Banks played a key role in Monday's rally as the Nifty Bank surged 962 points or 2.3 percent to 42,630 and formed a long bullish candle which resembles a bullish engulfing kind of candlestick pattern on the daily charts.

The market snapped a four-day losing streak and clocked more than 1 percent gains on December 26, the first day of monthly F&O contracts expiry week. Short covering and value buying lifted investor sentiment.

The BSE Sensex jumped 721 points to 60,566, while the Nifty50 rose 208 points to 18,015 and formed a strong bullish candle on the daily charts, taking support at 17,800-17,850 levels after long bearish candle formation in the previous trading session.

"Technically, this pattern signal a counterattack of bulls after a sharp weakness," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

After the downside breakout of crucial support of ascending trend line at the 18,100 level on Friday, the Nifty showing immediate upside bounces on Monday without a follow-through sell-off could be a cheering factor for bulls to make a comeback, Shetti feels.

A sustainable move above 18,100-18,150 levels is likely to be considered as a false downside breakout of the trend line and that could have a more positive impact on the mark, the market expert said.

All sectors, except healthcare, showed decent performance on Monday. The broader markets also joined the bulls' party on strong breadth. The Nifty Midcap 100 index surged 2.7 percent while the Smallcap 100 index gained 3.8 percent as about six shares advanced for every falling share on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,839, followed by 17,766 & 17,648. If the index moves up, the key resistance levels to watch out for are 18,076 followed by 18,149 and 18,267.

Banks played a key role in Monday's rally as the Nifty Bank surged 962 points or 2.3 percent to 42,630 and formed a long bullish candle which resembles a bullish engulfing kind of candlestick pattern on the daily charts.

The important pivot level, which will act as crucial support for the index, is placed at 41,861, followed by 41,560 and 41,072 levels. On the upside, key resistance levels are placed at 42,836 followed by 43,137 and 43,625 levels.

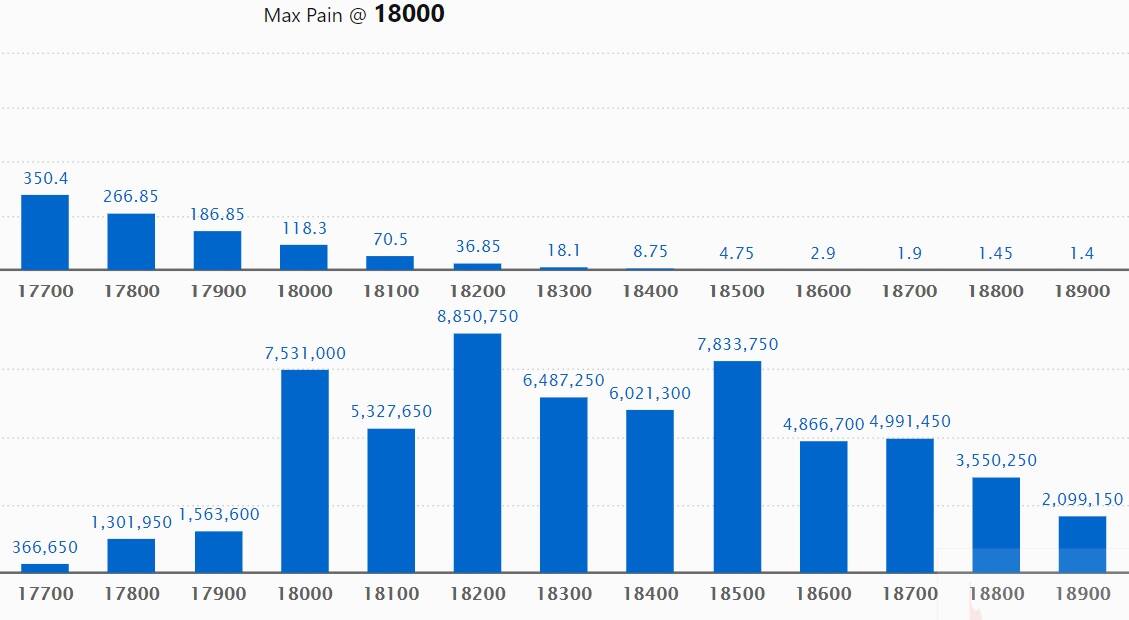

We have seen the maximum Call open interest at 18,200 strike, with 88.5 lakh contracts, which can act as a crucial resistance level in the last week of the December series.

This is followed by 19,000 strike, which holds 83.51 lakh contracts, and 18,500 strike, which have more than 78.33 lakh contracts.

Call writing was seen at 18,300 strike, which added 8.24 lakh contracts, followed by 18,500 strike, which added 4.36 lakh contracts, and 18,200 strike which added 97,150 contracts.

Call unwinding was seen at 18,800 strike, which shed 22.43 lakh contracts, followed by 18,100 strike which shed 18.96 lakh contracts and 18,000 strike which shed 18.53 lakh contracts.

We have seen a maximum Put open interest at 17,000 strike, with 75.97 lakh contracts which can act as a crucial support level in the last week of the December series.

This is followed by 17,800 strike, which holds 68.13 lakh contracts, and 18,000 strike, which has accumulated 64.8 lakh contracts.

Put writing was seen at 17,800 strike, which added 26.52 lakh contracts, followed by 18,000 strike, which added 26.17 lakh contracts and 17,000 strike which added 16.88 lakh contracts.

Put unwinding was seen at 18,200 strike, which shed 9.95 lakh contracts, followed by 18,300 strike which shed 3.38 lakh contracts, and 18,500 strike which shed 2.12 lakh contracts.

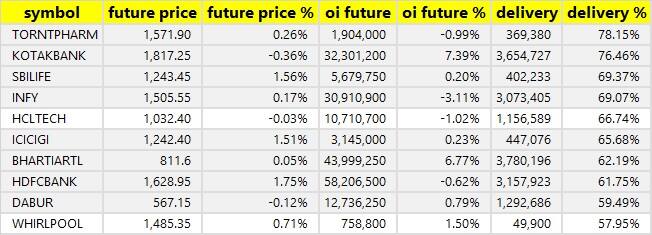

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in Torrent Pharma, Kotak Mahindra Bank, SBI Life Insurance Company, Infosys, and HCL Technologies, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, we have seen a long build-up in a total of 49 stocks on Monday, including Alkem Laboratories, Ramco Cements, Apollo Tyres, Nifty Financial, and NMDC.

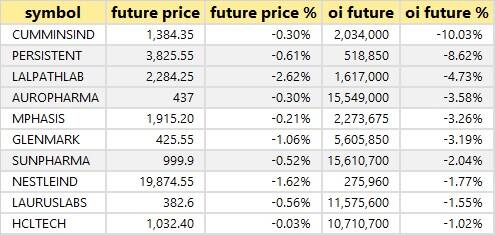

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, a total of 12 stocks have seen long unwinding on Monday including Cummins India, Persistent Systems, Dr Lal PathLabs, Aurobindo Pharma, and Mphasis.

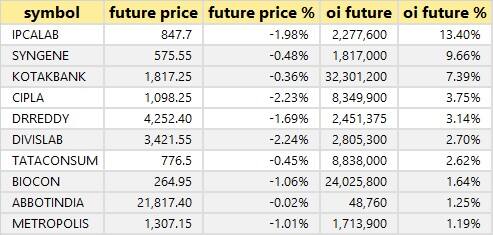

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, we have seen a short build-up in a total of 15 stocks on Monday including Ipca Laboratories, Syngene International, Kotak Mahindra Bank, Cipla, and Dr Reddy's Laboratories.

119 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, we have a total of 119 stocks in the short-covering list on Monday including Aarti Industries, Firstsource Solutions, HDFC AMC, Deepak Nitrite, and City Union Bank.

Veritas (India): Investor Swan Energy has bought additional 11.1 lakh shares in the company via open market transactions, whereas promoter Niti Nitinkumar Didwania was the seller. They have exchanged shares at an average price of Rs 179.55 per share.

Abans Holdings: Maven India Fund has bought 2.79 lakh shares or 0.55% stake in the financial services firm via open market transactions at an average price of Rs 202.14 per share. The stock has corrected 25 percent in two trading sessions from its issue price of Rs 270 per share, to close at Rs 202.50 on December 26.

(For more bulk deals, click here)

Investors Meetings on December 27

Tata Power Company: Company's officials will meet Ninetyone UK.

Pidilite Industries: Officials of the company will interact with Prabhudas Lilladher.

Greaves Cotton: Company officials will interact with Sharekhan, Sunidhi Securities, and Itus Capital Advisors, and participate in Motilal Oswal Conference.

EKI Energy Services: Officials of the company will interact with Choice Securities.

Lloyds Metals and Energy: Company's officials will interact with Phillip Capital.

Symphony: Officials of the company will interact with Quantum Asset Management Company.

Stocks in News

NTPC: The country's largest power generation company has signed a non-binding Memorandum of Understanding with Tecnimont, Indian subsidiary of Maire Tecnimont Group based in Italy. They jointly will evaluate and explore the possibility to develop commercial scale green methanol production facility at a NTPC project in India.

Time Technoplast: The company has received prestigious repeat order worth Rs 75 crore, from Adani Total Gas for supply of CNG cascades made from Type-IV composite cylinder. The delivery of these cascades will begin from January 2023.

Nureca: Promoter Payal Goyal has sold 2.74% stake in the company via open market transactions during November 29 and December 22 this year. With this, her stake in the company reduced to 29.83%, from 32.57% earlier.

GR Infraprojects: The company has received completion certificate for Expressway carriageway in Madhya Pradesh, from Authority’s Engineer and has declared the project fit for entry into commercial operation with effect from December 20. The said project on EPC mode under Bharatmala Pariyojana has been completed by the company, which had contract cost of Rs 991 crore.

Dev Information Technology: The Ahmedabad-based IT services & products company has sold 5.45% stake in Dev Accelerator (DevX), a managed co-working space business, at a valuation of Rs 104 crore. This secondary sale will bring down Dev IT’s shareholding in DevX from 41.26% to 35.81%.

Share India Securities: The company has received board approval for fund raising via rights issue to eligible equity shareholders, up to Rs 1,000 crore. It is going to appoint Corporate Professionals Capital as a lead Manager to the issue.

Fund Flow

Foreign institutional investors (FIIs) sold shares worth Rs 497.65 crore, while domestic institutional investors (DIIs) purchased shares worth Rs 1,285.74 crore on December 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has added Punjab National Bank to its F&O ban list for December 27. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.