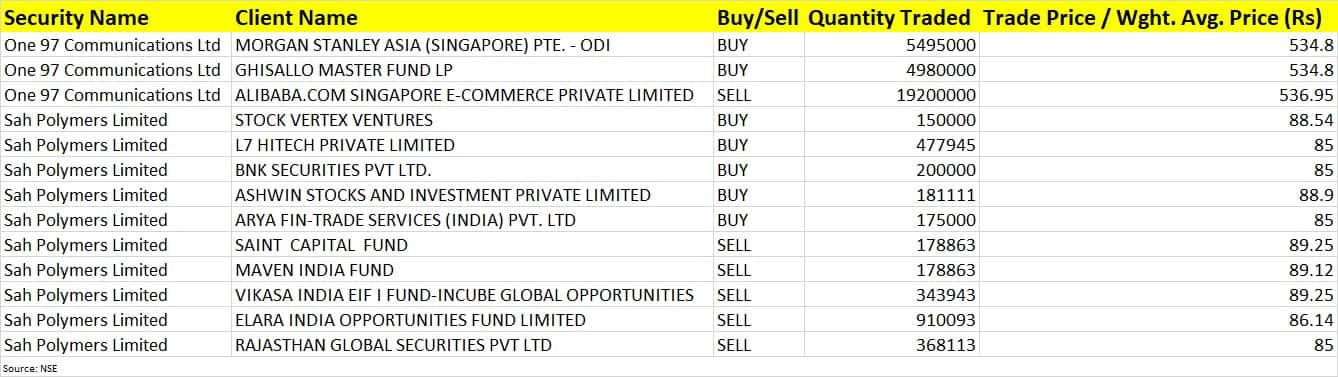

Alibaba.com Singapore E-Commerce Private Limited was the seller in this deal, offloading 1.92 crore shares in Paytm at an average price of Rs 536.95 per share.

Morgan Stanley and Ghisallo Master Fund acquired shares worth Rs 560.2 crore in One 97 Communications, the operator of mobile payments and commerce platform Paytm, via block deals on January 12.

Morgan Stanley Asia (Singapore) Pte - ODI acquired 54.95 lakh shares in the Paytm operator and hedge fund Ghisallo Master Fund LP bought 49.8 lakh shares in the company via open market transactions, as per the bulk deals data available on exchanges.

Both FIIs bought the above shares of One 97 Communications at an average price of Rs 534.8 per share.

However, Alibaba.com Singapore E-Commerce Private Limited was the seller in this deal, offloading 1.92 crore shares in Paytm at an average price of Rs 536.95 per share.

The 2.95 percent stake sale by Alibaba.com was worth Rs 1,030.94 crore. It had held a 6.26 percent stake or 4.06 crore shares in Paytm as of September 2022.

One 97 Communications shares corrected sharply, closing with 6.4 percent losses at Rs 542.25 after the said deal. In the last one year, the stock has halved from Rs 1,083.

Among other deals, Vikasa India EIF I Fund, and Rajasthan Global Securities exited Sah Polymers, the bulk packaging solutions provider, on its listing day on the bourses.

Vikasa India EIF I Fund-Incube Global Opportunities offloaded the entire 3.43 lakh shares at an average price of Rs 89.25 per share, and Rajasthan Global Securities sold 3.68 lakh shares at an average price of Rs 85 per share.

Saint Capital Fund sold 1.78 lakh shares in Sah Polymers at an average price of Rs 89.25 per share, Maven India Fund offloaded 1.78 lakh shares at an average price of Rs 89.12 per share, and Elara India Opportunities Fund sold 9.1 lakh shares at an average price of Rs 86.14 per share.

These investors might have utilised the sharp rally to offload shares in Sah Polymers. The stock surged 37 percent to close at Rs 89.25 on its debut.

However, Stock Vertex Ventures, L7 Hitech, BNK Securities, Ashwin Stocks and Investment, and Arya Fin-Trade Services (India) acquired 11.84 lakh shares of Sah Polymers.