The market was largely volatile and rangebound before closing the session with moderate losses on January 11 as traders were looking cautious ahead of CPI inflation numbers for December, scheduled to be released on January 12.

The BSE Sensex was down 10 points to 60,105, while the Nifty50 fell 18 points to 17,896 and formed a small-bodied bearish candle which resembles a high wave kind of pattern on the daily charts.

"The market sentiment remains negative as the benchmark Nifty fell below the crucial short-term moving average (50 EMA - 18,124). The daily RSI (relative strength index) is in bearish crossover on the daily timeframe, suggesting sluggish momentum," Rupak De, Senior Technical Analyst at LKP Securities said.

Over the short term, he feels the trend is likely to remain sideways or negative.

On the higher end, resistance is visible at 18,000-18,250, whereas on the lower end, support is visible at 17,800, the market expert said.

The broader markets also closed in red with the Nifty Midcap 100 index falling a third of a percent, and Smallcap 100 index down 0.05 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

Per the pivot charts, we have the key support level for the Nifty at 17,841, followed by 17,805, and 17,747. If the index moves up, the key resistance levels to watch out for are 17,957, followed by 17,993 and 18,051.

The Nifty Bank index rebounded 218 points to 42,233 on January 10, outperforming broader markets and forming a bullish candle which to some extent resembles Hammer kind of pattern formation on the daily charts.

The important pivot level, which will act as crucial support for the index, is placed at 41,868, followed by 41,729, and 41,504. On the upside, key resistance levels are placed at 42,318, followed by 42,457, and 42,682.

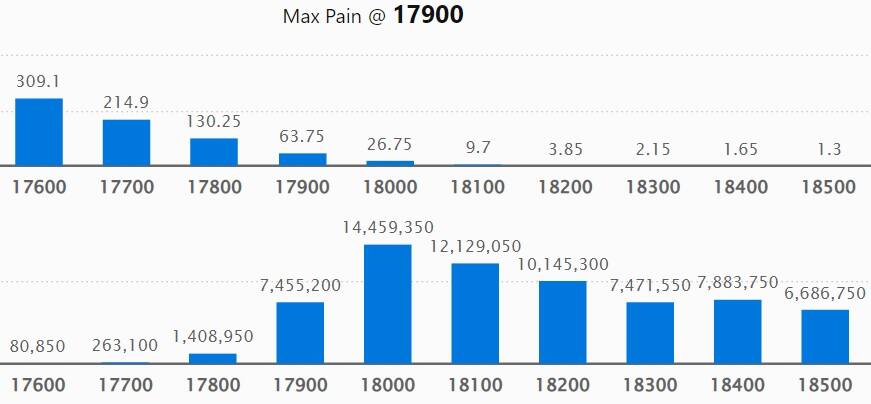

On the weekly basis, we have seen the maximum Call open interest (OI) at 18,000 strike, with 1.44 crore contracts, which can act as a crucial resistance level in the coming sessions of the January series.

This is followed by 18,100 strike, comprising 1.21 crore contracts, and 18,200 strike, where we have more than 1.01 crore contracts.

Call writing was seen at 17,900 strike, which added 24.1 lakh contracts, followed by 18,400 strike, which added 17.32 lakh contracts, and 18,000 strike, which added 13.71 lakh contracts.

Call unwinding was seen at 18,500 strike, which shed 22.59 lakh contracts, followed by 19,000 strike, which shed 16.17 lakh contracts, and 18,600 strike, which shed 15.9 lakh contracts.

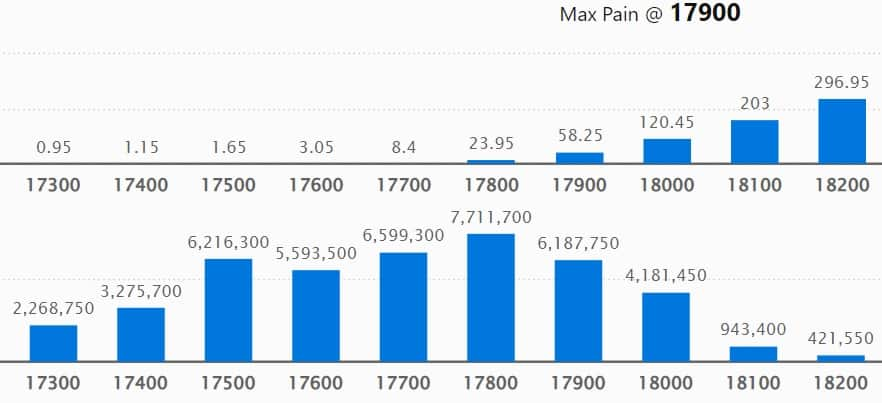

On the weekly basis, the maximum Put OI was seen at 17,800 strike, with 77.11 lakh contracts, which can act as crucial support for the Nifty50 in the coming sessions of the January series.

This is followed by 17,700 strike, comprising 65.99 lakh contracts, and 17,500 strike, where we have 62.16 lakh contracts.

Put writing was seen at 17,800 strike, which added 26.46 lakh contracts, followed by 17,600 strike, which added 14.08 lakh contracts, and 17,900 strike, which added 8.44 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 12.62 lakh contracts, followed by 18,100 strike, which shed 4.84 lakh contracts, and 17,700 strike, which shed 3.21 lakh contracts.

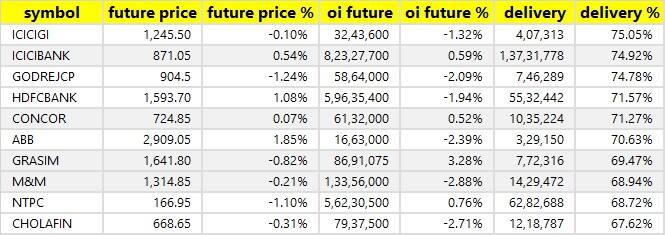

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in ICICI Lombard General Insurance Company, ICICI Bank, Godrej Consumer Products, HDFC Bank, and Container Corporation of India, among others.

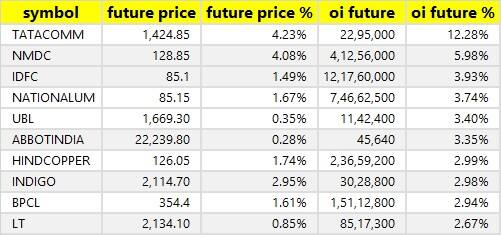

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 44 stocks on Wednesday, including Tata Communications, NMDC, IDFC, NALCO, and United Breweries.

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 35 stocks saw long unwinding on Wednesday, including MRF, Escorts, Zydus Lifesciences, Britannia Industries, and HDFC Life Insurance Company.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we have seen a short build-up in 67 stocks on Wednesday, including Gujarat Gas, Bharti Airtel, Coal India, Persistent Systems, and Coforge.

47 stocks witnessed short-covering

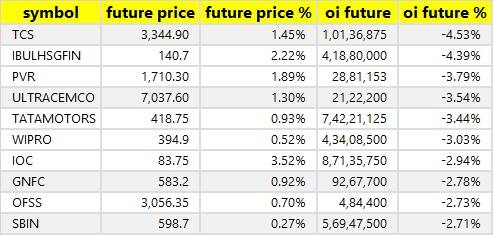

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have 47 stocks on the short-covering list on Wednesday, including TCS, Indiabulls Housing Finance, PVR, UltraTech Cement, and Tata Motors.

Tuticorin Alkali Chemicals and Fertilizers: Citrine Fund sold additional 15.24 lakh shares in the company via open market transactions at an average price of Rs 61.2 per share. However, Mercantile Ventures was the buyer of those shares at the same price.

(For more bulk deals, click here)

Infosys, HCL Technologies, Anand Rathi Wealth, Cyient, Den Networks, G G Engineering, GM Breweries, GTPL Hathway, and Plastiblends India will be in focus ahead of quarterly earnings on January 12.

Stocks in the news

Hindustan Unilever: The FMCG major has completed the acquisition of 51 percent shareholding of Zywie for Rs 264.28 crore for the first tranche. With this, Zywie Ventures has become a subsidiary of the company.

State Bank of India: The Central government extended the term of office of Challa Sreenivasulu Setty as Managing Director of the country's largest lender for a period of two years with effect from January 20, 2023.

Route Mobile: The communication platform as a service provider has signed an exclusive SMS firewall solution and connectivity service agreement with a leading mobile network operator (MNO) in Sri Lanka. The company will provide an end-to-end A2P monetization suite for all international A2P SMS' terminating on its network. Route Mobile will serve as the exclusive partner of the MNO for 2 years.

Bilcare: Rekha Jhunjhunwala has offloaded a 6.24 percent stake in Bilcare via open market transactions during January 10-11. With this, her shareholding in the company reduced to 0.106 percent, from 6.347 percent earlier.

5paisa Capital: The financial products provider has reported a 2.5 percent sequential increase in consolidated profit after tax at Rs 11.02 crore for the quarter ended December FY23. Consolidated revenue from operations at Rs 83.76 crore for the quarter grew by 5.3 percent QoQ. Consolidated profit at Rs 29.15 crore increased by 212 percent for nine months period ended December FY23 YoY, backed by improvement in quality of acquisition, reduction in CAC, focus on technology and providing superior trading platforms to customers. Revenue during the same period grew by 18.5 percent to Rs 247.3 crore.

Elgi Equipments: Pattons Inc, USA identified a suitable buyer for its property and has completed the sale on January 10. The company had already received approval from board of directors for the sale of a property of Pattons Inc, USA, a material subsidiary of the company which constituted more than 20 percent of its total assets, in June 2021 and subsequently, the shareholders at the Annual General Meeting approved the same in August 2021.

IIFL Wealth Management: The company will consider the declaration of a fourth interim dividend, if any, for FY23 as well as a sub-division of equity shares. The board members will also consider the issue of fully paid-up bonus equity share(s) to the shareholders of the company.

Fund Flow

Foreign institutional investors (FII) have net-sold shares worth Rs 3,208.15 crore, continuing selling for the 14th session in a row, but domestic institutional investors (DII) have managed to offset the FII outflow to a major extent by net-buying shares worth Rs 2,430.62 crore on January 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Indiabulls Housing Finance and GNFC will remain under the NSE F&O ban list for January 12. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.