Credit: UBS

Markets are underpricing the extent to which US monetary policy may ease in the coming year and the Federal Reserve may slash interest rates to just over 1 percent by early 2024 as hidden weaknesses in the labour market emerge, according to UBS' Arend Kapteyn.

The US central bank has led the charge in rapidly raising interest rates in 2022 to tackle multi-decade-high inflation, with the federal funds rate target range currently at 4.25-4.5 percent. According to CME's FedWatch Tool, prices of Fed Funds futures suggest there is more than 99 percent chance the mid-point of the target range will be above 4 percent by the end of 2023.

As per the Federal Open Market Committee's latest projections, the interest rate is expected to be 5-5.25 percent at the end of 2023 before easing to 4-4.25 percent by the end of 2024.

However, according to Kapteyn, UBS' global head of economics, the Fed funds rate may be cut to 3-3.25 percent by the end of 2023 and even further to 1-1.25 percent by early 2024.

"We are going into a much more disinflationary environment. We are probably the most optimistic about the speed at which inflation will decline this year," Kapteyn said on January 5 in a conference call.

Economy to crack

However, Kapteyn thinks the US economy is likely to "crack" before inflation, with rising consumer distress resulting in households dipping into their excess savings at an annualised rate of about $1 trillion. This could lead to the savings depleting by the end of the year – and well before that for low-income households.

But, it is the hidden weakness in the labour market that could really force the Fed's hand in July.

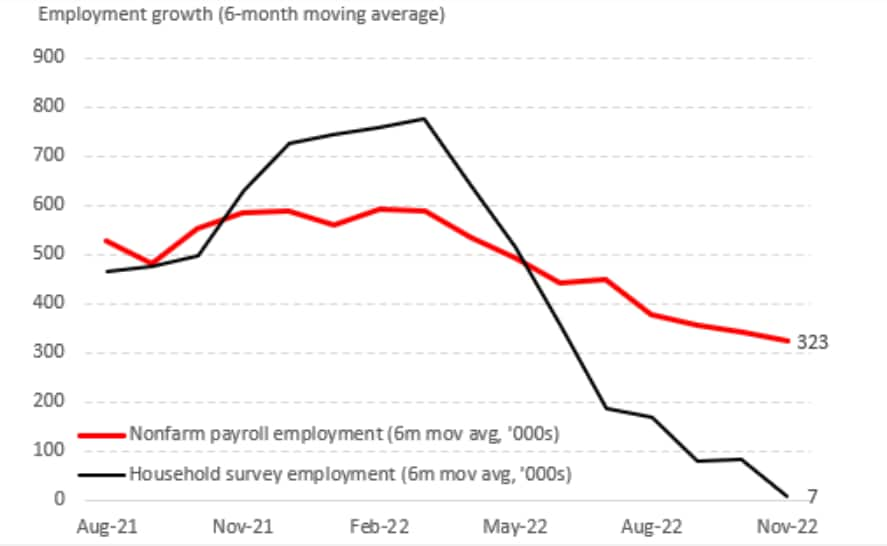

While non-farm payrolls have been solid, rising by 323,000 on average in the last six months, Kapteyn said there was a disconnect between that data and other labour market indicators.

Citing a recent paper (PDF) by Federal Reserve Bank of Philadelphia – which found that only 10,500 jobs were created in the US in April-June 2022 as against the 1.05 million per the monthly payrolls data – Kapteyn said the gap between the number of jobs created as per the household and establishment surveys is the biggest since World War II. Incoming tax data also suggests payrolls data may have been overstating the number of jobs being created.

Source: UBS

Source: UBS

"If you look at all the labour market data, it is much more consistent with an economy that is already starting to drift lower or become weaker and weaker and is edging closer to a recession as opposed to the picture you get when you look at the payrolls chart, which is saying 'everything is fine, the economy is rock solid'," Kapteyn said.

Low tolerance for job losses

According to Kapteyn, historically, the Fed's tolerance for job losses has been very low right before it cuts interest rates. As such, he expects another 50-basis-point increase in the rate to about 4.75-5 percent before the central bank begins to reverse course in the middle of 2023.

"As the recession then builds up by the end of the year, unemployment slowly climbs up to about 5.5 percent in 2024, job losses mount to about 1.7 million, there will be enough weakness for them to reverse almost the entire hiking cycle that they have just done," Kapteyn said.

"So, by the end of this year we think we will be back at 3.25 percent Fed funds rate, and by early next year at 1.25 percent. That is significantly more (rate cuts) than what the market is pricing."

The US unemployment rate is currently at 3.7 percent.