HCL Technologies is all set to report its October-December earnings numbers on January 12 and analysts are forecasting a 3 percent sequential growth in constant currency (CC) terms, which is likely to be greater than its peers.

TCS reported CC revenue growth of 2.2 percent quarter-on-quarter (QoQ), while Infosys is expected to clock 1.1 percent QoQ.

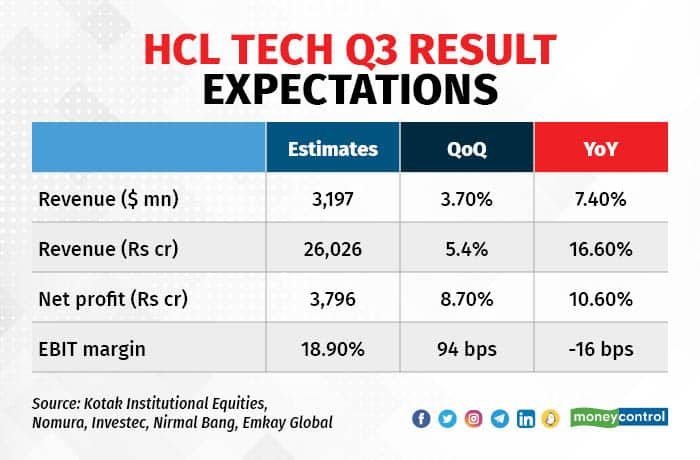

According to a poll of brokerages, consolidated revenue might come in at Rs 26,026 crore, registering 16.6 percent year-on-year (YoY) growth, while consolidated profit after tax (PAT) is expected to increase 10.6 percent YoY to Rs 3,796 crore.

At its investor day held on December 8 in New York, the company’s management had flagged off that Q3 FY23 will see higher-than-expected furloughs, with BFSI and hi-tech being the problem areas.

Analysts are pegging earnings before interest and tax (EBIT) margin at 18.9 percent for the quarter. This indicates a near 95-basis-point (bps) expansion. One basis point is one-hundredth of a percentage point.

If it weren’t for the furloughs, margin expansion could have been greater on the back of rupee depreciation and a slight shift in revenue mix towards the higher-margin Products & Platforms (P&P) business, said analysts at Nirmal Bang Institutional Equities.

Meanwhile, Kotak Institutional Equities is forecasting 12.7 percent sequential CC growth in products business and 14 percent decline on YoY comparison. On the other hand, services segment is seen clocking 2 percent CC growth QoQ.

“The Products and platforms segment might report a sharp rebound sequentially, driven by seasonal strength. Overall growth will be aided by this segment,” according to analysts at Emkay Global and Nomura.

Coming to deal wins, the total contract value might be flat in Q3 FY23 around $2 billion, compared to $2.38 billion recorded in the previous quarter. As indicated earlier by the management, the company believes it will continue to win deals in North America while Europe may see some slowdown.

In the intra-quarter update, top brass said they expect revenue growth to be at the lower end of the 13.5-14.5 percent band for FY23 and this guidance is likely to be maintained, said analysts.

Other key monitorables are:

- Impact on discretionary businesses, i.e., products and engineering and R&D services (ERS) in the event of recession

- Pricing environment and attrition

- Outcome of clients’ budgeting process

- Levers to increase margins

- Large deal activity in the market

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.