Representative image.

The market lost half a percent shedding its earlier gains on the last trading day of calendar year 2023, December 30. The markets were hit by sell-offs in select banking & financial services, FMCG, technology, and auto stocks.

The BSE Sensex fell 293 points to 60,841, while the Nifty50 declined 86 points to 18,105, and formed a bearish candle resembling a Dark Cloud Cover on the daily charts, indicating more weakness going ahead. but the correction in following session with red candle may give confirmation of further downtrend.

"On the daily charts, the Nifty formed a Dark Cloud Cover candlestick pattern, which will be confirmed if we see prices sustaining below Friday's low in the next trading session," said Vidnyan Sawant, AVP, Technical Research, GEPL Capital.

The momentum indicator RSI (relative strength index) is moving in sync with prices, indicating positive momentum.

Per the overall price structure and inference from indicators, Vidnyan expects the Nifty to move towards 18,200, followed by 18,350 levels. On the flip side, if the Nifty sustains below the 18,000 mark then the bullish view will be negated, he feels.

However, the broader markets performed better than the frontline indices as the Nifty Midcap 100 and Smallcap 100 indices gained 0.5 percent and 0.75 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

Per the pivot charts, the key support level for the Nifty is placed at 18,080, followed by 18,036, and 17,965. If the index moves up, the key resistance levels to watch out for are 18,221, followed by 18,264 and 18,335.

The Nifty Bank index was also under pressure on December 30, falling 266 points to 42,986, and formed a bearish candlestick pattern on the daily charts.

The important pivot level, which will act as crucial support for the index, is placed at 42,855, followed by 42,716, and 42,491. On the upside, key resistance levels are placed at 43,306, followed by 43,445, and 43,671.

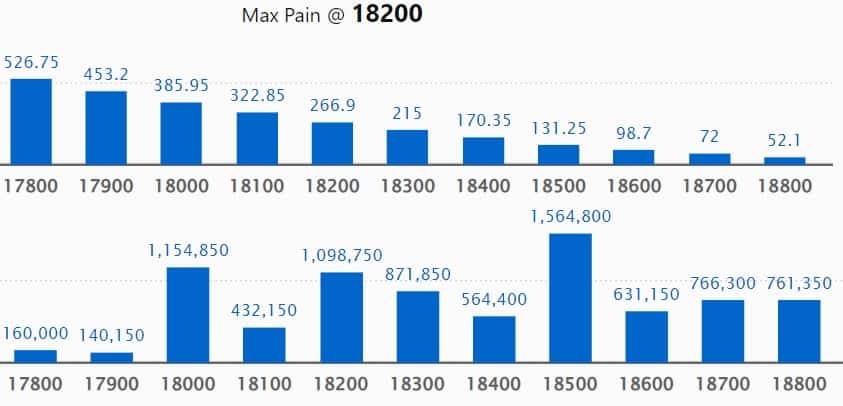

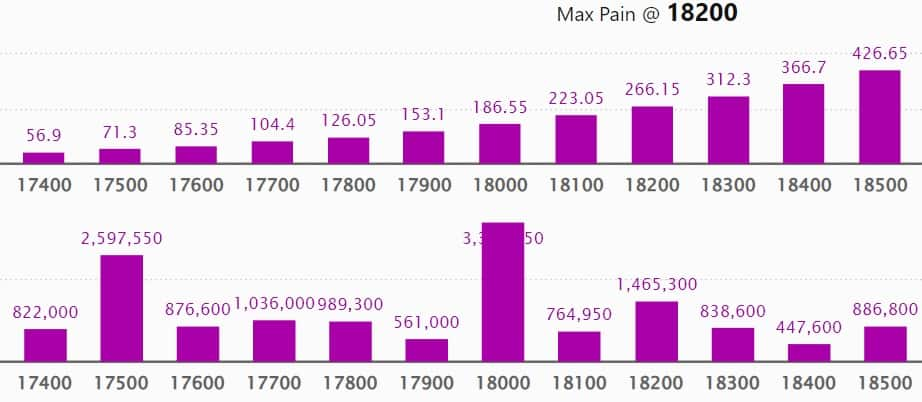

We have seen the maximum Call open interest (OI) at 19,000 strike, with 22.98 lakh contracts, which can act as a crucial resistance level in January series .

This is followed by 18,500 strike, comprising 15.64 lakh contracts, and 18,000 strike, where we have more than 11.54 lakh contracts.

Call writing was seen at 18,200 strike, which added 4.72 lakh contracts, followed by 18,300 strike, which added 3.72 lakh contracts, and 19,000 strike, which added 2.44 lakh contracts.

Call unwinding was seen at 18,000 strike, which shed 93,150 contracts, followed by 17,600 strike, which shed 14,950 contracts, and 17,500 strike, which shed 4,600 contracts.

We have seen maximum Put OI at 18,000 strike, with 33.54 lakh contracts, which can act as a crucial support level in January series.

This is followed by 17,000 strike, comprising 27.73 lakh contracts, and 17,500 strike, where we have 25.97 lakh contracts.

Put writing was seen at 18,000 strike, which added 4.85 lakh contracts, followed by 17,500 strike, which added 2.88 lakh contracts, and 18,300 strike, which added 2.81 lakh contracts.

Put unwinding was seen at 16,700 strike, which shed 66,650 contracts, followed by 16,500 strike, which shed 51,200 contracts, and 16,900 strike which shed 21,500 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in HDFC, Torrent Pharma, Crompton Greaves Consumer Electrical, Infosys, and ICICI Bank, among others.

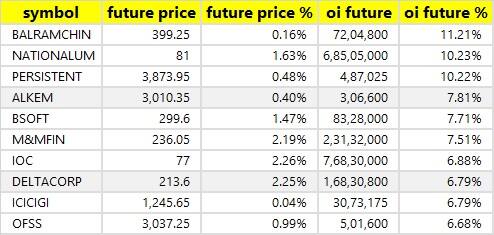

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in 78 stocks on Friday, including Balrampur Chini Mills, NALCO, Persistent Systems, Alkem Laboratories, and Birlasoft.

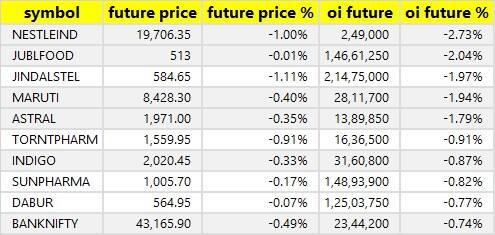

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 15 stocks saw long unwinding on Friday, including Nestle India, Jubilant Foodworks, Jindal Steel & Power, Maruti Suzuki, and Astral.

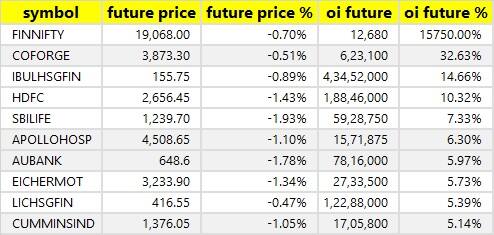

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we have seen short build-up in 67 stocks on Friday, including Coforge, Indiabulls Housing Finance, HDFC, SBI Life Insurance Company, and Apollo Hospitals Enterprises.

32 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have total 32 stocks in the short-covering list on Friday, including Chambal Fertilisers, Shriram Transport Finance, IDFC First Bank, Mphasis, and Dalmia Bharat.

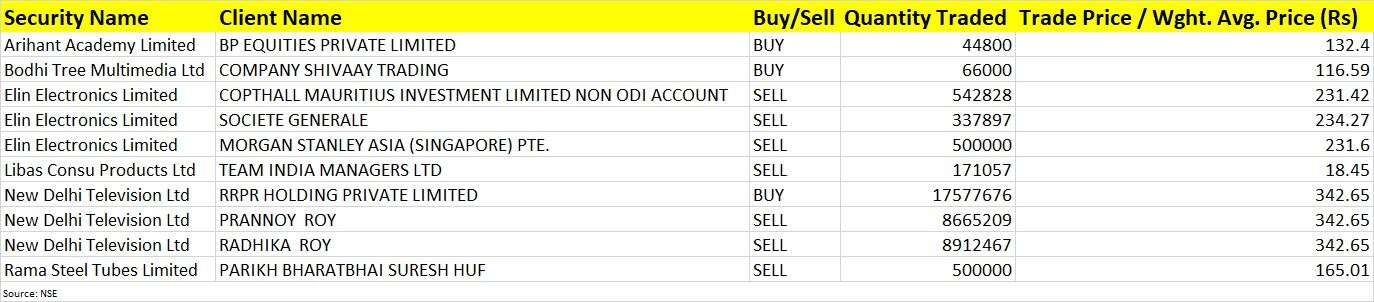

Elin Electronics: Copthall Mauritius Investment Limited non-ODI Account exited the electronics manufacturing services company by selling all 5.42 lakh shares via open market transactions, at an average price of Rs 231.42 per share. Societe Generale also offloaded 3.37 lakh shares at an average price of Rs 234.27 per share, while Morgan Stanley Asia (Singapore) Pte sold 5 lakh shares at an average price of Rs 231.6 per share. Morgan Stanley Asia (Singapore) held 10.06 lakh shares before the listing of Elin.

New Delhi Television: RRPR Holding, a indirect subsidiary of the Adani group, bought 1.75 crore shares (27.26 percent stake) in NDTV, at an average price of Rs 342.65 per share. Prannoy Roy and his wife Radhika Roy were the sellers, and with this stake sale, now they together hold 5 percent stake in NDTV.

(For more bulk deals, click here)

Investors Meets on January 2

Tata Motors: Company officials will interact with HDFC MF.

Supriya Lifescience: Officials of the company will interact with analysts / institutional investors.

Stocks in the News

HG Infra Engineering: the company emerged the L1 bidder for a DMRC (Delhi Metro Rail Corporation) project. The bid was for Rs 412.11 crore, and the construction period is 24 months.

Jammu & Kashmir Bank: the bank has raised Rs 1,021 crore via allotment of 1,021 non-convertible debentures (NCD) with a face value of Rs 1 crore each.

REC: the state-owned power project finance company has received board approval for the sale of its entire shareholding in WRSR Power Transmission to Adani Transmission. WRSR Power Transmission is owned by REC's subsidiary REC Power Development and Consultancy (RECPDCL). Adani Transmission has emerged the winning bidder through a tariff-based bidding process.

Tata Motors: Tata Passenger Electric Mobility, a subsidiary of Tata Motors, has decided to complete the acquisition of Ford India's manufacturing plant at Sanand in Gujarat on January 10, 2023. As a part of the acquisition, Ford India will transfer the entire land, buildings, and the vehicle manufacturing plant, along with machinery and equipment, for Rs 725.7 crore. Tata Motors will also retain certain employees.

NMDC: the Life Insurance Corporation of India pared its stake in the state-owned iron ore company by 2.07 percent via open market transactions. With this, LIC's shareholding in NMDC is reduced to 13.699 percent, from 15.772 percent earlier.

Religare Enterprises: Religare Finvest and parent company Religare Enterprises have entered into a one-time settlement agreement with 16 lenders for a full and final settlement of Religare Finvest’s dues. Religare Finvest has been taking necessary corrective measures as advised by the Reserve Bank of India, and will seek the removal of the CAP (corrective action plan) in due course, so that Religare Finvest can restart its lending business.

63 Moons Technologies: The company will provide software support services to the Multi Commodity Exchange of India for another six months, from January 1, 2023 to June 30, 2023, at the request of MCX. The earlier software support and maintenance agreement ended on December 31, 2022.

CreditAccess Grameen: the company completed two direct assignment transactions aggregating to Rs 297.79 crore in December 2022. During the quarter ending December 2022, the company has raised funds totalling Rs 3,300.38 crore through term loans, NCDs, ECBs (external commercial borrowings), and direct assignments.

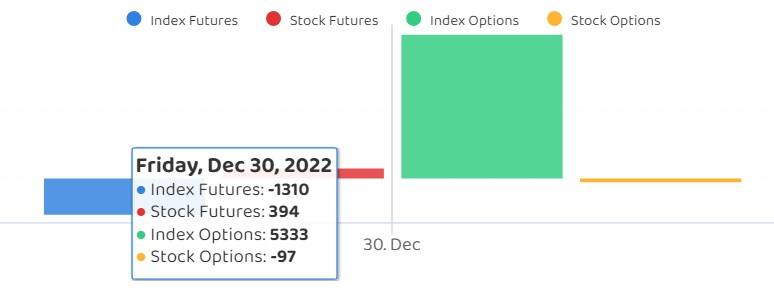

Fund Flow

Foreign institutional investors (FII) net sold shares worth Rs 2,950.89 crore, while domestic institutional investors (DII) net bought shares worth Rs 2,266.20 crore on December 30, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock under its F&O ban list for January 2. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.