The market fell sharply on January 4 after a two-day rally, as the selling pressure was seen across sectors. Banking & financial services, technology, and metal stocks took the biggest hit.

The BSE Sensex corrected 637 points or 1 percent to 60,657, while the Nifty50 declined nearly 190 points or 1 percent to 18,043 and formed a long bearish candle on the daily charts.

"A long bear candle was formed on the daily chart that indicates a downside breakout of the recent sideways range movement in the market. The negative chart pattern of lower tops and bottoms is intact and further weakness from here could drag the index down to the lower bottom in the near term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He feels the short-term trend of Nifty seems to have reversed down after a small pullback rally. Further weakness from here could take the Nifty down to the recent swing low of 17,775 level in the short term, Shetti said.

However, any pullback rally could find resistance around the 18,150 level, the analyst added.

The broader markets also reeled under selling pressure with the Nifty Midcap 100 and Smallcap 100 indices falling around 1 percent each, while the volatility index India VIX jumped 5.6 percent to 15.2 level, giving more comfort for bears.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

Per the pivot charts, we have the key support level for the Nifty at 18,017, followed by 17,965, and 17,880. If the index moves up, the key resistance levels to watch out for are 18,187, followed by 18,240 and 18,325.

The Nifty Bank index plunged 467 points to 42,959 on January 4 and formed a bearish candlestick pattern on the daily scale, erasing all its previous two-day gains.

The important pivot level, which will act as crucial support for the index, is placed at 42,857, followed by 42,687, and 42,412. On the upside, key resistance levels are placed at 43,407, followed by 43,577, and 43,852.

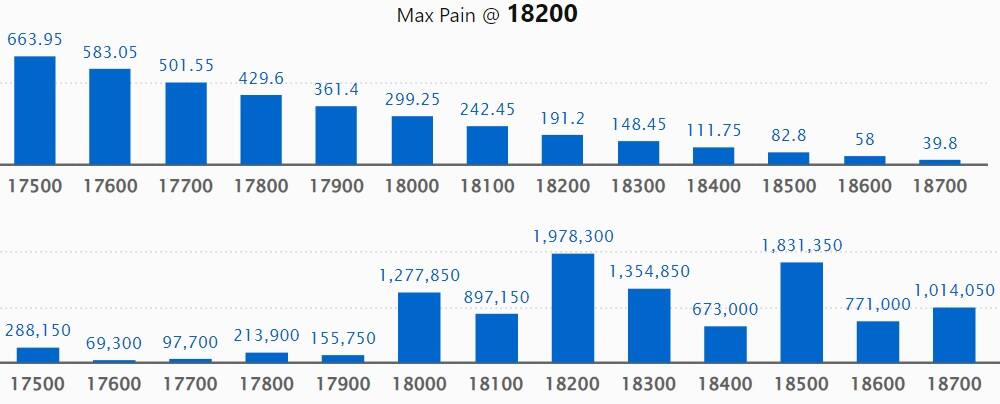

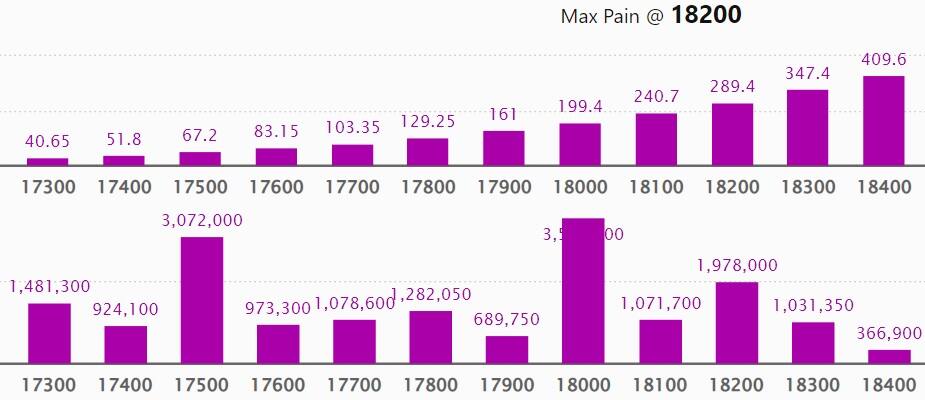

We have seen the maximum Call open interest (OI) at 19,000 strike, with 26.09 lakh contracts, which can act as a crucial resistance level in January series.

This is followed by 18,200 strike, comprising 19.78 lakh contracts, and 18,500 strike, where we have more than 18.31 lakh contracts.

Call writing was seen at 18,200 strike, which added 4.31 lakh contracts, followed by 18,100 strike, which added 4.11 lakh contracts, and 18,000 strike, which added 2.26 lakh contracts.

Call unwinding was seen at 19,200 strike, which shed 1.17 lakh contracts, followed by 19,100 strike, which shed 98,600 contracts, and 19,000 strike, which shed 69,100 contracts.

We have seen maximum Put OI at 18,000 strike, with 35.23 lakh contracts, which can act as a crucial support level in January series.

This is followed by 17,500 strike, comprising 30.72 lakh contracts, and 17,000 strike, where we have 27.93 lakh contracts.

Put writing was seen at 17,300 strike, which added 2.19 lakh contracts, followed by 18,100 strike, which added 2.05 lakh contracts, and 17,800 strike, which added 1.32 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 1.34 lakh contracts, followed by 18,000 and 18,500 strikes, which shed 1.13 lakh contracts each.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in SBI Card, Hindustan Unilever, Infosys, ICICI Bank, and HDFC, among others.

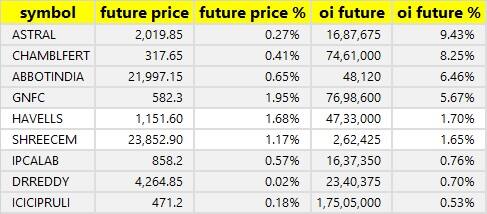

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, a long build-up was seen in 9 stocks on Wednesday, including Astral, Chambal Fertilizers, Abbott India, GNFC, and Havells India.

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 66 stocks saw long unwinding on Wednesday, including ONGC, Hindustan Copper, Tata Steel, Dalmia Bharat, and Jindal Steel & Power.

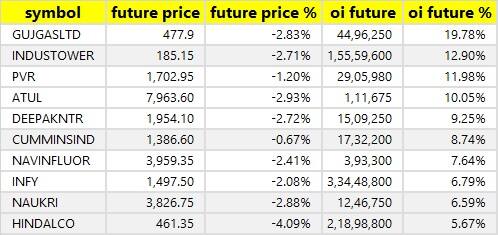

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we witnessed a short build-up in 110 stocks on Wednesday, including Gujarat Gas, Indus Towers, PVR, Atul, and Deepak Nitrite.

8 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have a total of 8 stocks in the short-covering list on Wednesday, including MCX India, Max Financial Services, HDFC Life Insurance Company, Hindustan Petroleum Corporation, and ABB India.

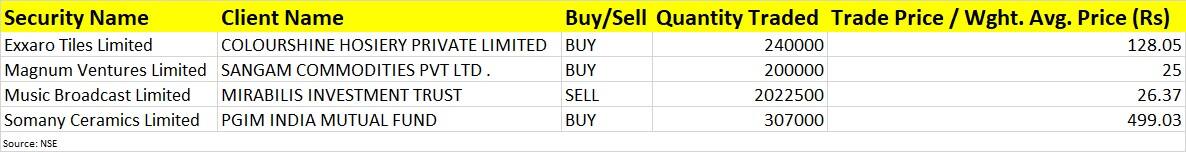

Somany Ceramics: PGIM India Mutual Fund bought 3.07 lakh shares in the company via open market transactions at an average price of Rs 499.03 per share.

(For more bulk deals, click here)

Investors meets on January 5

Tata Motors: Company's officials will interact with HDFC MF.

Eveready Industries India: Officials of the company will interact with Tata Mutual Fund, Nippon India Mutual Fund, ICICI Prudential Life Insurance, and ICICI Prudential Mutual Fund.

Windlas Biotech: Company's officials will meet investors or analysts.

Sterling Tools: Officials of the company will interact with various investors.

Maharashtra Seamless: Company's officials will interact with Abakkus Asset Manager LLP, Green Lantern Capital LLP, and Aequitas Investment Consultancy.

Stocks in the news

Hindustan Petroleum Corporation: HPCL has forayed into petrochemical business with pre-marketing of "HP Durapol" brand polymers, which is a pre-cursor to marketing of HPCL Rajasthan Refinery (HRRL) petrochemical products. HRRL is setting up a new 9 MMTPA capacity grass root Refinery-cum-Petrochemical complex at Pachpadra in Rajasthan.

NTPC: Subsidiary NTPC Green Energy (NGEL) has signed a non-binding memorandum of understanding (MoU) with Hindustan Petroleum Corporation for development of renewable energy based power projects. NTPC will tap business opportunities in renewable energy and supply 400 MW round the clock renewable power for requirements of HPCL.

Krishna Institute of Medical Sciences: The company has received board approval for raising of funds via issuance of non-convertible debentures (NCDs) of Rs 300 crore in one or more tranches over a period of time. This is subject to shareholders approval.

GR Infraprojects: Subsidiary GR Bhimasar Bhuj Highway has received a letter from the National Highways Authority of India declaring appointed date as January 2, 2023, for the road project. The project includes upgradation to four lane with paved shoulder of NH341 from Bhimasar, Junction of NH-41 to Anjar – Bhuj upto Airport Junction in Gujarat on hybrid annuity mode. The bid project cost is Rs 1,085 crore.

SJVN: The Cabinet Committee on Economic Affairs has approved investment of Rs 2,614 crore for company's 382 MW Sunni dam hydroelectric project in Himachal Pradesh. The project is scheduled to be commissioned within 63 months of the commencement of construction works and will generate 1,382 million units annually.

Likhitha Infrastructure: The company has received total orders worth Rs 457.39 crore from various oil & gas distribution companies during the quarter ended December FY23 including order worth Rs 120 crore received on January 2, 2023.

Hindustan Unilever: The FMCG major has completed the acquisition of 19.8 percent shareholding of Nutritionalab, for Rs 70 crore.

Marico: Consolidated revenue in Q3FY23 grew in low single digits on a year-on-year basis. As there has been some semblance of stability in key input prices and consumer pricing across key franchises, gross and operating margins are expected to improve both on a sequential and year-on year basis. Company expects a modest growth in operating profit due to lower revenue growth.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 2,620.89 crore, while domestic institutional investors (DII) bought shares worth Rs 773.58 crore on January 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for January 5. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.