Google currently faces two penalties from the Competition Commission of India (CCI) in two separate cases. (File image)

Dear Reader,

The Panorama newsletter is sent to Moneycontrol Pro subscribers on market days. It offers easy access to stories published on Moneycontrol Pro and gives a little extra by setting out a context or an event or trend that investors should keep track of.Global giants have often been accused of using their dominant position to capture market share. We have seen it happen in pharmaceuticals where Big Pharma calls the shots in managing regulators and government policies. The same is true with agrochemical giants. Now, technology companies have taken a page from their book.

Alphabet unit Google is in the dock for allegedly abusing its dominance in multiple markets in the Android ecosystem.

Google currently faces two penalties from the Competition Commission of India (CCI) in two separate cases — the Android case and the Play Store policies case.

The CCI in October fined Google $161 million (around Rs 1,337.76 crore) for exploiting its dominant position in the market for Android, which powers 97 percent of smartphones in India.

Separately, the regulator imposed a penalty of Rs 936.44 crore on Google for its Play Store policies, through which apps can be downloaded on mobiles. The CCI had also directed Google to allow third-party payment processors.

Google Play is accused of promoting its payment system – Google Pay – for purchasing apps and in-app purchases (IAPs). Other mobile wallets/UPI apps are not given priority for making such payments.

Google is also accused of skewing its search results in favour of Google Pay. Google, it’s also alleged, further privileges Google Pay by displaying it as the first ad when a user searches for another app facilitating payment through UPI.

In a setback to Google, the National Company Law Appellate Tribunal (NCLAT) on Wednesday declined to grant interim relief to the technology giant seeking a stay on CCI's Rs 936.44-crore penalty.

Meanwhile, the Supreme Court on Wednesday agreed to hear a plea of Google against a recent order of the NCLAT refusing an interim stay on a Rs 1,337-crore fine imposed by the CCI.

It is not only in India that the US giant is facing court cases. A California judge, in November 2022, cleared the way for a potential class-action lawsuit against Google for anti-competitive practices surrounding its Play store.

Over the last decade, Google has incurred $8.24 billion in EU anti-trust fines following three investigations into its business practices. In May 2022, the EC (European Commission) and the CMA (Britain's Competition and Markets Authority) each opened a formal investigation into Google Play's business practices.

Last month, Google, to comply with EU rules, said non-gaming app developers can switch to rival payment systems with a lower fee of 12 percent instead of 15 percent, with the move applying to European users.

Google and Apple at their mobile app stores have drawn criticism from developers who say the fees are excessive.

The two tech giants will use the money and legal power to ward off competition for as long as possible, just as pharmaceutical companies tried to stop Indian generic pharma players.

Unlike Indian pharma companies who fought Big Pharma after gaining critical mass, some of the tech players fighting the legal battle are startups that may not have the muscle power to sustain the legal battles. It is the lack of fighting power that the tech giants are betting on rather than any merit in their case.

Budget Snapshots:

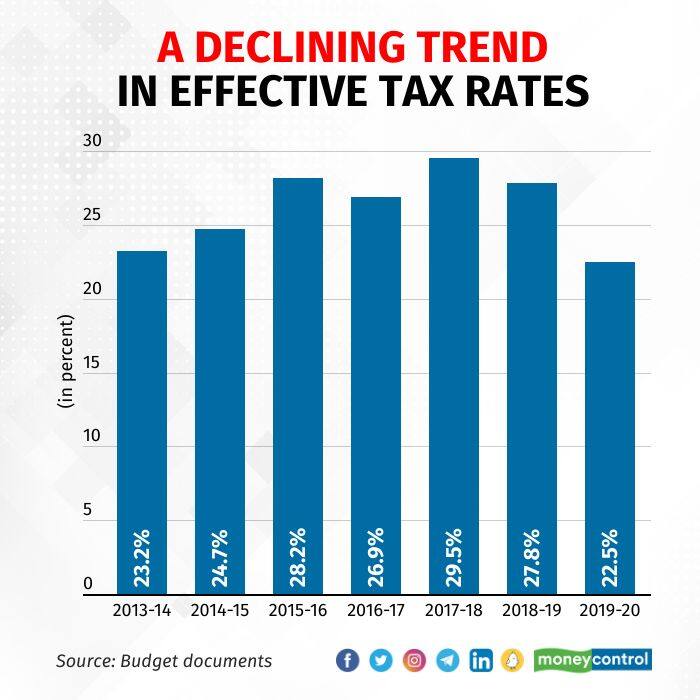

We are starting a series to highlight key issues related to the budget, with the help of charts. Today's Snapshot is on how corporate tax rates have fallen after the government offered an option of lower tax rates but with fewer exemptions. The idea was to make industry more competitive and encourage them to invest more. While tax rates have indeed declined, the government believes more can be done by companies on the investment front.

Investing insights from our research team

Discovery Series: Will this speciality steel maker continue to outperform?

More gain in store for the RateGain stock?

Sona BLW: An acquisition for the future

What else are we reading?

A tale of two pre-election budgets

Four investment themes for 2023 and beyond

SBI Life’s growth rates defy size constraints

Chart of the Day: Household savings drop? Blame it on pent-up consumption

Startup Street: Energising work culture through offsites

Reforms a must to realise agriculture sector’s potential

Why investors are rushing to mid and small-cap funds

Wall Street’s top cop trains his sights on crypto (republished from the FT)

Joshimath crisis: Can we create similar livelihood opportunities after relocation?

Technical Picks: TCS, Adani Enterprises, Mentha oil, NMDC, Wipro and USD-INR (These are published every trading day before markets open and can be read on the app).

Shishir AsthanaMoneycontrol Pro