Representative image

If the war on talent in IT dominated headlines in 2021, the winds began to shift in the opposite direction near the end of the previous fiscal year, with companies adding fewer employees with each passing quarter. The pain was more visible in the September quarter, when IT company employee additions fell 45 percent sequentially.

In the 2022 calendar year — or three quarters (figures for the December quarter will be available in January) — three out of four of the top IT firms have shown a declining trend in net employee additions.

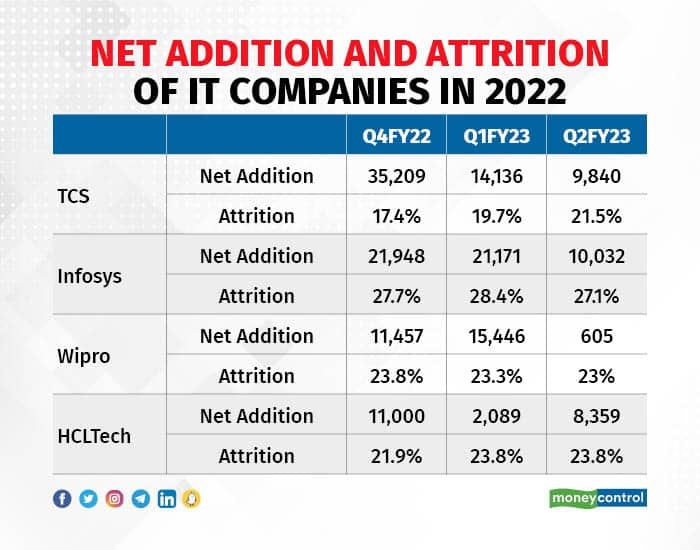

Tata Consultancy Services, India's largest software exporter, added 35,209 employees on a net basis in the March quarter, the company's highest-ever net addition in a quarter. This dropped by nearly 60% in the June quarter, when it added 14,136 new employees. This number fell to 9,840 in the September quarter, bringing the total for the calendar year to 59,185.

The company's highest-ever net addition at the start of the year doesn't mean attrition isn't a concern. While attrition is lower than that of competitors, it has continued to rise. It was 17.4 percent in the March quarter, followed by 19.7 percent and 21.5 percent in the following quarters.

Attrition was not the only factor. IT companies' margins have also been squeezed, with wage bills accounting for a sizable portion of expenses and employee costs rising.

Following the company's results in Q2FY23, TCS Chief Executive Officer Rajesh Gopinathan stated that it was not a short-term margin lever, but rather a strategic call to expand employee onboarding.

“We had hired close to 120,000 freshers last year and invested into that pool given the longer-term visibility that we have on demand. We will tweak our employee model on an ongoing basis looking at the demand. So, that is a reasonable expectation, but our overall hiring model is predicated on much longer cycles rather than on short-term, quarter-on-quarter adjustments,” he said.

Its competitor Infosys added 21,948 employees in the March quarter and 21,171 in the June quarter. However, in the September quarter, this was cut in half to 10,032 people, bringing the net addition for the year so far to 53,151. Attrition at Infosys is also high, but it started to decline in Q2FY22, falling from 28.4 percent to 27.1 percent sequentially.

Infosys’ cross-town rival Wipro added 11,457 employees in the first quarter of the calendar year, increasing to 15,446 in the June quarter, but this fell sharply to 605 in the September quarter, bringing the company's net addition for the year to 27,508. Attrition has started to dip and was at 23 percent in Q2FY23.

However, the pain is apparent for Wipro, which has delayed the onboarding of newly hired employees. While the company has stated that it will honour all offers made.

HCLTech defied the trend with a net employee addition of 11,000 in the March quarter, which fell sharply to 2,089 the following quarter and rose to 8,359 in the September quarter, bringing its total net addition over the three quarters of the 2022 calendar year to 21,448. Attrition for the last two quarters has remained at 23.8 percent.

As the talent market has begun to cool, companies are also looking at having a bottom-heavy pyramid and utilising the talent they've already hired. While the War on Talent was on, inflated salaries added to woes of companies, as they hired and replaced talent at a premium.

According to ICRA, wage cost inflation will likely begin to moderate by the end of the current fiscal year, but "margins will susceptible to any moderation in business performance due to macroeconomic headwinds."

As net additions have declined, so have IT job openings.

Data from specialist staffing firm Xpheno in November revealed that IT job openings were on the decline for 7 months before seeing some uptick. Available jobs fell by more than 50 percent year on year in October. Although the number of available jobs increased in November, it remained the second lowest in a 24-month period.

According to Xpheno data, jobs in the IT sector used to account for more than 80 percent of available job openings, but that figure is now less than 50 percent.

“While global big tech players and their counterparts continue to rock the boat with layoffs and hiring freeze, Indian IT majors and cohorts aren’t entirely following suit. The marginal recovery and return of hiring action among the Indian Tech cohorts is a sign of returning to moderated pre-Covid levels of action. There could well be a window of opportunity opening up for the? Indian IT Service sector, when global marquees under margin pressures, rework their plans to offshore jobs,” Xpheno co-founder Anil Ethanur said.

According to data from job platform foundit released earlier this month, there has been a revival in IT after months of decline, indicating a positive sentiment in hiring.