Bears seem to be have strong control over Dalal Street as the benchmark indices fell for a third consecutive session on January 6, forming long bearish candle on the daily charts. All sectors, barring FMCG, closed in red with major fall in technology, banking & financial services, metal, and pharma stocks.

The BSE Sensex tanked 453 points to 59,900 and the Nifty50 dropped 133 points to 17,860, while the similar kind of trend was also seen in broader markets. The Nifty Midcap 100 and Smallcap 100 indices corrected eight-tenth of percent each.

"The Nifty found support around the previous swing low on the daily timeframe. The momentum indicator RSI (relative strength index - 14) is in bearish crossover, suggesting weak price momentum for the near term," said Rupak De, Senior Technical Analyst at LKP Securities.

Going forward, 17,770 is likely to act as support for the falling Nifty. A decisive fall below the said level may take the index towards 17,500, he said.

On the higher end, resistance is visible at 18,000, above which a recovery may come, said De.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, we have the key support level for the Nifty at 17,805, followed by 17,745, and 17,649. If the index moves up, the key resistance levels to watch out for are 17,997, followed by 18,056 and 18,153.

The Nifty Bank index declined 420 points to 42,189 on January 6 and formed a bearish candlestick pattern on the daily charts for the third straight session, which is looked like three black crows pattern.

The important pivot level, which will act as crucial support for the index, is placed at 41,942, followed by 41,751, and 41,442. On the upside, key resistance levels are placed at 42,560, followed by 42,750, and 43,059.

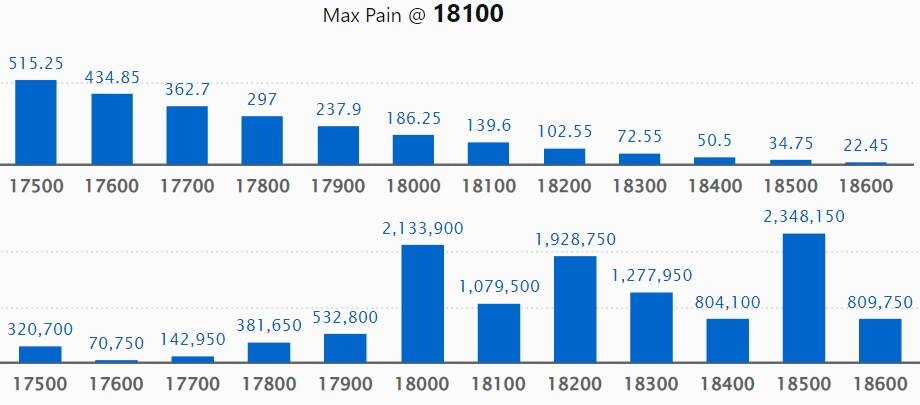

We have seen the maximum Call open interest (OI) at 19,000 strike, with 25.94 lakh contracts, which can act as a crucial resistance level in January series.

This is followed by 18,500 strike, comprising 23.48 lakh contracts, and 18,000 strike, where we have more than 21.33 lakh contracts.

Call writing was seen at 18,000 strike, which added 4.88 lakh contracts, followed by 18,200 strike, which added 3.53 lakh contracts, and 18,100 strike, which added 3.34 lakh contracts.

Call unwinding was seen at 18,600 strike, which shed 1.57 lakh contracts, followed by 18,900 strike, which shed 1.23 lakh contracts, and 19,000 strike, which shed 53,350 contracts.

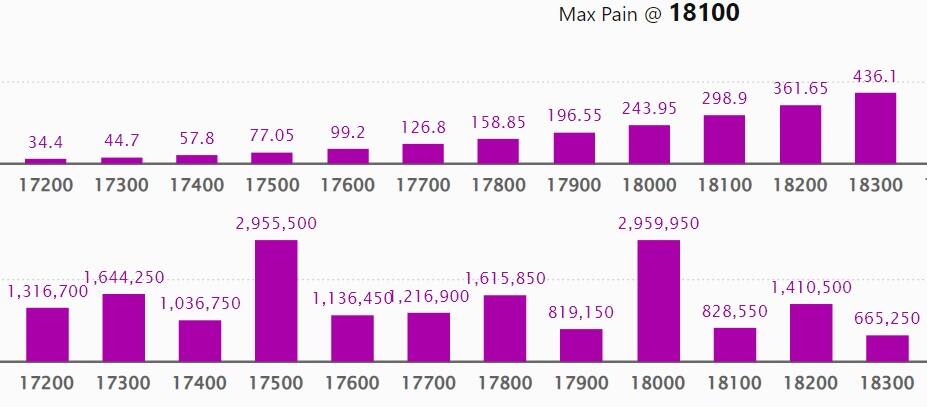

We have seen maximum Put OI at 17,000 strike, with 31.59 lakh contracts, which can act as a crucial support level in January series.

This is followed by 18,000 strike, comprising 29.59 lakh contracts, and 17,500 strike, where we have 29.55 lakh contracts.

Put writing was seen at 17,000 strike, which added 3.46 lakh contracts, followed by 17,800 strike, which added 2.07 lakh contracts, and 16,800 strike, which added 1.75 lakh contracts.

Put unwinding was seen at 18,000 strike, which shed 2.55 lakh contracts, followed by 17,500 strike, which shed 90,750 contracts, and 18,300 strike, which shed 81,200 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Oracle Financial, Power Grid Corporation of India, HCL Technologies, ICICI Bank, and Kotak Mahindra Bank, among others.

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 14 stocks on Friday, including ONGC, GNFC, Mahindra & Mahindra, MRF, and Britannia Industries.

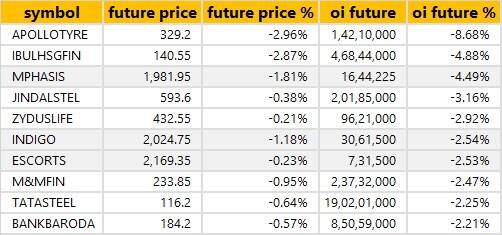

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 52 stocks saw long unwinding on Friday, including Apollo Tyres, Indiabulls Housing Finance, Mphasis, Jindal Steel & Power, and Zydus Life Sciences.

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we have seen short build-up in 108 stocks on Friday, including Cholamandalam Investment, Coal India, Bajaj Finserv, Atul, and Gujarat Gas.

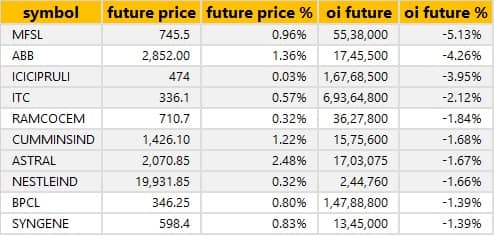

19 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have total 19 stocks in the short-covering list on Friday, including Max Financial Services, ABB India, ICICI Prudential Life Insurance, ITC, and Ramco Cements.

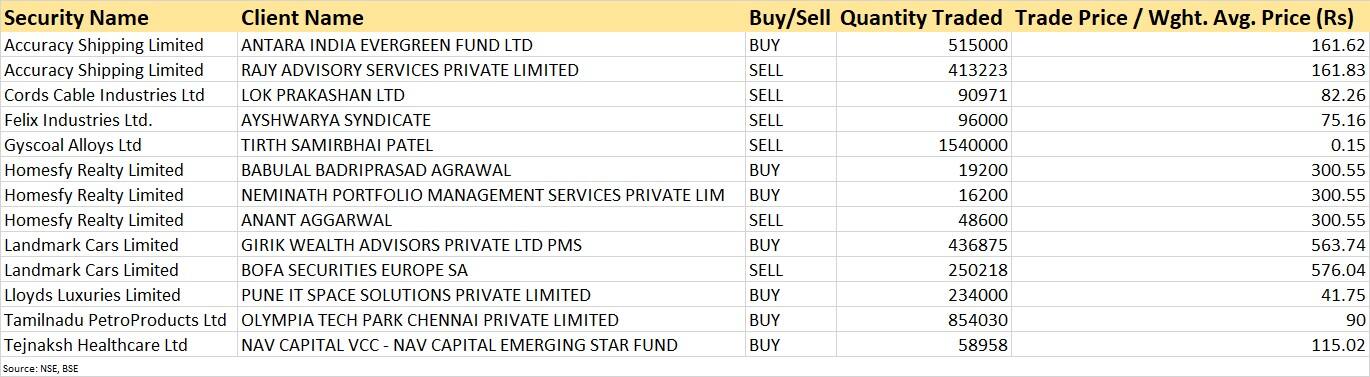

Landmark Cars: Girik Wealth Advisors Private Ltd PMS acquired 4.36 lakh shares in the company via open market transactions at an average price of Rs 563.74 per share. However, BOFA Securities Europe SA sold 2.5 lakh shares in the company at an average price of Rs 576.04 per share.

(For more bulk deals, click here)

Tata Consultancy Services will be in focus on January 9 as the country's largest software services exporter will announce its December quarter (Q3FY23) earnings.

Stocks in the news

Aditya Birla Fashion & Retail: The company proposes to raise funds by issuing 5,000 listed, unsecured, rated, redeemable non-convertible debentures of face value of Rs 10 lakh each issued at par aggregating to Rs 500 crore on private placement basis, on or after January 13.

Gland Pharma: Singapore subsidiary, Gland Pharma International PTE has entered into a share purchase agreement with FPCI Sino French Midcap Fund and others to acquire 100 percent stake in Cenexi and the Cenexi Holding Entities.

JK Cement: A wholly owned subsidiary JK Paints & Coatings invested Rs 153 crore and completed the acquisition of 60 percent equity shares of Acro Paints.

Lupin: The company received approval from USFDA for Fesoterodine fumarate extended-release tablets. Fesoterodine fumarate is a generic equivalent of Toviaz extended-release tablets of Pfizer Inc. These tablets had estimated annual sales of $177 million in the US as per IQVIA MAT data as of September 2022.

National Fertilizers: The company clocked 27 percent growth in total fertilizer sale during April-December 2022 as compared to corresponding period last year. The company reported total fertilizer sales of 49.71 lakh MT compared to 39.25 lakh MT in corresponding period last year.

HCL Technologies: The ODP Corporation has selected HCL Technologies as its primary IT partner. HCL will provide end-to-end IT operations and enterprise-wide digital transformation to support ODP's business strategy in its Office Depot, ODP Business Solutions and Veyer business units.

Titan Company: Total sales climbed by around 12 percent year-on-year during the third quarter of fiscal year 2022-23. In the last quarter, the company added a total of 111 new retail outlets and jewellery business grew 11 percent.

Tata Steel: India business production up 4.2 percent at 5 million tonne and delivery volumes down 3.6 percent at 4.73 million tonne, QoQ. Europe business production fell 6.25 percent at 2.25 million tonne and Europe business delivery volumes rose 4.8 percent to 1.96 million tonne, QoQ.

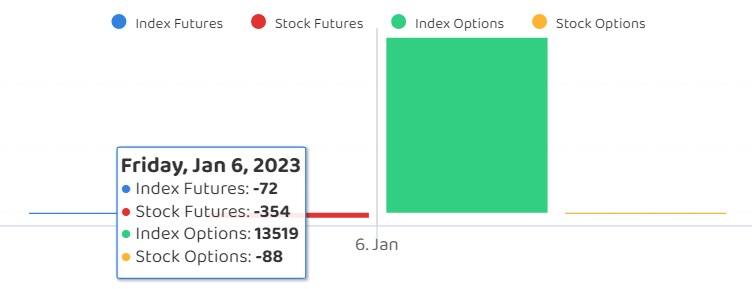

Fund Flow

Foreign institutional investors (FII) net sold shares worth Rs 2,902.46 crore, while domestic institutional investors (DII) net bought shares worth Rs 1,083.17 crore on January 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has retained Indiabulls Housing Finance under its F&O ban list for January 9. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.